Constitution of the United States/Tenth Amend.

Tenth Amendment Rights Reserved to the States and the People

Overview[edit | edit source]

Because the Tenth Amendment concerns the relationship between the federal government's powers and those powers reserved to the states, it is sometimes invoked--implicitly or explicitly--in cases exploring the limits of Congress's various enumerated powers.[1] These decisions are primarily addressed elsewhere in the Constitution Annotated under the particular enumerated federal power at issue.[2]

The key issue in Tenth Amendment doctrine, as such, is whether the Amendment imposes affirmative limitations on federal power beyond the limits inherent in the various enumerated powers themselves. In other words, assuming that an enumerated power supports congressional action in a particular area, may the Tenth Amendment (or the federalism principles it confirms[3]) nonetheless render the legislation beyond federal power? And, if so, what are the contours of the limitations that the Tenth Amendment imposes?

The Supreme Court's jurisprudence on these questions has not followed a straight line.[4] At times, the Court has stated that the Tenth Amendment lacks substantive constitutional content and "does not operate as a limitation upon the powers, express or implied, delegated to the national government."[5] At other times, the Court has found affirmative federalism limitations in the Amendment, invalidating federal statutes "not because Congress lacked legislative authority over the subject matter, but because those statutes violated the principles of federalism contained in the Tenth Amendment."[6]

The Supreme Court's Tenth Amendment jurisprudence has gone through several cycles over its history. In the nineteenth century, Chief Justice John Marshall's landmark opinion in McCulloch v. Maryland rejected the notion that the Tenth Amendment denied implied or incidental powers to the federal government, adopting an approach to assessing congressional power focused not on the Tenth Amendment itself, but the larger constitutional context.[7]

In the early twentieth century, the Court relied on the Tenth Amendment to strike down various economic regulations as invasive of the police power reserved to the states by the Amendment.[8] Beginning in the late 1930s, many of these decisions were overruled or limited as the Court embraced a broader conception of Congress's Commerce Clause power, along with the view that the Tenth Amendment does not bar federal action that is necessary and proper to the exercise of federal power.[9]

Tenth Amendment doctrine then laid largely dormant until the mid-1970s. In National League of Cities v Usery, the Court relied on the Amendment to hold that Congress may not use its commerce power to "directly displace the States' freedom to structure integral operations in areas of traditional governmental functions."[10] Less than a decade later in Garcia v. San Antonio Metropolitan Transit Authority, however, the Court overruled National League of Cities as "unworkable" and "inconsistent with established principles of federalism,"[11] while implying that the Tenth Amendment lacked any judicially enforceable protections for state sovereignty.[12]

In the 1990s, the Court changed course again, holding in New York v. United States that the Tenth Amendment prohibits Congress from "commandeering" the states--that is, directly compelling them to enact or enforce a federal regulatory program.[13] The resulting "anti-commandeering" doctrine has been the subject of a line of Supreme Court cases continuing to the present.[14]

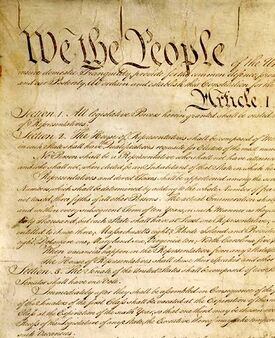

| Clause Text |

|---|

| The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people. |

Historical Background on Tenth Amendment[edit | edit source]

The Tenth Amendment confirms "the understanding of the people at the time the Constitution was adopted"[15] that the powers not delegated to the federal government by the Constitution are "reserved to the States respectively, or to the people."[16] In this sense, the Amendment is merely declaratory--a "truism" that "all is retained which has not been surrendered."[17] Justice Joseph Story characterizes it as a "mere affirmation" of "a necessary rule of interpreting" the Constitution:

Being an instrument of limited and enumerated powers, it follows irresistibly, that what is not conferred, is withheld, and belongs to the state authorities, if invested by their constitutions of government respectively in them; and if not so in vested, it is retained BY THE PEOPLE, as a part of their residuary sovereignty.3 Joseph Story, Commentaries on the Constitution of the United States § 1900 (1833).

The Tenth Amendment's purpose should be understood in the context of the Bill of Rights, of which it is a part. As originally drafted, the Constitution did not include a bill of rights, which was rejected when proposed late in the Constitutional Convention.[18] The Federalists argued that because the national government had limited and enumerated powers, there was no need to protect individual rights expressly: "Why, for instance, should it be said that the liberty of the press shall not be restrained, when no power is given [in the Constitution] by which restrictions may be imposed?"[19] On this view, including a list of rights in the Constitution could be "dangerous" because it might be misunderstood to imply that the national government had powers beyond those enumerated.[20]

The argument against including a bill of rights did not persuade many state ratifying conventions, however, and several states assented to the Constitution on the understanding and expectation that a bill of rights would quickly be added.[21] The first Congress accordingly proposed twelve amendments, ten of which were ratified by the requisite number of states and became the Bill of Rights.[22]

The last of these first ten amendments addressed the Federalists' concern that a list of rights might imply the federal government had powers beyond those enumerated. The Tenth Amendment thus served to "allay fears that the new national government might seek to exercise powers not granted, and that the states might not be able to exercise fully their reserved powers."[23]

Unlike the analogous provision in the Articles of Confederation,[24] both houses of Congress refused to insert the word "expressly" before the word "delegated" in the Tenth Amendment.[25] James Madison's remarks during the congressional debate on the Amendment are also notable: "Interference with the power of the States was no constitutional criterion of the power of Congress. If the power was not given, Congress could not exercise it; if given, they might exercise it, although it should interfere with the laws, or even the Constitutions of the States."[26]

Development of Doctrine[edit | edit source]

Early Tenth Amendment Jurisprudence[edit | edit source]

In McCulloch v. Maryland,[27] Chief Justice John Marshall famously adopted a broad interpretation of the Necessary and Proper Clause[28] to counter the argument that the federal government lacked power to establish a national bank. The opinion also rejected a Tenth Amendment argument, urged by Luther Martin as counsel for the State of Maryland, that the power to create corporations was reserved by that Amendment to the states.[29] Martin noted that the Amendment was added to assuage concerns, expressed by opponents of the Constitution's ratification, that the document would invade states' rights.[30]

Stressing the fact that the Tenth Amendment, unlike the Articles of Confederation, omitted the word "expressly" as a qualification of granted powers, McCulloch concluded that nothing in the Constitution "excludes incidental or implied powers."[31] The effect of the Tenth Amendment, rather, was to leave the question "whether the particular power which may become the subject of contest has been delegated to the one government, or prohibited to the other, to depend upon a fair construction of the whole instrument."[32]

Apart from some tax immunity decisions,[33] and a notable mention in the Civil Rights Cases,[34] the Tenth Amendment was infrequently invoked by the Court until the early twentieth century.[35]

State Police Power and Tenth Amendment Jurisprudence[edit | edit source]

In the first few decades of the twentieth century, the Supreme Court relied on the Tenth Amendment--alongside a narrow (by modern standards) understanding of the Interstate Commerce Clause[36]--to invalidate a variety of federal laws regulating economic activity because they invaded the states' reserved police powers to regulate public welfare and morality. Exemplary of this line of cases is Hammer v. Dagenhart,[37] which invalidated a federal law that prohibited the transportation in interstate commerce of goods produced through child labor.[38] Invoking the Tenth Amendment, the Court concluded that the Child Labor Law was an unwarranted invasion of the states' reserved powers,[39] reasoning:

In interpreting the Constitution it must never be forgotten that the nation is made up of states to which are entrusted the powers of local government. And to them and to the people the powers not expressly delegated to the national government are reserved. . . . To sustain this statute would not be in our judgment a recognition of the lawful exertion of congressional authority over interstate commerce, but would sanction an invasion by the federal power of the control of a matter purely local in its character . . . .Id. at 275-76 (citations omitted).

