Constitution of the United States/Art. I/Sec. 8/Clause 1 General Welfare

Article I Legislative Branch

Section 8 Enumerated Powers

Clause 1 General Welfare

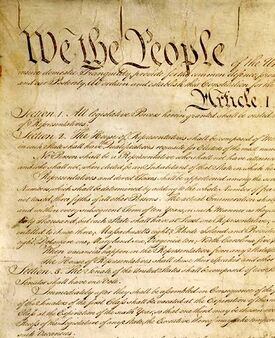

| Clause Text |

|---|

| The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States; |

Taxing Power[edit | edit source]

Overview of Taxing Clause[edit | edit source]

Article I, Section 8, Clause 1 of the Constitution provides Congress with broad authority to lay and collect taxes for federal debts, the common defense, and the general welfare.[1] By the Constitution's terms, the power of Congress to levy taxes is subject to but "one exception and only two qualifications."[2] Articles exported from any state may not be taxed at all,[3] direct taxes must be levied by the rule of apportionment,[4] and indirect taxes by the rule of uniformity.[5] The Supreme Court has emphasized the sweeping character of this power by saying from time to time that it "reaches every subject,"[6] that it is "exhaustive"[7] or that it "embraces every conceivable power of taxation."[8] Despite few express limitations on the taxing power, the scope of Congress's taxing power has been at times substantially curtailed by judicial decisions with respect to the manner in which taxes are imposed,[9] the objects for which they may be levied,[10] and the subject matter of taxation.[11]

Historical Background on Taxing Power[edit | edit source]

The Framers' principal motivation for granting Congress the power to tax in the Constitution was to provide the National Government with a mechanism to raise a "regular and adequate supply"[12] of revenue and pay its debts.[13] Under the predecessor Articles of Confederation, the National Government had no power to tax and could not compel states to raise revenue for national expenditures.[14] The National Government could requisition funds from states to place in the common treasury, but, under the Articles of Confederation, state requisitions were "mandatory in theory" only.[15] State governments resisted these calls for funds.[16] As a result, the National Government raised "very little" revenue through state requisitions,[17] inhibiting its ability to resolve immediate fiscal problems, such as repaying its Revolutionary War debts.[18]

In the first draft of the Constitution, the taxing clause stated, "The legislature of the United States shall have the power to lay and collect taxes, duties, imposts, and excises," "without any qualification whatsoever.'"[19] After discussions about the first draft's unlimited terms and several rewrites, the Framers limited the objects of the taxing power--for United States debts, defense, and the general welfare.[20] The Framers also discussed whether the clause should include language to limit expressly the subjects of the taxing power.[21] One of the arguments against a general taxing power was the potential danger to state governments.[22] A general taxing power ultimately prevailed as the Framers believed the Constitution's federal system would prevent the oppression of one government by the other through its taxing power, a general taxing power would circumvent the need to overtax certain subjects, and a general taxing power would allow the government to efficiently raise funds in times of war.[23]

Uniformity Clause and Indirect Taxes[edit | edit source]

Article I, Section 8, Clause 1 of the Constitution authorizes Congress to lay and collect duties, imposts, or excise taxes--collectively referred to as indirect taxes--and requires that they be "uniform throughout the United States."[24] The Supreme Court has held that an indirect tax satisfies the Uniformity Clause "only when the tax 'operates with the same force and effect in every place where the subject of it is found."[25] In general, an indirect tax does not violate the Uniformity Clause where the subject of the indirect tax is described in non-geographical terms.[26] If Congress uses geographical terms to describe the subject of the indirect tax, then the Supreme Court "will examine the classification closely to see if there is actual geographic discrimination."[27]

In Knowlton v. Moore,[28] the Supreme Court examined how the rule of uniformity applied to indirect taxes. In Knowlton, the Court adopted a less restrictive reading of the Uniformity Clause,[29] holding that, in selecting the subject of an indirect tax, Congress could define the class of objects subject to the tax and make distinctions between similar classes.[30] The Knowlton Court ruled that an inheritance tax that exempted legacies and distributive shares of personal property under $10,000 imposed a primary tax rate that varied based on the beneficiary's degree of relationship to the decedent, and progressively raised tax rates on legacies and distributive shares as they increased in size, did not violate the Uniformity Clause.[31] The Court held that the Uniformity Clause merely requires "geographical uniformity," meaning indirect taxes must operate in the same manner throughout the United States.[32]

The Court further clarified the meaning of the Uniformity Clause in United States v. Ptasynski.[33] In Ptasynski, the Court ruled that the Crude Oil Windfall Profit Tax Act of 1980,[34] which made the windfall profit tax inapplicable to "exempt Alaskan oil,"[35] did not violate the Uniformity Clause despite the Act's inclusion of favorable treatment for a geographically defined classification.[36] The Court explained, "Where Congress defines the subject of a tax in nongeographic terms, the Uniformity Clause is satisfied. . . . But where Congress does choose to frame a tax in geographic terms, we will examine the classification closely to see if there is actual geographic discrimination."[37] The Court held that the geographically defined classification was constitutional because Congress used "neutral factors" relating to the ecology, environment, and the remoteness of the location to conclude the exempt Alaskan oil classification merited favorable treatment.[38] Moreover, the Court found nothing in the legislative history that suggests Congress intended to grant Alaska "an undue preference at the expense of other oil producing states."[39]

Taxes to Regulate Conduct[edit | edit source]

Congress has broad discretion in selecting the "measure and objects" of taxation, and may use its taxing power to regulate private conduct.[40] For instance, the Supreme Court has sustained regulations on the contents of taxed packaged goods[41] and the packaging of taxed oleomargarine,[42] which were ostensibly designed to prevent fraud in the collection of the tax. It has also upheld measures taxing drugs[43] and firearms,[44] which prescribed rigorous restrictions under which such articles could be sold or transferred, and imposed heavy penalties upon persons dealing with them in any other way.

The Court has not invalidated a tax with a clear regulatory effect solely because Congress was motivated by a regulatory purpose.[45] Even where a tax is coupled with regulations that have no relation to the efficient collection of the tax, and no other purpose appears on the face of the statute, the Court has refused to inquire into the motives of the lawmakers and has sustained the tax despite its prohibitive proportions.[46] The Court has stated:

It is beyond serious question that a tax does not cease to be valid merely because it regulates, discourages, or even definitely deters the activities taxed. . . . The principle applies even though the revenue obtained is obviously negligible . . . or the revenue purpose of the tax may be secondary.United States v. Sanchez, 340 U.S. at 44 (1950).

In some cases, however, the structure of a taxation scheme is such as to suggest that Congress actually intends to regulate under a separate constitutional authority.[47] As long as such separate authority is available to Congress, the imposition of a tax as a penalty for such regulation is valid.[48] In National Federation of Independent Business v. Sebelius (NFIB),[49] the Court reaffirmed that it construes the Constitution to prohibit Congress from using the taxing power to enact taxes that are functionally regulatory penalties as a means of regulating in areas that Congress cannot regulate directly through a separate constitutional authority.[50] The Court has invalidated a few federal taxes on this basis.[51]

Discerning whether Congress, in passing a regulation that purports to be under the taxing authority, intends to exercise a separate constitutional authority, requires evaluation of a number of factors.[52] Under Bailey v. Drexel Furniture Co.,[53] decided in 1922, the Court, which had previously rejected a federal law regulating child labor as being outside of the Commerce Clause,[54] also rejected a 10% tax on the net profits of companies who knowingly employed child labor. The Court invalidated the child labor tax as a penalty exceeding Congress's constitutional authority and aiming to achieve a regulatory purpose "plainly within" the exclusive powers reserved to the states under the Tenth Amendment.[55] Four characteristics of the tax led the Court to conclude the tax was a penalty. First, the Court noted that the law in question set forth a specific and detailed regulatory scheme--including the ages, industry, and number of hours allowed--establishing when employment of underage youth would incur taxation.[56] Second, the tax was not commensurate with the degree of the infraction--i.e., a small departure from the prescribed course of conduct could feasibly lead to the 10% tax on net profits.[57] Third, the tax had a scienter requirement, so that the employer had to know that the child was below a specified age in order to incur taxation.[58] Fourth, the statute made the businesses subject to inspection by officers of the Secretary of Labor, positions not traditionally charged with the enforcement and collection of taxes.[59] The Court distinguished the child labor tax from acceptable regulatory taxes by emphasizing that in those cases Congress had authority outside the taxing power to regulate those activities.[60]

In the first half of the twentieth century, the Court continued to strike down federal taxes on the ground that they infringed on regulatory powers reserved to the states under the Tenth Amendment because Congress did not have separate constitutional authority to regulate the subject matter at issue. In 1935, in United States v. Constantine,[61] the Court struck down a federal excise tax on liquor dealers operating in violation of state law. The Court construed the Constitution to prohibit Congress from imposing the excise tax when the purpose of the tax was to punish rather than raise revenue.[62] The majority concluded that Congress exceeded its authority by penalizing liquor dealers for violating state law, because such regulation was reserved, under the Tenth Amendment, to the states.[63] Congress lacked authority to impose a penalty on liquor dealers following the repeal of the Eighteenth Amendment, which had established the national prohibition on alcohol.[64] The next year, in United States v. Butler,[65] the Court struck down a tax on agricultural producers that Congress had enacted to raise funds to subsidize specific crops and control agricultural commodity prices. The Court held that Congress did not hold the power to regulate the "purely local activity"[66] of controlling agricultural production, because the power to regulate local activity was reserved to the states under the Tenth Amendment.[67] The Court has since limited the applicability of these decisions.[68]

In subsequent cases, the Court upheld regulatory taxes without specifying whether Congress had authority to regulate the activity subject to tax under its other enumerated powers. For example, in Sonzinsky v. United States,[69] the Court rejected a challenge to a federal license tax on dealers, importers, and manufacturers of certain firearms. Similarly, in United States v. Sanchez,[70] the Court upheld a tax on unregistered transfers of marijuana that was challenged based on its penal nature.

