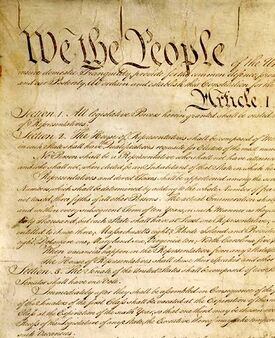

Constitution of the United States/Art. I/Sec. 9/Clause 4 Direct Taxes

Article I Legislative Branch

Section 9 Powers Denied Congress

Clause 4 Direct Taxes

| Clause Text |

|---|

| No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken. |

Overview of Direct Taxes[edit | edit source]

Under Article I, Section 9, Clause 4 and Article I, Section 2, Clause 3[1] of the Constitution, direct taxes are subject to the rule of apportionment.[2] Though the Supreme Court has not clearly distinguished direct taxes from indirect taxes,[3] the Court has identified capitation taxes--a tax "paid by every person, 'without regard to property, profession, or any other circumstance'"[4]--and taxes on real and personal property as direct taxes.[5] Under the rule of apportionment, Congress sets the total amount to be raised by a direct tax, then divides that amount among the states according to each state's population.[6] Thus, a state with one-twentieth of the Nation's population would be responsible for one-twentieth of the total amount of direct tax, without regard to that state's income or wealth levels.[7]

An 1861 federal tax on real property illustrates how the rule of apportionment operates.[8] Congress enacted a direct tax of $20 million.[9] After apportioning the direct tax among the states, territories, and the District of Columbia, the State of New York was liable for the largest portion of the tax, $2,603,918.67,[10] and the Territory of Dakota was liable for the least, $3,241.33.[11] The act called for the President to assign collection districts to states, territories, and the District of Columbia to apportion "to each county and State district its proper quota of direct tax"[12] and determine the amounts taxpayers in each collection district would be required to pay.[13]

The lack of clarity surrounding the meaning of a direct tax[14] and the Federal Government's desire for additional revenues ultimately contributed to the adoption in 1913 of the Sixteenth Amendment, which authorizes Congress to impose taxes on income without regard to the rule of apportionment.[15]

Historical Background on Direct Taxes[edit | edit source]

The Framers' principal motivation for granting Congress the power to tax in the Constitution was to provide the National Government with a mechanism to raise a "regular and adequate supply"[16] of revenue and pay its debts.[17] Under the predecessor Articles of Confederation, the National Government had no power to tax and could not compel states to raise revenue for national expenditures.[18] The National Government could requisition funds from states to place in the common treasury, but, under the Articles of Confederation, state requisitions were "mandatory in theory" only.[19] State governments resisted these calls for funds.[20] As a result, the National Government raised "very little" revenue through state requisitions,[21] inhibiting its ability to resolve immediate fiscal problems, such as repaying its Revolutionary War debts.[22]

By contrast, the Constitution provides Congress with broad authority to lay and collect taxes. Article I, Section 8, Clause 1 of the Constitution--commonly known as the Taxing and Spending Clause[23]--empowers Congress "To lay and collect Taxes, Duties, Impost and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States."[24] The U.S. Supreme Court has described Congress's power to tax as "very extensive."[25] Supreme Court Chief Justice Salmon P. Chase famously described the taxing power in the License Tax Cases:

It is given in the Constitution, with only one exception and only two qualifications. Congress cannot tax exports, and it must impose direct taxes by the rule of apportionment, and indirect taxes by the rule of uniformity. Thus limited, and thus only, it reaches every subject, and may be exercised at discretion.License Tax Cases, 72 U.S. at 471.

By proscribing direct taxes "unless in Proportion to the Census or enumeration herein" under Article I, Section 9, Clause 4, the Framers apportioned direct taxes consistent with how they apportioned representation in the House.[26] As James Madison noted in the Federalist Papers, linking tax liability to representation ensured that any advantage a state may have in enhancing its reported population size to increase its representation would be offset by its increased tax liability. Madison stated:

As the accuracy of the census to be obtained by the Congress will necessarily depend, in a considerable degree on the disposition, if not the co-operation of the States, it is of great importance that the States should feel as little bias as possible, to swell or to reduce the amount of their numbers. Were their share of representation alone to be governed by this rule, they would have an interest in exaggerating their inhabitants. Were the rule to decide their share of taxation alone, a contrary temptation would prevail. By extending the rule to both objects, the States will have opposite interests, which will control and balance each other, and produce the requisite impartiality.The Federalist No. 54 (James Madison).

