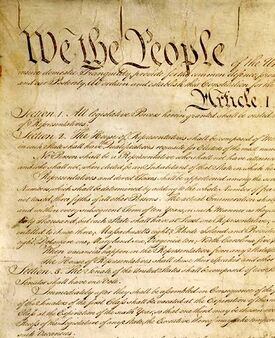

Constitution of the United States/Art. I/Sec. 8/Clause 3 Commerce

Article I Legislative Branch

Section 8 Enumerated Powers

Clause 3 Commerce

| Clause Text |

|---|

| To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes; |

Overview of Commerce Clause

The Commerce Clause gives Congress broad power to regulate interstate commerce and restricts states from impairing interstate commerce. Early Supreme Court cases primarily viewed the Commerce Clause as limiting state power rather than as a source of federal power. Of the approximately 1,400 Commerce Clause cases that the Supreme Court heard before 1900, most stemmed from state legislation.[1] As a consequence, the Supreme Court's early interpretations of the Commerce Clause focused on the meaning of "commerce" while paying less attention to the meaning of "regulate." During the 1930s, however, the Supreme Court increasingly heard cases on Congress's power to regulate commerce, with the result that its interstate Commerce Clause jurisprudence evolved markedly during the twentieth century.

Meaning of Commerce

While the etymology of the word "commerce" suggests that "merchandise," or goods for sale, was integral to its original meaning,[2] Chief Justice John Marshall in Gibbons v. Ogden interpreted the Commerce Clause broadly.[3] Gibbons concerned whether the New York legislature could grant a monopoly to Aaron Ogden to operate steamships on New York waters and thereby prevent Thomas Gibbons from operating a steamship between New York and New Jersey pursuant to a license granted by Congress.[4] In defending his New York-granted steamship monopoly, Ogden argued that transporting passengers did not constitute "commerce" under the Commerce Clause. Finding New York's grant of a steamship monopoly violated the Commerce Clause, Chief Justice Marshall reasoned that commerce encompassed not only buying and selling but also, more generally, intercourse and consequently navigation. The Chief Justice wrote:

The subject to be regulated is commerce. The counsel for the appellee would limit it to traffic, to buying and selling, or the interchange of commodities, and do not admit that it comprehends navigation. This would restrict a general term, applicable to many objects, to one of its significations. Commerce, undoubtedly, is traffic, but it is something more--it is intercourse.Gibbons v. Ogden, 22 U.S. (9 Wheat.) 1, 189 (1824).

Marshall further noted the general understanding of the meaning of commerce, the Article I, Section 9 prohibition against Congress granting any preference "by any regulation of commerce or revenue, to the ports of one State over those of another," and Congress's power to impose embargoes.[5]

In Gibbons, Marshall qualified the word "intercourse" with the word "commercial," thus retaining the element of monetary transactions.[6] Initially, the Court viewed activities covered by Congress's interstate commerce clause power narrowly. Thus, the Court held the Commerce Clause did not reach mining or manufacturing regardless of whether the product moved in interstate commerce;[7] insurance transactions crossing state lines;[8] and baseball exhibitions between professional teams traveling from state to state.[9] Similarly, the Court held that the Commerce Clause did not apply to contracts to insert advertisements in periodicals in another state[10] or to render personal services in another state.[11]

Later decisions treated the Commerce Clause more expansively. In 1945, the Court held in Associated Press v. United States that a press association gathering and transmitting news to client newspapers to be interstate commerce.[12] Likewise, in 1943, the Court held in American Medical Association v. United States that activities of Group Health Association, Inc., which serve only its own members, are "trade" and capable of becoming interstate commerce.[13] The Court also held insurance transactions between an insurer and insured in different states to be interstate commerce.[14] Most importantly, the Court held that manufacturing,[15] mining,[16] business transactions,[17] and the like, which occur antecedent or subsequent to a move across state lines, are part of an integrated commercial whole and covered by the Commerce Clause. As such, Supreme Court case law on the meaning of "commerce" in "interstate commerce" covers movements of persons and things, whether for profit or not, across state lines;[18] communications; transmissions of intelligence, whether for commercial purposes or otherwise;[19] and commercial negotiations that involve transportation of persons or things, or flows of services or power, across state lines.[20]

Meaning of Among the Several States in the Commerce Clause

The Supreme Court has interpreted the phrase "among the several states" to exclude transactions that occur wholly within a state. In Gibbons v. Ogden, Chief Justice John Marshall observed that the phrase "among the several States" was "not one which would probably have been selected to indicate the completely interior traffic of a state."[21] He noted that although the phrase "may very properly be restricted to that commerce which concerns more states than one,"[22] "[c]ommerce among the states, cannot stop at the external boundary line of each state, but may be introduced into the interior."[23] Identifying transactions covered by the Commerce Clause, he stated:

The genius and character of the whole government seem to be, that its action is to be applied to all the external concerns of the nation, and to those internal concerns which affect the states generally; but not to those which are completely within a particular state, which do not affect other states, and with which it is not necessary to interfere, for the purpose of executing some of the general powers of the government. 22 U.S. (9 Wheat.) 1, 194-195 (1824).

Subsequent to Gibbons, the Court held in a number of cases that Congress's Commerce Clause power did not extend to commerce that was "exclusively internal" to a state.[24] In these nineteenth and early twentieth century cases, the Court seemingly tied Congress's interstate commerce power to cross-border transactions notwithstanding Marshall's Gibbons reasoning that Congress's Commerce Clause power could extend to intrastate commerce that affects other states or implicates congressional power.[25] In its 1905 Swift & Co. v. United States decision, the Court revisited Marshall's expansive reading of the Commerce Clause to reason that, in a current of commerce, each element was within Congress's Commerce Clause power.[26] Looking at the interrelationship of industrial production to interstate commerce,[27] the Court noted that the cumulative impact[28] of minor transactions can impact interstate commerce.[29]

Meaning of Regulate in the Commerce Clause

The Court has interpreted "regulate" in the Commerce Clause as Congress's power to prescribe conditions and rules for commercial transactions, keep channels of commerce open, and regulate prices and terms of sale. In Gibbons v. Ogden, Chief Justice John Marshall discussed Congress's authority to "regulate," stating:

It is the power to regulate; that is, to prescribe the rule by which commerce is to be governed. This power, like all others vested in congress, is complete in itself, may be exercised to its utmost extent, and acknowledges no limitations, other than are prescribed in the constitution . . . If, as has always been understood, the sovereignty of congress, though limited to specified objects, is plenary as to those objects, the power over commerce with foreign nations, and among the several states, is vested in Congress as absolutely as it would be in a single government, having in its constitution the same restrictions on the exercise of the power as are found in the constitution of the United States.Gibbons v. Ogden, 22 U.S. (9 Wheat.) 1, 196-97 (1824).

Similarly, in Brooks v. United States, the Court explained "regulate," observing:

Congress can certainly regulate interstate commerce to the extent of forbidding and punishing the use of such commerce as an agency to promote immorality, dishonesty, or the spread of any evil or harm to the people of other states from the state of origin. In doing this, it is merely exercising the police power, for the benefit of the public, within the field of interstate commerce.Brooks v. United States, 267 U.S. 432, 436-37 (1925).

In upholding a federal statute prohibiting shipping goods made with child labor in interstate commerce in order to extirpate child labor rather than bar intrinsically harmful goods, the Court said: "It is no objection to the assertion of the power to regulate commerce that its exercise is attended by the same incidents which attend the exercise of the police power of the states."[30] Congress has also used its Commerce Clause power to enforce moral codes,[31] to ban racial discrimination in public accommodations,[32] and to protect the public from danger.[33] Consequently, Congress's power to regulate interstate commerce is among its most potent Article I, Section 8 powers.

