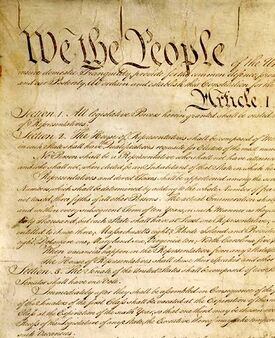

Constitution of the United States/Sixteenth Amend.

Sixteenth Amendment Income Tax

Overview[edit | edit source]

The Sixteenth Amendment, ratified in 1913, expanded on Congress's taxing power. Article I grants Congress authority to collect taxes,[1] but requires direct taxes to be imposed proportional to the population of the states.[2] The Sixteenth Amendment clarified that Congress has the power to collect an income tax without apportionment among the states, and without regard to population.[3] As discussed in the following essays, the Amendment was adopted in response to a Supreme Court decision that invalidated a federal income tax after holding it was a direct tax that was not properly apportioned.[4] Accordingly, the Sixteenth Amendment essentially creates an income tax exception to the requirement in Article I that direct taxes must be apportioned based on states' population.[5] This has raised the question--again, discussed in the following essays--of what counts as "income," and whether any given federal tax extends beyond income.[6] The Court has stated the test generally as whether the law taxes payments that qualify as "profits or gains,"[7] although this applies "regardless of whether the particular transaction results in net profit."[8] The Sixteenth Amendment applies to income derived "from whatever source," and thus can be subject to a somewhat broad interpretation.[9] Nonetheless, the apportionment exception in the Sixteenth Amendment does not extend to taxes on property, as opposed to income derived from property.[10]

| Clause Text |

|---|

| The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration. |

Historical Background on Sixteenth Amendment[edit | edit source]

The Sixteenth Amendment was adopted to address the Court's 1895 decision in Pollock v. Farmers' Loan & Trust Co.[11] holding unconstitutional Congress's attempt of the previous year to tax incomes uniformly throughout the United States.[12] A tax on incomes derived from property,[13] the Court declared, was a "direct tax," which Congress, under the terms of Article I, Sections 2[14] and 9,[15] could impose only by the rule of apportionment according to population. Scarcely fifteen years earlier, in Springer v. United States,[16] the Justices had unanimously sustained a similar tax during the Civil War,[17] the only other occasion preceding the Sixteenth Amendment in which Congress had used this method of raising revenue.[18]

During the years between the Pollock decision in 1895 and the ratification of the Sixteenth Amendment in 1913, the Court appeared sensitive to Pollock's ramifications for the Government, which it partially addressed by redefining "direct tax" and emphasizing the Court's past favorable treatment of excise taxation. Thus, in a series of cases, notably Nicol v. Ames,[19] Knowlton v. Moore,[20] and Patton v. Brady,[21] the Court held the following taxes to have been levied upon "incidents of ownership" and hence to be excises: a tax that involved affixing revenue stamps to memoranda evidencing the sale of merchandise on commodity exchanges; an inheritance tax; and a war revenue tax upon tobacco, on which the hitherto imposed excise tax had already been paid and that the manufacturer held for resale. The Court also sustained a corporate income tax as an excise "measured by income" on the privilege of doing business in corporate form.[22]

The adoption of the Sixteenth Amendment, however, put an end to speculation whether the Court would eventually reverse Pollock. Indeed, in its initial appraisal[23] of the Amendment, the Court classified income taxes as being inherently "indirect," stating:

[T]he command of the Amendment that all income taxes shall not be subject to apportionment by a consideration of the sources from which the taxed income may be derived, forbids the application to such taxes of the rule applied in the Pollock Case by which alone such taxes were removed from the great class of excises, duties and imports subject to the rule of uniformity and were placed under the other or direct class.Brushaber, 240 U.S. at 18-19.

The Court further observed: "[T]he Sixteenth Amendment conferred no new power of taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged . . . ."[24]

Income and Corporate Dividends[edit | edit source]

Building upon definitions formulated in cases construing the Corporation Tax Act of 1909,[25] the Court initially described income as "gain derived from capital, from labor, or from both combined," inclusive of the "profit gained through a sale or conversion of capital assets."[26] Consistent with the belief that all income "in the ordinary sense of the word" became taxable under the Sixteenth Amendment, the earliest decisions of the Court on the taxability of corporate dividends occasioned little comment.