In 2012, in NFIB v. Sebelius, the Court confirmed that the taxing power provides Congress with the authority to use taxes to carry out regulatory measures that might be impermissible if Congress enacted them under its other enumerated powers.[71] In NFIB, the Court upheld the constitutionality of a provision in the Patient Protection and Affordable Care Act (ACA) requiring individuals to either purchase minimum health insurance (commonly referred to as the "individual mandate") or pay a "penalty" in lieu of purchasing minimum health insurance.[72] Despite being labeled a penalty in the statute, the Court held the payment due in lieu of purchasing minimum health insurance (the exaction) was a constitutionally permissible use of Congress's authority under the taxing power.[73] More precisely, the Court ruled the exaction was a tax not a penalty for constitutional purposes, and thus the exaction was not impermissibly regulatory under the taxing power.[74]

Chief Justice John Roberts, in a majority holding,[75] distinguished the exaction in NFIB from its past precedent in which it held Congress lacked authority under the taxing power to use penalties disguised as taxes to regulate activities that it could not regulate directly through its other enumerated powers.[76] Specifically, the Court found that three of the four characteristics that it had used in Drexel Furniture Co. to conclude the child labor tax was a penalty for constitutional purposes were not present with respect to the individual mandate provision at issue in NFIB.[77] Unlike Drexel Furniture Co., the Court found: (1) the exaction was not "prohibitory" because the exaction was "far less" than the cost of insurance; (2) there was no scienter requirement--the exaction was not levied based on a taxpayer's knowledge of wrongdoing; and (3) the Internal Revenue Service (IRS) collected the exaction and the IRS was prohibited from using "those means most suggestive of a punitive sanction, such as criminal prosecution."[78]

The majority did not expressly address the first factor used by the Court in Drexel Furniture Co. to conclude the child labor tax was a penalty for constitutional purposes--whether the ACA set forth a specific and detailed course of conduct and imposed an exaction on those who transgress its standard. However, the majority did apply a functional approach that looked at the exaction's "substance and application" to conclude the exaction was a tax not a penalty for constitutional purposes.[79] The Court found that the exaction "look[ed] like a tax in many respects."[80] The Court observed that the exaction is located in the Internal Revenue Code (IRC); the requirement to pay the exaction is located in the IRC; the IRS enforces the exaction; the IRS assesses and collects the exaction "in the same manner as taxes"; the exaction does not apply to individuals who do not owe federal income taxes because their income is less than the filing threshold; taxpayers pay the exaction to the Treasury's general fund when they file their tax returns; the exaction is based on "such familiar factors" as taxable income, filing status, and the number of dependents; and the exaction "yields the essential factor of any tax: it produces at least some revenue for the government."[81] Additionally, in distinguishing penalties from taxes for constitutional purposes, the Court explained that, "if the concept of penalty means anything, it means punishment for an unlawful act or omission."[82] The Court emphasized that, besides the exaction itself, there were no additional "negative legal consequences" for failure to purchase health insurance.[83] The majority's discussion suggests that, for constitutional purposes, the prominence of regulatory motivations for tax provisions may become less important than the nature of the exactions imposed and the manner in which they are administered.

In those areas where activities are subject to both taxation and regulation, Congress's taxing authority is not limited from reaching illegal activities. For instance, Congress may tax an activity, such as the business of accepting wagers,[84] regardless of whether it is permitted or prohibited by the laws of the United States[85] or by those of a state.[86] However, Congress's authority to regulate using the taxing power "reaches only existing subjects."[87] For example, "Congress cannot authorize a trade or business within a state in order to tax it," because it would be "repugnant to the exclusive power of the State over the same subject."[88] Thus, so-called federal "licenses," so far as they relate to topics outside Congress's constitutional authority, merely express "the purpose of the [federal] government not to interfere . . . with the trade nominally licensed, if the required taxes are paid."[89] In those instances, whether a federally "licensed" trade shall be permitted at all is a question to be decided by a state.

Intergovernmental Tax Immunity Doctrine[edit | edit source]

There is no provision in the Constitution that expressly provides that the federal government is immune from state taxation,[90] just as there is no provision in the Constitution that expressly provides that states are immune from federal taxation.[91] However, the Supreme Court has applied the intergovernmental tax immunity doctrine to invalidate taxes that impair the sovereignty of the Federal Government or state governments. The intergovernmental tax immunity doctrine is a limitation on federal and state taxing powers by implication.[92] The Court has explained that the origins of the intergovernmental tax immunity doctrine lie in the Supremacy Clause,[93] the Tenth Amendment, and the preservation of the Constitution's system of dual federalism.[94]

The Court first articulated the principles underlying the intergovernmental tax immunity doctrine in 1819 in McCulloch v. Maryland.[95] In McCulloch, the Court ruled that the Supremacy Clause barred Maryland from imposing taxes on notes issued by the Second Bank of the United States and related penalties.[96] The Court reasoned that if a state had the power to tax the means of the Federal Government, the Supremacy Clause would be empty and without meaning.[97] Thus, the Court held states had "no power, by taxation or otherwise, to retard, impede, burden, or in any manner control, the operations of the constitutional laws enacted by Congress to carry into execution the powers vested in the general government."[98]

Initially, following McCulloch, there were few limitations on federal immunity from state taxation and state immunity from federal taxation.[99] The Court applied the intergovernmental tax immunity doctrine to prohibit federal and state governments from imposing a nondiscriminatory tax on the income or the assets an individual or business received from a contract with the other sovereign. In 1842, in Dobbins v. Commissioners of Erie County,[100] the Supreme Court held that the compensation of a federal officer was immune from state taxes.[101] In 1870, in Collector v. Day,[102] the Court relied on the dual federalism principles laid out in McCulloch to hold that the salary of a state officer was immune from federal taxes.[103] In 1895, building upon Day, the Court held in Pollock v. Farmers' Loan & Trust[104] that the interest earned from municipal bonds was immune from a nondiscriminatory federal tax because it was a tax on the power of states and their instrumentalities to borrow money, which was repugnant to the Constitution.[105]

By the beginning of the twentieth century, the Supreme Court began to outline the limits of Day and the scope of state immunity from nondiscriminatory federal taxation. In 1903, the Court upheld a federal succession tax upon a bequest to a municipality for public purposes on the ground that the tax was payable by the executor of an estate before distribution to the legatee, the municipality.[106] A closely divided Court declined to "regard it as a tax upon the municipality though it might operate incidentally to reduce the bequest by the amount of the tax."[107] The Court noted "many, if not all, forms of taxation--indeed it may be said generally that few taxes are wholly paid by the person upon whom they are directly and primarily imposed."[108] When South Carolina embarked upon the business of dispensing "intoxicating liquors," its agents were held to be subject to the federal license tax on dealers in intoxicating liquors, the ground of the holding being that agents were not carrying out the ordinary functions of government, but carrying on an ordinary private business.[109]

Another decision marking a clear departure from the logic of Collector v. Day was Flint v. Stone Tracy Co.,[110] in which the Court sustained an act of Congress taxing the privilege of doing business as a corporation, the tax being measured by the income.[111] The argument that the tax imposed an unconstitutional burden on the exercise by a state of its reserved power to create corporate franchises was rejected, partly because of the principle of national supremacy and partly on the ground that state immunity did not extend to private businesses.[112] This case also qualified Pollock v. Farmers' Loan & Trust Co. to the extent that it allowed Congress to impose a privilege tax on the income of corporations from all sources, including state bond interest.[113]

Subsequent cases have sustained an estate tax on a decedent's estate that included state bonds,[114] a federal transportation tax on the transportation of merchandise in performance of a contract to sell and deliver it to a county,[115] custom duties on the importation of scientific apparatus by a state university,[116] a federal admissions tax on admissions to athletic contests sponsored by a state institution when the state institution used the net proceeds from admissions to support a system of public education,[117] and a federal admissions tax on admissions to a municipal corporation's recreational facilities when the municipal corporation used the admissions charges to cover the recreational facilities' costs.[118] The income derived by independent contractors who were consulting engineers advising states on water supply and sewage disposal systems,[119] the compensation of trustees appointed to manage a street railway system temporarily taken over and operated by a state,[120] the net profits derived from the sale of state bonds,[121] and the net proceeds derived by a trust from the sale of oil produced under a lease of state lands[122] have all been held to be subject to federal taxation despite a possible economic burden on the states.

