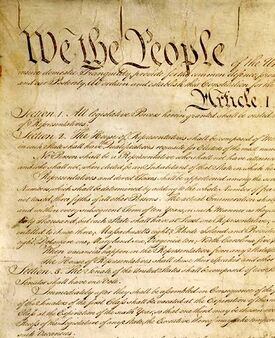

Constitution of the United States/First Amend./Establishment Clause

First Amendment: Establishment Clause

General Principle of Government Neutrality to Religion[edit | edit source]

The First Amendment's Establishment Clause forbids the government from making any law "respecting an establishment of religion."[1] Perhaps most obviously, this provision prevents the federal government from establishing an official national religion akin to the Church of England.[2] But a law may "respect" an establishment even if it does not explicitly establish a religion.[3] Thus, relying on the historical background preceding the adoption of the First Amendment, and looking particularly to the colonists' experiences with religious establishments, the Supreme Court has long understood the Establishment Clause to bar other types of government support that would tend to "establish" religion, as well.[4] According to the Court, for the Founders, laws respecting "the 'establishment' of a religion connoted sponsorship, financial support, and active involvement of the sovereign in religious activity."[5]

The Supreme Court has often referred to government neutrality towards religion as its guiding principle in applying the Establishment Clause.[6] For example, the Court has said the state must "be a neutral in its relations with groups of religious believers and non-believers."[7] The Court has further recognized that the government may provide some types of support without violating the Establishment Clause.[8] While "neutrality" has remained the general touchstone, the Court has adopted a variety of approaches to determine whether any given action is sufficiently neutral.[9]

Accommodationist and Separationist Theories of the Establishment Clause[edit | edit source]

The Supreme Court's Establishment Clause decisions embody, to varying degrees, two views of the Establishment Clause that have been described as "separationist" and "accommodationist."[10] These two views reflect an inherent tension between the two Religion Clauses.[11] The Establishment Clause prohibits the government from providing some types of support to religion, requiring some separation between church and state, while the Free Exercise Clause prohibits the government from excluding religious individuals "from receiving the benefits of public welfare legislation" because of their faith, allowing and even requiring some accommodation of religion.[12]

The separationist view is embodied by Thomas Jefferson's statement that the First Amendment created "a wall of separation between church and State."[13] Thus, in Everson v. Board of Education in 1947, the Supreme Court said that this wall "must be kept high and impregnable."[14] It went on:

The "establishment of religion" clause of the First Amendment means at least this: Neither a state nor the Federal Government can set up a church. Neither can pass laws which aid one religion, aid all religions, or prefer one religion over another. Neither can force nor influence a person to go to or to remain away from church against his will or force him to profess a belief or disbelief in any religion. No person can be punished for entertaining or professing religious beliefs or disbeliefs, for church attendance or non-attendance. No tax in any amount, large or small, can be levied to support any religious activities or institutions, whatever they may be called, or whatever form they may adopt to teach or practice religion. Neither a state nor the Federal Government can, openly or secretly, participate in the affairs of any religious organizations or groups and vice versa.Id. at 15-16.

The "separation" of church and state is intended not only to protect the government from religious influence, but also to protect religious exercise by preventing the government from intervening in religious affairs.[15]

Just five years after Everson, though, in Zorach v. Clauson, the Court confirmed that the government could sometimes accommodate private religious practices without violating Everson's wall.[16] It held that "no constitutional requirement . . . makes it necessary for government to be hostile to religion."[17] In 1971, in Lemon v. Kurtzman, the Supreme Court said that "far from being a 'wall,'" the line separating church from state "is a blurred, indistinct, and variable barrier depending on all the circumstances of a particular relationship."[18] And in a dissenting opinion in 1985, then-Associate Justice William Rehnquist argued that "[t]here is simply no historical foundation for the proposition that the Framers intended to build the 'wall of separation' that was constitutionalized in Everson."[19]

Establishment Clause Tests Generally[edit | edit source]

As discussed in the prior essay, the Supreme Court's Establishment Clause jurisprudence has changed over time, vacillating between separationist and accommodationist views.[20] Due in part to these distinct views of the Religion Clauses, the Supreme Court has employed a variety of analyses to determine whether any given law violates the Establishment Clause, depending in part on the type of government support being challenged. And even where the Supreme Court has applied the same tests to similar types of government aid, the way those tests have been applied has shifted as either the separationist or the accommodationist mode of analysis has been ascendant. One opinion noted the Court's "unwillingness to be confined to any single test or criterion in this sensitive area."[21]

For example, the Court has said a law that creates express denominational preferences is generally subject to a strict scrutiny analysis, and "must be invalidated unless it is justified by a compelling governmental interest" and "closely fitted to further that interest."[22] Most laws, however, do not involve such express discrimination, and the Establishment Clause forbids more than just the "governmental preference of one religion over another."[23] Accordingly, the Court historically adopted other tests to evaluate other types of laws.

The Court's predominant approach to evaluating Establishment Clause challenges during much of the modern era was a tripartite analysis known as the Lemon test,[24] although the Court used that test less frequently in the early 2000s[25] and by 2022, said it had "long ago abandoned" that approach.[26] Lemon v. Kurtzman's three-part test instructed courts that for a government action to be considered constitutional: (1) it "must have a secular legislative purpose"; (2) "its principal or primary effect must be one that neither advances nor inhibits religion"; and (3) it "must not foster 'an excessive government entanglement with religion.'"[27] These factors were not exclusive to Lemon: the Court looked to purpose and effect prior to that decision,[28] and continued to do so even in subsequent opinions that did not expressly cite Lemon.[29]

Since the adoption of Lemon there were questions about the degree to which each of its three factors was dispositive in particular cases. In an opinion issued the same day as Lemon, a plurality of the Court said standards in this area should "be viewed as guidelines," citing the difficulty of adopting one test to govern all circumstances.[30] The Court also employed variations on the Lemon test. For example, in Lynch v. Donnelly, issued in 1984, Justice Sandra Day O'Connor argued in a concurring opinion that in the first and second prongs of the Lemon test, the Court should ask whether a government action had "endorsed" religion.[31] The Supreme Court as a whole sometimes used this endorsement test.[32] Further, in a 1997 decision, the Supreme Court seemed to suggest a refinement of the last two prongs of the Lemon test, saying the Court uses "three primary criteria . . . to evaluate whether government aid has the effect of advancing religion:" looking to whether laws "result in governmental indoctrination; define [their] recipients by reference to religion; or create an excessive entanglement."[33]

Apart from the Lemon factors, the Supreme Court has sometimes evaluated Establishment Clause challenges by looking to whether the law is unduly coercive--particularly in the context of government-sponsored prayer.[34] "Coercion" includes at least legal compulsion,[35] but the Supreme Court has also held that "indirect coercive pressure" created by government support for "a particular religious belief" can run afoul of the Establishment Clause.[36]

Finally, the Supreme Court has sometimes reviewed laws by reference to historical traditions--and in a 2022 ruling, said this was the test courts should use "in place of Lemon and the endorsement test."[37] In decisions since the mid-1900s, the Court's Establishment Clause analysis has sometimes looked to the history of government regulation or accommodation of religion, and the responses to those government actions.[38] In particular, some cases evaluating the constitutionality of government-sponsored prayer practices have looked to historical practice, in addition to the coercion analysis discussed above.[39] Accordingly, the Supreme Court has ruled unconstitutional prayer practices that it believed were inconsistent with early understandings of the Establishment Clause,[40] but upheld legislative prayer schemes that were consistent with long-standing historical practices.[41]

In 2022's Kennedy v. Bremerton School District the Supreme Court said it had "abandoned Lemon and its endorsement test offshoot" in favor of "an analysis focused on original meaning and history."[42] The Court said the shortcomings of Lemon's "'ambitiou[s],' abstract, and ahistorical approach to the Establishment Clause" Lemon test were "apparent."[43] Nonetheless, the Court did not expressly overrule Lemon or other precedent applying that test, leaving questions about how courts will apply those rulings in the future.[44]

The following essays provide more detail on the Supreme Court's decisions interpreting the Establishment Clause, focusing primarily on explaining the different types of analyses the Court has employed over time. Following Supreme Court precedent, the essays discuss cases involving financial assistance and non-financial assistance to religion separately. Although the two types of cases have sometimes employed the same analyses--both applied the Lemon test in at least some instances--the application of those analyses has differed based on the factual circumstances.