Following similar logic, the Court in the 1920s and 1930s invoked the Tenth Amendment to invalidate a series of congressional economic regulations as invasive of state police powers, including: taxes on the sale of grain futures in markets that violated federal regulations;[40] taxes on the profits of factories in which child labor was used;[41] regulations and taxes on the production and manufacture of coal;[42] regulations of state building and loan associations;[43] and regulations and taxes on agricultural production.[44] In A.L.A. Schechter Poultry Corp. v. United States,[45] the Court, after holding that the commerce power did not extend to intrastate sales of poultry, relied on the Tenth Amendment to rebut the argument that the existence of an economic emergency (the Great Depression) could justify the legislation.[46]

Even during this period, however, not all federal statutes relating to objectives that could be characterized as traditional state responsibilities were held invalid. For example, in Hamilton v. Kentucky Distilleries Co.,[47] a unanimous Court upheld a wartime prohibition on distilled spirits with reasoning reminiscent of McCulloch:

That the United States lacks the police power, and that this was reserved to the States by the Tenth Amendment, is true. But it is nonetheless true that when the United States exerts any of the powers conferred upon it by the Constitution, no valid objection can be based upon the fact that such exercise may be attended by the same incidents which attend the exercise by a State of its police power.Id. at 156 (citations omitted) (Brandeis, J.).

In a series of cases in apparent tension with Hammer v. Dagenhart, the Court in this period sustained federal laws penalizing the interstate transportation of lottery tickets;[48] of women for immoral purposes;[49] of stolen automobiles;[50] and of tick-infected cattle.[51] In a case upholding a federal law that prohibited the killing or selling of migratory birds, enacted as implementing legislation for a treaty between the United States and Great Britain, Justice Oliver Wendell Holmes rejected the notion that "invisible radiation from the general terms of the Tenth Amendment" invalidated the statute.[52]

Tenth Amendment and Darby[edit | edit source]

Beginning in 1937, in its decisions sustaining the Social Security Act[53] and the National Labor Relations Act,[54] the Supreme Court retreated from the conception of the Tenth Amendment embraced in Hammer v. Dagenhart. Following this so-called "switch in time that saved nine,"[55] the Court generally upheld federal economic regulation as supported by the Commerce Clause, without regard to whether the object of the legislation might be said to intrude upon traditional state authority.

United States v. Darby,[56] which overruled Hammer v. Dagenhart, is perhaps the clearest expression of this view of the Tenth Amendment. In upholding Congress's power to enact the Fair Labor Standards Act, Chief Justice Harlan Stone wrote for a unanimous court:

It is no objection to the assertion of the power to regulate interstate commerce that its exercise is attended by the same incidents which attended the exercise of the police power of the states. . . . Our conclusion is unaffected by the Tenth Amendment which . . . states but a truism that all is retained which has not been surrendered. There is nothing in the history of its adoption to suggest that it was more than declaratory of the relationship between the national and state governments as it had been established by the Constitution.Darby, 312 U.S. at 114, 123-24. For cases anticipating Darby's holding, see Wright v. Union Cent. Life Ins. Co., 304 U.S. 502, 516-17 (1938); Tenn. Elec. Power Co. v. TVA, 306 U.S. 118, 143-44 (1939); United States v. Appalachian Elec. Power Co., 311 U.S. 377 (1940) ("So long as the things done within the states by the United States are valid under [Commerce Clause power], there can be no interference with the sovereignty of the state.").

A few years after Darby, the Court stated directly that "the Tenth Amendment 'does not operate as a limitation upon the powers, express or implied, delegated to the national government.'"[57] From the 1940s through the 1970s, the Court followed Darby and its progeny to summarily dismiss Tenth Amendment challenges based on the argument that otherwise valid federal laws intruded upon state police power over local matters reserved to the states through the Tenth Amendment.[58]

State Sovereignty and Tenth Amendment[edit | edit source]

Beginning in the mid-1970s, the Supreme Court relied on the Tenth Amendment to analyze congressional enactments alleged to intrude not upon state police power, but upon state sovereignty--such as whether Congress may apply general economic regulations to states and state instrumentalities.

In 1976, the Court revived the Tenth Amendment as an independent constitutional constraint in National League of Cities v. Usery.[59] The Court conceded that the legislation at issue--the Fair Labor Standards Act's minimum wages and maximum hours requirements (the same law upheld in Darby, but applied to state and local governmental employees)--was "undoubtedly within the scope of the Commerce Clause."[60] But the Court found that "there are attributes of sovereignty attaching to every state government which may not be impaired by Congress, not because Congress may lack an affirmative grant of legislative authority to reach the matter, but because the Constitution prohibits it from exercising the authority in that manner."[61] The Court concluded that the "power to determine the wages which shall be paid to those whom [states] employ in order to carry out their governmental functions" was such an area of inviolable state sovereignty.[62] As a result, as applied to certain state employees, the law was "not within the authority granted Congress."[63] National League of Cities implied that the Tenth Amendment was the source of its protections for state sovereignty,[64] distinguishing Darby's dismissal of the Tenth Amendment as a "truism."[65]

Following National League of Cities (itself a 5-4 decision), the Court applied the doctrine in a series of opinions, many closely divided, over roughly a decade.[66] Although much of this law does not survive the subsequent overturning of National League of Cities, some of the Court's holdings in these cases may have continuing application. In Hodel v. Virginia Surface Mining & Reclamation Ass'n, for instance, the Court clarified that Tenth Amendment protections apply only when Congress regulates "States as States," and not merely the activities of private individuals or business.[67] In Bell v. New Jersey, the Court held that state sovereignty protections under the Tenth Amendment did not apply to "obligations voluntarily assumed as a condition of federal funding."[68] Several decisions also held that National League of Cities did not apply to congressional power under the Reconstruction Amendments.[69]

In 1985, the Court overruled National League of Cities in Garcia v. San Antonio Metropolitan Transit Authority.[70] Justice Harry Blackmun's opinion for the Court concluded that National League of Cities' test, focusing on state authority over its "traditional governmental functions," had proven "both impractical and doctrinally barren."[71] With only passing reference to the Tenth Amendment, the Court in effect reverted to the Madisonian view of the Amendment reflected in United States v. Darby.[72]

Under Garcia, states retain their sovereign authority "only to the extent that the Constitution has not divested them of their original powers and transferred those powers to the Federal Government."[73] Garcia therefore held that application of the Fair Labor Standards Act's minimum wage and overtime provisions to state employees was within Congress's power under the Commerce Clause.