Early Jurisprudence on Direct Taxes[edit | edit source]

The Supreme Court first interpreted the Constitution's "direct tax" language shortly after the Nation's founding in Hylton v. United States.[27] Hylton presented the question of whether an unapportioned tax on carriages was a "direct tax," and therefore unconstitutional.[28] In three separate opinions, the deciding justices[29] each held that the tax was not "direct" within the meaning of the Constitution and suggested that the term "direct taxes" applied only to a narrow class of taxes that includes (1) capitation taxes[30] and (2) taxes on "land."[31]

In Hylton, the Supreme Court adopted a functional approach to determine whether a tax is direct, focusing on whether the tax at issue can be apportioned and, if so, whether apportionment would produce significant inequities among taxpayers.[32] As Justice Samuel Chase stated in his opinion, "If [a tax] is proposed to tax any specific article by the rule of apportionment, and it would evidently create great inequality and injustice, it is unreasonable to say, that the Constitution intended such tax should be laid by that rule."[33] As the Court recently explained its holding in Hylton, the "Court upheld the tax, in part reasoning that apportioning such a tax would make little sense, because it would have required taxing carriage owners at dramatically different rates depending on how many carriages were in their home State."[34] The Court in Hylton did not, however, offer a comprehensive definition of the types of taxes that are "direct."[35]

The result of Hylton was not challenged until after the Civil War. A number of taxes imposed to meet the demands of that war were challenged as direct taxes. The Supreme Court, however, sustained successively as "excises" or "duties," a tax on an insurance company's receipts for premiums and assessments,[36] a tax on the circulating notes of state banks,[37] an inheritance tax on real estate,[38] and a general tax on incomes.[39] In the last case, Springer v. United States, the Court noted that it regarded the term "direct taxes" as meaning capitation taxes and taxes on land.[40] The Court stated: "Our conclusions are, that direct taxes, within the meaning of the Constitution, are only capitation taxes, as expressed in that instrument, and taxes on real estate, and that the tax of which the plaintiff in error complains is within the category of an excise or duty."[41]

Direct Taxes and the Sixteenth Amendment[edit | edit source]

In 1895, the Supreme Court expanded its interpretation of the meaning of direct taxes in its two decisions in Pollock v. Farmers' Loan & Trust Co.,[42] holding that taxes on real and personal property, and income derived from them, were direct taxes.[43] These decisions significantly altered the Court's direct tax jurisprudence. Considering whether an 1894 act that imposed unapportioned taxes on income derived from both real and personal property were direct taxes,[44] the Court adopted two primary holdings on the scope of the Constitution's "direct tax" clause. First, the Court held that taxes on real estate and personal property are direct taxes.[45] Second, the Court held that a tax on income derived from real or personal property--as opposed to income derived from employment or some other source[46]--is, in effect, a tax imposed directly on the property itself and is also a direct tax.[47] Applying these holdings, the Court held that the provisions before it were unconstitutional because they were unapportioned taxes on income derived from real and personal property.[48]

The Pollock Court concluded that its holding did not conflict with the Court's prior decisions interpreting the direct tax language.[49] The Court reasoned that each of those decisions had sustained unapportioned taxes as either "excises" or "duties" imposed on a particular use of, or privilege associated with, the property in question, not as a tax on the property itself.[50] As to Hylton specifically, the Court determined that it had upheld the unapportioned carriage tax as an "excise" on the "expense" or "consumption" of carriages, rather than as a tax on carriage ownership.[51]