Historical Background

Sherman Antitrust Act of 1890 and Sugar Trust Case

To curb the growth of industrial combinations, Congress passed the Sherman Antitrust Act (Sherman Act) in 1890. Under the Sherman Act, Congress sought to regulate commerce as "traffic." The Sherman Act prohibited "every contract, combination in the form of trust or otherwise," or "conspiracy in restraint of trade and commerce among the several States, or with foreign nations"[34] and made it a misdemeanor to "monopolize or attempt to monopolize any part of such commerce."[35]

In 1895, the Court considered the Sherman Act in United States v. E. C. Knight Co. (Sugar Trust C)[36] in which the government asked the Court to cancel certain agreements whereby the American Sugar Refining Company had acquired "nearly complete control of the manufacture of refined sugar in the United States."[37] The Court rejected the government's claim on the grounds that the activities of the Sugar Trust had only an indirect effect on commerce, which Congress's Commerce Clause powers did not reach. Although the Court did not directly rule on the Sherman Act's constitutional validity, it analyzed the scope of Congress's commerce power when considering what activities the Sherman Act barred. Explaining the federal government's role in mitigating commercial power, Chief Justice Melville Fuller stated:

[T]he independence of the commercial power and of the police power, and the delimitation between them, however sometimes perplexing, should always be recognized and observed, for, while the one furnishes the strongest bond of union, the other is essential to the preservation of the autonomy of the States as required by our dual form of government; and acknowledged evils, however grave and urgent they may appear to be, had better be borne, than the risk be run, in the effort to suppress them, of more serious consequences by resort to expedients of even doubtful constitutionality.Id. at 13.

The E. C. Knight Court reasoned that a hard and fast line should exist between commercial and police powers based on (1) production being local and subject to state oversight; (2) commerce among the states does not begin until goods "commence their final movement from their State of origin to their destination;" (3) a product's sale is merely an incident of its production and, while capable of "bringing the operation of commerce into play," affects it only incidentally; (4) such restraint as would reach commerce, as just defined, in consequence of combinations to control production "in all its forms," would be "indirect, however inevitable and whatever its extent," and as such beyond the purview of the Act.[38] Applying this reasoning, the E. C. Knight Court stated:

The object [of the combination] was manifestly private gain in the manufacture of the commodity, but not through the control of interstate or foreign commerce. It is true that the bill alleged that the products of these refineries were sold and distributed among the several States, and that all the companies were engaged in trade or commerce with the several States and with foreign nations; but this was no more than to say that trade and commerce served manufacture to fulfill its function.Id. at 17.. . . [I]t does not follow that an attempt to monopolize, or the actual monopoly of, the manufacture was an attempt, whether executory or consummated, to monopolize commerce, even though, in order to dispose of the product, the instrumentality of commerce was necessarily invoked. There was nothing in the proofs to indicate any intention to put a restraint upon trade or commerce, and the fact, as we have seen, that trade or commerce might be indirectly affected was not enough to entitle complainants to a decree.Id. at 17. The doctrine of the case boiled down to the proposition that commerce was transportation only, a doctrine Justice John Marshall Harlan undertook to refute in his dissenting opinion. Justice Harlan stated: "Interstate commerce does not, therefore, consist in transportation simply. It includes the purchase and sale of articles that are intended to be transported from one State to another--every species of commercial intercourse among the States and with foreign nations." 156 U.S. at 22. Justice Harlan further stated:

Any combination, therefore, that disturbs or unreasonably obstructs freedom in buying and selling articles manufactured to be sold to persons in other States or to be carried to other States--a freedom that cannot exist if the right to buy and sell is fettered by unlawful restraints that crush out competition--affects, not incidentally, but directly, the people of all the States; and the remedy for such an evil is found only in the exercise of powers confided to a government which, this court has said, was the government of all, exercising powers delegated by all, representing all, acting for all.

156 U.S. at 33 (citing McCulloch v. Maryland, 17 U.S. (4 Wheat.) 316, 405 (1819)).

Four years later, in Addyston Pipe and Steel Co. v. United States,[39] the Court applied the Sherman Act to hold an industrial combination unlawful. The defendants in Addyston were manufacturing concerns that had effected a division of territory among them, which the Court held to be a "direct" restraint on the distribution and transportation of the products of the contracting firms. In reaching its holding, however, the Court did not question E. C. Knight, which remained substantially undisturbed until the Court's 1905 Swift decision.[40]

Current of Commerce Concept and 1905 Swift Case

In Swift & Co. v. United States, Justice Oliver Wendell Holmes referred to a "current of commerce" in providing a more expansive interpretation of the Commerce Clause. Swift concerned some thirty firms that bought livestock at stockyards, processed it into fresh meat, and then sold and shipped the fresh meat to purchasers in other states. The government alleged that the defendants had agreed, among other things, not to bid against each other in local markets, to fix prices, and to restrict meat shipments. On appeal to the Supreme Court, the defendants contended that some of the acts they were charged with were not acts in interstate commerce and consequently not covered by the Sherman Act. The Court ruled in favor of the government on the ground that the Sherman Act covered the "scheme as a whole" and that the local activities alleged were part of this general scheme.[41] Explaining why Congress's Commerce Clause power extended to acts that occurred within a single state, Justice Oliver Wendell Holmes reasoned:

Commerce among the States is not a technical legal conception, but a practical one, drawn from the course of business. When cattle are sent for sale from a place in one State, with the expectation that they will end their transit, after purchase, in another, and when in effect they do so, with only the interruption necessary to find a purchaser at the stockyards, and when this is a typical, constantly recurring course, the current thus existing is a current of commerce among the States, and the purchase of the cattle is a part and incident of such commerce.Id. at 398-99.

Likewise, the Court held that, even if title passed at the slaughterhouses, the sales were to persons in other states and shipments to such states were part of the transaction.[42] Thus, in Swift, the Court deemed sales to be part of the stream of interstate commerce if they enabled the manufacturer "to fulfill its function" although ten years earlier the Court had held in United States v. E. C. Knight Co (Sugar Trust Case)[43] that such sales were immaterial.

Thus, in Swift, the Court appeared to return to Chief Justice John Marshall's concept of commerce as traffic, which he had explored in Gibbons v. Ogden. As a result, activities that indirectly affected interstate trade could be deemed interstate commerce. The Swift Court stated: "But we do not mean to imply that the rule which marks the point at which state taxation or regulation becomes permissible necessarily is beyond the scope of interference by Congress in cases where such interference is deemed necessary for the protection of commerce among the States."[44] The Court also held that combinations of employees who engaged in intrastate activities such as manufacturing, mining, building, construction, and distributing poultry could be subject to the Sherman Act because of the effect, or intended effect, of these activities on interstate commerce.[45]

Packers and Stockyards Act of 1921 and Grain Futures Act of 1922

In 1921, Congress passed the Packers and Stockyards Act,[46] which brought the livestock industry in the country's chief stockyards under federal supervision. In 1922, Congress passed the Grain Futures Act[47] to regulate grain futures exchanges. In sustaining these laws, the Court relied on Swift & Co. v. United States. For example, in Stafford v. Wallace,[48] which involved the Packers and Stockyards Act, Chief Justice William Taft stated:

The object to be secured by the act is the free and unburdened flow of livestock from the ranges and farms of the West and Southwest through the great stockyards and slaughtering centers on the borders of that region, and thence in the form of meat products to the consuming cities of the country in the Middle West and East, or, still as livestock, to the feeding places and fattening farms in the Middle West or East for further preparation for the market.Id. at 514.