Taking a restrained view of judicial authority to invalidate federal laws, Garcia stated that the principal limits on congressional exercise of the commerce power against states are not judicial, but instead found in the federal government's structure and the political process.[74] Garcia did allow that there might be some "affirmative limits the constitutional structure might impose on federal action affecting the States," but concluded that "[t]hese cases do not require us to identify or define" them.[75]

Federal Power to Tax and Tenth Amendment[edit | edit source]

In a distinct line of cases beginning in the nineteenth century, the Supreme Court relied on the Tenth Amendment to find that states (and related parties) were immune from certain federal taxes.[76] For example, in Collector v. Day, the Court held that an otherwise valid income tax could not, consistent with the Tenth Amendment, be levied upon the official salaries of state officers.[77]

In the twentieth century, the Supreme Court overturned Collector v Day[78] and limited much of this doctrine, although it may retain some vitality as to federal taxes directly imposed on states.[79] (The doctrine of intergovernmental tax immunity is explained within the Constitution Annotated's discussion of Congress's taxing power.[80])

Modern Doctrine[edit | edit source]

Modern Tenth Amendment Jurisprudence Generally[edit | edit source]

After reaching an ebb in Garcia v. San Antonio Metropolitan Transit Authority,[81] the Tenth Amendment reemerged as a source of constitutional limits on congressional power in the 1990s. These modern cases rely less on the Amendment's text than on the constitutional system of federalism it embodies and confirms.[82]

The following essays review three lines of case law. The first concerns the "anti-commandeering" principle of New York v. United States.[83] Under that doctrine, the federal government may not directly compel states "to enact and enforce a federal regulatory program."[84] Second, the Court has relied on the "fundamental principle of equal sovereignty" in recent voting rights cases.[85] Although the precise textual basis for the doctrine is unclear, the equal sovereignty doctrine is at least arguably founded on Tenth Amendment principles.[86] Finally, although the Court's modern Commerce Clause doctrine is primarily discussed elsewhere in Constitution Annotated,[87] this section briefly discusses those cases' invocations of the Tenth Amendment.

Anti-Commandeering Doctrine[edit | edit source]

In Garcia v. San Antonio Metropolitan Transit Authority,[88] the Supreme Court adopted a narrow conception of states' reserved powers under the Tenth Amendment. Following Garcia, the Court adopted a "clear statement" rule requiring an unambiguous statement of congressional intent to displace state authority, a rule first articulated in Gregory v. Ashcroft.[89] After noting the serious constitutional issues that would be raised by interpreting the Age Discrimination in Employment Act to apply to appointed state judges, Gregory explained that, because Garcia "constrained" consideration of "the limits that the state-federal balance places on Congress's powers," a plain statement rule was all the more necessary.[90] The Court stated: "[I]nasmuch as this Court in Garcia has left primarily to the political process the protection of the States against intrusive exercises of Congress's Commerce Clause powers, we must be absolutely certain that Congress intended such an exercise."[91]

The Court's 1992 decision in New York v. United States[92] signaled a continuing retreat from the narrow conception of state power adopted in Garcia and the genesis of the Supreme Court's "anti-commandeering" doctrine. The New York holding that Congress may not "commandeer" state regulatory processes by ordering states to enact or administer a federal regulatory program limited congressional power previously recognized in dictum.[93]

Language in New York seems more reminiscent of National League of Cities v. Usery[94] than of the Court's later Garcia decision. First, Justice Sandra Day O'Connor's opinion declared that it makes no difference whether federalism constraints derive from the Tenth Amendment, or instead from a lack of power delegated to Congress under Article I: "the Tenth Amendment . . . directs us to determine . . . whether an incident of state sovereignty is protected by a limitation on an Article I power."[95] Second, the Court, without reference to Garcia, thoroughly repudiated Garcia's "structural" approach requiring states to look primarily to the political processes for protection. In rejecting arguments that New York's sovereignty could not have been infringed because its representatives participated in developing the compromise legislation and consented to its enactment, the Court declared: "The Constitution does not protect the sovereignty of States for the benefit of the States or State governments, [but instead] for the protection of individuals." Consequently, the Court reasoned, "State officials cannot consent to the enlargement of the powers of Congress beyond those enumerated in the Constitution."[96] The Court thus appeared to contemplate relaxation of Garcia's obstacles to federalism-based challenges.

Extending the principle applied in New York, the Court in Printz v. United States[97] held that Congress may not "circumvent" the prohibition on commandeering a state's regulatory processes "by conscripting the State's officers directly."[98] Printz struck down interim provisions of the Brady Handgun Violence Protection Act that required state and local law enforcement officers to conduct background checks on prospective handgun purchasers. In Printz, the Court noted:

The Federal Government may neither issue directives requiring the States to address particular problems, nor command the States' officers . . . to administer or enforce a federal regulatory program. It matters not whether policymaking is involved, and no case-by-case weighing of the burdens or benefits is necessary; such commands are fundamentally incompatible with our constitutional system of dual sovereignty.Id.

In Reno v. Condon,[99] the Court distinguished New York and Printz in upholding the Driver's Privacy Protection Act of 1994 (DPPA), a federal law that restricted the disclosure and resale of personal information contained in the records of state motor vehicles departments. The Court returned to a principle articulated in South Carolina v. Baker that distinguished between laws that improperly seek to control the manner in which states regulate private parties, and those that merely regulate state activities directly.[100]

In Condon, the Court found that the DPPA did "not require the States in their sovereign capacities to regulate their own citizens," but rather "regulate[d] the States as the owners of databases."[101] The Court saw no need to decide whether a federal law may regulate the states exclusively, because the DPPA was a law of general applicability that regulated private resellers of information as well as states.[102]

The Supreme Court's anti-commandeering cases have recognized parallels--as well as distinctions--between commandeering state legislatures and requiring states to implement policies as a condition of federal funding.[103] In both New York and Printz, the Court observed that Congress may attach conditions to federal funds disbursed under its Spending Clause power and thereby avoid anti-commandeering problems.[104] The Court's decision in National Federation of Independent Business v. Sebelius (NFIB) explored the limits of this power, holding that a federal spending condition unconstitutionally "coerced" state legislatures to adopt a federal regulatory program.[105]

In NFIB, which involved constitutional challenges to the Patient Protection and Affordable Care Act (ACA),[106] several states challenged a provision that would have terminated a state's Medicaid funding if the state failed to expand Medicaid coverage as directed by the Act.[107] The Court held that the ACA's Medicaid expansion was an unconstitutional exercise of Congress's spending power.[108] Though his opinion analyzed the ACA's Medicaid expansion under the Spending Clause, Chief Justice John Roberts made repeated reference to the commandeering issues raised in New York and Printz.[109] While those two decisions both recognized the government's power to attach conditions to funds, Chief Justice Roberts averred that the distinction between permissible conditions and impermissible commandeering collapses "when the state has no choice" in whether to accept the conditions.[110] The states argued--and the Court agreed--that the Medicaid expansion's condition on noncompliance did not offer the states a true choice and was therefore akin to the types of coercion forbidden in New York and Printz.[111]

NFIB was not the first Supreme Court case to scrutinize federal spending conditions,[112] but the case was the only instance in which the Supreme Court has invalidated an exercise of Congress's Spending Clause power. Several factors played a role in Chief Justice Roberts's analysis. First, as both the Chief Justice and the dissenters observed, states faced losing a substantial part of their budgets.[113] Second, the Chief Justice concluded that the ACA's Medicaid expansion represented "a shift in kind, not merely degree" that states could not have anticipated when they agreed to participate in Medicaid initially, despite Congress's express reservation of "the right to alter, amend, or repeal"[114] any aspect of Medicaid.[115]

Though NFIB explored the limits of Congress's power under the Spending Clause, the decision may be relevant to the development of anti-commandeering doctrine because it identifies a potential limit on what New York and Printz recognized as a constitutional alternative to commandeering.[116] Reframing an otherwise impermissible act of commandeering as a spending condition may be subject to challenge as unconstitutionally coercive, following the reasoning of Chief Justice Roberts and the four dissenting Justices.