After the Pollock decision, taxpayers challenged numerous taxes that Congress had treated as excises subject to the rule of uniformity as unconstitutional direct taxes. The Court, however, distinguished taxes levied "because of ownership" or "upon property as such" from those laid upon "privileges."[52] The Court sustained as "excises" a tax on sales of business exchanges,[53] a succession tax construed to fall on the recipients of the property transmitted rather than on the estate of the decedent,[54] and a tax on manufactured tobacco in the hands of a dealer, after an excise tax had been paid by the manufacturer.[55] In Thomas v. United States,[56] the Court sustained a stamp tax on sales of stock certificates based on the definition of "duties, imposts and excises."[57] The Court explained that these terms "were used comprehensively to cover customers and excise duties imposed on importation, consumption, manufacture and sale of certain commodities, privileges, particular business transactions, vocations, occupations and the like."[58] On the same day, the Court ruled in Spreckels Sugar Refining Co. v. McClain[59] that an exaction on the business of refining sugar and measured by gross receipts was an excise and properly levied under the rule of uniformity. Likewise, in Flint v. Stone Tracy Co.,[60] the Court held a tax on a corporation that was measured by income, including investment income, to be a tax on the privilege of doing business as a corporation rather than an income tax. Similarly, in Stanton v. Baltic Mining Co.[61], the Court held a tax on the annual production of mines "is not a tax upon property as such because of its ownership, but a true excise levied on the results of the business of carrying on mining operations."[62]

Pollock's holding and rationale were further limited in several respects.[63] Most prominently, Congress passed and the states ratified the Sixteenth Amendment in 1913 in direct response to Pollock's prohibition on the unapportioned taxation of income derived from real or personal property.[64] The Sixteenth Amendment authorized Congress "to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states."[65] Further, while the Court in Pollock held that a tax on income derived from property was indistinguishable from a tax on the property itself, the Court later rejected that reasoning in Stanton v. Baltic Mining Company, upholding an unapportioned tax on a mine's income as being "not a tax upon property as such . . . , but a true excise levied on the results of the business of carrying on mining operations."[66] The Court opined:

[T]he Sixteenth Amendment conferred no new power of taxation but simply prohibited the previous complete and plenary power of income taxation possessed by Congress from the beginning from being taken out of the category of indirect taxation to which it inherently belonged and being placed in the category of direct taxation subject to apportionment by a consideration of the sources from which the income was derived, that is by testing the tax not by what it was--a tax on income, but by a mistaken theory deduced from the origin or source of the income taxed.Id. at 112-13 (citing Brushaber v. Union Pac. R.R., 240 U.S. 1 (1916)).

Despite these developments, the Supreme Court has not expressly overruled Pollock's central holding that a tax on real or personal property solely because of its ownership is a direct tax.[67] In 1920, the Court relied on Pollock in Eisner v. Macomber to hold an unapportioned tax on shares issued as stock dividends unconstitutional.[68] There, the Court addressed whether a corporation's issuance of additional shares to a stockholder as stock dividends was "income" under the Sixteenth Amendment and, if not, whether a tax on those unrealized gains was a direct tax.[69] After concluding that the stock dividends were not "income,"[70] the Court relied on Pollock to conclude that the tax was a direct tax.[71]

The Eisner Court determined that the limitation on Congress's taxing power identified in Pollock "still has an appropriate and important function . . . not to be overridden by Congress or disregarded by the courts."[72] The Court observed that the Sixteenth Amendment must be "construed in connection with the taxing clauses of the original Constitution and the effect attributed to them," including Pollock's holding that "taxes upon property, real and personal," are direct taxes.[73] Applying that limitation, the Court held that the tax before it was unconstitutional because it was an unapportioned tax on personal property.[74]

In the Supreme Court's 2012 decision, National Federation of Independent Business v. Sebelius, the Supreme Court upheld the Affordable Care Act individual mandate, known as a "shared responsibility payment," as a tax under Article I, Section 8, Clause 1 of the Constitution.[75] In its ruling, the Court explained that the individual mandate was not a direct tax subject to the rule of apportionment. The Court stated:

A tax on going without health insurance does not fall within any recognized category of direct tax. It is not a capitation. Capitations are taxes paid by every person "without regard to property, profession or any other circumstance." The whole point of the shared responsibility payment is that it is triggered by specific circumstances--earning a certain amount of income but not obtaining health insurance. The payment is also plainly not a tax on the ownership of land or personal property. The shared responsibility payment is thus not a direct tax that must be apportioned among the several States.Id. at 571.

The Supreme Court further explained that direct taxes are capitation taxes, real estate taxes, and personal property taxes.[76] While income taxes are also direct taxes under Pollock, adoption of the Sixteenth Amendment,[77] as discussed above, amended the Constitution to permit the federal government to tax income.