In South Carolina v. Baker,[123] the Court finally explicitly confirmed that it had overruled its holding in Pollock that state bond interest was immune from a nondiscriminatory federal tax.[124] The Court observed that "the more general rule that neither the federal nor the state governments could tax income an individual directly derived from any contract with another government"[125] had already been rejected in numerous decisions involving immunity under the intergovernmental tax immunity doctrine.[126] Thus, the Court concluded,

We see no constitutional reason for treating persons who receive interest on government bonds differently than persons who receive income from other types of contracts with the government, and no tenable rationale for distinguishing the costs imposed on states by a tax on state bond interest from the costs imposed by a tax on the income from any other state contract.Id. at 524-25.

The specific ruling of Day that the Federal Government was prohibited from taxing the salaries of state government officers has been overruled.[127] But the principles underlying that decision--that Congress may not lay a tax that would impair the sovereignty of the states--is still recognized as retaining some vitality.[128] The Court in South Carolina v. Baker summarized the modern intergovernmental tax immunity doctrine,[129] stating:

States can never tax the United States directly but can tax any private parties with whom it does business, even though the financial burden falls on the United States, as long as the tax does not discriminate against the United States or those with whom it deals [and] the rule with respect to state tax immunity is essentially the same.Id.

The Court reasoned that under the modern doctrine there were "at least some" nondiscriminatory taxes that the Federal Government could impose directly on states that states could not impose directly on the Federal Government, but it did not address the extent to which states were immune from direct federal taxation.[130] In a footnote, the Court reaffirmed the principal from New York v. United States[131] that the issue of whether a federal tax violates state tax immunity under the intergovernmental tax immunity does not arise unless the tax is collected directly from a state.[132]

Spending Power[edit | edit source]

Overview of Spending Clause[edit | edit source]

In its modern understanding, the Spending Clause of the U.S. Constitution ranks among Congress's most important powers. The Clause appears first in Article I, Section 8's list of enumerated legislative powers. It states in relevant part that "Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States."[133] The Court has construed the Spending Clause as legislative authority for federal programs as varied and consequential as Social Security,[134] Medicaid,[135] and federal education programs.[136] The spending power also underlies laws regulating local land-use decisions and the treatment of persons institutionalized by states,[137] as well as statutes prohibiting discrimination on certain protected grounds.[138]

The Spending Clause has not always been understood to confer such broad authority. The scope of Congress's spending power divided key members of the founding generation, and these disputes persisted throughout the nineteenth century.[139] The Supreme Court did not squarely address the substantive power of Congress's spending power until the 1930s, when it embraced a relatively broad view of Congress's discretion to identify the expenditures that further the general welfare.[140] Congress has used that power to pursue broad policy objectives, including objectives that it could not achieve legislating under its other enumerated powers. Under the usual framework, Congress offers federal funds in exchange for a recipient agreeing to honor conditions that accompany the funds. This offer and acceptance, the Court has said, is what lends Spending Clause legislation its legitimacy.

In its modern case law, the Court has reaffirmed the central holdings of its 1930s cases. However, the Court has also articulated and developed restrictions or limitations on the spending power. Chief among these are factors that ensure the knowing[141] and voluntary[142] acceptance of funding conditions. Other factors affect the Court's review of Spending Clause legislation as well.[143]

Historical Background on Spending Clause[edit | edit source]

Under the Articles of Confederation, the Confederation Congress had authority to "ascertain the necessary sums of money to be raised for the service of the United States, and to appropriate and apply the same for defraying the public expenses."[144] "All charges of war, and all other expenses" that were "incurred for the common defense or general welfare" were paid "out of a common treasury."[145]

For many of the Founding generation, though, this power to determine necessary expenses had limited utility.[146] The common treasury depended entirely on taxes levied by states under state law.[147] If a state failed to supply its quota for national expenses, the Confederation Congress had few effective alternatives. For example, in 1782 New Jersey urged the Confederation Congress to put a stop to the practice of other states paying the wages of troops of their own line rather than contributing those sums to the common treasury to support the Continental Army as a whole.[148] The Confederation Congress's response was that it had already done all it could to ensure that the "whole army" would be "regularly and duly paid" by setting revenue quotas for states, but given the lack of a national taxing power only states could take the actions necessary to meet those quotas.[149]

The Constitution ratified by the states plainly addressed the prior lack of a national taxing power. Congress had the "Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States."[150] What was far from plain, both before and after ratification, was the authority that the Spending Clause conferred on Congress to authorize expenditures.[151]

One collection of views, commonly associated with James Madison, argued that the Constitution was structured so that the general language of the Spending Clause was followed by a "specification of the objects alluded to by these general terms."[152] The Madisonian view judged the validity of a particular spending measure by asking whether the spending addressed a subject within one of Congress's other enumerated powers.[153] Another set of viewpoints, commonly associated with Alexander Hamilton, took a broader view.[154] Hamilton argued that the phrase "the general welfare" was as "comprehensive as any that could have been used."[155] The phrase embraced subject matter of such wide variety that it defied further specification or definition.[156]

Early Spending Clause Jurisprudence[edit | edit source]

Some Supreme Court opinions issued prior to 1936 featured arguments from parties that a particular appropriation exceeded Congress's authority under the Spending Clause. Despite these arguments occasionally arising, the Court in the nineteenth and early twentieth centuries generally declined to address them. In 1892, the Court avoided the question of whether the Spending Clause permitted Congress to direct payments to the producers of domestic sugar, because if the appropriation exceeded Congress's spending powers, that conclusion would not yield the relief sought by those seeking to invalidate the producer payment.[157] Perhaps more important, in 1923, the Court relied on justiciability doctrines to dismiss separate challenges, brought by a state and an individual taxpayer, to a federal program offering grants to states to reduce maternal and infant mortality.[158] Until the New Deal, disputes about the scope of Congress's spending power were generally fought between and within the political branches, not in the courts.[159] However, the Court had held by the 1930s that the Spending Clause's use of the term "debts" allows Congress to pay claims that rest on moral considerations, in addition to those claims that rest on legally enforceable obligations of the United States.[160]

By 1937, the state of the case law had changed following three groundbreaking decisions. In 1936, the Court decided United States v. Butler, a challenge to the Agricultural Adjustment Act of 1933.[161] To boost agricultural commodities prices, the Act authorized the Secretary of Agriculture to levy fees on agricultural commodity processors and pay farmers of the same commodities who agreed to reduce their acreage under cultivation.[162] Processors challenged the program as exceeding Congress's legislative authority. The Federal Government pointed to the Spending Clause as constitutional authority for the Act.[163]

For the first time in its history, the Court considered three perspectives of the authority granted by the Clause.[164] The Court first noted that though it had "never been authoritatively accepted," one could argue that the Spending Clause granted Congress authority to provide for the general welfare by regulating agriculture, whether or not taxation or expenditure figured in the regulation.[165] The Court rejected this view. The grant of such a "general and unlimited" regulatory power in the first clause of Article I, Section 8 could not be squared with the later enumeration of Congress's legislative powers.[166] The "only thing" that the Clause granted was "the power to tax for the purpose of providing funds for payment" of debts and supporting the general welfare.[167]

Having rejected the conception of the Spending Clause as general regulatory authority, the Butler Court then considered two long-standing views on the types of taxes and expenditures authorized by the Clause's reference to the "general welfare."[168] The Madisonian view held that "the grant of power to tax and spend for the general national welfare must be confined to the enumerated legislative fields committed to the Congress."[169] The Hamiltonian view cast the power as "separate and distinct from those later enumerated" and "not restricted" by them.[170] Recognizing that support existed among the Founders for both perspectives, the Court adopted the Hamiltonian view, stating that "the power of Congress to authorize expenditure of public moneys for public purposes is not limited by the direct grants of legislative power found in the Constitution."[171]

Even under this "broader construction" of the Clause, however, the Court held that the Act exceeded Congress's authority.[172] The producer fee and the farmer payments were part of a plan to regulate agriculture, which the Court held invaded the reserved powers of states.[173] If Congress could not directly regulate agriculture, it could not "purchase compliance" with such federal policies by offering funds to farmers that they could not afford to refuse.[174]

One year later, in 1937, the Court reaffirmed Butler's embrace of the Hamiltonian perspective and offered further guidance on Congress's authority to identify expenditures that serve the general welfare.[175] In resolving a challenge to the Social Security Act's system of old-age benefits, the Court in Helvering v. Davis characterized Spending Clause analysis as requiring a fact-intensive distinction between "one welfare and another," that is, "between particular and general."[176] Congress had discretion to decide that expenditures aided the general welfare, unless that choice was "clearly wrong, a display of arbitrary power," or "not an exercise of judgment."[177] What qualified as the general welfare could change with the times.[178] Congress could thus conclude that legislation to support the destitute elderly, a "national" problem, would advance the general welfare.[179]