The Supreme Court's most recent consideration of the anti-commandeering principle occurred in 2018 in Murphy v. NCAA.[117] In Murphy, Justice Samuel Alito, writing on behalf of the Court, invalidated on anti-commandeering grounds a provision in the Professional and Amateur Sports Protection Act (PASPA) that prohibited states from authorizing sports gambling schemes.[118] Noting the rule from New York and Printz that Congress lacks "the power to issue orders directly to the States,"[119] the Court concluded that PASPA's prohibition of state authorization of sports gambling violated the anti-commandeering rule by putting state legislatures under the "direct control of Congress."[120] In so concluding, Justice Alito rejected the argument that the anti-commandeering doctrine only applies to "affirmative" congressional commands, as opposed to when Congress prohibits certain state action.[121] Finding the distinction between affirmative requirements and prohibitions "empty," the Court held that both types of commands equally intrude on state sovereign interests.[122]

In holding that Congress cannot command a state legislature to refrain from enacting a law, the Murphy Court reconciled its holding with two related doctrines.[123] First, the Court noted that while cases like Garcia, Baker, and Condon establish that the anti-commandeering doctrine "does not apply when Congress evenhandedly regulates activity in which both States and private actors engage,"[124] PASPA's anti-authorization provision was, in contrast, solely directed at the activities of state legislatures.[125] Second, the Court rejected the argument that PASPA constituted a "valid preemption provision" under the Supremacy Clause.[126] While acknowledging that the "language used by Congress and this Court" with respect to preemption is sometimes imprecise,[127] Justice Alito viewed "every form of preemption" to be based on a federal law that regulates the conduct of private actors--either by directly regulating private entities or by conferring a federal right to be free from state regulation.[128] In contrast, PASPA's anti-authorization provision did not "confer any federal rights on private actors interested in conducting sports gambling operations" or "impose any federal restrictions on private actors."[129] As a result, the Murphy Court viewed the challenged provision to be a direct command to the states in violation of the anti-commandeering rule.[130]

On June 15, 2023, the Supreme Court issued a decision in Haaland v. Brackeen[131], a case challenging the constitutionality of the Indian Child Welfare Act (ICWA). ICWA regulates state court child custody proceedings that involve Indian children by establishing a preference for placing Indian children with Indian families or institutions instead of unrelated non-Indians or non-Indian institutions.[132] The Court upheld ICWA as a valid exercise of Congress's broad power to legislate with respect to Indian tribes under the Indian Commerce Clause.[133] In reaching its decision, the Court rejected the argument that the challenged ICWA provisions "commandeered" state courts and officials to implement federal Indian policy in violation of the Tenth Amendment.[134] The Court concluded that ICWA's requirement that "any party" initiating an involuntary child custody proceeding demonstrate "active efforts" to avoid separating the Indian family did not implicate the anti-commandeering doctrine.[135] Noting that state agencies or private parties could initiate such proceedings and satisfy this requirement, the Court wrote that "[l]egislation that applies evenhandedly to state and private actors does not typically implicate the Tenth Amendment."[136] Moreover, ICWA did not commandeer state courts by mandating that they apply placement preferences in child custody proceedings because Congress can require state courts to enforce federal law.[137]

Equal Sovereignty Doctrine[edit | edit source]

In two recent voting rights cases, the Supreme Court has invoked "the fundamental principle of equal sovereignty" as a limitation on congressional power.[138] Because the United States "was and is a union of states, equal in power, dignity and authority,"[139] the equal sovereignty principle limits Congress's ability to enact legislation that subjects different states to unequal burdens, at least without a sufficient justification.[140]

Whether the equal sovereignty principle is based on the Tenth Amendment, or some other constitutional provision, is unclear from the Court's cases. Although the Constitution explicitly mandates equal treatment of states in some particular contexts,[141] no provision of the Constitution explicitly requires Congress to treat states equally as a general matter.[142] In cases involving the admission of new states, the Supreme Court in the nineteenth century developed the "equal footing" doctrine,[143] which generally requires that Congress admit new states on equal terms with the original states.[144] It thus forbids Congress from imposing "restrictions upon a new state which deprive it of equality with other members of the Union."[145] Until recently, the applicability of that doctrine outside the state admission context was questionable, as South Carolina v. Katzenbach observed that "[t]he doctrine of the equality of States . . . applies only to the terms upon which States are admitted to the Union."[146]

In Northwest Austin Municipal Utility District Number One v. Holder[147] and Shelby County v. Holder,[148] however, the Court applied the equal sovereignty principle more broadly. Both cases concerned the constitutionality of Sections 4 and 5 of the Voting Rights Act of 1965 (VRA). To remedy the racial discrimination in voting endemic during the Jim Crow era, Section 4 of the VRA contained a "coverage formula" identifying jurisdictions with a history of racial discrimination against voters, while Section 5 required those jurisdictions to obtain "preclearance" from the Department of Justice or a federal court before changing their voting procedures.[149] As a result, jurisdictions covered by Section 4 were subject to more stringent requirements when seeking to change their voting laws, compared to other states.

Although the Court upheld the constitutionality of this arrangement in Katzenbach,[150] Northwest Austin observed that the VRA's preclearance requirements and coverage formula impose "substantial federalism costs"[151] that have become tougher to justify given improved conditions since 1965.[152] The Court observed that the coverage formula, by differentiating between the states, departs from "the fundamental principle of equal sovereignty," and raises "serious constitutional questions."[153] Ultimately, however, the Court resolved Northwest Austin on statutory grounds.[154]

Four years later, Shelby County resolved the constitutional question left open in Northwest Austin, relying on the equal sovereignty principle to strike down the VRA's coverage formula as unconstitutional.[155] Under the test used in Shelby County, "a departure from the fundamental principle of equal sovereignty requires a showing that a statute's disparate geographic coverage is sufficiently related to the problem that it targets."[156] The Court observed that in the nearly fifty years since the VRA was first upheld in Katzenbach, "things have changed dramatically," pointing to increases in African-American voter registration rates and turnout in covered jurisdictions.[157] As a result, and in contrast to the "exceptional conditions" present in Katzenbach, current conditions did not justify applying the preclearance formula to only certain states and counties.[158]

As the Court has not decided an equal sovereignty challenge since Shelby County, it remains unclear whether and how the doctrine will apply outside of the voting rights context.