Financial Assistance to Religion[edit | edit source]

Overview of Financial Assistance to Religion[edit | edit source]

When the government provides financial aid to religious entities, as opposed to providing other types of aid such as facilities or supplies, such support presents heightened Establishment Clause concerns.[45] The Court has recognized that "financial support" of religion was squarely in the minds of those who adopted the Establishment Clause.[46]

Historically, the Supreme Court generally evaluated such aid under the three-part framework of Lemon v. Kurtzman--although its financial aid cases have also reflected the varying approaches to Lemon, including the endorsement approach.[47] While the Court has since "abandoned" the Lemon test in favor of an approach that looks to historical tradition,[48] it has not specifically overruled that opinion or some other cases applying that analysis, meaning the outcomes of those rulings may still be considered binding precedent. Accordingly, particularly in light of the fact that the Court has not frequently applied a test looking to historical traditions in the context of financial aid,[49] there is some uncertainty regarding how at least certain types of financial aid may be reviewed in the future.

In addition, one central issue in modern Establishment Clause jurisprudence concerns who decides that aid will be provided to a religious entity. The Supreme Court has said financial aid will be especially problematic if the government is giving funds directly to religious entities, as opposed to giving funds to religious entities indirectly--that is, giving funds to third parties who privately choose to use public funds to support religious entities.[50] The Court has said that indirect aid will generally be permissible under Lemon if the "government aid program is neutral with respect to religion, and provides assistance directly to a broad class of citizens who, in turn, direct government aid to religious schools wholly as a result of their own genuine and independent private choice."[51]

In a few cases, the Supreme Court has considered the denial of financial assistance, and has held in those cases that the government did not violate the Establishment Clause either by imposing a generally applicable tax on a religious entity[52] or denying a tax exemption for religiously motivated activity.[53]

Early Cases on Financial Assistance to Religion[edit | edit source]

The Supreme Court first recognized that the Establishment Clause applied to the states (through the Fourteenth Amendment) in 1947's Everson v. Board of Education.[54] Prior to Everson, the Court had issued only two decisions evaluating federal financial assistance to religious institutions.[55] Both took a fact-specific approach to evaluating the constitutional challenges in those cases rather than attempting to articulate a broader test, and both rejected the Establishment Clause challenges. Accordingly, these early cases, along with Everson, demonstrated that not all forms of government aid to religion violate the Establishment Clause.[56]

Everson thus was the Supreme Court's first significant modern attempt to elucidate the terms of the Establishment Clause.[57] The Court upheld a state program that reimbursed parents for bus fare to send their children to school, including children who attended parochial schools.[58] The Court largely declined to articulate a single test for courts to evaluate Establishment Clause challenges, although it did make some broad pronouncements about how to approach the Religion Clauses. For instance, in balancing the two Religion Clauses, the Court cautioned that in "protecting" citizens from "state-established churches," it did not want to "inadvertently prohibit [the state] from extending its general state law benefits to all its citizens without regard to their religious belief."[59] The Court said that the First Amendment "requires the state to be . . . neutral in its relations with groups of religious believers and non-believers; it does not require the state to be their adversary."[60]

Applying these general principles, the Supreme Court said that the bus fare reimbursement program was constitutional.[61] Although it used "tax-raised funds" to help some children "get to church schools," this was only "as a part of a general program" that paid "the fares of pupils attending public and other schools."[62] In the Court's view, the Establishment Clause did not require the state to "cut[ ] off church schools" from "general government services."[63]

Adoption of the Lemon Test[edit | edit source]

The tripartite Establishment Clause test asking courts to look to purpose, effect, and entanglement is primarily associated with Lemon v. Kurtzman, decided in 1971.[64] However, the Supreme Court first compiled these three factors a year earlier, in Walz v. Tax Commission.[65] The Walz petitioners raised an Establishment Clause challenge to a state tax exemption for religious properties used solely for religious worship.[66] In upholding the exemption, the Court held first that its "legislative purpose" was "neither the advancement nor the inhibition of religion; . . . neither sponsorship nor hostility."[67] The state had granted the exemption not only to religious properties, but to "a broad class of property owned by nonprofit, quasi-public corporations" that the state considered to be "beneficial and stabilizing influences in community life."[68] The Court then considered whether the effect of the law was "an excessive government entanglement with religion."[69] The Court acknowledged that the exemption would create some entanglement by giving churches "an indirect economic benefit," but stated that the exemption entailed less government involvement than either taxing the churches or giving them a direct money subsidy.[70] As part of its analysis into whether the exemption impermissibly sponsored religion, the Court also emphasized widespread historical precedent for tax exemptions.[71] Ultimately, the Court ruled that the exemption created "only a minimal and remote involvement between church and state."[72]

In Lemon, the Supreme Court formally synthesized a three-part test for analyzing Establishment Clause challenges: to be constitutional, laws (1) "must have a secular legislative purpose;" (2) must have a "principal or primary effect . . . that neither advances nor inhibits religion . . .;" (3) and "must not foster 'an excessive government entanglement with religion.'"[73] The Court applied this test in Lemon to conclude that two state programs providing public funds to church-affiliated schools were unconstitutional because they created an excessive entanglement with religion.[74]

The first program provided supplemental payments to teachers in nonpublic schools.[75] The Court believed there was significant "danger that a teacher under religious control and discipline" could not separate "the religious from the purely secular aspects of . . . education."[76] Given this "potential for impermissible fostering of religion," the Court said that the state would have to ensure "that subsidized teachers do not inculcate religion"--and noted that the state had in fact imposed a number of restrictions on the use of state aid.[77] But in the Supreme Court's view, these restrictions created an "excessive and enduring entanglement between state and church" by requiring "a comprehensive, discriminating, and continuing state surveillance" of the religious schools.[78]

The second program considered in Lemon reimbursed nonpublic schools for purchasing certain secular educational services or textbooks.[79] The Court ruled this program unconstitutional for the same reasons as the first, noting that the program required the state to review reimbursements and required schools to use certain accounting procedures.[80] The Court said that the second program suffered from "the further defect of providing state financial aid directly to the church-related school."[81] This was particularly concerning to the Court because historically, programs involving "a continuing cash subsidy . . . have almost always been accompanied by varying measures of [government] control and surveillance."[82] The Court was also concerned about the "divisive political potential" and the relatively unprecedented nature of both programs, stating that these factors might suggest a danger of even greater government regulation of religious schools in the future.[83]

Application of the Lemon Test[edit | edit source]

Since 1971, the Supreme Court has most frequently evaluated financial assistance to religious entities under the Lemon framework, notwithstanding its gradual disfavor and eventual "abandonment" of Lemon.[84] In a series of decisions issued during the 1970s, the Court applied these three factors to a series of programs offering funds to schools, holding some of those programs constitutional and others unconstitutional. The Court rejected Establishment Clause challenges to generally available aid programs that provided that funds could not be used "for sectarian purposes," concluding this type of restriction ensured the program would not have an unconstitutional effect of advancing religion under Lemon.[85] For example, in Tilton v. Richardson and Hunt v. McNair, the Court upheld programs that funded the construction or improvement of educational facilities, but expressly excluded facilities used for religious worship or instruction.[86] Further, in Tilton, the Court ruled that a provision that would have allowed federally funded facilities to revert to religious purposes after twenty years was unconstitutional.[87]