- ↑ Art. I, Sec. 2, Clause 3 Seats ("Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons."). The Fourteenth Amendment subsequently modified apportionment of Representatives. Fourteenth Amend., Section 2 Apportionment of Representation ("Representatives shall be apportioned among the several States according to their respective numbers, counting the whole number of persons in each State, excluding Indians not taxed.").

- ↑ Art. I, Sec. 9, Clause 4 Direct Taxes ("No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."); Id. art. I, § 2, cl. 3 ("Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers . . . .").

- ↑ Article I, Section 8, Clause 1 of the U.S. Constitution subjects duties, imposts, and excise taxes--collectively referred to as indirect taxes--to the rule of uniformity. Art. I, Section 8 Enumerated Powers. The rule of uniformity requires an indirect tax to operate in the same manner throughout the United States.

- ↑ Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519, 571 (2012) [hereinafter NFIB] (emphasis omitted) (citing Hylton v. United States, 3 U.S. 171, 175 (1796) (opinion of Chase, J.)).

- ↑ Pollock v. Farmers' Loan & Trust Co., 157 U.S. 429 (1895); Hylton v. United States, 3 U.S. 171 (1796); see also NFIB, 567 U.S. at 571 (holding that the individual mandate provision in the Patient Protection and Affordable Care Act was not a direct tax because it did "not fall within" any of the "recognized categor[ies]" of direct taxes, capitation taxes and taxes on real or personal property).

- ↑ See, e.g., Act of Aug. 5, 1861, ch. 45, 12 Stat. 292; Act of Jan. 9, 1815, ch. 21, 3 Stat. 164.

- ↑ Erik M. Jensen, The Taxing Power, the Sixteenth Amendment, and the Meaning of "Incomes," 33 Ariz. St. L.J. 1057, 1067 (2001). See also Hylton, 3 U.S. at 174.

- ↑ Act of Aug. 5, 1861, ch. 45, 12 Stat. 292, 294; see also Act of Jan. 9, 1815, ch. 21, 3 Stat. 164.

- ↑ Act of Aug. 5, 1861, ch. 45, 12 Stat. 292, 294.

- ↑ Id. at 295 ("To the State of New York, two million six hundred and three thousand nine hundred and eighteen and two-third dollars.").

- ↑ Id. at 296 ("To the Territory of Dakota, three thousand two hundred and forty-one and one-third dollars.").

- ↑ Id. at 301.

- ↑ Id. at 296 ("That, for the purpose of assessing the above tax and collecting the same, the President of the United States be, and he is hereby authorized, to divide, respectively, the States and Territories of the United States and the District of Columbia into convenient collection districts, and to nominate and, by and with the advice of the Senate, to appoint an assessor and a collector for each such district, who shall be freeholders and resident within the same."); id. at 302 ("[T]he said assessors, respectively, shall make out lists containing the sums payable according to the provisions of this act upon every object of taxation in and for each collection district; which lists shall contain the name of each person residing within the said district, owning or having the care or superintendence of property lying within the said district which is liable to the said tax.").

- ↑ In National Federation of Independent Business v. Sebelius, the Court noted that "[e]ven when the Direct Tax Clause was written it was unclear what else, other than a capitation (also known as a "head tax" or a "poll tax"), might be a direct tax." Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519 (2012). See also 2 Records of the Federal Convention 350 (Max Farrand ed., 1911) ("Mr. King asked what was the precise meaning of direct taxation? No one answered.")

- ↑ Fourteenth Amendment Equal Protection and Other Rights. See Fourteenth Amendment Equal Protection and Other Rights.

- ↑ The Federalist No. 30 (Alexander Hamilton).

- ↑ Gillian E. Metzger, To Tax, To Spend, To Regulate, 126 Harv. L. Rev. 83, 89 (2012); see Veazie Bank v. Fenno, 75 U.S. 533, 540 (1869) ("The [National Government] had been reduced to the verge of impotency by the necessity of relying for revenue upon requisitions on the States, and it was a leading object in the adoption of the Constitution to relieve the government, to be organized under it, from this necessity, and confer upon it ample power to provide revenue by the taxation of persons and property."); Bruce Ackerman, Taxation and the Constitution, 99 Colum. L. Rev. 1, 6 (1999) ("The [Federalists] would never have launched their campaign against America's first Constitution, the Articles of Confederation, had it not been for its failure to provide adequate fiscal powers for the national government."); see generally The Federalist No. 30 (Alexander Hamilton) (advocating for a "General Power of Taxation").