Emphasizing that a stockholder should be viewed as "a different entity from the corporation," the Court in Lynch v. Hornby,[27] held that a cash dividend equal to 24% of the par value of the outstanding stock and made possible largely by converting assets earned prior to the adoption of the Amendment into money, was taxable income to the stockholder for the year in which he received it, although such an extraordinary payment might appear "to be a mere realization in possession of an inchoate and contingent interest . . . [of] the stockholder . . . in a surplus of corporate assets previously existing." [28] In Peabody v. Eisner,[29] decided the same day as Lynch, the Court ruled that a dividend paid in the stock of another corporation, although representing earnings that had accrued before ratification of the Amendment, was also taxable to the shareholder as income. The Court likened the dividend to a distribution in specie.[30]

Two years later, the Court decided Eisner v. Macomber.[31] Departing from its earlier interpretations of the Sixteenth Amendment--that the Amendment corrected Pollock to restore income taxation to "the category of indirect taxation to which it inherently belonged"[32]--Justice Mahlon Pitney, writing for the Court, stated that the Sixteenth Amendment "did not extend the taxing power to new subjects, but merely removed the necessity which otherwise might exist for an apportionment among the States of taxes laid on income."[33] Specifically, Eisner held that a stock dividend was capital when a stockholder of the issuing corporation received it and the dividend did not become taxable "income" until sold or converted, and then only to the extent that the stockholder realized a gain upon the proportion of the original investment that the stock represented. A stock dividend, Justice Mahlon Pitney maintained:

Far from being a realization of profits of the stockholder . . . tends rather to postpone such realization, in that the fund represented by the new stock has been transferred from surplus to capital, and no longer is available for actual distribution. . . . We are clear that not only does a stock dividend really take nothing from the property of the corporation and add nothing to that of the shareholder, but that the antecedent accumulation of profits evidenced thereby, while indicating that the shareholder is richer because of an increase of his capital, at the same time shows [that] he has not realized or received any income in the transaction.Id. at 211, 212.

Conceding that a stock dividend represented a gain, Justice Mahlon Pitney concluded that the only gain taxable as "income" under the Amendment was "a gain, a profit, something of exchangeable value proceeding from the property, severed from the capital however invested or employed, and coming in, being 'derived,' that is, received or drawn by the recipient (the taxpayer) for his separate use, benefit and disposal;--that is income derived from property. Nothing else answers the description," including "a gain accruing to capital, not a growth or increment of value in the investment."[34]

Although the Court has not overturned the principle it asserted in Eisner v. Macomber,[35] it has narrowed its application. In United States v. Phellis, the Court treated as taxable income new stock issued in connection with a corporate reorganization designed to move the place of incorporation.[36] The Court rejected a test that compared the market value of the shares in the older corporation with the aggregate market value of those shares plus the dividend shares immediately after the reorganization, which showed that the stockholders experienced no increase in aggregate wealth.[37] Instead, the Court viewed the shareholders as having essentially exchanged stock in the old corporation for stock in the new corporation. The Phellis Court stated:

It thus appears that in substance and fact, as well as in appearance, the dividend received by claimant was a gain, a profit, derived from his capital interest in the old company, not in liquidation of the capital but in distribution of accumulated profits of the company; something of exchangeable value produced by and proceeding from his investment therein, severed from it and drawn by him for his separate use. Hence it constituted individual income within the meaning of the income tax law . . . .Phellis, 257 U.S. at 175.