The Court also applied Lemon to disapprove of a number of financial aid programs in the 1970s.[88] In Committee for Public Education and Religious Liberty v. Nyquist and Levitt v. Committee for Public Education, the Supreme Court held that two state programs funding private schools violated the Establishment Clause because the programs lacked any measures to ensure that the funds would not be used for religious purposes.[89] In Nyquist, the Court considered a state law that, among other things, offered grants to private schools for facilities maintenance and repair.[90] The law did not "restrict payments . . . to the upkeep of facilities used exclusively for secular purposes," and would have, for example, allowed schools to use the funds for "the salaries of employees who maintain the school chapel, or the cost of renovating classrooms in which religion is taught."[91] Accordingly, the Court concluded that the program failed the effect prong of Lemon because it would "inevitably . . . subsidize and advance the religious mission of sectarian schools."[92]

Similarly, in Levitt, the Supreme Court held that a state program reimbursing religious schools for performing certain testing and recordkeeping services violated the Establishment Clause because "the aid that [would] be devoted to secular functions [was] not identifiable and separable from aid to sectarian activities."[93] The Court noted that the tests were prepared by "teachers under the authority of religious institutions" and ruled that there was an inherent risk of the test being used for "religious indoctrination."[94] Seven years after its decision in Levitt, the Supreme Court upheld a revised version of the same testing-reimbursement law.[95] The new law did not allow reimbursement for teacher-prepared tests and allowed states to audit payments.[96] The Court ruled that these new safeguards were sufficient to ensure "that the cash reimbursements would cover only secular services,"[97] and did not create an impermissible entanglement with religion.[98]

Starting in 1980, the Supreme Court almost uniformly rejected Establishment Clause challenges to financial aid provisions, finding a constitutional violation in only one case, discussed below.[99] The Court's analysis generally continued to focus on purpose, effect, and entanglement, although it occasionally referred more generally to a program's neutrality without explicitly citing Lemon.[100] Further, the Court began to move away from the separationist approach of Nyquist and Levitt, suggesting that financial aid programs might not have to prohibit expressly the religious use of funds in order to be ruled constitutional.[101] Indeed, the Supreme Court has rejected Establishment Clause challenges to a number of programs in part because they offer benefits broadly to both religious and nonreligious recipients.[102]

In Mueller v. Allen, the Supreme Court concluded that a state could allow individual tax deductions for tuition, textbooks, and transportation costs incurred in sending students to religious schools.[103] While the program disallowed deductions for instructional materials used to "inculcate" religious tenets or doctrine,[104] the Court's analysis did not seem to turn on this restriction. The Court instead stressed, among other factors, that the tax deduction was "available for educational expenses incurred by all parents, including those whose children attend public schools and those whose children attend non-sectarian private schools or sectarian private schools."[105] Because the benefit was broadly available and neutral on its face with respect to religion, the Court believed that the program had a primarily secular effect and did not imply state endorsement of religion.[106]

The Court solidified this approach in Bowen v. Kendrick, upholding a federal grant program for adolescent health services even though it did not expressly prohibit the use of federal funds for religious purposes.[107] The Court noted that the statute made funds available to a wide variety of organizations and concluded that there was no evidence that a "significant proportion of the federal funds" would be given to religious institutions.[108] Further, the Court said that it would assume that even absent an express restriction on the religious use of funds, religious grantees could carry out the funded programs "in a lawful, secular manner."[109]

Texas Monthly, Inc. v. Bullock, however, illustrates the limits of the Supreme Court's favored approach of the 1980s. In Texas Monthly, the Court struck down a state tax exemption for periodicals distributed by a religious faith that consisted wholly of religious writings.[110] Justice William Brennan, writing for a plurality of the Court, concluded that this exemption failed the endorsement test.[111] He said that "when government directs a subsidy exclusively to religious organizations that is not required by the Free Exercise Clause," that conveys an impermissible message of "state sponsorship of religious belief."[112]

Zelman and Indirect Assistance to Religion[edit | edit source]

The Supreme Court has generally been more permissive of indirect financial aid programs, where the government does not give funds directly to religious organizations but gives them instead to third parties who make "genuinely independent and private choices" to support religious entities.[113] In such circumstances, the Court has not required the government to include religious use restrictions.[114] Instead, where financial aid is provided to religious entities indirectly, the Court has said that such programs satisfy Lemon's effect prong even if the funds ultimately support religious activities--so long as the program is "neutral in all respects toward religion,"[115] particularly in the sense of using religiously neutral criteria to distribute aid.[116]

One 1973 case, Committee for Public Education and Religious Liberty v. Nyquist, suggested that the Supreme Court might view at least some types of indirect aid programs with heightened scrutiny.[117] Nyquist struck down an indirect aid program that assisted only private schools, providing tuition reimbursements and tax benefits to parents.[118] With respect to the tuition reimbursements, the Court concluded that regardless of the fact that the funds were given to parents and not directly to schools, the program was still unconstitutional because "the effect of the aid is unmistakably to provide desired financial support for nonpublic, sectarian institutions."[119] The Court ruled that the tax benefits were similarly unconstitutional, saying that "in practical terms," there was little difference between the tuition grant and the tax benefits.[120]

In Zelman v. Simmons-Harris, however, the Supreme Court suggested that indirect aid programs will generally satisfy Lemon, if they are "programs of true private choice."[121] Zelman rejected an Establishment Clause challenge to a municipal program that offered "tuition aid" to parents with financial need who sought to enroll their children in schools in underperforming districts.[122] The parents could choose to use the tuition aid at religious or nonreligious private schools, as well as public schools.[123] The Court said that where the government program aided "a broad class of citizens" who then chose to "direct government aid to religious schools wholly as a result of their own genuine and independent private choice," any support for religion was "reasonably attributable to the individual recipient, not to the government, whose role ends with the disbursement of benefits."[124] Consequently, under the endorsement test, "no reasonable observer would think" that such a program "carries with it the imprimatur of government endorsement" of religion.[125]

Zelman distinguished but did not overrule Nyquist, saying "Nyquist does not govern neutral educational assistance programs that, like the program here, offer aid directly to a broad class of individual recipients defined without regard to religion."[126] The Court emphasized that the program in Nyquist provided benefits "exclusively to private schools," rather than providing benefits "generally without regard to the sectarian-nonsectarian, or public-nonpublic nature of the institution benefited."[127] Zelman thus seemed to leave open the question of whether an indirect aid program that was neutral towards religion on its face and supported both religious and secular private entities, but did not also aid public entities, would raise Establishment Clause concerns. However, the Supreme Court has more recently said that an Establishment Clause challenge to a state tax benefit program indirectly assisting only private schools would be "unavailing."[128] Accordingly, although the Supreme Court has never expressly overruled Nyquist, that case may now be narrowed to such a limited set of facts that the Court is unlikely to rely on it in future cases.