Whereas Helvering reaffirmed and expanded upon aspects of Butler, a companion case, Charles C. Steward Machine Co. v. Davis,[180] eroded Butler's coercion conclusions. Steward Machine Co. involved a challenge to a federal payroll tax.[181] Employers who made contributions to an unemployment fund established under state law could credit the contribution against the federal tax, but only if the state's unemployment-fund law met standards set forth in federal law.[182] The Court held that this framework did not coerce states to enact unemployment-fund laws; the prospect of a tax credit was merely an "inducement."[183] States had the freedom of will to participate (or not) in the provision of unemployment relief, and if a state decided to participate it could rescind that decision at any time by repealing its unemployment-fund law.[184]

As the Court's first forays into debates about the Spending Clause drew to a close, a few points were clear. The Spending Clause did not bestow general regulatory powers on Congress. Instead, the power conferred was the power to tax and spend in aid of the general welfare. These fiscal powers were not limited by the Constitution's other grants of enumerated legislative powers. Congress instead had broad discretion to determine the types of expenditures that would further the general welfare, and the federal courts would not second-guess that choice. Where Congress's offer of federal funds came with conditions attached, the federal courts would view the funds as a mere inducement to accept the condition unless compulsion was apparent.

Modern Spending Clause Jurisprudence Generally[edit | edit source]

The Supreme Court's early Spending Clause case law culminated, in 1937, with an embrace of a relatively expansive view of Congress's power to tax and spend in aid of the general welfare. That same expansive view permeates the Court's modern Spending Clause case law. The Court has repeatedly stated that, by allocating federal funds and attaching conditions to those funds,[185] Congress may pursue broad policy objectives.[186] Congress may even achieve policy outcomes that it could not directly legislate using its other enumerated powers.[187]

Much of the Court's modern Spending Clause jurisprudence has focused on what the Court has termed "restrictions"[188] or "limits"[189] on the spending power. The Court today judges the constitutional validity of federal spending using five factors. First, Congress must unambiguously identify conditions attached to federal funds. Second, Congress must refrain from offers of funds that coerce acceptance of funding conditions. Third, spending must be in pursuit of the general welfare. Fourth, conditions on federal funds must relate to the federal interest in a program. Finally, a funding condition may not induce conduct on the part of the funds recipient that is itself unconstitutional.

Clear Notice Requirement and Spending Clause[edit | edit source]

The Court evaluates Spending Clause legislation by requiring Congress to state conditions attached to federal funds in unambiguous terms. This requirement derives from a distinction between legislation enacted pursuant to Congress's other enumerated powers and legislation enacted under the Spending Clause. When Congress legislates under its power to enforce the Fourteenth Amendment, for example, it can command action or proscribe conduct.[190] Spending Clause legislation, on the other hand, is akin to a contract.[191] Congress makes federal funds available, subject to stated conditions, and a recipient knowingly and voluntarily accepts the funds and the conditions.[192] Knowing and voluntary acceptance is what lends Spending Clause legislation its legitimacy.[193]

Much of the Court's modern Spending Clause case law involves states as recipients, and that context has shaped the Court's clear-notice doctrine.[194] In view of limits on Congress's ability to command action by states,[195] the Justices have stressed that knowing and voluntary acceptance is "critical to ensuring that Spending Clause legislation does not undermine the status of the States as independent sovereigns in our federal system."[196] In particular, the clear-notice requirement--along with the anti-coercion principle discussed below--ensure that state officials bear political accountability for only those funding conditions that the officials had a legitimate chance of rejecting.[197]

A funds recipient cannot knowingly accept a condition if the recipient is either not aware of the condition or unable to determine the recipient's obligations under the condition.[198] To gauge whether Congress stated a condition with requisite clarity, the Court views Congress's offer from the perspective of a state official who is deciding whether to accept conditioned funds.[199] The Court asks whether the statute that makes the funds available provided the state official with clear notice of a particular obligation imposed by the condition.[200]

Questions of enforcement of funding conditions have implicated the clear-notice requirement. The Court has stated that, typically, the remedy for noncompliance with a funding condition is for the Federal Government to take action against a grantee.[201] Unless a statute provides otherwise, a state will not usually have clear notice that noncompliance with a funding condition would result in a suit brought by someone other than the Federal Government, such as an end beneficiary of the program supported with conditioned funds.[202] However, the Court has found funding conditions enforceable by private parties when a statute conferred a specific monetary entitlement on a person bringing suit who lacked sufficient administrative procedures to challenge denial of that entitlement.[203] The Court has also found that Spending Clause legislation may give rise to privately enforceable rights under 42 U.S.C. § 1983, which provides a cause of action for violations of the Constitution and laws by state actors, if Congress unambiguously conferred such individual rights under the statute.[204]

The Court has applied clear-notice principles to determine whether a funds recipient plainly knew it could be held liable for the particular conduct at issue in the suit.[205] Congress must also speak with a clear voice regarding the scope of remedies authorized by statute.[206] If a private suit is authorized but statute does not specify remedies, the Court has stated that the funds recipient is on notice that it may be subject to the usual remedies for a breach of contract action.[207]

Anti-Coercion Requirement and Spending Clause[edit | edit source]

As discussed above, Spending Clause legislation derives its legitimacy from a funds recipient's knowing and voluntary acceptance of the conditions attached to federal funds.[208] While the clear-notice requirement is directed at ensuring a funds recipient's acceptance of Congress's conditions is knowing, the anti-coercion principle aims at acceptance that is voluntary.

Spending Clause legislation often advances policy objectives by using the prospect of federal funds as pressure or incentive to accept the conditions that go along with the funds.[209] States can either accept the incentive or assert their prerogative of not agreeing to federal stipulations.[210] There is a limit, however, to Congress's ability to exert influence on states through offers of conditioned funds.[211] Depending on how a conditional offer of funds is presented, permissible inducement can turn into impermissible compulsion.[212]

The Court's modern case law includes two applications of the anti-coercion principle.[213] In its first case, the 1987 decision in South Dakota v. Dole, the Court held that the threat of withholding 5% of highway funding from states that refused to adopt a minimum drinking age of twenty-one was only "relatively mild encouragement" to accept Congress's policy condition.[214] As Chief Justice John Roberts would later explain, this sum was less than one-half of one percent of South Dakota's budget at the time.[215]

In the second case, the 2012 decision in National Federation of Independent Business (NFIB) v. Sebelius, seven of nine Justices concluded that Congress presented states with a coercive funding condition by requiring them to expand Medicaid coverage to new populations or lose all Medicaid funds.[216] However, the seven Justices joined two different opinions: a plurality opinion authored by Chief Justice Roberts on behalf of himself and Justices Stephen Breyer and Elena Kagan, and a joint dissent by Justices Antonin Scalia, Anthony Kennedy, Clarence Thomas, and Samuel Alito. The fractured nature of this most recent application of the anti-coercion principle leaves its precise contours unclear.

Chief Justice Roberts explained that the condition confronting the Court was not a condition on the use of funds, but rather a threat to terminate "other significant independent grants" of funds.[217] Conditions that govern the use of funds ensure that grantees spend federal funds for only authorized purposes, while conditions of the Medicaid-expansion variety could properly be viewed as Congress's attempt to pressure states to accept policy changes.[218] Moreover, this instance of Medicaid expansion was not a mere modification of an existing program, as with past changes to Medicaid; it was the creation of a "new health care program."[219] States could not have anticipated the contours of this new program when they first agreed to participate in Medicaid, yet were required to participate in the new program to keep federal funding for pre-expansion Medicaid populations.[220]

Faced with such a policy condition, Chief Justice Roberts focused on the "financial inducement offered by Congress," or in other words, the amount of funding a state could lose if it declined to expand Medicaid coverage.[221] The threatened loss of federal funds equal to 10% of a state's overall budget--twenty times the portion of the state budget at issue in Dole--left states with no choice but to accept Medicaid expansion.[222]

The joint dissent, on the other hand, framed the coercion inquiry as whether "states really have no choice other than to accept the package."[223] This formulation appeared to place particular emphasis on the practical effects of a state declining Medicaid expansion.[224] For example, the joint dissent reasoned that though states possess separate taxing powers, as a practical matter those state powers could not be used to create alternate health care coverage under state law on the pre-expansion model of Medicaid.[225]

General Welfare, Relatedness, and Independent Constitutional Bars[edit | edit source]

Beyond the clear-notice requirement and the anti-coercion rule, the Court evaluates Spending Clause legislation using three additional factors. First, spending must be in pursuit of the general welfare.[226] This determination is largely for Congress to make.[227] The Court substantially defers to Congress's decision that a particular expenditure advances the general welfare.[228] The Court has not invalidated Spending Clause legislation on the ground that it did not satisfy the general welfare requirement.[229] It has even questioned whether the general-welfare requirement is judicially enforceable.[230]