By contrast, in Miles v. Safe Deposit Company, the Court held that no taxable income resulted when a stockholder received rights to subscribe for shares in a new issue of capital stock, the intrinsic value of which was assumed to exceed the issuing price.[38] The Court declared the right to subscribe to be analogous to a stock dividend, stating "the District Court rightly held defendant in error liable to income tax as to so much of the proceeds of sale of the subscription rights as represented a realized profit over and above the cost to it of what was sold."[39]

Corporate Earnings[edit | edit source]

In Helvering v. National Grocery Company, the Court rejected the contention that a tax on undistributed corporate profits is essentially a penalty or a direct tax on capital subject to apportionment.[40] Because the exaction was permissible as a tax, its penal objective, which was "to force corporations to distribute earnings in order to create a basis for taxation against the stockholders," did not impair its validity.[41] The Court rejected the contention that the tax was a direct tax on a state of mind because liability was assessed upon a mere purpose to evade imposition of surtaxes against stockholders. The Court held that, while "the existence of the defined purpose was a condition precedent to the imposition of the tax liability," that "[did] not prevent it from being a true income tax within the meaning of the Sixteenth Amendment."[42] Subsequently, in Helvering v. Northwest Steel Mills,[43] the Court addressed the constitutionality of the undistributed profits tax, observing:

It is true that the surtax is imposed upon annual income only if it is not distributed, but this does not serve to make it anything other than a true tax on income within the meaning of the Sixteenth Amendment. Nor is it true . . . that because there might be an impairment of the capital stock, the tax on the current annual profit would be the equivalent of a tax upon capital. Whether there was an impairment of the capital stock or not, the tax . . . was imposed on profits earned during a definite period--a tax year--and therefore on profits constituting income within the meaning of the Sixteenth Amendment.311 U.S. at 53.

Similarly, the Court has held Congress's power to tax the income of an unincorporated joint stock association to be unaffected by the fact that, under state law, the association is not a legal entity and cannot hold title to property, or by the fact that the shareholders are liable for its debts as partners.[44]

Whether subsidies paid to corporations in money or in the form of grants of land or other physical property constitute taxable income has also concerned the Court. In Edwards v. Cuba Railroad,[45] the Court ruled that subsidies of lands, equipment, and money paid by Cuba to construct a railroad were not taxable income but should be viewed as having been received by the railroad as a reimbursement for capital expenditures in completing such project.

On the other hand, sums the Federal Government paid to fulfill its guarantee of minimum operating revenue to railroads during the six months following relinquishment of their control by that government were found to be taxable income. Such payments were distinguished from those excluded from computation of income in the preceding case in that the former were neither bonuses, nor gifts, nor subsidies, "that is, contributions to capital."[46] Other corporate receipts deemed to be taxable as income include: (1) "insiders profits" realized by a director and stockholder of a corporation from transaction in its stock, which, as required by the Securities and Exchange Act,[47] are paid over to the corporation;[48] (2) money received as exemplary damages for fraud or as the punitive two-thirds portion of a treble damage antitrust recovery;[49] and (3) compensation awarded for the fair rental value of trucking facilities operated by the taxpayer under control and possession of the government during World War II, for in the last instance the government never acquired title to the property and had not damaged it beyond ordinary wear.[50]

Gains[edit | edit source]

The Supreme Court has stated that although "economic gain is not always taxable as income, it is settled that the realization of gain need not be in cash derived from the sale of an asset."[51] Thus, when through forfeiture of a lease, a landlord became possessed of a new building erected on his land by the outgoing tenant, the resulting gain to the former was taxable to him in that same year. The Court noted:

The fact that the gain is a portion of the value of the property received by the taxpayer in the transaction does not negative its realization. . . . It is not necessary to recognition of taxable gain that he should be able to sever the improvement begetting the gain from his original capital. If that were necessary, no income could arise from the exchange of property; whereas such gain has always been recognized as realized taxable gain.Id.