Further reinforcing Zelman, the Supreme Court has held that states do not violate the Establishment Clause by offering scholarship funds to students who may choose to use those funds at religious schools or for religious studies,[129] or by offering tax credits for donating to private organizations that granted scholarships to private schools.[130] To take one last example, the Supreme Court ruled that it did not violate the Establishment Clause for a public university to pay for the printing of a religious student publication in Rosenberger v. Rector and Visitors of the University of Virginia.[131] The university generally offered funds to approved student groups.[132] The student groups chose how to use the funds, and the funds were given to the printer, rather than being paid directly to the religious student group.[133] Under the circumstances, the Court said it was not "plausible" that any religious speech supported with these funds would be attributed to the university.[134] The Court emphasized that the funds were available on a "religion-neutral basis" as part of a program that funded "secular services" such as printing.[135]

Denying Financial Assistance to Religion[edit | edit source]

Government decisions that refuse to grant a tax exemption may be viewed as a decision to deny financial aid. On that theory, religious entities have sometimes argued that the federal government's decision to deny them a tax exemption for religiously motivated actions violated the Establishment Clause where the exemption allegedly preferred certain religions.[136] The Supreme Court rejected the constitutional challenges in two such cases, noting that the federal government's tax laws were generally neutral in their purpose and effect, and that the challenged policies did not facially discriminate on the basis of religion.[137] In one of the cases, the Court further concluded that the decision to tax the church did not threaten an "excessive entanglement between church and state," even though the government would have to obtain certain information from religious entities to ascertain tax liability.[138] The Court described this as a "routine regulatory interaction" that did not require an impermissible inquiry "into religious doctrine" or entail "'detailed monitoring and close administrative contact' between secular and religious bodies."[139]

Entanglement was at the core of another Supreme Court opinion rejecting an Establishment Clause challenge to a state's decision to impose generally applicable sales and use taxes on religious publications.[140] A religious organization that sold evangelical materials such as books and tapes sought an exemption from state tax liability, arguing that the state would violate Lemon's entanglement prong by taxing its materials.[141] The Supreme Court rejected this argument, saying that even if the law imposed accounting burdens on the organization, "such administrative and recordkeeping burdens do not rise to a constitutionally significant level."[142] Among other factors, the Court noted that the scheme did not require invasive surveillance or inspection of the organization's "day-to-day operations," and did not require the state "to inquire into the religious content of the items sold or the religious motivation for selling or purchasing the items."[143] The Court emphasized that materials were "subject to the tax regardless of content or motive": the state cared only "whether there is a sale or a use, a question which involves only a secular determination."[144]

In Harris v. McRae, the Court considered a statute that even more directly denied financial assistance.[145] The Court rejected an Establishment Clause challenge to the Hyde Amendment, a law prohibiting federal funds from being used to fund certain abortions under the Medicaid program.[146] Challengers to the Hyde Amendment argued that this funding condition unconstitutionally "incorporate[d] into law the doctrines of the Roman Catholic Church concerning the sinfulness of abortion and the time at which life commences."[147] The Supreme Court, however, concluded that the condition did not violate Lemon, saying the fact that the restriction "may coincide with the religious tenets of the Roman Catholic Church does not, without more, contravene the Establishment Clause."[148] In the Court's view, the Hyde Amendment was "as much a reflection of 'traditionalist' values towards abortion, as it [wa]s an embodiment of the views of any particular religion."[149]

Non-Financial Assistance to Religion[edit | edit source]

Overview of Non-Financial Assistance to Religion[edit | edit source]

Apart from financial aid, the Supreme Court has recognized that other types of support for religion can violate the Establishment Clause.[150] Broadly considered, the Establishment Clause "forestalls compulsion by law of the acceptance of any creed or the practice of any form of worship."[151] Accordingly, for example, the Supreme Court has held invalid laws that required public schools to tailor their teachings to religious doctrine[152] or to conduct prayers,[153] as well as laws that created denominational preferences.[154] The Supreme Court has also, with varied outcomes, considered Establishment Clause challenges to government actions such as the sponsorship of monuments involving religious symbols,[155] the provision of textbooks, facilities, or other non-financial resources to religious schools,[156] and laws attempting to accommodate religiously motivated conduct.[157]

As discussed elsewhere, Establishment Clause challenges to financial aid cases have primarily been analyzed under Lemon v. Kurtzman or Zelman v. Simmons-Harris, distinguishing between direct and indirect aid.[158] The distinction between direct and indirect aid has not been as significant in evaluating non-financial aid.[159] Supreme Court cases involving non-financial support for religion have frequently employed Lemon's three-part inquiry into purpose, effect, and entanglement,[160] but have also used other types of inquiries, including looking for government endorsement or coercion, or considering historical practices.[161] By 2022, the Supreme Court said it had "abandoned Lemon and its endorsement test offshoot."[162] Instead, moving forward, the Court said the Establishment Clause "must be interpreted by 'reference to historical practices and understandings.'"[163] There are a greater number of cases that looked to historical traditions or coercion in the context of nonfinancial aid, as compared to financial aid cases.[164]

Early Cases on Non-Financial Assistance to Religion[edit | edit source]

Following 1947's Everson v. Board of Education,[165] the Supreme Court's early cases considering non-financial support for religion stressed general principles of neutrality towards religion.[166] In Illinois ex rel. McCollum v. Board of Education, decided in 1948, the Court held that a program allowing private religious teachers to teach religion in public schools violated the "wall of separation between Church and State" referred to in Everson.[167] The Court raised concerns about "the use of tax-supported property for religious instruction and the close cooperation between the school authorities and the religious council in promoting religious education."[168] The school acted unconstitutionally by using "the State's compulsory public school machinery" to provide pupils for religious classes.[169]

Four years later, the Supreme Court concluded in Zorach v. Clauson that a different "released time" program allowing students to leave school grounds to receive religious instruction did not violate the Establishment Clause.[170] By contrast to the program invalidated in McCollum, the Zorach program "involve[d] neither religious instruction in public school classrooms nor the expenditure of public funds," and used no "coercion to get public school students into religious classrooms."[171] The Court said that while the First Amendment required the "complete and unequivocal" separation of church and state as to matters "within the scope of its coverage," it did not require separation "in every and all aspects."[172] Disallowing the public schools' accommodation of students' "religious needs," according to the Court, would have stretched the separation concept to an undesired "extreme[ ]."[173]

Also drawing on Everson, the Court's early cases sometimes reviewed "the background and environment of the period in which [the Establishment Clause] was fashioned and adopted" to analyze whether state laws would be consistent with the Founders' intent.[174] In Torcaso v. Watkins, the Supreme Court looked to colonial history with religious test oaths, and held that the "policy of probing religious beliefs by test oaths or limiting public offices to persons who have . . . a belief in some particular kind of religious concept" was "historically and constitutionally discredited."[175] The Court held that a state law requiring public officials to declare a "belief in the existence of God" violated the Establishment Clause because its "purpose" and "effect" was to put "the power and authority of the State . . . on the side of one particular sort of believers."[176] More broadly, the Court declared that the government cannot "pass laws or impose requirements which aid all religions as against non-believers," nor can it "aid those religions based on a belief in the existence of God as against those religions founded on different beliefs."[177]

In Engel v. Vitale, the Supreme Court looked to history again to hold unconstitutional a state law requiring a specified prayer to be recited at the beginning of a school day.[178] As part of its analysis, the Court noted that as "a matter of history[,] . . . this very practice of establishing governmentally composed prayers for religious services was one of the reasons which caused many of our early colonists to leave England and seek religious freedom in America."[179] The Court further reviewed post-Revolution movements to disestablish religion in the former colonies, concluding that when the First Amendment was adopted, "there was a widespread awareness among many Americans . . . . that one of the greatest dangers to the freedom of the individual to worship in his own way lay in the Government's placing its official stamp of approval upon one particular kind of prayer or one particular form of religious services."[180]

Purpose and Effect Test Before Lemon[edit | edit source]