- ↑ See Articles of Confederation of 1777, arts. II, VIII; Ackerman, supra here, at 6 ("The Articles of Confederation stated that the 'common treasury . . . shall be supplied by the several States, in proportion to the value of all land within each State,' Articles of Confederation art. VIII (1781), but did not explicitly authorize the Continental Congress to impose any sanctions when a state failed to comply. This silence was especially eloquent in light of the second Article's pronouncement: 'Each State retains its sovereignty, freedom and independence, and every power, jurisdiction and right, which is not by the confederation expressly delegated to the United States, in Congress assembled.'").

- ↑ Calvin H. Johnson, Righteous Anger at the Wicked States: The Meaning of the Founders' Constitution, 15 (2005); see Articles of Confederation of 1777, art. VIII.

- ↑ Johnson, supra note here, at 16 ("Some states simply ignored the requisitions. Some sent them back to Congress for amendment, more to the states' liking. New Jersey said it had paid enough tax by paying the tariffs or 'imposts' on goods imported through New York or Philadelphia and it repudiated the requisition in full.").

- ↑ Robert D. Cooter & Neil S. Siegel, Not the Power to Destroy: An Effects Theory of the Tax Power, 98 VA. L. REV. 1195, 1202 (2012); see, e.g., Johnson, supra note here, at 15 ("In the requisition of 1786--the last before the Constitution--Congress mandated that states pay $3,800,000, but it collected only $663."); see Metzger, supra note here, at 89 ("Under the Articles of Confederation, states had failed to meet congressional requisitions on a massive scale and Congress was bankrupt.").

- ↑ Johnson, supra note here, at 16-17 ("Congress's Board of Treasury had concluded in June 1786 that there was 'no reasonable hope' that the requisitions would yield enough to allow Congress to make payments on the foreign debts, even assuming that nothing would be paid on the domestic war debt. . . . Almost all of the money called for by the 1786 requisition would have gone to payments on the Revolutionary War debt. French and Dutch creditors were due payments of $1.7 million, including interest and some payment on the principal. Domestic creditors were due to be paid $1.6 million for interest only. Express advocacy of repudiation of the federal debt was rare, but with the failure of requisitions, payment was not possible. . . . Beyond the repayment of war debts, the federal goals were quite modest. The operating budget was only about $450,000 . . . . Without money, however, the handful of troops on the frontier would have to be disbanded and the Congress's offices shut."); see Cooter & Siegel, supra note here, at 1204.

- ↑ See, e.g., United States v. Richardson, 418 U.S. 166, 169-70 (1974).

- ↑ Art. I, Section 8 Enumerated Powers; see also id. art. I, § 8, cl. 18 ("To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.").

- ↑ License Tax Cases, 72 U.S. 462, 471 (1866); see also United States v. Kahriger, 345 U.S. 22, 28 (1953) ("It is axiomatic that the power of Congress to tax is extensive and sometimes falls with crushing effect . . . . As is well known, the constitutional restraints on taxing are few."); Brushaber v. Union Pac. R. Co., 240 U.S. 1, 12 (1916) ("That the authority conferred upon Congress by § 8 of article 1 'to lay and collect taxes, duties, imposts and excises' is exhaustive and embraces every conceivable power of taxation has never been questioned or, if it has, has been so often authoritatively declared as to render it necessary only to state the doctrine."); Austin v. Aldermen, 74 U.S. (7 Wall.) 694, 699 (1869) ("The right of taxation, where it exists, is necessarily unlimited in its nature. It carries with it inherently the power to embarrass and destroy."); see generally Veazie Bank v. Fenno, 75 U.S. 533, 540 (1869) (explaining "[N]othing is clearer, from the discussions in the [Constitutional] Convention and the discussions which preceded final ratification [of the Constitution] by the necessary number of States, than the purpose to give this power to Congress, as to the taxation of everything except exports, in its fullest extent.").

- ↑ Art. I, Section 2 House of Representatives ("Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers . . . .").

- ↑ Hylton, 3 U.S. 171.