The Stafford Court reasoned the stockyards were "not a place of rest or final destination."[49] Instead, they were "but a throat through which the current flows," and the sales there were not "merely local transactions. [T]hey do not stop the flow . . . but, on the contrary, [are] indispensable to its continuity."[50]

In Chicago Board of Trade v. Olsen,[51] involving the Grain Futures Act, the Court followed the reasoning in Stafford. Discussing Swift, Chief Justice Taft remarked:

[Swift] was a milestone in the interpretation of the commerce clause of the Constitution. It recognized the great changes and development in the business of this vast country and drew again the dividing line between interstate and intrastate commerce where the Constitution intended it to be. It refused to permit local incidents of a great interstate movement, which taken alone are intrastate, to characterize the movement as such.Id. at 35.

In Olsen, the Court examined how futures sales relate to cash sales and impact the interstate grain trade. Writing for the Court, Chief Justice Taft stated: "The question of price dominates trade between the States. Sales of an article which affect the country-wide price of the article directly affect the country-wide commerce in it."[52] Thus, a practice that demonstrably affects prices would affect interstate trade "directly" and, even though local in itself, would be subject to Congress's regulatory power under the Commerce Clause. In Olsen, Chief Justice Taft also stressed the importance of congressional deference. He stated:

Whatever amounts to more or less constant practice, and threatens to obstruct or unduly to burden the freedom of interstate commerce is within the regulatory power of Congress under the commerce clause, and it is primarily for Congress to consider and decide the fact of the danger to meet it. This court will certainly not substitute its judgment for that of Congress in such a matter unless the relation of the subject to interstate commerce and its effect upon it are clearly nonexistent.Id. at 37, quoting Stafford v. Wallace, 258 U.S. 495, 521 (1922).

New Deal Legislation Generally

Several days after President Franklin D. Roosevelt's first inauguration, Chief Justice Charles Evans Hughes described a problem the new Administration faced, stating: "When industry is grievously hurt, when producing concerns fail, when unemployment mounts and communities dependent upon profitable production are prostrated, the wells of commerce go dry."[53] Congress's legislative response to the Great Depression marked a significant expansion of federal economic regulation. Congress did not limit itself to regulating traffic among the states and the instrumentalities thereof. It also attempted to govern production and industrial relations in the field of production, areas over which states had historically exercised legislative power. Confronted with this expansive exercise of congressional power, the Court reexamined Congress's interstate commerce power.

National Industrial Recovery and Agricultural Adjustment Acts of 1933

Passed on June 16, 1933, the National Industrial Recovery Act (NIRA) marked Congress's initial effort to address the Great Depression.[54] NIRA recognized the existence of "a national emergency productive of widespread unemployment and disorganization of industry" that burdened "interstate and foreign commerce," affected "the public welfare," and undermined "the standards of living of the American people." To alleviate these conditions, NIRA authorized the President to approve "codes of fair competition" if industrial or trade groups applied for such codes, or to prescribe such codes if there were no applications. Among other things, NIRA required the codes to provide certain guarantees respecting hours, wages, and collective bargaining.[55]

In A. L. A. Schechter Poultry Corp. v. United States,[56] the Supreme Court held the Live Poultry Code to be unconstitutional. Although practically all poultry Schechter handled came from outside the state, and hence via interstate commerce, the Court held that once the chickens arrived in Schechter's wholesale market, interstate commerce in them ceased. Although NIRA purported to govern business activities that "affected" interstate commerce, Chief Justice Charles Hughes interpreted "affected" to mean "directly" affect commerce. He stated:

[T]he distinction between direct and indirect effects of intrastate transactions upon interstate commerce must be recognized as a fundamental one, essential to the maintenance of our constitutional system. Otherwise, . . . there would be virtually no limit to the federal power and for all practical purposes we should have a completely centralized government.Id. at 548. See also id. at 546.

In short, the Court appeared to have returned in Schechter to the rationale of the Sugar Trust case.[57]

Congress next attempted to address the Depression through the Agricultural Adjustment Act of 1933 (AAA).[58] The Court, however, set the AAA aside in United States v. Butler on the grounds that Congress had attempted to regulate production in violation of the Tenth Amendment.[59]

Railroad Retirement and Securities Exchange Acts of 1934

To assist commerce and labor, Congress passed the Railroad Retirement Act (RRA) in 1934,[60] which ordered compulsory retirement for superannuated employees of interstate carriers and provided they receive pensions from a fund comprised of the compulsory contributions from the carriers and the carriers' present and future employees. In Railroad Retirement Board v. Alton Railroad,[61] however, a closely divided Court held the RRA to exceed Congress's Commerce Clause power and to violate the Due Process Clause of the Fifth Amendment. Writing for the majority, Justice Owen Roberts stated:

We feel bound to hold that a pension plan thus imposed is in no proper sense a regulation of the activity of interstate transportation. It is an attempt for social ends to impose by sheer fiat noncontractual incidents upon the relation of employer and employee, not as a rule or regulation of commerce and transportation between the States, but as a means of assuring a particular class of employees against old age dependency. This is neither a necessary nor an appropriate rule or regulation affecting the due fulfillment of the railroads' duty to serve the public in interstate transportation.Id. at 374.

In dissent, Chief Justice Charles Hughes contended that "the morale of the employees [had] an important bearing upon the efficiency of the transportation service."[62] He added:

The fundamental consideration which supports this type of legislation is that industry should take care of its human wastage, whether that is due to accident or age. That view cannot be dismissed as arbitrary or capricious. It is a reasoned conviction based upon abundant experience. The expression of that conviction in law is regulation. When expressed in the government of interstate carriers, with respect to their employees likewise engaged in interstate commerce, it is a regulation of that commerce. As such, so far as the subject matter is concerned, the commerce clause should be held applicable.Id. at 384.

In subsequent legislation, Congress levied an excise on interstate carriers and their employees, while by separate but parallel legislation, it created a fund in the Treasury from which pensions would be paid along the lines of the original plan. The Court did not appear to question the constitutionality of this scheme in Railroad Retirement Board v. Duquesne Warehouse Co.[63]

New Deal legislation did not necessarily require expansive interpretations of congressional power. The Securities Exchange Act of 1934[64] created the Securities and Exchange Commission (SEC), authorized the Commission to promulgate regulations to keep dealings in securities honest, and closed the channels of interstate commerce and the mails to dealers refusing to register under the Act.

Public Utility Holding Company and Bituminous Coal Conservation Acts of 1935

In 1935, Congress passed the Public Utility Holding Company Act ("Wheeler-Rayburn Act")[65] and the Bituminous Coal Conservation Act.[66] The Wheeler-Rayburn Act required covered companies to register with the Securities and Exchange Commission and report on their business, organization, and financial structure or be prohibited from using mails and other interstate commerce facilities. Under Section 11, the so-called "death sentence" clause, the Wheeler-Rayburn Act closed channels of interstate communication after a certain date to certain types of public utility holding companies whose operations, Congress found, were calculated chiefly to exploit the investing and consuming public. In a series of decisions, the Court sustained these provisions,[67] relying principally on Gibbons v. Ogden.

The Court, however, disallowed the Guffey-Snyder Bituminous Coal Conservation Act (BCCA) of 1935,[68] which regulated the price of soft coal that was sold both in interstate commerce and "locally," and the hours of labor and wages in the mines. The BCCA declared these provisions to be separable, so that the invalidity of one set would not affect the validity of the other. However, a majority of the Court, in an opinion written by Justice George Sutherland, held that (1) these provisions were not separable because the BCCA constituted one connected scheme of regulation, and (2) the BCCA was unconstitutional because it invaded the reserved powers of the states over conditions of employment in productive industry.[69] Taking Chief Justice Charles Hughes' assertion in A. L. A. Schechter Poultry Corp. v. United States of the "fundamental" distinction between "direct" and "indirect" effects, which, in turn, drew upon the Sugar Trust, Justice Sutherland stated:

Much stress is put upon the evils which come from the struggle between employers and employees over the matter of wages, working conditions, the right of collective bargaining, etc., and the resulting strikes, curtailment and irregularity of production and effect on prices; and it is insisted that interstate commerce is greatly affected thereby. But . . . the conclusive answer is that the evils are all local evils over which the Federal Government has no legislative control. . . . Such effect as they may have upon commerce, however extensive it may be, is secondary and indirect. An increase in the greatness of the effect adds to its importance. It does not alter its character.Id. at 308-09.