Hence, the taxpayer was incorrect in contending "that the Amendment does not permit the taxation of such [a] gain without apportionment amongst the states."[52] Consistent with this holding, the Court has also ruled that, when an apartment house was acquired by bequest subject to an unassumed mortgage, and several years later was sold for a price slightly in excess of the mortgage, the basis for determining the gain from that sale was the difference between the selling price, undiminished by the amount of the mortgage, and the value of the property at the time of the acquisition, less deductions for depreciation during the years the building was held by the taxpayer. The latter's contention that the Revenue Act, as thus applied, taxed something that was not revenue, was declared to be unfounded.[53]

The Court also rejected the argument that a gift of stock became a capital asset of the donee and that, consequently, no part of the stock's value could be treated as taxable income of the donee when sold. The Court held that it was within the power of Congress to require a donee of stock, who sells it at a profit, to pay income tax on the difference between the selling price and the value when the donor acquired it.[54] In Helvering v. Horst, the Court explained:

[N]ot all economic gain of the taxpayer is taxable income. From the beginning the revenue laws have been interpreted as defining 'realization' of income as the taxable event, rather than the acquisition of the right to receive it. And 'realization' is not deemed to occur until the income is paid. But the decisions and regulations have consistently recognized that receipt in cash or property is not the only characteristic of realization of income to a taxpayer on the cash receipts basis. Where the taxpayer does not receive payment of income in money or property realization may occur when the last step is taken by which he obtains the fruition of the economic gain which has already accrued to him.Helvering v. Horst, 311 U.S. 112, 115 (1940). See also Old Colony Trust Co. v. Commissioner, 279 U.S. 716 (1929); Corliss v. Bowers, 281 U.S. 376, 378 (1930); Burnet v. Wells, 289 U.S. 670 (1933).

Consequently, an owner of bonds, reporting on the cash receipts basis, who clipped interest coupons therefrom before their due date and gave them to his son, was held to have realized taxable income in the amount of said coupons, notwithstanding that his son had collected them upon maturity later in the year.[55]

Income from Illicit Transactions[edit | edit source]

In United States v. Sullivan,[56] the Court held that gains derived from illicit traffic were taxable income under the Act of 1921.[57] Justice Oliver Holmes wrote, for the unanimous Court: "We see no reason . . . why the fact that a business is unlawful should exempt it from paying the taxes that if lawful it would have to pay."[58] Consistent with that decision, although not without dissent, the Court ruled that Congress has the power to tax as income moneys received by an extortioner,[59] and, more recently, that embezzled money is taxable income of an embezzler in the year of embezzlement. In James v. United States, the Court reasoned

When a taxpayer acquires earnings, lawfully or unlawfully, without the consensual recognition, express or implied, of an obligation to repay and without restriction as to their disposition, 'he has received income which he is required to return, even though it may still be claimed that he is not entitled to retain the money, and even though he may still be adjudged liable to restore its equivalent.'James v. United States, 366 U.S. 213, 219 (1961) (overruling Commissioner v. Wilcox, 327 U.S. 404 (1946)).

Deductions and Exemptions[edit | edit source]

The Sixteenth Amendment authorization to tax income "from whatever source derived" does not preclude Congress from granting exemptions.[60] Thus, the fact that, "[u]nder the Revenue Acts of 1913, 1916, 1917 and 1918, stock fire insurance companies were taxed upon their income, including gains realized from the sale or other disposition of property accruing subsequent to March 1, 1913,"[61] but were not so taxed by the Revenue Acts of 1921, 1924, and 1926, did not prevent Congress, under the terms of the Revenue Act of 1928, from taxing all the gain attributable to increase in value after March 1, 1913, that such a company realized from a sale of property in 1928.[62] The constitutional power of Congress to tax a gain being well-established, the Court found Congress competent to choose "the moment of its realization and the amount realized"; and "[i]ts failure to impose a tax upon the increase in value in the earlier years . . . cannot preclude it from taxing the gain in the year when realized."[63] As the Court has observed, Congress is equally well-equipped with the "power to condition, limit, or deny deductions from gross incomes in order to arrive at the net that it chooses to tax."[64] Accordingly, even though the rental value of a building used by its owner does not constitute income within the meaning of the Amendment,[65] Congress was competent to provide that an insurance company shall not be entitled to deductions for depreciation, maintenance, and property taxes on real estate owned and occupied by it unless it includes in its computation of gross income the rental value of the space thus used.[66]

Also, a taxpayer who erected a $3,000,000 office building on land, the unimproved value of which was $660,000, and who subsequently purchased the lease on the latter for $2,100,000, is entitled to compute depreciation over the remaining useful life of the building on that portion of $1,440,000, representing the difference between the price and the unimproved value, as may be allocated to the building; but he cannot deduct the $1,440,000 as a business expense incurred in eliminating the cost of allegedly excessive rentals under the lease, nor can he treat that sum as a prepayment of rent to be amortized over the twenty-one-year period that the lease was to run.[67]