- ↑ Id. at 172. The tax at issue in Hylton imposed a specific yearly sum on carriages. Act of June 5, 1794, ch. 45, 1 Stat. 373, 374 (1794). The amount varied between one and ten dollars, depending on the type of carriage. Id. The tax exempted carriages used in husbandry or for the transportation of goods, wares, merchandise, produce, or commodities. Id.

- ↑ Only four of the six Justices who comprised the Supreme Court at the time participated in the Hylton argument--Associate Justices Samuel Chase, William Paterson, James Iredell, and James Wilson. Consistent with the Court's practice during that period, Justices Chase, Paterson, and Iredell each wrote a separate, or "seriatim," opinion holding the tax to be constitutional. See Hylton, 3 U.S. at 172-83; M. Todd Henderson, From Seriatim to Consensus and Back Again: A Theory of Dissent, 2007 Sup. Ct. Rev. 283, 303-11 (2007). Justice Wilson abstained from voting on the case because he had previously expressed an opinion on the issue while serving as a circuit court judge and because the unanimity of the remaining three participating Justices made his opinion unnecessary. See Hylton, 3 U.S. at 183-84.

- ↑ See Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519, 571 (2012) [hereinafter NFIB] (citing Hylton, 3 U.S. at 175 (opinion of Chase, J.)).

- ↑ Hylton, 3 U.S. at 174-75 (opinion of Chase, J.); Id. at 176-77 (opinion of Paterson, J.); Id. at 183 (opinion of Iredell, J.).

- ↑ Id. at 174 (opinion of Chase, J.); Id. at 179-80 (opinion of Paterson, J.); Id. at 181-83 (opinion of Iredell, J.).

- ↑ Id.

- ↑ NFIB, 567 U.S. at 570; see Hylton, 3 U.S. at 179 (opinion of Paterson, J.) ("A tax on carriages, if apportioned, would be oppressive and pernicious. How would it work? In some states there are many carriages, and in others but few. Shall the whole sum fall on one or two individuals in a state, who may happen to own and possess carriages? The thing would be absurd, and inequitable.").

- ↑ Contra Springer v. United States, 102 U.S. 586, 602 (1880) ("Our conclusions are, that direct taxes, within the meaning of the Constitution, are only capitation taxes, as expressed in that instrument, and taxes on real estate." (emphasis added)); but see Pollock v. Farmers' Loan & Trust Co., 157 U.S. 429 (1895) (holding taxes on personal property are also direct taxes).

- ↑ Pacific Ins. Co. v. Soule, 74 U.S. (7 Wall.) 433 (1869).

- ↑ Veazie Bank v. Fenno, 75 U.S. (8 Wall.) 533 (1869).

- ↑ Scholey v. Rew, 90 U.S. (23 Wall.) 331 (1875).

- ↑ Springer v. United States, 102 U.S. 586 (1881).

- ↑ Id. at 602.

- ↑ Id. (emphasis retained).

- ↑ 158 U.S. 601 (1895) [hereinafter Pollock II]; 157 U.S. 429 [hereinafter Pollock I]. Pollock came to the Court twice. In Pollock I, the Court invalidated the tax at issue insofar as it was a tax upon income derived from real property, but the Court was equally divided on whether income derived from personal property was a direct tax. 157 U.S. at 583, 586. In Pollock II, on petitions for rehearing, the Court held that a tax on income derived from personal property was also a direct tax. 158 U.S. at 637. For simplicity, this essay refers to the two decisions collectively as the "Pollock" decision.

- ↑ Pollock II, 158 U.S. 601; Pollock I, 157 U.S. 429.

- ↑ Pollock II, 158 U.S. at 618; Pollock I, 157 U.S. at 558; see Act of Aug. 27, 1894, ch. 349, 28 Stat. 509.

- ↑ Pollock II, 158 U.S. at 628; Pollock I, 157 U.S. at 580-81.

- ↑ The Court stated that its holding did not extend to income or other gains derived from "business, privileges, or employments." Pollock II, 158 U.S. at 635.

- ↑ Pollock I, 157 U.S. at 581 ("An annual tax upon the annual value or annual user of real estate appears to us the same in substance as an annual tax on the real estate, which would be paid out of the rent or income."); Pollock II, 158 U.S. at 628 (applying "the same reasoning . . . to capital in personalty held for the purpose of income, or ordinarily yielding income, and to the income therefrom").