National Labor Relations Act of 1935

In NLRB v. Jones & Laughlin Steel Corporation, the Court reduced the distinction between "direct" and "indirect" effects, thereby enabling Congress to regulate productive industry and labor relations.[70] The National Labor Relations Act (NLRA) of 1935[71] granted workers a right to organize, forbade unlawful employer interference with this right, established procedures for workers to select representatives with whom employers were required to bargain, and created a board to oversee these processes.[72]

In an opinion by Chief Justice Charles Hughes, the Court upheld the NLRA, stating: "The close and intimate effect, which brings the subject within the reach of federal power may be due to activities in relation to productive industry although the industry when separately viewed is local."[73] Considering defendant's "far-flung activities,"[74] the Court expressed concern about strife between the industry and its employees, stating:

We are asked to shut our eyes to the plainest facts of our national life and to deal with the question of direct and indirect effects in an intellectual vacuum. When industries organize themselves on a national scale, making their relation to interstate commerce the dominant factor in their activities, how can it be maintained that their industrial labor relations constitute a forbidden field into which Congress may not enter when it is necessary to protect interstate commerce from the paralyzing consequences of industrial war? We have often said that interstate commerce itself is a practical conception. It is equally true that interferences with that commerce must be appraised by a judgment that does not ignore actual experience.Id. at 41-42.

The Court held the NLRA to be within Congress's constitutional powers because a strike that interrupted business "might be catastrophic."[75] The Court also held that the NLRA applied to (1) two minor concerns,[76] (2) a local retail auto dealer on the ground that he was an integral part of a manufacturer's national distribution system,[77] (3) a labor dispute arising during alteration of a county courthouse because one-half of the cost was attributable to materials shipped from out-of-state,[78] and (4) a dispute involving a local retail distributor of fuel oil that it obtained from a wholesaler who imported it from another state.[79] The Court stated: "This Court has consistently declared that in passing the National Labor Relations Act, Congress intended to and did vest in the Board the fullest jurisdictional breadth constitutionally permissible under the Commerce Clause."[80] Thus, the Court implicitly approved the National Labor Relations Board's jurisdictional standards, which assumed a prescribed dollar volume of business had a requisite effect on interstate commerce.[81]

Agricultural Marketing Agreement Act of 1937

By passing the Agricultural Marketing Agreement Act (AMAA) on June 3, 1937,[82] Congress sought to bolster agriculture by authorizing the Secretary of Agriculture to fix the minimum prices of certain agricultural products, when the handling of such products occurs "in the current of interstate or foreign commerce or . . . directly burdens, obstructs or affects interstate or foreign commerce in such commodity or product thereof." In United States v. Wrightwood Dairy Co.,[83] the Court sustained an order of the Secretary of Agriculture that fixed the minimum prices to be paid to producers of milk in the Chicago "marketing area." The dairy company demurred to the regulation on the ground it applied to milk produced and sold intrastate. Sustaining the order, the Court said:

Congress plainly has power to regulate the price of milk distributed through the medium of interstate commerce . . . and it possesses every power needed to make that regulation effective. The commerce power is not confined in its exercise to the regulation of commerce among the States. It extends to those activities intrastate which so affect interstate commerce, or the exertion of the power of Congress over it, as to make regulation of them appropriate means to the attainment of a legitimate end, the effective execution of the granted power to regulate interstate commerce. The power of Congress over interstate commerce is plenary and complete in itself, may be exercised to its utmost extent, and acknowledges no limitations other than are prescribed in the Constitution. It follows that no form of State activity can constitutionally thwart the regulatory power granted by the commerce clause to Congress. Hence the reach of that power extends to those intrastate activities which in a substantial way interfere with or obstruct the exercise of the granted power.315 U.S. at 118-19.

In Wickard v. Filburn,[84] the Court sustained even greater Congressional regulation over production. The Agricultural Adjustment Act (AAA) of 1938, as amended in 1941,[85] regulated production even when it was not intended for commerce but wholly for consumption on the producer's farm. Sustaining the AAA amendment, the Court noted that it supported the market, stating:

It can hardly be denied that a factor of such volume and variability as home-consumed wheat would have a substantial influence on price and market conditions. . . . But if we assume that it is never marketed, it supplies a need of the man who grew it which would otherwise be reflected by purchases in the open market. Home-grown wheat in this sense competes with wheat in commerce. The stimulation of commerce is a use of the regulatory function quite as definitely as prohibitions or restrictions thereon. This record leaves us in no doubt that Congress may properly have considered that wheat consumed on the farm grown, if wholly outside the scheme of regulation, would have a substantial effect in defeating and obstructing its purpose to stimulate trade therein at increased prices.317 U.S. at 128-29.

The Court also stated:

[Q]uestions of the power of Congress are not to be decided by reference to any formula which would give controlling force to nomenclature such as 'production' and 'indirect' and foreclose consideration of the actual effects of the activity in question upon interstate commerce. The Court's recognition of the relevance of the economic effects in the application of the Commerce Clause . . . has made the mechanical application of legal formulas no longer feasible.Id. at 120, 123-24. In United States v. Rock Royal Co-operative, Inc., 307 U.S. 533 (1939), the Court sustained an order under the Agricultural Marketing Agreement Act of 1937, 50 Stat. 246, regulating the price of milk in certain instances. Writing for the Court, Justice Stanley Reed stated:The challenge is to the regulation 'of the price to be paid upon the sale by a dairy farmer who delivers his milk to some country plant.' It is urged that the sale, a local transaction, is fully completed before any interstate commerce begins and that the attempt to fix the price or other elements of that incident violates the Tenth Amendment. But where commodities are bought for use beyond state lines, the sale is a part of interstate commerce. We have likewise held that where sales for interstate transportation were commingled with intrastate transactions, the existence of the local activity did not interfere with the federal power to regulate inspection of the whole. Activities conducted within state lines do not by this fact alone escape the sweep of the Commerce Clause. Interstate commerce may be dependent upon them. Power to establish quotas for interstate marketing gives power to name quotas for that which is to be left within the state of production. Where local and foreign milk alike are drawn into a general plan for protecting the interstate commerce in the commodity from the interferences, burdens and obstructions, arising from excessive surplus and the social and sanitary evils of low values, the power of the Congress extends also to the local sales.Id. at 568-69.

Fair Labor Standards Act of 1938

In 1938, Congress enacted the Fair Labor Standards Act (FLSA), which prohibited shipping goods in interstate commerce that were manufactured by workmen whose employment did not comply with prescribed wages and hours.[86] The FLSA defined interstate commerce to mean "trade, commerce, transportation, transmission, or communication among the several States or from any State to any place outside thereof." The FLSA further provided that "for the purposes of this act an employee shall be deemed to have been engaged in the production of goods [for interstate commerce] if such employee was employed . . . in any process or occupation directly essential to the production thereof in any State."[87] Sustaining an indictment under the FLSA, Chief Justice Harlan Stone, writing for a unanimous Court, stated:

The motive and purpose of the present regulation are plainly to make effective the congressional conception of public policy that interstate commerce should not be made the instrument of competition in the distribution of goods produced under substandard labor conditions, which competition is injurious to the commerce and to the States from and to which the commerce flows.United States v. Darby, 312 U.S. 100, 115 (1941).