In the 1960s, the Court began to move away from the general neutrality principles embodied in the metaphor of a wall separating church and state, focusing more specifically on whether challenged laws had the purpose or effect of aiding religion.[181] To evaluate the constitutionality of state criminal laws prohibiting commercial activities on Sunday, McGowan v. Maryland reviewed "the history of Sunday Closing Laws."[182] That review led the Court to conclude that, although "the original laws which dealt with Sunday labor were motivated by religious forces," such laws had subsequently lost "some of their totally religious flavor."[183] Ultimately, the Court accepted the state's judgment "that the [challenged] statutes' present purpose and effect is not to aid religion but to set aside a day of rest and recreation."[184] The Court held that creating a common day of rest embodied a secular purpose, and emphasized that the statute allowed "nonlaboring persons" to engage in a variety of nonreligious Sunday activities.[185] However, the Court cautioned that a law might violate the Establishment Clause if "its purpose--evidenced either on the face of the legislation, in conjunction with its legislative history, or in its operative effect--is to use the State's coercive power to aid religion."[186]

Formalizing this focus on purpose and effect, School District of Abington Township v. Schempp clarified:

The test may be stated as follows: what are the purpose and the primary effect of the enactment? If either is the advancement or inhibition of religion then the enactment exceeds the scope of legislative power as circumscribed by the Constitution. . . . [T]o withstand the strictures of the Establishment Clause there must be a secular legislative purpose and a primary effect that neither advances nor inhibits religion.Sch. Dist. of Abington Twp. v. Schempp, 374 U.S. 203, 222 (1963).

The Court applied this analysis in Schempp to hold that two states violated the Establishment Clause by requiring schools to begin the school day with Bible readings.[187] One of the states argued that the Bible readings served a secular purpose--promoting moral values and teaching literature.[188] The Court rejected this claim based on evidence showing that the reading was a religious exercise.[189]

Impermissible religious purpose arose again in Epperson v. Arkansas, in which the Supreme Court invalidated a state law that prohibited teaching evolution in school.[190] After reviewing the law's history, the Court said there was "no doubt" that the law prohibited "discussing the theory of evolution because it is contrary to the belief of some that the Book of Genesis must be the exclusive source of doctrine as to the origin of man."[191] This purpose of advancing a specific religious doctrine violated the First Amendment.[192] By contrast, the Court concluded that a federal law relieving conscientious objectors from military service did not violate the Establishment Clause, even though it included only objectors whose religious beliefs opposed all wars, excluding objectors opposed only to specific wars.[193] The Court believed that the law's differing treatment of religious objectors did not doom the law where it did not facially discriminate between religions, and critically, where the government had demonstrated that the law served a number of valid secular purposes.[194]

By contrast, the Supreme Court rejected an Establishment Clause challenge to a textbook lending program in Board of Education v. Allen, applying the test outlined in Schempp.[195] The law required public schools to lend textbooks to students, including students enrolled at private schools.[196] The Court held that the law served a secular purpose--furthering children's "educational opportunities"--and that there was no evidence that the law had the effect of impermissibly advancing religion.[197] Among other factors, the Court noted that the textbooks were loaned to students, not parochial schools, and that the program included only secular textbooks.[198] Consequently, the Court concluded the program aided only the secular education conducted in religious schools, rejecting the idea "that the processes of secular and religious training are so intertwined that secular textbooks furnished to students . . . are in fact instrumental in the teaching of religion."[199]

Non-Financial Assistance to Religion and the Lemon Test[edit | edit source]

Lemon's Purpose Prong[edit | edit source]

The Supreme Court's 1971 decision in Lemon v. Kurtzman further entrenched the Establishment Clause's focus on purpose and effect, and added a third element to the inquiry: entanglement.[200] Under Lemon, to be considered constitutional, laws (1) "must have a secular legislative purpose;" (2) must have a "principal or primary effect . . . that neither advances nor inhibits religion"; (3) and "must not foster 'an excessive government entanglement with religion.'"[201] However, the Court said in 2022 that it had "long ago abandoned Lemon and its endorsement test offshoot."[202] Nonetheless, it has not expressly overruled either Lemon or most other cases analyzing specific government actions by reference to purpose, effect, or entanglement--so the holdings of those cases remain binding in some courts.[203] Furthermore, even as the Court has shifted its doctrinal framework, over the years, it has sometimes given weight to the same kinds of facts or reasoning over those different frameworks. For those reasons, this essay explains the Court's Lemon jurisprudence in some detail.

The first Lemon factor focused on the purpose of a government policy.[204] According to the Supreme Court: "When the government acts with the ostensible and predominant purpose of advancing religion, it violates that central Establishment Clause value of official religious neutrality . . . ."[205] To determine a law's purpose, courts looked to the "text, legislative history, and implementation of the statute."[206] Accordingly, in ruling one government display of the Ten Commandments unconstitutional, the Supreme Court analyzed the history of the display and the county orders requiring the display, concluding that the original version had an "unmistakable" religious object, and that subsequent amendments to the display had failed to "cast off the objective so unmistakable in the earlier displays."[207]

It was relatively rare for the Supreme Court to find that a law failed Lemon's first factor, as it said a law would be unconstitutional "only when . . . there was no question that the statute or activity was motivated wholly by religious considerations."[208] Thus, the presence of "legitimate secular purposes" could outweigh potential religious purposes.[209] For example, the Court recognized supporting secular education[210] and protecting speech[211] as legitimate secular purposes. Further, to satisfy Lemon, the law's purpose did not have to "be unrelated to religion."[212] The Supreme Court has approved of laws that seek to accommodate religion, or to "alleviate significant governmental interference with the ability of religious organizations to define and carry out their religious missions."[213] For example, in Wisconsin v. Yoder, the Court rejected an Establishment Clause challenge to a state decision exempting the Amish from compulsory public education, saying "[t]he purpose and effect of such an exemption are not to support, favor, advance, or assist the Amish, but to allow their centuries-old religious society . . . to survive free from the heavy impediment compliance with the Wisconsin compulsory-education law would impose."[214]

However, the Court cautioned that the asserted secular purpose must "be genuine, not a sham, and not merely secondary to a religious objective."[215] The relevant inquiry was whether Congress "act[ed] with the intent of promoting a particular point of view in religious matters."[216] Thus, in one case, the Court ruled unconstitutional a state law relating to the teaching of "creation science," concluding that the law did not further its stated purpose of "academic freedom."[217] Instead, the Court believed that the evidence demonstrated that the primary purpose of the law "was to restructure the science curriculum to conform with a particular religious viewpoint."[218]

Two cases involving government displays of religious symbols further illustrate this first factor of the Lemon inquiry. First, in Stone v. Graham, the Supreme Court held that a state law requiring public schools to post a copy of the Ten Commandments in classrooms was unconstitutional because it had "no secular legislative purpose."[219] The Court said that the law's "avowed" secular purpose--displaying the Ten Commandments as part of "the fundamental legal code"--could not "blind" it to the law's "plainly religious" purpose.[220] Noting that the Ten Commandments were not "integrated into the school curriculum" in any "appropriate" field of study, the Court concluded that the only possible effect of the posting could be "to induce the schoolchildren to read, meditate upon, perhaps to venerate and obey, the Commandments," an impermissible religious objective.[221]

By contrast, in Lynch v. Donnelly, the Court rejected an Establishment Clause challenge to a city's Christmas display, which included a crèche along with a number of other decorations such as reindeer, candy-striped poles, and a Christmas tree.[222] The Court said that under these circumstances, the city had stated "legitimate secular purposes": "to celebrate the Holiday and to depict the origins of that Holiday."[223] The religious nature of the crèche had to be viewed in the context of the whole display, and the Court concluded that there was "insufficient evidence to establish that the inclusion of the crèche is a purposeful or surreptitious effort to express some kind of subtle governmental advocacy of a particular religious message."[224]