Diminution of Loss[edit | edit source]

Mere diminution of loss is neither gain, profit, nor income. Accordingly, in Bowers v. Kerbaugh-Empire, the Court held that one who in 1913 borrowed a sum of money to be repaid in German marks and who subsequently lost the money in a business transaction cannot be taxed on the curtailment of debt effected by using depreciated marks in 1921 to settle a liability of $798,144 for $113,688, the "saving" having been exceeded by a loss on the entire operation.[68] The Court stated:

The contention that the item in question is cash gain disregards the fact that the borrowed money was lost, and that the excess of such loss over income was more than the amount borrowed. When the loans were made and notes given, the assets and liabilities of defendant in error were increased alike. The loss of the money borrowed wiped out the increase of assets, but the liability remained. The assets were further diminished by payment of the debt. The loss was less than it would have been if marks had not declined in value; but the mere diminution of loss is not gain, profit or income.Id. at 175.

- ↑ Art. I, Section 8 Enumerated Powers; see also Art. I, Sec. 8, Cl. 1: Overview of Taxing Clause.

- ↑ Art. I, Sec. 2, Clause 3 Seats; id. art. I, § 9, cl. 4.

- ↑ Sixteenth Amendment Income Tax.

- ↑ Sixteenth Amend.: Historical Background on Sixteenth Amendment; see also Art. I, Sec. 9, Cl. 4: Direct Taxes and the Sixteenth Amendment.

- ↑ See, e.g., Eisner v. Macomber, 252 U.S. 189, 206 (1920) (saying the Sixteenth Amendment "did not extend the taxing power to new subjects, but merely removed the necessity which otherwise might exist for an apportionment among the States of taxes laid on income").

- ↑ See, e.g., id. (noting that the Amendment should not be extended beyond "income," in order to fully effectuate the Article I limitation).

- ↑ See, e.g., Edwards v. Cuba R. Co., 268 U.S. 628, 633 (1925). See also Bowers v. Kerbaugh-Empire Co., 271 U.S. 170, 174 (1926) ("[I]ncome may be defined as gain derived from capital, from labor, or from both combined, including profit gained through sale or conversion of capital.").

- ↑ Burnet v. Sanford & Brooks Co., 282 U.S. 359, 364 (1931).

- ↑ Sixteenth Amendment Income Tax. The definition of income in early federal tax laws has been interpreted as essentially being tied to the constitutional definition, as the Court said the text indicated "the purpose of Congress to use the full measure of its taxing power." Helvering v. Clifford, 309 U.S. 331, 334 (1940).

- ↑ See Eisner, 252 U.S. at 207-08.

- ↑ 157 U.S. 429 (1895) ( Pollock I); 158 U.S. 601 (1895) (Pollock II) [hereinafter collectively referred to as Pollock]. Pollock came to the Court twice. In Pollock I, the Court invalidated the tax at issue insofar as it was a tax upon income derived from real property, but the Court was equally divided on whether income derived from personal property was a direct tax. Pollock I, 157 U.S. at 583. In Pollock II, on petitions for rehearing, the Court held that a tax on income derived from personal property was also a direct tax. Pollock II, 158 U.S. at 637.

- ↑ Act of Aug. 27, 18949, § 27, 28 Stat. 509, 553.

- ↑ In Pollock II, the Court conceded that taxes on incomes from "professions, trades, employments, or vocations" levied by this act were excise taxes and therefore valid. The Court voided the entire statute, however, on the ground that Congress never intended to permit the entire "burden of the tax to be borne by professions, trades, employments, or vocations" after exempting real estate and personal property. Pollock II, 158 U.S. at 635.

- ↑ U.S. Const. art I, § 2, cl. 3 ("Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers . . . .").

- ↑ U.S. Const. art I, § 9, cl. 4 ("No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken.").

- ↑ 102 U.S. 586 (1881).