In support of the decision, the Court invoked Chief Justice John Marshall's interpretations of the Necessary and Proper Clause in McCulloch v. Maryland and the Commerce Clause in Gibbons v. Ogden.[88] The Court rejected objections purporting to be based on the Tenth Amendment, stating:

Our conclusion is unaffected by the Tenth Amendment which provides: 'The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.' The amendment states but a truism that all is retained which has not been surrendered. There is nothing in the history of its adoption to suggest that it was more than declaratory of the relationship between the national and State governments as it had been established by the Constitution before the amendment or that its purpose was other than to allay fears that the new National Government might seek to exercise powers not granted, and that the States might not be able to exercise fully their reserved powers.Id. at 123-24.

Subsequent decisions of the Court took a broad view of which employees should be covered by the FSLA,[89] and in 1949, Congress narrowed the permissible range of coverage and disapproved some of the Court's decisions.[90] But, in 1961,[91] with extensions in 1966,[92] Congress expanded the FSLA's coverage by several million persons, introducing the "enterprise" concept by which all employees in a business producing anything in commerce or affecting commerce were covered by the minimum wage-maximum hours standards.[93] Sustaining the "enterprise concept" in Maryland v. Wirtz,[94] Justice John Harlan, writing for a unanimous Court, held the FSLA's expanded coverage legal based on two theories: (1) all of a business's significant labor costs, not just those costs attributable to employees engaged in production in interstate commerce, contribute to the business's competitive position in commerce; and (2) ending substandard labor conditions that affect all employees, not just those actually engaged in interstate commerce, facilitates labor peace, and smooth functioning of interstate commerce.[95]

Dual Federalism and Commerce Clause

Prior to the 1930s, the Court had effectively followed a doctrine of "dual federalism," under which Congress's power to regulate activity largely depended on whether the activity had a "direct" rather than an "indirect" effect on interstate commerce.[96] When the Court adopted a less restrictive interpretation of the Commerce Clause during and after the New Deal, the question of how concerns over federalism might impact congressional regulation of private activities became moot. However, in a number of instances, the states themselves engaged in commercial activities, which would have been subject to federal legislation if a privately owned enterprise had engaged in the activity. Consequently, the Court sustained applying federal law to these state proprietary activities.[97] As Congress began to extend regulation to state governmental activities, the judicial response was inconsistent.[98] Although the Court may revisit constraining federal power on federalism grounds, Congress lacks authority under the Commerce Clause to regulate states when federal statutory provisions would "commandeer" a state's legislative or executive authority to implement a federal regulatory program.[99]

Modern Doctrine

United States v. Lopez and Interstate Commerce Clause

Construing modern interstate Commerce Clause doctrine in its 1995 decision of United States v. Lopez, the Court identified three general categories of commerce that were subject to Congress's Commerce Clause powers. These are (1) "channels of interstate commerce"; (2) "instrumentalities of interstate commerce, or persons or things in interstate commerce"; and (3) "activities having a substantial relation to interstate commerce."[100] In general, Congress's authority under the interstate Commerce Clause has expanded since the 1930s because of the volume of interstate commerce and Congress's ability to regulate intrastate activities that sufficiently affect interstate commerce. In New York v. United States, the Court noted:

[T]he volume of interstate commerce and the range of commonly accepted objects of government regulation have expanded considerably in the last 200 years, and the regulatory authority of Congress has expanded along with them. As interstate commerce has become ubiquitous, activities once considered purely local have come to have effects on the national economy, and have accordingly come within the scope of Congress's commerce power.New York v. United States, 505 U.S. 144, 158 (1992).

In addition, the Court has from time-to-time expressly noted that Congress's exercise of power under the Commerce Clause is akin to the police power exercised by the states.[101]

Channels of Interstate Commerce

In United States v. Lopez, the Court identified "channels of interstate commerce" as being subject to Congress's Commerce Clause power.[102] Channels of interstate commerce encompasses physical conduits of interstate commerce such as highways, waterways, railroads, airspace, and telecommunication networks, as well as the use of such interstate channels for ends Congress wishes to prohibit. As early as 1849, the Court had noted that whether "the transportation of passengers is a part of commerce is not now an open question."[103] In Hoke v. United States, the Court expanded its description of interstate commerce to include "the transportation of persons and property."[104] When the Court decided Caminetti v. United States in 1917, the Court observed that it was long settled that not only "the transportation of passengers in interstate commerce" but also the use of such authority to keep those channels "free from immoral and injurious uses" falls within Congress's regulatory power under the Commerce Clause.[105]

Courts have upheld various acts of Congress as falling within its authority to regulate channels of interstate commerce. For example, in United States v. Morrison, the Court noted that federal courts have uniformly upheld a federal prohibition on traveling across state lines to commit intimate-partner abuse, reasoning that the prohibition regulates "the use of channels of interstate commerce--i.e., the use of the interstate transportation routes through which persons and goods move."[106]

In Pierce County v. Guillen, the Court considered the constitutionality of a law that prohibited using certain highway data identifying hazardous highway locations, which the Highway Safety Act (HSA) of 1966 required states to collect, in discovery or as evidence in state or federal court proceedings.[107] The Court observed that the provision had been adopted in response to states being reluctant to comply with the HSA's requirements due to concerns about potential liability for accidents that occurred in those hazardous locations before they could be addressed.[108] The Court concluded that the data collection requirement was adopted to help state and local governments "in reducing hazardous conditions in the Nation's channels of commerce," and that "Congress could reasonably believe that adopting a measure eliminating an unforeseen side effect of the information-gathering requirement . . . would result in more diligent efforts [by states] to collect the relevant information."[109] Accordingly, the Court held that the provision preventing use of the data in state and federal court proceedings--not just the data collection itself--was within the scope of Congress's Commerce Clause power.[110]

Persons or Things in and Instrumentalities of Interstate Commerce

In United States v. Lopez, the Court identified "instrumentalities of interstate commerce, or persons or things in interstate commerce" as being subject to Congress's Commerce Clause power.[111] Consequently, Congress has authority to regulate persons or objects in interstate commerce and the instrumentalities[112] of interstate commerce. Regulation under this category is not limited to persons or objects crossing state lines but may extend to objects or persons that have or will cross state lines. Thus, for example, the Court has upheld federal laws that penalized convicted felons for possessing or receiving firearms that had been previously transported in interstate commerce, independent of any activity by the felons, with no other connection between the felons' conduct and interstate commerce.[113]

In United States v. Sullivan, the Court sustained a conviction for misbranding under the Federal Food, Drug and Cosmetic Act.[114] Sullivan, a pharmacist in Columbus, Georgia, had bought a properly labeled 1,000-tablet bottle of sulfathiazole from an Atlanta wholesaler. The bottle had been shipped to the Atlanta wholesaler by a Chicago supplier six months earlier. Three months after Sullivan received the bottle, he made two retail sales of 12 tablets each, placing the tablets in boxes not labeled in strict accordance with the law. Upholding the conviction, the Court concluded that there was no question of "the constitutional power of Congress under the Commerce Clause to regulate the branding of articles that have completed an interstate shipment and are being held for future sales in purely local or intrastate commerce."[115]

Intrastate Activities Having a Substantial Relation to Interstate Commerce

In United States v. Lopez, the Court identified "activities having a substantial relation to interstate commerce" as being subject to Congress's Commerce Clause power.[116] Consequently, Congress's power extends beyond transactions or actions that involve crossing state or national boundaries to activities that, though local in nature, sufficiently "affect" commerce. The Court has stated that, "even activity that is purely intrastate in character may be regulated by Congress, where the activity, combined with like conduct by others similarly situated, affects commerce among the States or with foreign nations."[117] This power derives from the Commerce Clause supplemented by the Necessary and Proper Clause.