Overview of Lemon's Effect Prong[edit | edit source]

The second Lemon requirement was that a government policy must have a "principal or primary effect . . . that neither advances nor inhibits religion."[225] In 1997, the Supreme Court said it used "three primary criteria . . . to evaluate whether government aid has the effect of advancing religion:" looking to whether laws "result in governmental indoctrination; define [their] recipients by reference to religion; or create an excessive entanglement."[226]

The Supreme Court sometimes discussed the effect inquiry in terms of "incidental" or "indirect" benefits, saying that a policy will not have an impermissible effect if it only incidentally aids religion.[227] For example, the Court has characterized the textbook lending program in Board of Education v. Allen and the bus transportation program in Everson v. Board of Education as using "primarily secular means to accomplish a primarily secular end," aiding religion only indirectly, rather than as the "primary effect."[228] Similarly, the Court has said a law will not violate Lemon's effect prong "simply because it allows churches to advance religion."[229] Instead, to violate the effect prong, "it must be fair to say that the government itself has advanced religion through its own activities and influence."[230] Thus, one relevant concern is whether any aid to religion can be attributed to the government, rather than private parties.[231]

Generally, the Supreme Court has said that "government programs that neutrally provide benefits to a broad class of citizens defined without reference to religion are not readily subject to an Establishment Clause challenge just because sectarian institutions may also receive an attenuated financial benefit."[232] Thus, following the pre-Lemon precedent of Allen,[233] the Supreme Court rejected Establishment Clause challenges to school aid programs that were generally available to both religious and nonreligious recipients and supplied discrete secular services controlled by the state, including standardized testing services, speech and diagnostic health services, and off-site therapeutic and remedial services;[234] providing a sign-language interpreter;[235] and allowing religious groups to use school facilities.[236] However, as discussed in more detail elsewhere, the fact that a program is neutral in the sense of even distribution of benefits has not always been dispositive to the inquiry--particularly if the aid was not secular or if it was diverted to religious uses.[237]

Lemon's Effect Prong and Accommodation of Religion[edit | edit source]

As under the purpose prong, the government may generally accommodate religious activity without violating Lemon's effect prong.[238] For example, in 1987, the Supreme Court rejected a constitutional challenge to a provision in the Civil Rights Act of 1964 that exempted religious organizations from certain employment discrimination provisions.[239] While the Court acknowledged that the exemption "single[d] out religious entities for a benefit," it nonetheless concluded that the Establishment Clause allowed the accommodation, given that the government had "act[ed] with the proper purpose of lifting a regulation that burdens the exercise of religion."[240]

The Court has also warned, however, that "[a]t some point, accommodation may devolve into 'an unlawful fostering of religion.'"[241] Two years earlier, the Court had ruled unconstitutional a state law that barred employers from requiring employees to work on any day that the employee observed as the Sabbath.[242] By giving employees "an absolute and unqualified right not to work on whatever day they designate as their Sabbath," the Court said the law's "primary effect . . . impermissibly advance[d] a particular religious practice."[243] In implicit contrast to the Sunday Closing law approved in McGowan v. Maryland,[244] the law specifically referred to the "Sabbath," a religious term, and did not create a common day of rest.[245] This law granting an "unyielding weighting in favor of Sabbath observers" could be seen as an example of an impermissible accommodation.[246]

Two other examples further illustrate when laws crossed the line from permissible accommodation to impermissible advancement of religion.[247] In Larkin v. Grendel's Den, the Court held that a state law giving "churches and schools the power effectively to veto applications for liquor licenses within a 500-foot radius" violated the Establishment Clause.[248] According to the Court, the law had the impermissible effect of advancing religion: the veto power could be "employed for explicitly religious goals" and the "joint exercise of legislative authority . . . provide[d] a significant symbolic benefit to religion."[249] Similarly, in Board of Education of Kiryas Joel Village School District v. Grumet, the Court said that a state had violated the Establishment Clause by drawing a school district that "divide[d] residents according to religious affiliation."[250] The Court believed that the inhabitants of the school district did not merely happen to be "united by common doctrine," but instead said that the state intentionally limited the district to a specific sect, giving that religious group "exclusive control of the political subdivision."[251] This went beyond the bounds of a permissible accommodation by "singl[ing] out a particular religious sect for special treatment"--the "unconstitutional delegation of political power."[252]

Lemon's Effect Prong and Pervasively Sectarian Institutions[edit | edit source]

In a series of rulings that were eventually partially overturned, the Supreme Court suggested that providing certain secular materials or services to religious schools could violate Lemon's effect prong because of the pervasively religious character of the schools.[253] Thus, in Meek v. Pittenger and Wolman v. Walter, the Supreme Court concluded that programs providing instructional materials such as maps or laboratory equipment to nonpublic schools were unconstitutional.[254] The Court held in Meek that although the aid was "ostensibly limited to wholly neutral, secular instructional material and equipment," it would "inescapably result[ ] in the direct and substantial advancement of religious activity" because the schools' secular educational functions could not be separated from their predominantly religious activities.[255] In both cases, the Court emphasized that while the programs were open to all private schools, most of the private schools participating in the programs were religious.[256] Thus, the programs had "the unconstitutional primary effect of advancing religion because of the predominantly religious character of the schools" participating.[257] The Court recognized in Wolman that these rulings were in "tension" with Board of Education v. Allen, discussed elsewhere,[258] which had ruled that "secular" textbooks could be provided to religious schools in a way that served nonsectarian educational purposes.[259] That tension was ultimately resolved by Mitchell v. Helms, as discussed below.[260]

Building on the reasoning of Meek and Wolman, the Supreme Court also invalidated programs that offered secular education in private schools in School District v. Ball and Aguilar v. Felton.[261] Ball involved two state programs: a shared time program paying public school employees to teach supplemental classes at religious schools during the school day, and a community education program paying public and nonpublic teachers to lead various classes at religious schools after the school day.[262] For both programs, the Court emphasized the pervasive religious atmosphere in which the classes were being taught, saying there was "a substantial risk" that the religious messages conveyed by the school during its regular activities would "infuse the supposedly secular classes."[263] Accordingly, the programs "entailed too great a risk of state-sponsored indoctrination."[264] Aguilar involved a federal law allowing federal funds to be used to pay public employees teaching in nonpublic schools.[265] Similar to Ball, the Court stressed the "pervasively sectarian environment" in which the program was being offered, although it ruled on Lemon's entanglement prong rather than the effect prong.[266]

The Court reconsidered the same federal program in Agostini v. Felton, overruling Aguilar and partially overruling Ball (with respect to the shared time program).[267] The Court said that its prior decisions had erred by assuming that the programs would inevitably result in state-sponsored indoctrination merely because the instruction happened on the premises of a pervasively sectarian school.[268] Instead, the Agostini Court emphasized that the federal law allocated public education services "on the basis of criteria that neither favor nor disfavor religion."[269] Ultimately, the Court approved the program because it did not violate "any of three primary criteria we currently use to evaluate whether government aid has the effect of advancing religion: it does not result in governmental indoctrination; define its recipients by reference to religion; or create an excessive entanglement."[270]