Commerce Clause and Tenth Amendment[edit | edit source]

In 1995, the Court in United States v. Lopez[159] struck down a federal statute prohibiting possession of a gun at or near a school, rejecting an argument that possession of firearms in school zones can be punished under the Commerce Clause because of its economic effects.[160] Accepting that rationale, the Court said, would eliminate the "distinction between what is truly national and what is truly local," would convert Congress's commerce power into a general police power of the sort retained by the states, and would undermine the first principle that the federal government is one of enumerated and limited powers.[161]

Application of the same principle led five years later to the Court's decision in United States v. Morrison[162] invalidating a provision of the Violence Against Women Act (VAWA) that created a federal cause of action for victims of gender-motivated violence. The Court concluded that Congress may not regulate "noneconomic, violent criminal conduct based solely on that conduct's aggregate effect on interstate commerce."[163] "[W]e can think of no better example of the police power, which the Founders denied the National Government and reposed in the States, than the suppression of violent crime and vindication of its victims."[164]

In contrast to Lopez and Morrison, the Court in Gonzales v. Raich upheld Congress's authority under the Commerce Clause to prohibit the intrastate cultivation and use of medical marijuana, based on its aggregate effect on interstate commerce.[165] Raich distinguished Lopez and Morrison as regulations of noneconomic activity,[166] relying mainly on older Commerce Clause precedents.[167] The majority in Raich referenced the Tenth Amendment only obliquely through a citation to United States v. Darby,[168] while the dissenters did so more directly, arguing this application of federal law unconstitutionally encroached on state police powers.[169]

In the 2012 case National Federation of Independent Business v. Sebelius, the Court held that Congress's Commerce Clause power could not be used to compel individuals to engage in commercial activity.[170] As a result, the "individual mandate" of the Patient Protection and Affordable Care Act, which required most uninsured individuals to buy health insurance or pay a penalty,[171] was beyond Congress's Commerce Clause power.[172] On route to this holding, the Court noted that Congress's enumerated powers "must be read carefully to avoid creating a general federal authority akin to the police power," invoking the Tenth Amendment and related federalism principles.[173]

- ↑ See, e.g., United States v. Morrison, 529 U.S. 598, 618 (2000) ("[W]e can think of no better example of the police power, which the Founders denied the National Government and reposed in the States, than the suppression of violent crime and vindication of its victims.").

- ↑ See, e.g., Art. I, Sec. 8, Cl. 1: Overview of Taxing Clause; Art. I, Sec. 8, Cl. 1: Overview of Spending Clause; Art. I, Sec. 8, Cl. 3: United States v. Lopez and Interstate Commerce Clause.

- ↑ See New York v. United States, 505 U.S. 144, 156 (1992) (finding that the Tenth Amendment "restrains the power of Congress . . . but this limit is not derived from the text of the Tenth Amendment itself").

- ↑ Id. at 160 ("The Court's [Tenth Amendment jurisprudence] has traveled an unsteady path."); Morrison, 529 U.S. at 645 (Souter, J., dissenting) ("[H]istory seems to be recycling, for the theory of traditional state concern as grounding a limiting principle [based on the Tenth Amendment] has been rejected previously, and more than once.").

- ↑ Fernandez v. Wiener, 326 U.S. 340, 362 (1945); accord United States v. Darby, 312 U.S. 100, 124 (1941).

- ↑ Reno v. Condon, 528 U.S. 141, 149 (2000); accord New York, 505 U.S. at 157, 166 ("[E]ven where Congress has the authority under the Constitution to pass laws requiring or prohibiting certain acts, it lacks the power directly to compel the States to require or prohibit those acts.").

- ↑ McCulloch v. Maryland, 17 U.S. (4 Wheat.) 316, 406 (1819) ("[The Tenth Amendment] thus leav[es] the question, whether the particular power which may become the subject of contest, has been delegated to the one government, or prohibited to the other, to depend on a fair construction of the whole [Constitution].").

- ↑ See, e.g., Hammer v. Dagenhart, 247 U.S. 251, 274 (1918) (invalidating federal prohibition on interstate trafficking in goods produced by child labor as invading "the local power always existing and carefully reserved to the states in the Tenth Amendment to the Constitution."), overruled by Darby, 312 U.S. at 117; United States v. Butler, 297 U.S. 1, 68 (1936) (relying on Tenth Amendment to hold tax provision in Agricultural Adjustment Act unconstitutional because it "invades the reserved rights of the states").

- ↑ See, e.g., Darby, 312 U.S. at 124 ("From the beginning and for many years the [Tenth] amendment has been construed as not depriving the national government of authority to resort to all means for the exercise of a granted power which are appropriate and plainly adapted to the permitted end.") (citing McCulloch, 17 U.S. at 405-06).

- ↑ Nat'l League of Cities v. Usery, 426 U.S. 833, 852 (1976), overruled by Garcia v. San Antonio Metro. Transit Auth., 469 U.S. 528 (1985).

- ↑ Garcia, 469 U.S. at 531.

- ↑ Id. at 549-52.

- ↑ 505 U.S. 144, 161 (1992) (quoting Hodel v. Va. Surface Mining & Reclamation Ass'n, 452 U.S. 264, 288 (1981)).

- ↑ See, e.g., Murphy v. NCAA, No. 16-476 (U.S. May 14, 2018); Printz v. United States, 521 U.S. 898 (1997).

- ↑ United States v. Sprague, 282 U.S. 716, 733 (1931).

- ↑ Tenth Amendment Rights Reserved to the States and the People.

- ↑ New York v. United States, 505 U.S. 144, 156 (1992) (quoting United States v. Darby, 312 U.S. 100, 124 (1941)).

- ↑ 2 Max Farrand, Records of the Federal Convention of 1787, at 341-42, 587-88, 617-618 (1911) [hereinafter Farrand's Records].

- ↑ See The Federalist No. 84 (Alexander Hamilton).

- ↑ Id. For the Antifederalists, of course, the absence of a bill of rights was a primary reason to oppose ratification of the Constitution. See, e.g., George Mason, Objections to this Constitution of Government (1787), reprinted in 2 Farrand's Records, supra note here, at 637-38 ("There is no Declaration of Rights . . . .").

- ↑ See generally Garcia v. San Antonio Metro. Transit Auth., 469 U.S. 528, 568-70 (1985) (Powell, J., dissenting) (reviewing this history and noting that "eight States voted for the Constitution only after proposing amendments to be adopted after ratification").

- ↑ See Introduction: Bill of Rights (First Through Tenth Amendments).

- ↑ United States v. Darby, 312 U.S. 100, 124 (1941).

- ↑ Articles of Confederation, art. II ("Each state retains its sovereignty, freedom and independence, and every Power, Jurisdiction and right, which is not by this confederation expressly delegated to the United States, in Congress assembled.").

- ↑ Annals of Cong. 767-68 (1789) (defeated in House 17 to 32); 2 B. Schwartz, The Bill of Rights: A Documentary History 1150-51 (1971) (defeated in Senate by unrecorded vote).

- ↑ 2 Annals of Cong. 1897 (1791).

- ↑ 17 U.S. (4 Wheat.) 316 (1819).

- ↑ See Art. I, Sec. 8, Cl. 18: Necessary and Proper Clause Early Doctrine and McCulloch v. Maryland.

- ↑ McCulloch, 17 U.S. (4 Wheat.) at 372-74 (argument of counsel).

- ↑ Id. at 372.

- ↑ Id. at 406 (opinion of Marshall, C.J.).

- ↑ Id. The Court later relied on this passage of McCulloch to state that "[f]rom the beginning . . . the amendment has been construed as not depriving the national government of authority to resort to all means for the exercise of a granted power which are appropriate and plainly adapted to the permitted end." United States v. Darby, 312 U.S. 100, 124 (1941).