Second, a funding condition must reasonably relate to the federal interest in a program.[231] The Court has not held that a funding condition was unrelated to a federal interest. It has instead sustained a condition requiring states to set a minimum drinking age of twenty-one, because that condition promoted the federal interest in safe interstate travel.[232] The Court has also concluded that Congress could require a state to not employ in its federally supported programs a person who plays an active role in the affairs of a political party.[233] This condition advanced the federal interest in sound management of federal funds.[234]

Third, a funding condition may not induce states to act in a way that is itself unconstitutional.[235] This factor asks whether provisions of the Constitution, other than the Spending Clause, prohibit the conduct that the funding condition would prompt.[236] The constraining effect of other constitutional provisions is explored in other essays.[237] However, under the Court's modern case law, it appears that one provision of the Constitution in particular, the Tenth Amendment, is not properly understood as a capable of standing as an independent constitutional bar to a conditional offer of federal funds that otherwise satisfies the Court's five-factor analysis.[238]

- ↑ See Nicol v. Ames, 173 U.S. 509, 514-16 (1899); 3 Joseph Story, Commentaries on the Constitution of the United States 368-69 (1833); The Federalist No. 41 (James Madison).

- ↑ License Tax Cases, 72 U.S. (5 Wall.) 462, 471 (1866).

- ↑ Art. I, Sec. 9, Clause 5 Exports.

- ↑ Id. art. I, § 9, cl. 4.

- ↑ Id. art. I, § 8, cl. 1.

- ↑ License Tax Cases, 72 U.S. (5 Wall.) at 471.

- ↑ Brushaber v. Union Pac. R.R., 240 U.S. 1, 12 (1916).

- ↑ Id.

- ↑ See, e.g., Bailey v. Drexel Furniture Co. (Child Labor Tax Case), 259 U.S. 20, 36-37 (1922).

- ↑ See, e.g., United States v. Constantine, 296 U.S. 287, 293-94 (1935).

- ↑ See, e.g., Collector v. Day, 78 U.S. (11 Wall.) 113, 120-21 (1871), overruled by Graves v. New York ex rel. O'Keefe, 306 U.S. 466 (1939).

- ↑ The Federalist No. 30 (Alexander Hamilton).

- ↑ Gillian E. Metzger, To Tax, To Spend, To Regulate, 126 Harv. L. Rev. 83, 89 (2012); see Veazie Bank v. Fenno, 75 U.S. 533, 540 (1869) ("The [National Government] had been reduced to the verge of impotency by the necessity of relying for revenue upon requisitions on the States, and it was a leading object in the adoption of the Constitution to relieve the government, to be organized under it, from this necessity, and confer upon it ample power to provide revenue by the taxation of persons and property."); Bruce Ackerman, Taxation and the Constitution, Colum. L. Rev. 1, 6 (1999) ("The [Federalists] would never have launched their campaign against America's first Constitution, the Articles of Confederation, had it not been for its failure to provide adequate fiscal powers for the national government."); see generally The Federalist No. 30 (Alexander Hamilton) (advocating for a "General Power of Taxation").

- ↑ See Articles of Confederation of 1781, arts. II, VIII; The Federalist No. 30 (Alexander Hamilton); Ackerman, supra note here at 6 ("The Articles of Confederation stated that the 'common treasury . . . shall be supplied by the several States, in proportion to the value of all land within each State,' Articles of Confederation art. VIII (1781), but did not explicitly authorize the Continental Congress to impose any sanctions when a state failed to comply. This silence was especially eloquent in light of the second Article's pronouncement: 'Each State retains its sovereignty, freedom and independence, and every power, jurisdiction and right, which is not by the confederation expressly delegated to the United States, in Congress assembled.'").

- ↑ Calvin H. Johnson, Righteous Anger at the Wicked States: The Meaning of the Founders' Constitution 15 (Cambridge University Press) (2005); see Articles of Confederation of 1781, art. VIII.

- ↑ Johnson, supra note here, at 16 ("Some states simply ignored the requisitions. Some sent them back to Congress for amendment, more to the states' liking. New Jersey said it had paid enough tax by paying the tariffs or 'imposts' on goods imported through New York or Philadelphia and it repudiated the requisition in full.").

- ↑ Robert D. Cooter & Neil S. Siegel, Not the Power to Destroy: An Effects Theory of the Tax Power, 98 Va. L. Rev. 1195, 1202 (2012); see, e.g., Johnson, supra note here, at 15 ("In the requisition of 1786--the last before the Constitution--Congress mandated that states pay $3,800,000, but it collected only $663."); see Metzger, supra note here, at 89 ("Under the Articles of Confederation, states had failed to meet congressional requisitions on a massive scale and Congress was bankrupt.").

- ↑ Johnson, supra note here, at 16-17 ("Congress's Board of Treasury had concluded in June 1786 that there was 'no reasonable hope' that the requisitions would yield enough to allow Congress to make payments on the foreign debts, even assuming that nothing would be paid on the domestic war debt. . . . Almost all of the money called for by the 1786 requisition would have gone to payments on the Revolutionary War debt. French and Dutch creditors were due payments of $1.7 million, including interest and some payment on the principal. Domestic creditors were due to be paid $1.6 million for interest only. Express advocacy of repudiation of the federal debt was rare, but with the failure of requisitions, payment was not possible. . . . Beyond the repayment of war debts, the federal goals were quite modest. The operating budget was only about $450,000 . . . . Without money, however, the handful of troops on the frontier would have to be disbanded and the Congress's offices shut."); see Cooter & Siegel, supra note here, at 1204.

- ↑ 3 Joseph Story, Commentaries on the Constitution of the United States § 925 (1833).

- ↑ Id. at § 926.

- ↑ Id. at §§ 930-931; The Federalist No. 31 (Alexander Hamilton): see The Federalist No. 41 (James Madison); The Federalist No. 34 (Alexander Hamilton).

- ↑ 3 Joseph Story, Commentaries on the Constitution of the United States § 936 (1833); see The Federalist No. 31 (Alexander Hamilton); The Federalist No. 30 (Alexander Hamilton).

- ↑ 3 Joseph Story, Commentaries on the Constitution of the United States §§ 930-945 (1833); The Federalist No. 31 (Alexander Hamilton); see The Federalist No. 34 (Alexander Hamilton); The Federalist No. 30 (Alexander Hamilton).

- ↑ Art. I, Section 8 Enumerated Powers; see Flint v. Stone Tracy Co., 220 U.S. 107, 151 (1911) ("[T]he terms duties, imposts and excises are generally treated as embracing the indirect forms of taxation contemplated by the Constitution.").

- ↑ United States v. Ptasynski, 462 U.S. 74, 82 (1983) (quoting Head Money Cases, 112 U.S. 580, 594 (1884)).

- ↑ Ptasynski, 462 U.S. at 84; see, e.g., Knowlton v. Moore, 178 U.S. 41, 106 (1900).

- ↑ Ptasynski, 462 U.S. at 85.

- ↑ 178 U.S. at 46.

- ↑ Id. at 84-106; see id. at 96 ("The proceedings of the Continental Congress also make it clear that the words 'uniform throughout the United States,' which were afterwards inserted in the Constitution of the United States, had, prior to its adoption, been frequently used, and always with reference purely to a geographical uniformity and as synonymous with the expression, 'to operate generally throughout the United States.' The foregoing situation so thoroughly permeated all the proceedings of the Continental Congress that we might well rest content with their mere statement. . . . The view that intrinsic uniformity was not then conceived is well shown.").

- ↑ Id. at 83-110; see also Ptasynski, 462 U.S. at 82.

- ↑ Knowlton, 178 U.S. at 110; see id. at 83-84.

- ↑ Id. at 87.

- ↑ 462 U.S. 74.

- ↑ Pub. L. No. 96-223, 94 Stat. 229 (1980).

- ↑ Ptasynski, 462 U.S. at 77; see id. at 77-78 ("[Exempt Alaskan oil] is defined as: 'any crude oil (other than Sadlerochit oil) which is produced (1) from a reservoir from which oil has been produced in commercial quantities through a well located north of the Arctic Circle, or (2) from a well located on the northerly side of the divide of the Alaska-Aleutian Range and at least 75 miles from the nearest point on the Trans-Alaska Pipeline System.' § 4994(e). Although the Act refers to this class of oil as 'exempt Alaskan oil,' the reference is not entirely accurate. The Act exempts only certain oil produced in Alaska from the windfall profit tax. Indeed, less than 20% of current Alaskan production is exempt. Nor is the exemption limited to the State of Alaska. Oil produced in certain offshore territorial waters--beyond the limits of any State--is included within the exemption.").

- ↑ Id. at 85.

- ↑ Id. at 84-85.

- ↑ Id. at 85.