- ↑ Pollock II, 158 U.S. at 637; Pollock I, 157 U.S. at 583.

- ↑ Pollock II, 158 U.S. at 626-27; Pollock I, 157 U.S. at 574-80.

- ↑ Pollock II, 158 U.S. at 626-27; Pollock I, 157 U.S. at 574-80.

- ↑ Pollock II, 158 U.S. at 627 ("What was decided in the Hylton Case was, then, that a tax on carriages was an excise, and therefore an indirect tax.").

- ↑ Stanton v. Baltic Mining Co., 240 U.S. 103 (1916); Knowlton v. Moore, 178 U.S. 41, 80 (1900).

- ↑ Nicol v. Ames, 173 U.S. 509 (1899).

- ↑ Knowlton, 178 U.S. at 41.

- ↑ Patton v. Brady, 184 U.S. 608 (1902).

- ↑ 192 U.S. 363 (1904).

- ↑ Id. at 369.

- ↑ Id. at 370.

- ↑ 192 U.S. 397 (1904)

- ↑ 220 U.S. 107 (1911).

- ↑ 240 U.S. 103 (1916).

- ↑ Stanton, 240 U.S. at 114 (citing Stratton's Independence v. Howbert, 231 U.S. 399 (1913)).

- ↑ Erik M. Jensen, The Taxing Power, the Sixteenth Amendment, and the Meaning of "Incomes," 33 Ariz. St. L.J. 1057, 1073 (2001).

- ↑ Id.; Boris I. Bittker, Constitutional Limits on the Taxing Power of the Federal Government, 41 Tax Law. 3 (1987).

- ↑ Sixteenth Amendment Income Tax (emphasis added).

- ↑ 240 U.S. 103, 112-14 (1916).

- ↑ See Union Elec. Co. v. United States, 363 F.3d 1292, 1299 (Fed. Cir. 2004) ("We agree that Pollock has never been overruled, though its reasoning appears to have been discredited."); see also NFIB, 567 U.S. at 571 ("In 1895, [in Pollock II,] we expanded our interpretation [of direct taxes] to include taxes on personal property and income from personal property, in the course of striking down aspects of the federal income tax. That result was overturned by the Sixteenth Amendment, although we continued to consider taxes on personal property to be direct taxes" (citations omitted)).

- ↑ Eisner v. Macomber, 252 U.S. 189, 219 (1920).

- ↑ Id. at 201-19.

- ↑ Id. at 201-17. Eisner defined "income" as "the gain derived from capital, labor, or from both combined." Id. at 207 (internal quotation marks omitted).

- ↑ 252 U.S. at 218-19.

- ↑ Id. at 206.

- ↑ Id. at 205-06; id. at 218-19.

- ↑ Id. at 219. In 1921, the Court sustained an estate tax as an excise in New York Trust Co. v. Eisner, 256 U.S. 345, 349 (1921). The Court further held that including certain property in computing an estate tax does not constitute a direct tax on the following such property: (1) property held as joint tenants or as tenants by the entirety; or (2) the entire value of community property owned by a husband and wife; or (3) life insurance proceeds. Philips v. Dime Trust & S.D. Co., 284 U.S. 345, 349 (1921) (joint tenants); Tyler v. United States, 281 U.S. 497 (1930) (tenants by the entirety); Fernandez v. Wiener, 326 U.S. 340 (1945) (community property); Chase Nat'l Bank v. United States, 278 U.S. 327 (1929) (insurance proceeds); United States v. Manufacturers Nat'l Bank, 363 U.S. 194, 198-201 (1960) (insurance proceeds). Similarly, the Court upheld a graduated tax on gifts as an excise, saying that it was "a tax laid only upon the exercise of a single one of those powers incident to ownership, the power to give the property owned to another." Bromley v. McCaughn, 280 U.S. 124, 136 (1929). See also Helvering v. Bullard, 303 U.S. 297 (1938).

- ↑ Nat'l Fed'n of Indep. Bus. v. Sebelius, 567 U.S. 519 (2012).

- ↑ Id.

- ↑ See Sixteenth Amendment Income Tax.