- ↑ Act of June 30, 1864, ch. 173, § 116, 13 Stat. 223, 281.

- ↑ For an account of the Pollock decision, see "From the Hylton to the Pollock Case," under Art. I, § 9, cl. 4, supra note here.

- ↑ 173 U.S. 509 (1899).

- ↑ 178 U.S. 41 (1900).

- ↑ 184 U.S. 608 (1902).

- ↑ Flint v. Stone Tracy Co., 220 U.S. 107 (1911).

- ↑ Brushaber v. Union Pac. R.R., 240 U.S. 1 (1916); Stanton v. Baltic Mining Co., 240 U.S. 103 (1916); Tyee Realty Co. v. Anderson, 240 U.S. 115 (1916).

- ↑ Stanton, 240 U.S. at 112.

- ↑ Stratton's Independence, Ltd. v. Howbert, 231 U.S. 399 (1913); Doyle v. Mitchell Bros. Co., 247 U.S. 179 (1918).

- ↑ Eisner v. Macomber, 252 U.S. 189, 207 (1920); Bowers v. Kerbaugh-Empire Co., 271 U.S. 170 (1926).

- ↑ 247 U.S. 339 (1918).

- ↑ Id. at 344. In Lynch v. Turrish, 247 U.S. 221 (1918), the Court declared a single and final dividend distributed upon liquidation of a corporation's entire assets, although equaling twice the par value of the capital stock, to represent only the corporation's intrinsic value earned prior to the effective date of the Sixteenth Amendment. Consequently, the Court held the distribution was not taxable income to the shareholder in the year in which the shareholder actually received it. Similarly, Southern Pacific Co. v. Lowe, 247 U.S. 330 (1918), concerned a railway company whose entire capital stock was owned by and whose physical assets were leased to and used by another railway company. The Court held the dividends that the first railway company paid out of surplus accumulated before the Sixteenth Amendment's effective date to be a nontaxable bookkeeping transaction between virtually identical corporations.

- ↑ 247 U.S. 347 (1918).

- ↑ Id.

- ↑ 252 U.S. 189 (1920).

- ↑ Stanton v. Baltic Mining Co., 240 U.S. 103, 112 (1916).

- ↑ 252 U.S. at 206.

- ↑ Id. at 207. See also Merchants' L. & T. Co. v. Smietanka, 255 U.S. 509 (1921).

- ↑ The Court refused to reconsider Eisner in Helvering v. Griffiths, 318 U.S. 371 (1943).

- ↑ United States v. Phellis, 257 U.S. 156 (1921)

- ↑ Id.; See also Rockefeller v. United States, 257 U.S. 176 (1921); Cullinan v. Walker, 262 U.S. 134 (1923). In Marr v. United States, 268 U.S. 536 (1925), the Court held that the increased market value of stock issued by a new corporation in exchange for the stock of an older corporation--the assets of which the new corporation would absorb--was taxable income to the holder, even though the income represented the older corporation's profits and the capital remained invested in the same general enterprise. The Court likened Weiss v. Stearn, 265 U.S. 242 (1924), to Eisner v. Macomber, and distinguished it from the aforementioned cases on the ground of preservation of corporate identity. The Court observed that: "[Although the] new corporation had . . . been organized to take over the assets and business of the old . . . [,] the corporate identity was deemed to have been substantially maintained because the new corporation was organized under the laws of the same State with presumably the same powers as the old. There was also no change in the character of the securities issued. By reason of these facts, the proportional interest of the stockholder after the distribution of the new securities was deemed to be exactly the same . . . ." Marr, 268 U.S. at 541. Similarly, consistent with Eisner v. Macomber, the Court ruled that a dividend in common stock paid to holders of preferred stock, and a dividend in preferred stock paid to holders of common stock, constitute taxable income under the Sixteenth Amendment because they gave the stockholders an interest different from that represented by their prior holdings.

- ↑ Miles v. Safe Deposit Co., 259 U.S. 247 (1922). The Court stated: "The stockholder's right to take his part of the new shares therefore--assuming their intrinsic value to have exceeded the issuing price--was essentially analogous to a stock dividend. . . . [T]he subscription right of itself constituted no gain, profit, or income taxable without apportionment under the Sixteenth Amendment." Id. at 252.