The seminal case on Congress's authority to regulate certain intrastate commerce is Wickard v. Filburn, which sustained federal regulation of a wheat crop that was grown on a family farm and intended solely for home consumption.[118] The Court reasoned that even if the locally-grown and consumed wheat were never marketed, it supplied a need for the family that otherwise would have been satisfied through the market and therefore competes with wheat in commerce.[119] The Court also posited that if prices rose, the family might be induced to introduce the wheat onto the market.[120] Accordingly, the Court concluded, wheat grown on a farm for personal consumption could "have a substantial effect in defeating and obstructing [Congress's] purpose" in enacting the legislation if omitted from the regulatory scheme.[121]

Subsequent cases have applied a rational basis test to determine whether Congress may reasonably conclude that an activity affects interstate commerce, resulting in a broad application of the "affects" standard. In Hodel v. Indiana, the Court addressed provisions of the Surface Mining and Reclamation Control Act of 1977 designed to preserve "prime farmland." The trial court had relied on an interagency report that determined that the amount of such land disturbed annually by surface mining amounted to 0.006% of the total prime farmland acreage nationwide, concluding that the impact on commerce was "infinitesimal" or "trivial." Disagreeing, the Court said: "A court may invalidate legislation enacted under the Commerce Clause only if it is clear that there is no rational basis for a congressional finding that the regulated activity affects interstate commerce, or that there is no reasonable connection between the regulatory means selected and the asserted ends."[122] Moreover, "[t]he pertinent inquiry therefore is not how much commerce is involved but whether Congress could rationally conclude that the regulated activity affects interstate commerce."[123]

In a companion case, Hodel v. Virginia Surface Mining & Reclamation Ass'n, the Court reiterated that "[t]he denomination of an activity as a 'local' or 'intrastate' activity does not resolve the question whether Congress may regulate it under the Commerce Clause."[124] Rather, the Court stated, "the commerce power 'extends to those activities intrastate which so affect interstate commerce, or the exertion of the power of Congress over it, as to make regulation of them appropriate means to the attainment of a legitimate end, the effective execution of the granted power to regulate interstate commerce.'"[125] Judicial review is narrow. A court must defer to Congress's determination of an "effect" if it is rational, and Congress must have acted reasonably in choosing the means.[126]

The expansion of the class-of-activities standard in the "affecting" cases has been a potent engine of regulation. In Perez v. United States,[127] the Court sustained the application of a federal "loan-sharking" law to a local culprit. The Court held that, although individual loan-sharking activities might be intrastate in nature, Congress possessed the power to determine that the activity was within a class of activities that affected interstate commerce, thus affording Congress an opportunity to regulate the entire class. Although the Court and the congressional findings emphasized that loan-sharking was generally part of organized crime operating on a national scale and that loan-sharking was commonly used to finance organized crime's national operations, subsequent cases do not depend upon a defensible assumption of relatedness in the class.

The Court applied the federal arson statute to the attempted "torching" of a defendant's two-unit apartment building. The Court merely pointed to the fact that the rental of real estate "unquestionably" affects interstate commerce and that "the local rental of an apartment unit is merely an element of a much broader commercial market in real estate."[128] The apparent test of whether aggregation of local activity can be said to affect commerce was made clear next in an antitrust context.[129]

In a case allowing continuation of an antitrust suit challenging a hospital's exclusion of a surgeon from practice in the hospital, the Court observed that in order to establish the required jurisdictional nexus with commerce, the appropriate focus is not on the actual effects of the conspiracy but instead on the possible consequences for the affected market if the conspiracy is successful. The required nexus in this case was sufficient because competitive significance is measured by a general evaluation of the impact of the restraint on other participants and potential participants in the market from which the surgeon was excluded.[130]

Limits on Federal Regulation of Intrastate Activity

In United States v. Lopez[131] the Court, for the first time in almost sixty years,[132] invalidated a federal law as exceeding Congress's authority under the Commerce Clause. The statute made it a federal offense to possess a firearm within 1,000 feet of a school.[133] The Court reviewed the doctrinal development of the Commerce Clause, especially the effects and aggregation tests, and reaffirmed that it is the Court's responsibility to decide whether a rational basis exists for concluding that a regulated activity sufficiently affects interstate commerce when a law is challenged.[134] As noted previously, the Court's evaluation started with a consideration of whether the legislation fell within the three broad categories of activity that Congress may regulate or protect under its commerce power: (1) the use of the channels of interstate commerce; (2) the use of instrumentalities of interstate commerce; or (3) activities that substantially affect interstate commerce.[135]

The Court reasoned that the criminalized activity did not implicate the first two categories.[136] As for the third, the Court found an insufficient connection. First, a wide variety of regulations of "intrastate economic activity" has been sustained where an activity substantially affects interstate commerce. But the statute being challenged, the Court continued, was a criminal law that had nothing to do with "commerce" or with "any sort of economic enterprise." Therefore, it could not be sustained under precedents "upholding regulations of activities that arise out of or are connected with a commercial transaction, which viewed in the aggregate, substantially affects interstate commerce."[137] The provision did not contain a "jurisdictional element which would ensure, through case-by-case inquiry, that the firearm possession in question affects interstate commerce."[138] The existence of such a section, the Court implied, would have saved the constitutionality of the provision by requiring a showing of some connection to commerce in each particular case.

Finally, the Court rejected arguments of the government and dissent that there was a sufficient connection between the offense and interstate commerce.[139] At base, the Court's concern was that accepting the attenuated connection arguments presented would eviscerate federalism. The Court stated:

Under the theories that the government presents . . . it is difficult to perceive any limitation on federal power, even in areas such as criminal law enforcement or education where States historically have been sovereign. Thus, if we were to accept the Government's arguments, we are hard pressed to posit any activity by an individual that Congress is without power to regulate.Id. at 564.

Whether Lopez indicated a determination by the Court to police more closely Congress's exercise of its commerce power, so that it would be a noteworthy case,[140] or whether it was rather a "warning shot" across the bow of Congress, urging more restraint in the exercise of power or more care in the drafting of laws, was not immediately clear. The Court's decision five years later in United States v. Morrison,[141] however, suggests that stricter scrutiny of Congress's exercise of its commerce power is the chosen path, at least for legislation that falls outside the realm of economic regulation.[142] The Court will no longer defer, via rational basis review, to every congressional finding of substantial effects on interstate commerce, but instead will examine the nature of the asserted nexus to commerce, and will also consider whether a holding of constitutionality is consistent with its view of the commerce power as being a limited power that cannot be allowed to displace all exercise of state police powers.

In Morrison the Court applied Lopez principles to invalidate a provision of the Violence Against Women Act (VAWA) that created a federal cause of action for victims of gender-motivated violence. Gender-motivated crimes of violence "are not, in any sense of the phrase, economic activity,"[143] the Court explained, and there was allegedly no precedent for upholding commerce-power regulation of intrastate activity that was not economic in nature. The provision, like the invalidated provision of the Gun-Free School Zones Act, contained no jurisdictional element tying the regulated violence to interstate commerce. Unlike the Gun-Free School Zones Act, the VAWA did contain "numerous" congressional findings about the serious effects of gender-motivated crimes,[144] but the Court rejected reliance on these findings. "The existence of congressional findings is not sufficient, by itself, to sustain the constitutionality of Commerce Clause legislation. [The issue of constitutionality] is ultimately a judicial rather than a legislative question, and can be settled finally only by this Court."[145]

The problem with the VAWA findings was that they "relied heavily" on the reasoning rejected in Lopez--the "but-for causal chain from the initial occurrence of crime . . . to every attenuated effect upon interstate commerce." As the Court had explained in Lopez, acceptance of this reasoning would eliminate the distinction between what is truly national and what is truly local, and would allow Congress to regulate virtually any activity and basically any crime.[146] Accordingly, the Court "reject[ed] the argument that Congress may regulate noneconomic, violent criminal conduct based solely on that conduct's aggregate effect on interstate commerce." Resurrecting the dual federalism dichotomy, the Court could find "no better example of the police power, which the Founders denied the national government and reposed in the States, than the suppression of violent crime and vindication of its victims."[147]

Yet, the ultimate impact of these cases on Congress's power over commerce may be limited. In Gonzales v. Raich,[148] the Court reaffirmed an expansive application of Wickard v. Filburn, and signaled that its jurisprudence is unlikely to threaten the enforcement of broad regulatory schemes based on the Commerce Clause. In Raich, the Court considered whether the cultivation, distribution, or possession of marijuana for personal medical purposes pursuant to the California Compassionate Use Act of 1996 could be prosecuted under the federal Controlled Substances Act (CSA).[149] The respondents argued that this class of activities should be considered as separate and distinct from the drug-trafficking that was the focus of the CSA, and that regulation of this limited non-commercial use of marijuana should be evaluated separately.