- ↑ See infra Amdt10.2.5 Federal Power to Tax and the Tenth Amendment (discussing Collector v. Day, 78 U.S. (11 Wall.) 113 (1871), overruled by Graves v. New York ex rel. O'Keefe, 306 U.S. 466, 486 (1939), and related intergovernmental tax immunity cases).

- ↑ Civil Rights Cases, 109 U.S. 3, 14-15 (1883) (arguing that allowing federal regulation of racial discrimination by private actors via the Fourteenth Amendment "steps into the domain of local jurisprudence" and would be "repugnant to the Tenth Amendment of the Constitution"). The discussion of state sovereignty in Lane County v. Oregon also indirectly refers to the Tenth Amendment:[I]n many articles of the Constitution the necessary existence of the States, and, within their proper spheres, the independent authority of the States, is distinctly recognized. To them nearly the whole charge of interior regulation is committed or left; to them and to the people all powers not expressly delegated to the national government are reserved. Lane Cnty. v. Oregon, 74 U.S. 71, 76 (1868) (Salmon, C.J.); accord Slaughter-House Cases, 83 U.S. 36, 62-63 (1872); Mayor of City of New York v. Miln, 36 U.S. 102, 139 (1837).

- ↑ There are a handful of invocations of the Tenth Amendment in nineteenth century Supreme Court cases not involving taxation. These are usually in dissent or in passing reference. See, e.g., Taylor v. Beckham, 178 U.S. 548, 595 (1900) (Harlan, J., dissenting); Legal Tender Cases, 110 U.S. 421, 466 (1884) (Field, J., dissenting); Ex parte Virginia, 100 U.S. 339, 358 (1879) (Field, J., dissenting); Fong Yue Ting v. United States, 149 U.S. 698, 758 (1893) (Field, J., dissenting); Leisy v. Hardin, 135 U.S. 100, 127 (1890) (Gray, J. dissenting); Veazie Bank v. Fenno, 75 U.S. 533, 550 (1869) (Nelson, J., dissenting); Bank of Augusta v. Earle, 38 U.S. 519, 606 (1839) (McKinley, J. dissenting); Gibbons v. Ogden, 22 U.S. 1, 198 (1824); Thurlow v. Massachusetts, 46 U.S. 504, 587 (1847) (opinion of McLean, J.), overruled by Leisy v. Hardin, 135 U.S. 100 (1890).

- ↑ See Art. I, Sec. 8, Cl. 3: United States v. Lopez and Interstate Commerce Clause.

- ↑ 247 U.S. 251 (1918), overruled by United States v. Darby, 312 U.S. 100 (1941).

- ↑ Id. at 268 n.1.

- ↑ Id. at 274.

- ↑ Hill v. Wallace, 259 U.S. 44 (1922); see also Trusler v. Crooks, 269 U.S. 475 (1926).

- ↑ Child Labor Tax Case, 259 U.S. 20, 26, 38 (1922).

- ↑ Carter v. Carter Coal Co., 298 U.S. 238, 294 (1936).

- ↑ Hopkins Fed. Sav. & Loan Ass'n v. Cleary, 296 U.S. 315, 337 (1935).

- ↑ United States v. Butler, 297 U.S. 1, 68 (1936) ("The act invades the reserved rights of the states. It is a statutory plan to regulate and control agricultural production, a matter beyond the powers delegated to the federal government.")

- ↑ 295 U.S. 495 (1935).

- ↑ Id. at 528-29 ("Extraordinary conditions do not create or enlarge constitutional power . . . . Such assertions of extraconstitutional authority were anticipated and precluded by the explicit terms of the Tenth Amendment.").

- ↑ 251 U.S. 146 (1919).

- ↑ Champion v. Ames, 188 U.S. 321 (1903); see also United States v. Ferger, 250 U.S. 199 (1919) (upholding law punishing the forgery of bills of lading in interstate and foreign commerce).

- ↑ Hoke v. United States, 227 U.S. 308 (1913).

- ↑ Brooks v. United States, 267 U.S. 432 (1925).

- ↑ Thornton v. United States, 271 U.S. 414 (1926).

- ↑ Missouri v. Holland, 252 U.S. 416, 434 (1920).

- ↑ Steward Mach. Co. v. Davis, 301 U.S. 548 (1937); Helvering v. Davis, 301 U.S. 619 (1937).

- ↑ NLRB v. Jones & Laughlin Steel Corp., 301 U.S. 1 (1937); see Art. I, Sec. 8, Cl. 3: National Labor Relations Act of 1935.

- ↑ See John R. Vile, Truism, Tautology or Vital Principle? The Tenth Amendment Since United States v. Darby, 27 Cumb. L. Rev. 445, 457-58 (1997) (reviewing this history with respect to the Tenth Amendment).

- ↑ 312 U.S. 100 (1941); accord United States v. Carolene Prods. Co., 304 U.S. 144, 147 (1938).

- ↑ Case v. Bowles, 327 U.S. 92, 102 (1946) (quoting Fernandez v. Wiener, 326 U.S. 340, 362 (1945)).

- ↑ See, e.g., Oklahoma ex rel. Phillips v. Guy F. Atkinson Co.,, 313 U.S. 508, 534 (1941); Nw. Elec. Co. v. Fed. Power Comm'n, 321 U.S. 119, 125 (1944); Oklahoma v. U.S. Civil Serv. Comm'n, 330 U.S. 127, 143 (1947); United Pub. Workers of Am. (C.I.O.) v. Mitchell, 330 U.S. 75, 95-96 (1947); Granville-Smith v. Granville-Smith, 349 U.S. 1, 27 (1955); Roth v. United States, 354 U.S. 476, 492-93 (1957); Reina v. United States, 364 U.S. 507, 511 (1960); United States v. Oregon, 366 U.S. 643, 649 (1961); Sperry v. Florida ex rel. Fla. Bar, 373 U.S. 379, 403 (1963); Perez v. United States, 402 U.S. 146, 151 (1971); Fry v. United States, 421 U.S. 542, 547 n.7 (1975).

- ↑ 426 U.S. 833 (1976), overruled by Garcia v. San Antonio Metro. Transit Auth., 469 U.S. 528 (1985).

- ↑ Id. at 841.

- ↑ Id. at 845.

- ↑ Id.

- ↑ Id. at 832.

- ↑ Id. at 843 ("The [Tenth] Amendment expressly declares the constitutional policy that Congress may not exercise power in a fashion that impairs the States' integrity or their ability to function effectively in a federal system." (quoting Fry v. United States, 421 U.S. 542, 547 n. 7 (1975)). Although National League of Cities is not entirely clear that the Tenth Amendment is the basis for its doctrine, the dissent in that case, as well as subsequent Court decisions, treat the opinion as based on the Tenth Amendment. Id. at 862 (Justice William Brennan, dissenting); FERC v. Mississippi, 456 U.S. 742, 776 (1982) (Justice Sandra Day O'Connor, dissenting); EEOC v. Wyoming, 460 U.S. 226, 235 (1983) (referring to "the doctrine of Tenth Amendment immunity articulated in National League of Cities v. Usery").