- ↑ Id. at 85-86.

- ↑ Flint v. Stone Tracy Co., 220 U.S. 107, 167 (1911).

- ↑ Felsenheld v. United States, 186 U.S. 126 (1902).

- ↑ In re Kollock, 165 U.S. 526 (1897).

- ↑ United States v. Doremus, 249 U.S. 86 (1919); cf. Nigro v. United States, 276 U.S. 332 (1928).

- ↑ Sonzinsky v. United States, 300 U.S. 506 (1937).

- ↑ Without casting doubt on the ability of Congress to regulate or punish through its taxing power, the Court has overruled United States v. Kahriger, 345 U.S. 22 (1953), and Lewis v. United States, 348 U.S. 419 (1955), to the extent that the opinions precluded individuals from asserting their Fifth Amendment privilege from self-incrimination as a defense to prosecution for violations of tax statutory schemes requiring registration and information reporting. Marchetti v. United States, 390 U.S. 39 (1968); see Leary v. United States, 395 U.S. 6 (1969); Grosso v. United States, 390 U.S. 62 (1968); Haynes v. United States, 390 U.S. 85 (1968).

- ↑ McCray v. United States, 195 U.S. 27 (1904); see United States v. Doremus, 249 U.S. 86 (1919); Patton v. Brady, 184 U.S. 608 (1902).

- ↑ Sunshine Anthracite Coal Co. v. Adkins, 310 U.S. 381, 393 (1940).

- ↑ Id.; see also Edye v. Robertson (Head Money Cases), 112 U.S. 580 (1884).

- ↑ 567 U.S. 519 (2012).

- ↑ Id. at 572-73.

- ↑ See, e.g., United States v. Butler (Child Labor Tax Case), 297 U.S. 1, 68-69 (1936); United States v. Constantine, 296 U.S. 287, 293-94 (1935); Bailey v. Drexel Furniture Co. (Child Labor Tax Case), 259 U.S. 20, 37 (1922).

- ↑ Hill v. Wallace, 259 U.S. 44 (1922); see also Helwig v. United States, 188 U.S. 605 (1903).

- ↑ 259 U.S. 20.

- ↑ Hammer v. Dagenhart, 247 U.S. 251 (1918), overruled by United States v. Darby, 312 U.S. 100 (1941).

- ↑ Drexel Furniture Co., 259 U.S. at 37.

- ↑ Id. at 36.

- ↑ Id.

- ↑ Id. at 36-37.

- ↑ Id. at 37.

- ↑ Id. at 40-44.

- ↑ 296 U.S. 287 (1935).

- ↑ Id. at 294.

- ↑ Id. at 296.

- ↑ Id. at 293-94.

- ↑ 297 U.S. 1, 63 (1936).

- ↑ Id. at 63-64.

- ↑ Id. at 68-69.

- ↑ See NFIB v. Sebelius, 567 U.S. 519, 572-73 (2012).

- ↑ 300 U.S. 506, 513-14 (1937).

- ↑ 340 U.S. 42, 44 (1950).

- ↑ NFIB, 567 U.S. 519.

- ↑ Id. at 574 (majority opinion).

- ↑ Id.

- ↑ Id. at 572-74.

- ↑ Justices Ruth Bader Ginsburg, Stephen Breyer, Sonia Sotomayor and Elena Kagan joined this portion of Justice Roberts' opinion.

- ↑ Id. at 564-68.

- ↑ Id. at 565-66.

- ↑ Id. at 566.

- ↑ Id. at 565 (quoting United States v. Constantine, 296 U.S. 287, 294 (1935)).

- ↑ Id. at 563.

- ↑ NFIB, 567 U.S. at 563-64.

- ↑ Id. at 567 (quoting United States v. Reorganized CF&I Fabricators of Utah, Inc., 518 U.S. 213, 224 (1996)).

- ↑ Id. at 568.

- ↑ United States v. Kahriger, 345 U.S. 22 (1953).

- ↑ United States v. Stafoff, 260 U.S. 477, 480 (1923); United States v. Yuginovich, 256 U.S. 450, 462 (1921).

- ↑ United States v. Constantine, 296 U.S. 287, 293 (1935).

- ↑ License Tax Cases, 72 U.S. (5 Wall.) 462, 471 (1867).

- ↑ Id.

- ↑ Id.

- ↑ Collector v. Day, 78 U.S. (11 Wall.) 113, 127 (1871), overruled by Graves v. New York ex rel. O'Keefe, 306 U.S. 466, 486 (1939).

- ↑ Day, 78 U.S. (11 Wall.) at 127.

- ↑ Graves, 306 U.S. at 477-78 (1939).

- ↑ Article VI Supreme Law.

- ↑ See, e.g., South Carolina v. Baker, 485 U.S. 505, 523, 523 n.14 (1988); United States v. New Mexico, 455 U.S. 720, 735-36 (1982); New York v. United States, 326 U.S. 572, 586-87 (1946); Day, 78 U.S. (11 Wall.) at 123-27; McCulloch, v. Maryland, 17 U.S. (4 Wheat.) 316, 427-37 (1819).

- ↑ 17 U.S. (4 Wheat.) at 427-37.

- ↑ Id. at 436.

- ↑ Id. at 433.

- ↑ Id. at 436.

- ↑ Jefferson Cnty. v. Acker, 527 U.S. 423, 436 (1999), superseded on other grounds by statute, Removal Clarification Act of 2011, Pub. L. No. 112-51, 125 Stat. 545 (broadening grounds for removal of certain litigation to federal courts); see also Panhandle Oil Co. v. Mississippi ex rel. Knox, 277 U.S. 218 (1928) (holding a state tax on the privilege of distributing gasoline measured by gallons of gasoline sold was unconstitutional as applied to sales a distributor made to the United States), abrogated by Alabama v. King & Boozer, 314 U.S. 1 (1941).

- ↑ 41 U.S. (16 Pet.) 435, 450 (1842), superseded by statute, Public Salary Act of 1939, Pub. L. No. 76-32, tit. 1, ch. 59, § 4, 53 Stat. 574, 575 (codified as amended at 4 U.S.C. § 111).

- ↑ Id. at 450.

- ↑ 78 U.S. (11 Wall.) 113 (1871), overruled by Graves v. New York ex rel. O'Keefe, 306 U.S. 466 (1939).

- ↑ Id. at 120-21.

- ↑ Pollock v. Farmers' Loan & Tr. Co., 157 U.S. 429 (1895), overruled by South Carolina v. Baker, 485 U.S. 505 (1988).

- ↑ Id. at 586 (citing Weston v. City Council of Charleston, 27 U.S. (2 Pet.) 449, 468 (1829) (holding federal bond interest was immune from state taxation)).

- ↑ Snyder v. Bettman, 190 U.S. 249 (1903).

- ↑ Id. at 254.

- ↑ Id.

- ↑ South Carolina v. United States, 199 U.S. 437 (1905); see also Ohio v. Helvering, 292 U.S. 360 (1394); but see New York v. United States, 326 U.S. 572 (1946) (abandoning the governmental/proprietary distinction in determining state immunity from federal taxation).

- ↑ 220 U.S. 107 (1911).

- ↑ Id. at 146, 177.

- ↑ Id. at 152-58.

- ↑ See id. at 162-65.

- ↑ Greiner v. Lewellyn, 258 U.S. 384, 387 (1922).

- ↑ Wheeler Lumber Bridge & Supply Co. of Des Moines v. United States, 281 U.S. 572, 579 (1930).

- ↑ Bd. of Trs. v. United States, 289 U.S. 48, 59-60 (1933) ("explaining Congress has the exclusive power to regulate foreign commerce under Article I, Section 8, clause 3 of the U.S. Constitution and that the principles underlying state immunity from federal taxation do not provide a basis for state control over importation.").

- ↑ Allen v. Regents, 304 U.S. 439, 451-453 (1938) (citing South Carolina v. United States, 199 U.S. 437 (1905)).

- ↑ Wilmette Park Dist. v. Campbell, 338 U.S. 411, 413-14, 420 (1949).

- ↑ Metcalf & Eddy v. Mitchell, 269 U.S. 514, 518, 524-26 (1926).

- ↑ Helvering v. Powers, 293 U.S. 214, 225-27 (1934) (citing South Carolina v. United States, 199 U.S. 437 (1905)) and Ohio v. Helvering, 292 U.S. 360 (1394)).

- ↑ Willcuts v. Bunn, 282 U.S. 216, 223, 230-34 (1931).

- ↑ Helvering v. Mountain Producers Corp., 303 U.S. 376, 385-87 (1938) overruling in part Burnet v. Coronado Oil & Gas Co., 285 U.S. 393, 52 S. Ct. 443, 76 L. Ed. 815 (1932) and Gillespie v. Oklahoma, 257 U.S. 501 (1922).

- ↑ 485 U.S. 505 (1988).

- ↑ Id. at 524.

- ↑ Id. at 517.