In Raich, the Court declined the invitation to apply Lopez and Morrison to select applications of a statute, holding that the Court would defer to Congress if there was a rational basis to believe that regulation of home-consumed marijuana would affect the market for marijuana generally. The Court found that there was a "rational basis" to believe that diversion of medicinal marijuana into the illegal market would depress the price on the latter market.[150] The Court also had little trouble finding that, even in application to medicinal marijuana, the CSA was an economic regulation. Noting that the definition of "economics" includes "the production, distribution, and consumption of commodities,"[151] the Court found that prohibiting the intrastate possession or manufacture of an article of commerce is a rational and commonly used means of regulating commerce in that product.[152]

The Court's decision also contained an intertwined but potentially separate argument that Congress had ample authority under the Necessary and Proper Clause to regulate the intrastate manufacture and possession of controlled substances, because failure to regulate these activities would undercut the ability of the government to enforce the CSA generally.[153] The Court quoted language from Lopez that appears to authorize the regulation of such activities on the basis that they are an essential part of a regulatory scheme.[154] Justice Antonin Scalia, in concurrence, suggested that this latter category of activities could be regulated under the Necessary and Proper Clause regardless of whether the activity in question was economic or whether it substantially affected interstate commerce.[155]

Regulation of Activity Versus Inactivity

While the Supreme Court has interpreted Congress's Commerce Clause authority to reach a wide range of activity, it has concluded that the Commerce Clause does not authorize Congress to regulate inactivity. In National Federation of Independent Business (NFIB) v. Sebelius,[156] the Court held that Congress does not have the authority under the Commerce Clause to impose a requirement compelling certain individuals to maintain a minimum level of health insurance. The "individual mandate" provisions of the Affordable Care Act generally subject individuals who failed to purchase health insurance to a monetary penalty, administered through the tax code.[157]

Chief Justice John Roberts's controlling opinion[158] suggested that Congress's authority to regulate interstate commerce presupposes the existence of a commercial activity to regulate. Further, his opinion noted that the commerce power had been uniformly described in previous cases as involving the regulation of an "activity."[159] The individual mandate, on the other hand, compels an individual to become active in commerce on the theory that the individual's inactivity affects interstate commerce. Justice Roberts suggested that regulation of individuals because they are doing nothing would result in an unprecedented expansion of congressional authority with few discernable limitations. While recognizing that most people are likely to seek health care at some point in their lives, Justice Roberts noted that there was no precedent for the argument that individuals who might engage in a commercial activity in the future could, on that basis, be regulated today.[160]

Regulation of Interstate Commerce to Achieve Policy Goals

Congress has, at times, used its interstate Commerce Clause authority to pursue policy goals tangential or unrelated to the commercial nature of the activity being regulated. The Court has several times expressly noted that Congress's exercise of power under the Commerce Clause is akin to the police power exercised by the states.[161] Many of the 1964 public accommodations law applications have been premised on the point that large and small establishments alike may serve interstate travelers, making it permissible for Congress to regulate them under the Commerce Clause so as to prevent or deter racial discrimination.[162] For example, in Heart of Atlanta Motel, Inc. v. United States, the Court upheld a provision of Title II of the Civil Rights Act of 1964 that prohibited certain categories of business establishments that served interstate travelers from discriminating or segregating on the basis of race, color, religion, or national origin.[163] In that same case, the Court observed that Congress had used its authority over and interest in protecting interstate commerce to regulate gambling, criminal enterprises, deceptive sales practices, fraudulent security transactions, misbranding drugs, labor practices such as wages and hours, labor union membership, crop control, discrimination against shippers, injurious price cutting that affected small businesses, resale price maintenance, professional football, and racial discrimination in bus terminal restaurants.[164]

Civil Rights and Commerce Clause

It has been generally established that Congress has power under the Commerce Clause to prohibit racial discrimination in the use of channels of commerce.[165] The Court firmly and unanimously sustained the power under the clause to forbid discrimination within the states when Congress in 1964 enacted a comprehensive measure outlawing discrimination because of race or color in access to public accommodations with a requisite connection to interstate commerce.[166] Hotels and motels were declared covered--that is, declared to "affect commerce"--if they provided lodging to transient guests; restaurants, cafeterias, and the like, were covered only if they served or offered to serve interstate travelers or if a substantial portion of the food which they served had moved in commerce.[167] The Court sustained the Act as applied to a downtown Atlanta motel that did serve interstate travelers,[168] to an out-of-the-way restaurant in Birmingham that catered to a local clientele but that had spent 46 percent of its previous year's out-go on meat from a local supplier who had procured it from out-of-state,[169] and to a rural amusement area operating a snack bar and other facilities, which advertised in a manner likely to attract an interstate clientele and that served food a substantial portion of which came from outside the state.[170]

Writing for the Court in Heart of Atlanta Motel and McClung, Justice Tom Clark denied that Congress was disabled from regulating the operations of motels or restaurants because those operations may be, or may appear to be, "local" in character. He wrote: "[T]he power of Congress to promote interstate commerce also includes the power to regulate the local incidents thereof, including local activities in both the States of origin and destination, which might have a substantial and harmful effect upon that commerce."[171]

Although Congress was regulating on the basis of moral judgments and not to facilitate commercial intercourse, the Court still considered Congress's actions to be covered by the Commerce Clause. The Heart of Atlanta Court stated:

That Congress [may legislate] . . . against moral wrongs . . . rendered its enactments no less valid. In framing Title II of this Act Congress was also dealing with what it considered a moral problem. But that fact does not detract from the overwhelming evidence of the disruptive effect that racial discrimination has had on commercial intercourse. It was this burden which empowered Congress to enact appropriate legislation, and, given this basis for the exercise of its power, Congress was not restricted by the fact that the particular obstruction to interstate commerce with which it was dealing was also deemed a moral and social wrong.Heart of Atlanta Motel, Inc., 379 U.S. at 257.