- ↑ Nat'l League of Cities, 426 at 842-43 ("[The Tenth Amendment] is not without significance." (quoting Fry, 421 U.S. at 547 n.7)).

- ↑ See, e.g., FERC, 456 U.S. 742; EEOC, 460 U.S. 226; see also United Transp. Union v. LIRR, 455 U.S. 678 (1982).

- ↑ 452 U.S. 264, 287 (1981); accord Hodel v. Indiana, 452 U.S. 314, 330 (1981).

- ↑ 461 U.S. 773, 790 (1983). Cf. Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519, 577-82 (2012) (plurality opinion).

- ↑ Fitzpatrick v. Bitzer, 427 U.S. 445, 452-56 (1976); Milliken v. Bradley, 433 U.S. 267, 291 (1977); Monell v. Dep't of Soc. Servs. of N.Y., 436 U.S. 658, 690 n.54 (1978); City of Rome v. United States, 446 U.S. 156, 178-79 (1980); Fullilove v. Klutznick, 448 U.S. 448, 476-78 (1980) (plurality opinion of Burger, C.J.). Cf. Shelby Cnty. v. Holder, 570 U.S. 529, 543-45 (2013).

- ↑ 469 U.S. 528 (1985). The issue was again decided by a 5-4 vote, with Justice Harry Blackmun's qualified acceptance of the National League of Cities approach having changed to a rejection.

- ↑ Id. at 557.

- ↑ 312 U.S. 100, 124 (1941); see Tenth Amend.: Tenth Amendment and Darby. Madison's views were quoted by the Court in Garcia, 469 U.S. at 549.

- ↑ 469 U.S. at 549.

- ↑ Id. at 550-51.

- ↑ Id. at 556. Beginning in the 1990s, the Court began to identify and define these affirmative limitations. See Tenth Amend.: Anti-Commandeering Doctrine.

- ↑ This "intergovernmental tax immunity" doctrine traces its origin to the holding in McCulloch v. Maryland that the Supremacy Clause barred Maryland from taxing the Second Bank of the United States. See 17 U.S. (4 Wheat.) 316, 436 (1819); see also Massachusetts v. United States, 435 U.S. 444, 454 (1978).

- ↑ 78 U.S. (11 Wall.) 113, 124 (1871), overruled by Graves v. New York ex rel. O'Keefe, 306 U.S. 466, 486 (1939); see also, e.g., Pollock v. Farmers' Loan & Tr. Co., 157 U.S. 429 (1895), overruled by South Carolina v. Baker, 485 U.S. 505 (1988); New York v. United States, 326 U.S. 572 (1946).

- ↑ Graves, 306 U.S. at 486.

- ↑ See generally Baker, 485 U.S. at 523-24 (summarizing modern doctrine).

- ↑ See Art. I, Sec. 8, Cl. 1: Intergovernmental Tax Immunity Doctrine.

- ↑ 469 U.S. 528 (1985).

- ↑ See New York v. United States, 505 U.S. 144, 157-58 (1992) (finding protection for state sovereignty against commandeering was "not derived from the text of the Tenth Amendment itself" but in how it "confirms that the power of the Federal Government is subject to limits"); accord Murphy v. NCAA, No. 16-476, slip op. at 15-16 (U.S. May 14, 2018). At times, the Court has described its anti-commandeering doctrine as an interpretation of the word "proper" under the Necessary and Proper Clause. See Printz v. United States, 521 U.S. 898, 923-24 (1997); Murphy, slip op. at 2 (Thomas, J., concurring); see generally Art. I, Sec. 8, Cl. 18: Meaning of Proper.

- ↑ 505 U.S. 144 (1992).

- ↑ Id. at 170 (quoting Hodel v. Va. Surface Mining & Reclamation Ass'n, 452 U.S. 264, 288 (1981)).

- ↑ Shelby Cnty. v. Holder, 570 U.S. 529, 544 (2013).

- ↑ See Leah M. Litman, Inventing Equal Sovereignty, 114 Mich. L. Rev. 1207, 1232 (2016).

- ↑ See Art. I, Sec. 8, Cl. 3: United States v. Lopez and Interstate Commerce Clause.

- ↑ 469 U.S. 528 (1985).

- ↑ 501 U.S. 452 (1991).

- ↑ The Court left no doubt that it considered the constitutional issue to be serious: "[T]he authority of the people of the States to determine the qualifications of their most important government officials . . . is an authority that lies at 'the heart of representative government' [and] is a power reserved to the States under the Tenth Amendment and guaranteed them by [the Guarantee Clause]." Id. at 463. In the latter context, the Court's opinion by Justice Sandra Day O'Connor cited Deborah Jones Merritt, The Guarantee Clause and State Autonomy: Federalism for a Third Century, 88 Colum. L. Rev. 1 (1988) and Michael W. McConnell, Federalism: Evaluating the Founders' Design, 54 U. Chi. L. Rev. 1484 (1987) (also cited by the Court); and Van Alystyne, The Second Death of Federalism, 83 Mich. L. Rev. 1709 (1985).

- ↑ 501 U.S. at 464.

- ↑ 505 U.S. 144 (1992).

- ↑ See, e.g., Hodel v. Va. Surface Mining & Reclamation Ass'n, 452 U.S. 264, 288 (1981); FERC v. Mississippi, 456 U.S. 742, 765 (1982); South Carolina v. Baker, 485 U.S. 505, 513-15 (1988).

- ↑ 426 U.S. 833 (1976).

- ↑ 505 U.S. at 157. "If a power is delegated to Congress in the Constitution, the Tenth Amendment expressly disclaims any reservation of that power to the States . . . ." Id. at 156 (quoted with approval in Watters v. Wachovia Bank, N.A., 550 U.S. 1, 22 (2007) (holding a national bank's state-chartered subsidiary real estate lending business is subject to federal, not state, law)).

- ↑ 505 U.S. at 181, 182.

- ↑ 521 U.S. 898 (1997).

- ↑ Id. at 935.

- ↑ 528 U.S. 141 (2000).

- ↑ 485 U.S. 505, 514-15 (1988).

- ↑ Condon, 528 U.S. at 151.

- ↑ Id.

- ↑ See Art. I, Sec. 8, Cl. 1: Overview of Spending Clause.

- ↑ New York v. United States, 505 U.S. 144, 167 (1992); Printz v. United States, 521 U.S. 898, 917 (1997).

- ↑ 567 U.S. 519, 580 (2012) (plurality opinion of Roberts, C.J.).

- ↑ Pub. L. No. 111-148, 124 Stat. 119 (2010).

- ↑ See 46 U.S.C. §§ 1396a (setting forth Medicaid requirements), 1396c (permitting the Secretary of the Department of Health and Human Services to withhold Medicaid payments).

- ↑ NFIB, 567 U.S. at 580 (plurality opinion). Chief Justice Roberts's opinion with respect to the Medicaid expansion was joined by only three members of the Court, though four other Justices agreed that the ACA's Medicaid expansion was unconstitutionally coercive. See id. at 681 (Scalia, Kennedy, Thomas, and Alito, JJ., dissenting).

- ↑ Id. at 577 (plurality opinion of Roberts, C.J.).

- ↑ Id. at 578.

- ↑ Id. at 579-80.

- ↑ See, e.g., South Dakota v. Dole, 483 U.S. 203 (1987); Pennhurst State Sch. & Hosp. v. Halderman, 451 U.S. 1 (1981).