- ↑ Id. at 518-525 (citing Washington v. United States, 460 U.S. 536 (1983); United States v. New Mexico, 455 U.S. 720 (1982); United States v. Cnty. of Fresno, 429 U.S. 452 (1977); United States v. City of Detroit, 355 U.S. 466 (1958); Oklahoma Tax Comm'n v. Texas Co., 336 U.S. 342 (1949); Alabama v. King & Boozer, 314 U.S. 1 (1941); Graves v. New York ex rel. O'Keefe, 306 U.S. 466 (1939); Helvering v. Gerhardt, 304 U.S. 405 (1938); Mountain Producers Corp., 303 U.S. 376 (1938); James v. Dravo Contracting Co., 302 U.S. 134 (1937)).

- ↑ Graves v. New York ex rel. O'Keefe, 306 U.S. 466, 486 (1939). Collector v. Day, 78 U.S. (11 Wall.) 113 (1871), was decided in 1871 while the country was still in the throes of Reconstruction. As noted by Chief Justice Stone in a footnote to his opinion in Helvering v. Gerhardt, 304 U.S. 405, 414 n.4 (1938), the Court had not determined how far the Civil War Amendments had broadened the federal power at the expense of the states, but the fact that the taxing power had recently been used with destructive effect upon notes issued by state banks for circulation in Veazie Bank v. Fenno, 75 U.S. (8 Wall.) 533 (1869), suggested the possibility of similar attacks upon the existence of the states themselves. Two years later, the Court took the logical step of holding that a federal tax on railroad bond interest could not be imposed on the interest received by a municipal corporation that issued bonds to provide a loan to a railroad company because the federal tax was a tax on the municipal corporation. United States v. R.R., 84 U.S. (17 Wall.) 322 (1873). Then, the far-reaching extension of state immunity from federal taxation was granted in Pollock v. Farmers' Loan & Tr. Co., 157 U.S. 429 (1895), when interest received by a private investor on state or municipal bonds was held to be exempt from federal taxation. Though relegated to virtual desuetude, Pollock was not expressly overruled until South Carolina v. Baker, 485 U.S. 505 (1988). As the apprehension of this era subsided, the doctrine of these cases that extended the reach of state immunity from federal taxation was pushed into the background. It never received the same wide application as did McCulloch v. Maryland, 17 U.S. (4 Wheat.) 316 (1819), in curbing the power of the states to tax operations or instrumentalities of the Federal Government. The Supreme Court has not issued an opinion significantly narrowing the national taxing power in the name of dual federalism since the early twentieth century. In 1931, the Court held that a federal excise tax on articles sold by manufacturers was inapplicable to the sale of a motorcycle to a municipal corporation for use by the corporation in its police service. Indian Motorcycle Co. v. United States, 283 U.S. 570, 579 (1931). Justices Stone and Brandeis dissented from this decision, and it is doubtful whether it would be followed today. Cf. Massachusetts v. United States, 435 U.S. 444 (1978) (upholding the application of a nondiscriminatory federal user fee on all civil aircraft that fly in U.S. navigable airspace to state-owned aircraft used exclusively for police functions when the user fees defrayed the costs of federal aviation programs). The Court in Indian Motorcycle Co. relied on its decision in Panhandle Oil Co. v. Mississippi ex rel. Knox, 277 U.S. 218 (1928), in which it invalidated the application of a state privilege tax to sales of gasoline a distributor made to the United States. The Court later rejected this reasoning from Panhandle Oil Co. in Alabama v. King & Boozer, 314 U.S. 1 (1941). In King & Boozer, the Court stated, "The asserted right of the one to be free of taxation by the other does not spell immunity from paying the added costs, attributable to the taxation of those who furnish supplies to the Government and who have been granted no tax immunity." King & Boozer, 314 U.S. at 9.

- ↑ At least, if the various opinions in New York v. United States, 326 U.S. 572 (1946), retain force, and they may in view of (a later) New York v. United States, 505 U.S. 144 (1992), a Commerce Clause case rather than a tax case. See also South Carolina v. Baker, 485 U.S. 505, 523 n. 14 (1988).

- ↑ South Carolina v. Baker, 485 U.S. at 523.

- ↑ Id.; see id. at 523 n.14. The Supreme Court's decision in South Carolina v. Baker came just three years after Garcia v. San Antonio Metropolitan Transit Authority, 469 U.S. 528 (1985), where the Court held that the Tenth Amendment's limit on Congress's authority to regulate state activities was structural as opposed to substantive and that States must find their protection through the national political process (e.g., elections). The Court in South Carolina v. Baker observed that even in Garcia it "left open the possibility that some extraordinary defects in the national political process might render congressional regulation of state activities invalid under the Tenth Amendment." Id. In both Garcia and South Carolina v. Baker, the Court declined to identify and define the defects that would lead to invalidation of legislation. Id.; see id. at 520 n.11 ("To some, Garcia v. San Antonio Metropolitan Transit Authority, 469 U.S. 528 (1985), may suggest further limitations on state tax immunity. We need not, however, decide here the extent to which the scope of the federal and state immunities differ or the extent, if any, to which States are currently immune from direct nondiscriminatory federal taxation."); cf. New York v. United States, 326 U.S. 572, 586 (1946) ("Concededly a federal tax discriminating against a State would be an unconstitutional exertion of power over a coexisting sovereignty within the same framework of government.").

- ↑ New York v. United States, 326 U.S. 572 (1946) (upholding the application of a nondiscriminatory federal excise tax to state sales of bottled mineral water taken from state-owned springs).

- ↑ South Carolina v. Baker, 485 U.S at 523 n.14.

- ↑ Art. I, Section 8 Enumerated Powers.

- ↑ Helvering v. Davis, 301 U.S. 619, 641 (1937).

- ↑ Armstrong v. Exceptional Child Ctr., Inc., 575 U.S. 320, 332 (2015).

- ↑ Arlington Cent. Sch. Dist. Bd. of Educ. v. Murphy, 548 U.S. 291, 296 (2006) (observing that "Congress enacted the" Individuals with Disabilities Education Act "pursuant to the Spending Clause"); Bennett v. Ky. Dep't of Educ., 470 U.S. 656, 665 (1985) (examining funds received by states under Title I of the of the Elementary and Secondary Education Act).

- ↑ Sossamon v. Texas, 563 U.S. 277, 281 (2011) (explaining that Congress enacted the Religious Land Use and Institutionalized Persons Act under its Spending and Commerce Clause powers).

- ↑ Cummings v. Premier Rehab Keller, P.L.L.C., 142 S. Ct. 1562, 1569 (2022).

- ↑ See Art. I, Sec. 8, Cl. 1: Historical Background on Spending Clause.

- ↑ See Art. I, Sec. 8, Cl. 1: Early Spending Clause Jurisprudence.

- ↑ See Art. I, Sec. 8, Cl. 1: Clear Notice Requirement and Spending Clause.

- ↑ See Art. I, Sec. 8, Cl. 1: Anti-Coercion Requirement and Spending Clause.

- ↑ See Art. I, Sec. 8, Cl. 1: General Welfare, Relatedness, and Independent Constitutional Bars.

- ↑ Articles of Confederation of 1781, art. IX, para. 5.

- ↑ Id., art. VIII, para. 1.

- ↑ See, e.g., The Federalist No. 21 (Alexander Hamilton) ("The principle of regulating the contributions of the States to the common treasury by QUOTAS is another fundamental error in the Confederation.").

- ↑ Articles of Confederation of 1781, art. VIII, paras. 1-2 (specifying that the common treasury would be "supplied by the several States" according to land values and that "taxes for paying" each state's share of necessary sums "shall be laid and leveied by the authority and direction of the legislatures of the several States").

- ↑ 23 J. of the Cont'l Cong. 629 (Oct. 1, 1782). The Continental Congress provided for the raising of the Continental Army by establishing regimental quotas for each state to furnish. See, e.g., 18 J. of the Cont'l Cong. 894 (Oct. 3, 1780). Troops furnished by a state were considered part of the state's "line." See Robert K. Wright, Jr., The Continental Army 438 (1983) (explaining that a "line" was that "portion of the Continental Army under the auspices of a specific state").

- ↑ See 23 J. of the Cont'l Cong. 629-31 (Oct. 1, 1782) (asserting that if "individual states undertake, without the previous warrant of Congress, to disperse any part of moneys required for and appropriated to the payment of the army, . . . the federal constitution must be so far infringed").

- ↑ Art. I, Section 8 Enumerated Powers.

- ↑ These disputes persisted long after the Founding generation. See, e.g., Theodore Sky, To Provide for the General Welfare 245-46 (2003) (discussing then-Rep. Abraham Lincoln's Hamiltonian rejoinder to President James K. Polk's 1848 veto of a river-and-harbors bill).

- ↑ See The Federalist No. 41 (James Madison).

- ↑ The Virginia Report of 1799-1800, at 201 (J.W. Randolph ed., 1850) ("Whenever, therefore, money has been raised by the general authority, and is to be applied to a particular measure, a question arises whether the particular measure be within the enumerated authorities vested in Congress.").