- ↑ Id. at 253.

- ↑ Helvering v. National Grocery Co., 304 U.S. 282 (1938).

- ↑ Id. at 288.

- ↑ Id. at 288-89. In Helvering v. Mitchell, 303 U.S. 391 (1938), the defendant contended that the collection of 50% of any deficiency in addition to the deficiency alleged to have resulted from a fraudulent intent to evade the income tax amounted to the imposition of a criminal penalty. The Court, however, described the additional sum as a civil and not a criminal sanction, and one which could be constitutionally employed to safeguard the Government against loss of revenue. In contrast, the exaction upheld in Helvering v. National Grocery Co., though conceded to possess the attributes of a civil sanction, was held to be sustainable as a tax.

- ↑ 311 U.S. 46 (1940). See also Crane-Johnson Co. v. Helvering, 311 U.S. 54 (1940).

- ↑ Burk-Waggoner Ass'n v. Hopkins, 269 U.S. 110 (1925).

- ↑ 268 U.S. 628 (1925).

- ↑ Texas & Pacific Ry. v. United States, 286 U.S. 285, 289 (1932); Continental Tie & L. Co. v. United States, 286 U.S. 290 (1932).

- ↑ 15 U.S.C. § 78p.

- ↑ General American Investors Co. v. Commissioner, 348 U.S. 434 (1955).

- ↑ Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955).

- ↑ Commissioner v. Gillette Motor Co., 364 U.S. 130 (1960).

- ↑ Helvering v. Bruun, 309 U.S. 461, 469 (1940).

- ↑ Id. at 468.

- ↑ Crane v. Commissioner, 331 U.S. 1, 15-16 (1947). See also Diedrich v. Comm'r, 457 U.S. 191 (1982).

- ↑ In Taft v. Bowers, the Court observed that the donor could not, "by mere gift, enable another to hold this stock free from . . . [the] right . . . [of] the sovereign to take part of any increase in its value when separated through sale or conversion and reduced to possession." 278 U.S. 470, 482, 484 (1929). However, when a husband, as part of a divorce settlement, transfers his own corporate stock to his wife, he is deemed to have exchanged the stock for the release of his wife's inchoate, marital rights, the value of which are presumed to be equal to the current, market value of the stock, and, accordingly, he incurs a taxable gain measured by the difference between the initial purchase price of the stock and said market value upon transfer. United States v. Davis, 370 U.S. 65 (1962).

- ↑ Helvering, 311 U.S. at 115. The Court was also called upon to resolve questions as to whether gains, realized after 1913, on transactions consummated prior to ratification of the Sixteenth Amendment, were taxable and, if so, how such tax was to be determined. The Court's answer generally was that if the gain to the person whose income is under consideration became such subsequent to the date at which the amendment went into effect, namely, March 1, 1913, and was a real--not merely an apparent--gain, said gain is taxable. Thus, one who purchased stock in 1912 for $500 could not limit his taxable gain to the difference between the value of the stock on March 1, 1913--$695--and the price obtained on the sale thereof, in 1916--$13,931. Instead, the seller was obliged to pay tax on the entire gain, that is, the difference between the original purchase price of $500 and the $13,931 in proceeds of the sale. Goodrich v. Edwards, 255 U.S. 527 (1921). Conversely, one who acquired stock in 1912 for $291,600 and who sold the same in 1916 for only $269,346, incurred a loss and could not be taxed at all, notwithstanding the fact that on March 1, 1913, his stock had depreciated to $148,635. Walsh v. Brewster, 255 U.S. 536 (1921). On the other hand, although the difference between the amount of life insurance premiums paid as of 1908, and the amount distributed in 1919, when the insured received the amount of his policy plus cash dividends apportioned thereto since 1908, constituted a gain, that portion of the latter that accrued between 1908 and 1913 was deemed to be an accretion of capital and hence not taxable. Lucas v. Alexander, 279 U.S. 473 (1929). However, a litigant who, in 1915, reduced to judgment a suit pending on February 26, 1913, for an accounting under a patent infringement, was unable to have treated as capital, and excluded from the taxable income produced by such settlement, that portion of his claim that had accrued prior to March 1, 1913. Income within the meaning of the Amendment was interpreted to be the fruit that is born of capital, not the potency of fruition. All that the taxpayer possessed in 1913 was a contingent chose in action that was inchoate, uncertain, and contested. United States v. Safety Car Heating Co., 297 U.S. 88 (1936).Similarly, purchasers of coal lands subject to mining leases executed before adoption of the Amendment could not successfully contend that royalties received from 1920 to 1926 were payments for capital assets sold before March 1, 1913, and hence not taxable. Such an exemption, these purchasers argued, would have been in harmony with applicable local law, under which title to coal passes immediately to the lessee on execution of such leases. To the Court, however, such leases were not to be viewed "as a 'sale' of the mineral content of the soil," as minerals "may or may not be present in the leased premises, and may or may not be found [therein]. . . . If found, their abstraction . . . is a time-consuming operation and the payments made by the lessee to the lessor do not normally become payable as the result of a single transaction. . . . " The result for tax purposes would have been the same even had the lease provided that title to the minerals would pass only "on severance by the lessee." Burnet v. Harmel, 287 U.S. 103, 107, 106, 111 (1932).