- ↑ NFIB, 567 U.S. at 581-82 (plurality opinion of Roberts, C.J.); id. at 682 (Scalia, Kennedy, Thomas, and Alito, JJ., dissenting).

- ↑ 42 U.S.C. § 1304.

- ↑ NFIB, 567 U.S. at 583 (plurality opinion of Roberts, C.J.).

- ↑ New York v. United States, 505 U.S. 144, 167 (1992); Printz v. United States, 521 U.S. 898, 917 (1997).

- ↑ Murphy v. NCAA, No. 16-476, slip op. at 17-24 (U.S. May 14, 2018).

- ↑ See Pub. L. No. 102-559, § 2(a), 106 Stat. 4227, 4228 (1992) (codified at 28 U.S.C. § 3702).

- ↑ See Murphy, No.16-476, slip op. at 17-18. Murphy offered three justifications for the anti-commandeering rule: (1) to protect liberty by ensuring a "healthy balance of power" between the states and the federal government; (2) to promote political accountability by the United States avoiding the blurring of which government is to credit or blame for a particular policy; (3) to prevent Congress from shifting the costs of regulation to the states. Id. at 17-18.

- ↑ Id. at 18.

- ↑ Id.

- ↑ Id.

- ↑ Id. at 17-18.

- ↑ Id. at 18.

- ↑ Id. at 18-19. The Court also distinguished two other cases, Hodel v. Va. Surface Mining & Reclamation Ass'n, 452 U.S. 264 (1981), and FERC v. Mississippi, 456 U.S. 742 (1982), in which the Court rejected anti-commandeering challenges to federal statutes. See Murphy, No. 16-476, slip op. at 17-19.

- ↑ See Murphy, No. 16-476, slip op. Murphy identified two requirements for a preemption provision to be deemed valid: (1) the provision must represent an exercise of power conferred on Congress by the Constitution; (2) the provision must regulate private actors and not the states. Id.

- ↑ Id. at 1480-81.

- ↑ Id. at 1481.

- ↑ Id. (noting that if a private actor started a sports gambling operation, either with or without state authorization, PASPA's anti-authorization provision would not be violated).

- ↑ Id. The Court ultimately invalidated PASPA in its entirety, holding that other provisions of the law that regulated private conduct were inseverable from the anti-authorization provision and therefore could not exist independently from the unconstitutional provision. See id. at 1481-84.

- ↑ Haaland v. Brackeen, No. 21-376 (U.S. June 15, 2023).

- ↑ Id.at 11-12 (citing 25 U.S.C. § 1915).

- ↑ Id.at 11-12.

- ↑ Id.at 18-29.

- ↑ Id.at 18-23.

- ↑ Id.at 20 (citations and internal quotation marks omitted).

- ↑ Id.at 24. In addition, the Court held that ICWA provisions requiring state courts to maintain records of custody proceedings did not implicate the Tenth Amendment because such "adjudicative tasks" were ancillary to states courts' responsibility to enforce ICWA. Id.at 25-29.

- ↑ Nw. Austin Mun. Util. Dist. No. One v. Holder, 557 U.S. 193, 203 (2009); Shelby Cnty. v. Holder, 570 U.S. 529, 544 (2013).

- ↑ Shelby Cnty., 570 U.S. at 544 (citing Coyle v. Smith, 221 U.S. 559, 567 (1911)).

- ↑ Id. at 542 ("[A] departure from the fundamental principle of equal sovereignty requires a showing that a statute's disparate geographic coverage is sufficiently related to the problem that it targets." (quoting Nw. Austin, 557 U.S. at 203)).

- ↑ See, e.g., Art. I, Sec. 3, Clause 1 Composition ("The Senate of the United States shall be composed of two Senators from each State . . . ."); Art. I, Section 8 Enumerated Powers (requiring "Duties, Imposts, and Excises" to be "uniform throughout the United States"); Art. I, Sec. 8, Clause 3 Commerce (requiring "an uniform Rule of Naturalization" and "uniform Laws on the subject of Bankruptcies throughout the United States"); Art. I, Sec. 9, Clause 6 Ports ("No Preference shall be given by any Regulation of Commerce or Revenue to the Ports of one State over those of another.").

- ↑ See generally Leah M. Litman, Inventing Equal Sovereignty, 114 Mich. L. Rev. 1207, 1230-32 (2016); Thomas Colby, In Defense of the Equal Sovereignty Principle, 65 Duke L.J. 1087, 1099 (2016).

- ↑ See Art. IV, Sec. 3, Cl. 1: Overview of Admissions (New States) Clause.

- ↑ Lessee of Pollard v. Hagan, 44 U.S. 212, 223 (1845).

- ↑ Coyle v. Smith, 221 U.S. 559, 567 (1911).

- ↑ South Carolina v. Katzenbach, 383 U.S. 301, 328-29 (1966) (citing Coyle, 221 U.S. 559).

- ↑ 557 U.S. 193, 203 (2009).

- ↑ 570 U.S. 529, 544 (2013).

- ↑ Id. at 537-38.

- ↑ 383 U.S. at 328-83; accord Georgia v. United States, 411 U.S. 526 (1973); City of Rome v. United States, 446 U.S. 156 (1980); Lopez v. Monterey Cnty., 525 U.S. 266 (1999).

- ↑ Nw. Austin, 557 U.S. at 202 (quoting Lopez, 525 U.S. at 282).

- ↑ Id. at 202 ("Things have changed in the South."), 203 ("[T]he statute's coverage formula is based on data that is now more than 35 years old, and there is considerable evidence that it fails to account for current political conditions.").

- ↑ Id. at 203-04.

- ↑ Id. at 206-11.

- ↑ Shelby Cnty. v. Holder, 570 U.S. 529, 557 (2013).

- ↑ Id. at 542 (quoting Nw. Austin, 557 U.S. at 203).

- ↑ Id. at 547-48.

- ↑ Id. at 557.

- ↑ 514 U.S. 549 (1995).

- ↑ Id. at 564-65.

- ↑ Id. at 552, 567-68.

- ↑ 529 U.S. 598 (2000).

- ↑ Id. at 617.

- ↑ Id. at 618.

- ↑ 545 U.S. 1, 22 (2005).

- ↑ Id. at 25.

- ↑ Id. at 17-21 (discussing Wickard v. Filburn, 317 U.S. 111 (1942)).

- ↑ Id. at 29 ("[S]tate action cannot circumscribe Congress's plenary commerce power." (citing United States v. Darby, 312 U.S. 100, 114 (1941))).

- ↑ Id. at 50 (O'Connor, J., dissenting) ("It will not do to say that Congress may regulate noncommercial activity simply because it may have an effect on the demand for commercial goods . . . . We have already rejected the result that would follow--a federal police power." (citing Lopez, 514 U.S. at 564)); id. at 66 (Thomas, J., dissenting) ("Here, Congress has encroached on States' traditional police powers to define the criminal law and to protect the health, safety, and welfare of their citizens.").

- ↑ Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519, 552 (2012) (plurality opinion of Roberts, C.J.).

- ↑ Id. at 539.

- ↑ Id. at 558. The Court ultimately upheld the individual mandate under Congress's taxing power. Id. at 561-63.

- ↑ Id. at 535-36.