The 2000 decision Mitchell v. Helms revisited Meek and Wolman, reviewing a federal program authorizing public schools to lend secular materials purchased with federal funds to private schools.[271] The Supreme Court rejected an Establishment Clause challenge to the program and partially overruled Meek and Wolman in a split decision.[272] The four-Justice plurality opinion applied the "effects" criteria outlined in Agostini, ruling that the program was constitutional because it created no indoctrination attributable to the state and did not define the recipients by reference to religion.[273] For the plurality, the program was sufficiently neutral towards religion because it "offer[ed] aid on the same terms, without regard to religion, to all who adequately further [a legitimate secular] purpose."[274] Even if some aid were diverted to religious uses, the plurality would have held, those religious uses "cannot be attributed to the government and [are] thus not of constitutional concern."[275]

Concurring in the judgment, Justice Sandra Sandra Day O'Connor expressed concerns about the "unprecedented breadth" of the plurality's statements about neutrality and divertibility.[276] In her view, the federal program was constitutional not simply because aid was "distributed on the basis of neutral, secular criteria," but also because restrictions on the funds ensured that "religious schools reap[ed] no financial benefit," and because federal law required the supplied materials to be secular.[277] Justice O'Connor believed that whether the aid had been diverted to religious instruction was a relevant consideration, but concluded that any diversion in this case was "de minimis."[278] She agreed with the plurality opinion that Meek and Wolman erred in assuming without evidence "that secular instructional materials and equipment would be diverted to use for religious indoctrination."[279] For Justice O'Connor, while the mere possibility of diversion was insufficient to doom a program, the Establishment Clause did bar the actual diversion of government aid to religious uses.[280]

Accordingly, following Mitchell, the Supreme Court will not assume that government aid will be impermissibly used for religious activities under Lemon's effect prong merely because the recipient has a religious character.[281] Further, it appears that a majority of Justices agreed with Justice O'Connor that actual diversion of aid to religious indoctrination violates the Constitution.[282] Some lower courts have also recognized Justice O'Connor's approach to the neutrality inquiry as controlling.[283] It remains to be seen what effect the "abandonment" of Lemon will have on the analysis of aid that is used for religious indoctrination.[284]

Lemon's Entanglement Prong[edit | edit source]

Under Lemon's "entanglement" prong, a law could create impermissible entanglement either through excessive government surveillance or through its divisive political potential.[285] The Court therefore struck down laws that would require "comprehensive, discriminating, and continuing" government supervision and control of religion,[286] or that impermissibly politicized religion.[287] However, contrary to the language in Lemon itself, the Supreme Court did not always treat the entanglement prong of the Lemon test as a distinct inquiry.[288] Notably, the Supreme Court treated entanglement as an element of Lemon's effect prong in 1997's Agostini v. Felton.[289]

To violate the Establishment Clause under Lemon's third prong, an entanglement had to be "excessive," as some "[i]nteraction between church and state is inevitable."[290] The Court has sometimes noted that laws creating permissible accommodations have created "a more complete separation" between church and state, the opposite of a greater entanglement.[291] Further, the Court has concluded that relatively minor oversight or administrative burdens did not qualify as impermissible entanglement.[292] For example, the Court said applying the recordkeeping requirements of the Fair Labor Standards Act to religious organizations did not create an excessive entanglement, emphasizing that the requirements applied only to certain commercial activities, with "no impact on petitioners' own evangelical activities or on individuals engaged in volunteer work for other religious organizations."[293] In another case, the Court concluded minor "custodial oversight" of religious groups, where the law prohibited greater government control or sponsorship of the groups' activities, did not violate the entanglement prong.[294]

By contrast, the Supreme Court said in Larkin v. Grendel's Den that a statute giving churches the power to veto liquor licenses for nearby businesses "enmeshe[d] churches in the exercise of substantial governmental powers contrary to our consistent interpretation of the Establishment Clause."[295] According to the Court, "few entanglements could be more offensive" than delegating "discretionary governmental powers" to religious groups.[296]

As discussed in more detail elsewhere,[297] the Supreme Court held in a few decisions in the 1970s and 1980s that providing certain secular materials or services to religious schools violated the effect and entanglement prongs of Lemon.[298] Notably, in Aguilar v. Felton, the Supreme Court said that a law allowing federal funds to be used to pay public employees teaching in nonpublic schools was unconstitutional "because the supervisory system established by the [implementing city would] inevitably result[ ] in the excessive entanglement of church and state."[299] The Court relied on the fact that the aid was "provided in a pervasively sectarian environment," and assumed that "because assistance is provided in the form of teachers, ongoing inspection is required to ensure the absence of a religious message."[300] However, these rulings were subsequently overruled.[301] The Supreme Court said it would "no longer presume that public employees will inculcate religion simply because they happen to be in a sectarian environment," and accordingly, would "also discard the assumption that pervasive monitoring of [the funded] teachers is required."[302]

Lemon relied in part on the "divisive political potential" of the school funding programs at issue in that case to find that there was an unconstitutional excessive entanglement.[303] However, the Court later suggested that "political divisiveness alone" is not enough "to invalidate otherwise permissible conduct,"[304] and further, that divisiveness may only be relevant in cases involving "direct subsid[ies]" to religious entities.[305] Notwithstanding these statements, in Larson v. Valente, decided in 1982, the Supreme Court held that a state statute imposing "registration and reporting requirements upon only those religious organizations that solicit more than fifty per cent of their funds from nonmembers" violated Lemon's entanglement prong because of its political divisiveness.[306] The opinion first ruled that the law created a denominational preference, triggering strict scrutiny.[307] But after concluding that the law failed strict scrutiny, the Court also went on to apply Lemon's three-part test.[308] The Court said that "the 'risk of politicizing religion'" was "obvious" in a law that selectively imposed burdens on "particular denominations."[309]

Endorsement Variation on Lemon[edit | edit source]

In Lynch v. Donnelly, issued in 1984, Justice Sandra Day O'Connor suggested a "clarification" of Lemon.[310] She argued that the Court should ask whether a city's Christmas display had "endorsed Christianity," saying that the first and second prongs of the Lemon test relate to endorsement.[311] Justice O'Connor stated: "The purpose prong of the Lemon test asks whether government's actual purpose is to endorse or disapprove of religion. The effect prong asks whether, irrespective of government's actual purpose, the practice under review in fact conveys a message of endorsement or disapproval."[312] In a later concurrence, Justice O'Connor stated that endorsement should be judged by whether a "reasonable observer" would think the government is endorsing religion.[313]

The Supreme Court as a whole employed this endorsement variation on Lemon in a number of cases.[314] For example, in cases involving non-financial aid to religious schools, the Court sometimes asked whether children or the larger community would perceive the challenged government support as an endorsement of religion.[315] Further, like Lynch v. Donnelly itself, some of the Court's Establishment Clause cases focusing on endorsement have involved government-sponsored displays or monuments involving religious symbols.[316] In Lynch, the Court upheld the display of a crèche as part of a set of holiday symbols, but in County of Allegheny v. ACLU, the Court held that a county violated the Establishment Clause by displaying a crèche by itself in a prominent position in a county building.[317] The Court held that the latter display "endorse[d] Christian doctrine."[318] Although there was a sign stating that the crèche was owned by a private religious organization, the Court said that under the circumstances, the sign showed only "that the government is endorsing the religious message of that organization."[319] Addressing a different kind of symbol in Capitol Square Review & Advisory Board v. Pinette, the Supreme Court ruled that a public body had not impermissibly endorsed religion when it allowed the Ku Klux Klan to set up a cross in a plaza that had been used as a public forum for a variety of speakers "for many, many years."[320] Given the context, the Court concluded that the cross would be seen as "private speech endorsing religion," and not attributed to the government.[321]

Non-Financial Assistance to Religion and Non-Lemon Tests[edit | edit source]

Abandonment of the Lemon Test[edit | edit source]