- ↑ 274 U.S. 259 (1927).

- ↑ 42 Stat. 227, 250, 268.

- ↑ 274 U.S. at 263. Profits from illegal undertakings being taxable as income, expenses in the form of salaries and rentals incurred by bookmakers are deductible. Commissioner v. Sullivan, 356 U.S. 27 (1958).

- ↑ Rutkin v. United States, 343 U.S. 130 (1952). Four Justices--Hugo Black, Stanley Reed, Felix Frankfurter, and William Douglas--dissented.

- ↑ Brushaber v. Union Pac. R.R., 240 U.S. 1 (1916).

- ↑ MacLaughlin v. Alliance Ins. Co., 286 U.S. 244, 247 (1932).

- ↑ Id.

- ↑ Id. at 250.

- ↑ Helvering v. Independent Life Ins. Co., 292 U.S. 371, 381 (1934); Helvering v. Winmill, 305 U.S. 79, 84 (1938).

- ↑ A tax on the rental value of property so occupied is a direct tax on the land and must be apportioned. Helvering v. Independent L. Ins. Co., 292 U.S. 371, 378-79 (1934).

- ↑ Helvering, 292 U.S. at 381. Expenditures incurred in the prosecution of work under a contract for the purpose of earning profits are not capital investments, the cost of which, if converted, must first be restored from the proceeds before there is a capital gain taxable as income. Accordingly, a dredging contractor, recovering a judgment for breach of warranty of the character of the material to be dredged, must include the amount thereof in the gross income of the year in which it was received, rather than of the years during which the contract was performed, even though it merely represents a return of expenditures made in performing the contract and resulting in a loss. The gain or profit subject to tax under the Sixteenth Amendment is the excess of receipts over allowable deductions during the accounting period, without regard to whether or not such excess represents a profit ascertained on the basis of particular transactions of the taxpayer when they are brought to a conclusion. Burnet v. Sanford & Brooks Co., 282 U.S. 359 (1931).The grant on denial of deductions is not based on the taxpayers' engagement in constitutionally protected activities; accordingly, no deduction is granted for sums expended in combating legislation, enactment of which would destroy taxpayer's business. Cammarano v. United States, 358 U.S. 498 (1959).Likewise, when tank truck owners, either intentionally for business reasons or unintentionally, violate state maximum weight laws, and incur fines, the latter are not deductible, for fines are penalties rather than tolls for the use of highways, and Congress is not to be viewed as having intended to encourage enterprises to violate state policy. Tank Truck Rentals v. Commissioner, 356 U.S. 30 (1958); Hoover Express Co. v. United States, 356 U.S. 38 (1958).

- ↑ Millinery Corp. v. Commissioner, 350 U.S. 456 (1956).

- ↑ 271 U.S. 170 (1926).