The Court held that evidence supported Congress's conclusion that racial discrimination impeded interstate travel by more than 20 million Black citizens, which was an impairment Congress could legislate to remove.[172]

The Commerce Clause basis for civil rights legislation prohibiting private discrimination was important because early cases had interpreted Congress's power under the Fourteenth and Fifteenth Amendments as limited to official discrimination.[173] The Court's subsequent determination that Congress has broader powers under the Fourteenth and Fifteenth Amendments reduced the importance of the Commerce Clause in this area.[174]

Criminal Law and Commerce Clause

Federal criminal jurisdiction based on the commerce or postal power has historically been an auxiliary criminal jurisdiction. That is, Congress has made federal crimes of acts that would usually constitute state crimes but for some contact, however tangential, with a matter subject to congressional regulation even though the federal interest in the acts may be minimal.[175] Early examples of this type of federal criminal statute include the Mann Act of 1910, which outlawed transporting a woman or girl across state lines for purposes of prostitution, debauchery, or other immoral acts,[176] the Dyer Act of 1919, which criminalized interstate transportation of stolen automobiles,[177] and the Lindbergh Law of 1932, which made transporting a kidnapped person across state lines a federal crime.[178] Congress subsequently expanded federal criminal law beyond prohibiting use of interstate facilities in the commission of a crime. Typical of this expansion is a statute making it a federal offense to "in any way or degree obstruct . . . delay . . . or affect . . . commerce . . . by robbery or extortion."[179] But Congress's authority to make crimes federal offenses is not unlimited. In its 1821 Cohens v. Virginia decision, the Court held that "Congress cannot punish felonies generally" and may enact only those criminal laws that are connected to one of its constitutionally enumerated powers, such as the commerce power.[180] As a consequence, most federal offenses include a jurisdictional element that ties the underlying offense to one of Congress's constitutional powers.[181]

Dormant Commerce Clause

Overview of Dormant Commerce Clause

Even as the Commerce Clause empowers Congress to pass federal laws, it has also come to limit state authority to regulate commerce. In contrast to the doctrine of preemption, which generally applies in areas where Congress has acted,[182] the so-called "Dormant" Commerce Clause may bar state or local regulations even where there is no relevant congressional legislation. Although the Commerce Clause "is framed as a positive grant of power to Congress" and not an explicit limit on states' authority,[183] the Supreme Court has also interpreted the Clause to prohibit state laws that unduly restrict interstate commerce even in the absence of congressional legislation--i.e., where Congress is "dormant." This "negative" or "dormant" interpretation of the Commerce Clause "prevents the States from adopting protectionist measures and thus preserves a national market for goods and services."[184]

The Supreme Court has identified two principles that animate its modern Dormant Commerce Clause analysis. First, subject to certain exceptions, states may not discriminate against interstate commerce.[185] Second, states may not take actions that are facially neutral but unduly burden interstate commerce.[186]

On May 11, 2023, the Supreme Court issued an opinion in National Pork Producers Council v. Ross affirming a lower court decision dismissing a lawsuit that California's Proposition 12, which forbids selling pork from certain pigs that are "confined in a cruel manner," violates the Dormant Commerce Clause.[187] In reaching its decision, the Court rejected an argument that Proposition 12 violated an "extraterritoriality doctrine" that would "forbid[] enforcement of state laws that have the 'practical effect of controlling commerce outside the State,' even when those laws do not purposely discriminate against out-of-state economic interests."[188] The Court also rejected an argument that Proposition 12 violated the Dormant Commerce Clause under the Pike v. Bruce Church Inc. line of cases, which the petitioners had argued provides that courts should "assess 'the burden imposed on interstate commerce' by a state law and prevent its enforcement if the law's burdens are 'clearly excessive in relation to the putative local benefits.'"[189]

Historical Background on Dormant Commerce Clause

The Supreme Court has long rooted its Dormant Commerce Clause jurisprudence in historical circumstances, characterizing the doctrine as a response to the state barriers to trade that served as an impetus for developing a new Constitution.[190] Under the Articles of Confederation, Congress lacked the authority to regulate interstate and foreign commerce.[191] The Annapolis Convention of 1786 was convened out of a desire to remove the protectionist barriers to trade that some states had imposed.[192] At the Philadelphia Convention in 1787, the Framers discussed Congress's authority to regulate interstate commerce in the context of that goal.[193]

In the Federalist Papers, Alexander Hamilton and James Madison discussed the benefits of a free national market, such as improving the circulation of commodities for export to foreign markets, increasing the diversity and scope of production, facilitating aid between the states, and providing for more advantageous terms of foreign trade.[194] They also warned that protectionism could lead to interstate conflicts.[195]

Despite these concerns, the Framers did not adopt a constitutional provision expressly addressing state and local regulations affecting interstate commerce. The Import-Export Clause provides that "[n]o State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing its inspection laws."[196] That clause has not been held to apply to trade among the states, however.[197] Similarly, in the Federalist No. 32, Hamilton asserted that the states' taxing authority "remains undiminished" save for imposts or duties on imports or exports.[198] He did not specify, however, whether Congress and the states also enjoyed concurrent power over interstate and foreign commerce. Instead, the Supreme Court has developed its Dormant Commerce Clause jurisprudence to serve as a limitation on some state regulations and taxes, and has linked that jurisprudence with the concerns and goals expressed by the various Framers.

Early Dormant Commerce Clause Jurisprudence

The Supreme Court first described the principles that would become the dormant Commerce Clause doctrine in 1824. In Gibbons v. Ogden, the Court struck down New York's grant of a monopoly on steamboat traffic in New York waters.[199] The Court decided the case on Supremacy Clause grounds, ruling that the Federal Coastal Act of 1793 preempted the state law. Accordingly, the Court did not decide whether the Commerce Clause barred states from regulating interstate commerce. Chief Justice John Marshall recognized, however, the "great force" of Daniel Webster's argument that the state law violated the Commerce Clause because that clause conferred upon Congress an exclusive power to regulate national commerce.[200] In dicta, Chief Justice Marshall suggested that the power to regulate commerce between the states might be exclusively federal.[201] At the same time, he also recognized that any national power to regulate commerce coexisted with state regulatory authority over matters that could affect commerce, such as laws governing inspection, quarantine, and health, as well as "laws for regulating the internal commerce of a State."[202]

Chief Justice Marshall again addressed the nascent Dormant Commerce Clause doctrine in Willson v. Black-Bird Creek Marsh Co.[203] In that case, a sloop owner whose vessel ran into a dam across a navigable creek challenged a state law authorizing the construction of the dam, arguing that the law conflicted with the federal power to regulate interstate commerce. The Supreme Court rejected this argument, concluding that the state law could not "be considered as repugnant to the [federal] power to regulate commerce in its dormant state . . . ."[204] The Court did not explain the basis for its holding, however, or attempt to square it with the ruling in Gibbons.

Over time, the Court came to add more nuance than was present in its earliest dicta. In Cooley v. Board of Wardens,[205] the Court enunciated a doctrine of partial federal exclusivity that inquired into the subject of a regulation. The Court distinguished between subjects of interstate commerce that "imperatively demand a single uniform rule" nationwide, and subjects of commerce that do not demand such uniformity and which may require "that diversity, which alone can meet the local necessities."[206] While the Court held that Congress's power over the former category was exclusive, it also held that Congress and the states could concurrently regulate the latter category. Concluding that the regulation of pilotage was "incapable of uniformity throughout all the states," the Court upheld a Pennsylvania state law that required ships to hire a local pilot when entering or leaving the Port of Philadelphia.[207]

The Court first struck down a state law solely on Commerce Clause grounds more than two decades later. In the State Freight Tax Case, the Court held unconstitutional a statute that required every company transporting freight within the state, with certain exceptions, to pay a tax at specified rates on each ton of freight carried.[208] Two years later, in Welton v. Missouri,[209] the Court held unconstitutional a state law that required a peddler's license for merchants selling goods that came from other states. In doing so, it identified two separate goals that the dormant Commerce Clause might serve. First, it adopted Cooley's consideration of the goal of uniformity of commercial regulation. It then provided the additional justification that Congress had not enacted specific legislation governing interstate commerce, which was "equivalent to a declaration that inter-State commerce shall be free and untrammelled." In other words, Congress's silence on the subject was an indication that states could not regulate it.[210]

Prior to 1945, the Court considered whether state regulations imposed unreasonable or undue burdens on interstate commerce, but did not generally weigh a regulation's burdens against its benefits. Instead, the Court distinguished between instances where a state regulated interstate commerce and thus imposed a "direct" and impermissible burden on interstate commerce, and those where it imposed an "indirect" burden or merely "affected" interstate commerce, such as in the course of exercising its police powers.[211] The Court indicated that "a state enactment [that] imposes a direct burden upon interstate commerce . . . must fall regardless of federal legislation," indicating that such laws would be invalid even if they were not actually discriminatory.[212]