- ↑ Having endorsed the Hamiltonian view in his influential treatise on the Constitution, Justice Joseph Story is often listed alongside Hamilton as one of its chief proponents. See, e.g., United States v. Butler, 297 U.S. 1, 66 (1936); see also 2 Joseph Story, Commentaries on the Constitution of the United States § 922 (1833).

- ↑ Alexander Hamilton, Report on the Subject of Manufactures 54 (1791).

- ↑ Id.

- ↑ See Marshall Field & Co. v. Clark, 143 U.S. 649, 695-96 (1892).

- ↑ See Massachusetts v. Mellon, 262 U.S. 447, 483, 488 (1923) (dismissing challenge by state and taxpayer on political question and standing grounds, respectively).

- ↑ See, e.g., David E. Engdahl, The Spending Power, 44 Duke L.J. 1, 26-35 (1994).

- ↑ See United States v. Realty Co., 163 U.S. 427, 440 (1896). The Court reaffirmed this understanding in its New Deal-era cases. See Cincinnati Soap Co. v. United States, 301 U.S. 308, 317 (1937).

- ↑ 297 U.S. 1, 53 (1936).

- ↑ See id. at 58-59.

- ↑ Id. at 64.

- ↑ See United States v. Gerlach Live Stock Co., 339 U.S. 725, 738 (1950) (characterizing Butler as the Supreme Court's "first" declaration on the "substantive power" to tax and spend).

- ↑ Butler, 297 U.S. at 64.

- ↑ Id.

- ↑ Id.

- ↑ Id. at 65.

- ↑ Id.

- ↑ Id.

- ↑ Id. at 66.

- ↑ Id. at 66, 77-78.

- ↑ Id. at 68 (stating that the regulation of agriculture involved a power not delegated to the Federal Government).

- ↑ Id. at 70-71, 74.

- ↑ Helvering v. Davis, 301 U.S. 619, 640 (1937) (stating that, so far as the federal courts are concerned, differences between the Madisonian and Hamiltonian views had been "settled by decision" in Butler).

- ↑ Id.

- ↑ Id.

- ↑ Id. at 641.

- ↑ Id. at 644.

- ↑ 301 U.S. 548 (1937).

- ↑ Id. at 573-74.

- ↑ Id. at 574-75.

- ↑ Id. at 590.

- ↑ Id. at 590, 592-93.

- ↑ The Court has stated that Congress's authority to attach conditions to federal funds derives, in part, from the Necessary and Proper Clause. See Sabri v. United States, 541 U.S. 600, 605 (2004); see also Art. I, Sec. 8, Cl. 18: Overview of Necessary and Proper Clause.

- ↑ Cummings v. Premier Rehab Keller, P.L.L.C., 142 S. Ct. 1562, 1568 (2022); Agency for Int'l Dev. v. All. for Open Soc'y Int'l, Inc., 570 U.S. 205, 213 (2013); Arlington Cent. Sch. Dist. Bd. of Educ. v. Murphy, 548 U.S. 291, 296 (2006); South Dakota v. Dole, 483 U.S. 203, 206-07 (1987); Fullilove v. Klutznick, 448 U.S. 448, 474 (1980) (opinion of Burger, C.J.).

- ↑ Coll. Sav. Bank v. Fla. Prepaid Postsecondary Educ. Expense Bd., 527 U.S. 666, 686 (1999); Oklahoma v. U.S. Civ. Serv. Comm'n, 330 U.S. 127, 143 (1947).

- ↑ Dole, 483 U.S. at 207.

- ↑ Pennhurst State Sch. & Hosp. v. Halderman, 451 U.S. 1, 17 n.13 (1981).

- ↑ Gebser v. Lago Vista Indep. Sch. Dist., 524 U.S. 274 (1998); see also Fourteenth Amend., Sec. 5: Modern Doctrine on Enforcement Clause.

- ↑ However, the Court has stated that its contract analogy does not necessarily result in offers of federal funds made pursuant to Spending Clause legislation being viewed in all respects as a bilateral contract. See, e.g., Barnes v. Gorman, 536 U.S. 181, 188 n.2 (2002); Bennett v. Ky. Dep't of Educ., 470 U.S. 656, 669 (1985).

- ↑ Pennhurst State Sch. & Hosp. v. Halderman, 451 U.S. 1, 17 (1981).

- ↑ Barnes, 536 U.S. at 186.

- ↑ But see Cummings v. Premier Rehab Keller, P.L.L.C., 142 S. Ct. 1562, 1569 (2022) (applying clear-notice requirements to ascertain the scope of damages available against a private rehabilitation facility made subject to certain federal requirements by virtue of its participation in Medicare and Medicaid).

- ↑ See Tenth Amend.: Anti-Commandeering Doctrine.

- ↑ Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519, 577 (2012) (plurality opinion of Roberts, C.J., joined by Breyer and Kagan, JJ.).

- ↑ See id. at 578-79 (discussing New York v. United States, 505 U.S. 144, 169 (1992)).

- ↑ Id.; see also Pennhurst State Sch. & Hosp. v. Halderman, 451 U.S. 1, 25 (1981) ("Though Congress's power to legislate under the spending power is broad, it does not include surprising participating States with post acceptance or 'retroactive' conditions.").

- ↑ Arlington Cent. Sch. Dist. Bd. of Educ. v. Murphy, 548 U.S. 291, 296 (2006).

- ↑ See id.

- ↑ Pennhurst State Sch. & Hosp., 451 U.S. at 28; see also Bell v. New Jersey, 461 U.S. 773, 791 (1983) (explaining, in the context of an enforcement action by the Federal Government, a state has "no sovereign right to retain funds without complying with" valid conditions).

- ↑ See Pennhurst State Sch. & Hosp., 451 U.S. at 28.

- ↑ See Gonzaga University v. Doe, 536 U.S. 273, 280-83 (2002) (discussing Wright v. Roanoke Redevelopment and Hous. Auth., 479 U.S. 418 (1987), and Wilder v. Va. Hosp. Ass'n, 496 U.S. 498 (1990)); see also Suter v. Artist M., 503 U.S. 347, 363 (1992). The Court has also implied a private right of action to enforce certain statutes barring discrimination in federally financed programs. See, e.g., Barnes v. Gorman, 536 U.S. 181, 185 (2002).

- ↑ Health & Hosp. Corp. of Marion Cnty. v. Talevski, No. 21-806 (U.S. June 8, 2023). In Talevski, the Supreme Court considered whether Spending Clause statutes may be enforceable through [1] 42 U.S.C. § 1983 (Section 1983), which provides a cause of action to any person deprived of "any rights . . . . secured by the Constitution and laws . . . . " [2] 42 U.S.C. § 1983. Although" the typical remedy for state noncompliance with federally imposed conditions is not a private cause of action for noncompliance but rather action by the Federal Government to terminate funds to the State" (Gonzaga Univ. v. Doe, 536 U.S. 273, 280 (2002)), the Court held that a Spending Clause statute may be enforceable under Section 1983 if it "has 'unambiguously conferred' 'individual rights upon a class of beneficiaries' to which the plaintiff belongs" and "the provision in question is 'phrased in terms of the persons benefited' and contains 'rights-creating, individual-centric language with an 'unmistakable focus on the benefited class.'" Talevski, slip op. at 14 (quoting Gonzaga, 556 U.S. at 283, 284, 285-86, 287). The Court noted, however, that Section 1983 would not be available if Congress had created an incompatible enforcement scheme or otherwise indicated that it did not intend to provide for such relief. The Court stated "[e]ven if a statutory provision unambiguously secures rights, a defendant 'may defeat t[he] presumption by demonstrating that Congress did not intend' that § 1983 be available to enforce those rights." Id. at 17 (quoting Rancho Palos Verdes v. Abrams, 544 U.S. 113, 120 (2005)).

- ↑ Davis v. Monroe Cnty. Bd. of Educ., 526 U.S. 629, 640 (1999); Gebser v. Lago Vista Indep. Sch. Dist., 524 U.S. 274, 287-88 (1998).

- ↑ See Sossamon v. Texas, 563 U.S. 277, 286 (2011) (statutory authorization of "appropriate relief" did not unambiguously include a damages award against a state because states are usually immune from such suits); Arlington Cent. Sch. Dist. Bd. of Educ., 548 U.S. at 300 (statutory reference to an "award of reasonable attorneys' fees as part of the costs" of a suit did not clearly allow recovery of expert fees).

- ↑ See Cummings v. Premier Rehab Keller, P.L.L.C., 142 S. Ct. 1562, 1576 (2022) (holding that a request for emotional distress damages failed clear-notice requirement because it was not a remedy usually available in breach of contract actions between private parties); Barnes v. Gorman, 536 U.S. 181, 187-88 (2002) (same conclusion with respect to punitive damages).

- ↑ See Art. I, Sec. 8, Cl. 1: Clear Notice Requirement and Spending Clause.