The Supreme Court did not generally apply Lemon rigidly, and two years after the decision, the Court described its three factors--purpose, effect, and entanglement--as "helpful signposts" in the Establishment Clause inquiry.[322] These three factors were also part of Establishment Clause jurisprudence before Lemon.[323] Since at least the early 1990s, however, the Supreme Court faced calls to reconsider Lemon.[324] While some opinions in the beginning of the 2000s continued to use the Lemon factors or variations on that test as their primary mode of analysis,[325] the Court ultimately said Lemon was "abandoned" in a 2022 opinion.[326]

The Court's 2019 decision in American Legion v. American Humanist Association had already limited Lemon's applicability, suggesting that in the future, it would not apply Lemon to evaluate "longstanding monuments, symbols, and practices."[327] Instead, a plurality of the Court said such practices should instead be considered constitutional so long as they "follow in" a historical "tradition" of religious accommodation.[328] In 2022's Kennedy v. Bremerton School District, the Court said it had "long ago abandoned Lemon and its endorsement test offshoot," citing portions of American Legion that discussed a number of earlier cases in which the Court did not apply Lemon.[329] Instead, moving forward, the Court said the Establishment Clause "must be interpreted by 'reference to historical practices and understandings.'"[330] The analysis in Kennedy itself referred to the Court's prior cases on coercion, suggesting that will also provide an appropriate mode of analysis in the future.[331]

Coercion and Establishment Clause Doctrine[edit | edit source]

Particularly in the context of government-sponsored prayer practices, the Supreme Court has sometimes evaluated Establishment Clause challenges by looking for impermissible government coercion.[332] Although the Court has said the Establishment Clause is concerned with many aspects of the relationship between government and religion,[333] "at a minimum, the Constitution guarantees that government may not coerce anyone to support or participate in religion or its exercise."[334]

The Supreme Court has accordingly held that the government violates the Establishment Clause where there is coercion, including "indirect coercive pressure."[335] In Engel v. Vitale, the Court clarified that a law requiring a specific prayer to be recited in schools was unconstitutional even though participation was voluntary, in the sense that students could opt out.[336] Similarly, in Lee v. Weisman, the Court held that a high school violated the Establishment Clause with its involvement in prayers at high school graduations.[337] The school had "decided that an invocation and a benediction should be given," chosen "the religious participant" to give that invocation, and offered guidelines directing the content of the prayers.[338] The Court's opinion stressed the "heightened concerns with . . . subtle coercive pressure in the elementary and secondary public schools."[339] Under the circumstances, the Court said that "the dissenter of high school age" would have "a reasonable perception that she is being forced by the State to pray in a manner her conscience will not allow."[340] In Santa Fe Independent School District v. Doe, the Court again held that a school policy permitting student-led prayer at football games created impermissible coercion.[341] Although many students could freely choose whether to attend games, the delivery of a pregame prayer "over the school's public address system, by a speaker representing the student body, under the supervision of school faculty, and pursuant to a school policy that explicitly and implicitly encourages public prayer" nonetheless had "the improper effect of coercing those present to participate in an act of religious worship."[342]

The Supreme Court has reached different conclusions with respect to policies involving adults. For example, in Lee, the Supreme Court distinguished a prior case that rejected an Establishment Clause challenge to prayers at state legislative sessions, noting the "obvious differences" between a session "where adults are free to enter and leave" and a graduation ceremony, "the one school event most important for the student to attend."[343] Further, in a case where parents chose whether or not to allow their students to attend the meetings of a private religious club, the Supreme Court held that the school would not create impermissible coercion merely by allowing the meetings to occur on school premises after school hours.[344]

In Kennedy v. Bremerton School District, the Court considered whether a school would have violated the Establishment Clause by allowing a football coach to pray at the fifty yard line immediately after football games.[345] The school argued that the coach impermissibly coerced students to join his prayers, noting that the coach had previously led students in prayer before games and conducted overtly religious inspirational talks after games, and some students felt pressured to participate in the earlier prayers.[346] The Court concluded those arguments were not relevant because the school's disciplinary action against the coach focused on later instances when the coach "did not seek to direct any prayers to students."[347] In comparison to Santa Fe, the Court concluded that the coach's prayers "were not publicly broadcast or recited to a captive audience," and students were not "expected to participate."[348] People who saw or heard his prayers on the fifty-yard line could be offended, but not coerced, in the Court's view.[349] The Court further said that the school could not require teachers to "eschew any visible religious expression," because that would impermissibly "preference secular activity."[350]

More broadly, Kennedy said that in the future, courts should evaluate Establishment Clause challenges "by 'reference to historical practices and understandings.'"[351] The Supreme Court acknowledged that while coercion "was among the foremost hallmarks of religious establishments the framers sought to prohibit when they adopted the First Amendment," the Justices "have sometimes disagreed on what exactly qualifies as impermissible coercion in light of the original meaning of the Establishment Clause."[352] The Court did not expressly resolve those open disputes, ruling instead that in Kennedy, the coach's "private religious exercise did not come close to crossing any line one might imagine separating protected private expression from impermissible government coercion."[353]

Establishment Clause and Historical Practices and Tradition[edit | edit source]

As previously discussed, the Supreme Court has long evaluated Establishment Clause challenges in part by reference to historical understandings of the Clause.[354] That mode of analysis did not disappear after the Court's decision in Lemon,[355] and eventually became the Court's primary mode of analysis, as further discussed below.[356] However, while earlier cases largely relied on history to rule government actions unconstitutional, post-Lemon cases largely pointed to historical tradition to uphold government actions that the Court saw as permissible accommodations of religion.[357] For example, in an opinion rejecting an Establishment Clause challenge to a city's Christmas display, the Court noted the "unbroken history of official acknowledgment by all three branches of government of the role of religion in American life from at least 1789."[358]

In the 2019 decision American Legion v. American Humanist Association, a split majority of the Supreme Court rejected a constitutional challenge to a Latin Cross erected as a World War I memorial.[359] The plurality opinion (with some support from Justice Clarence Thomas, concurring in the judgment) stated that "longstanding monuments, symbols, and practices" should not be evaluated under Lemon 's tripartite analysis, but should instead be considered constitutional so long as they "follow in" a historical "tradition" of religious accommodation.[360] A majority of the Court acknowledged that the cross was a Christian symbol, but decided that "the symbol took on an added secular meaning when used in World War I memorials."[361] Among other factors, the Court emphasized that the monument had "stood undisturbed for nearly a century" and had "acquired historical importance" to the community.[362] Consequently, the Court concluded that "destroying or defacing the Cross . . . would not be neutral and would not further the ideals of respect and tolerance embodied in the First Amendment."[363]

The Supreme Court had previously applied an analysis looking to historical traditions in two cases involving prayer at state and local legislative sessions.[364] In 1983's Marsh v. Chambers, the Court noted that "opening . . . sessions of legislative and other deliberative public bodies with prayer is deeply embedded in the history and tradition of this country."[365] It upheld the state's prayer practice after concluding that the public employment of the legislative chaplain and the "Judeo-Christian" nature of the prayers were consistent with historical practices, given that "there [was] no indication that the prayer opportunity ha[d] been exploited to proselytize or advance any one, or to disparage any other, faith or belief."[366] The Supreme Court engaged in a similar analysis in 2014's Town of Greece v. Galloway, ruling that a municipality's challenged prayer practices "fit[ ] within the tradition long followed in Congress and the state legislatures."[367] The Court rejected an argument that the prayers should be considered unconstitutional because they were identified with a single religion, saying that some of the early prayers during congressional sessions had a "decidedly Christian nature."[368] These legislative prayer cases were presumably encompassed in the American Legion plurality's reference to "longstanding . . . practices,"[369] although future cases will have to elucidate what other government activities may be described by that phrase.