Constitution of the United States/Art. I/Sec. 10/Clause 1 Proscribed Powers

Article I Legislative Branch

Section 10 Powers Denied States

Clause 1 Proscribed Powers

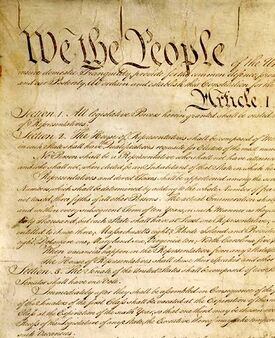

| Clause Text |

|---|

| No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility. |

Foreign Policy by States[edit | edit source]

At the time of the Civil War, the Court relied on the prohibition on treaties, alliances, or confederations in holding that the Confederation formed by the seceding states could not be recognized as having any legal existence.[1] Today, the prohibition's practical significance lies in the limitations that it implies upon the power of the states to deal with matters having a bearing upon international relations.

In the early case of Holmes v. Jennison,[2] Chief Justice Roger Taney invoked it as a reason for holding that a state had no power to deliver up a fugitive from justice to a foreign state. More recently, the kindred idea that the responsibility for the conduct of foreign relations rests exclusively with the Federal Government prompted the Court to hold that, because the oil under the three-mile marginal belt along the California coast might well become the subject of international dispute, and because the ocean, including this three-mile belt, is of vital consequence to the Nation in its desire to engage in commerce and to live in peace with the world, the Federal Government has paramount rights in and power over that belt, including full dominion over the resources of the soil under the water area.[3] In Skiriotes v. Florida,[4] the Court, on the other hand, ruled that this clause did not disable Florida from regulating the manner in which its own citizens may engage in sponge fishing outside its territorial waters. Speaking for a unanimous Court, Chief Justice Charles Evans Hughes declared, "When its action does not conflict with federal legislation, the sovereign authority of the State over the conduct of its citizens upon the high seas is analogous to the sovereign authority of the United States over its citizens in like circumstances."[5]

Coining Money by States[edit | edit source]

Within the sense of the Constitution, bills of credit signify a paper medium of exchange, intended to circulate between individuals, and between the government and individuals, for the ordinary purposes of society. It is immaterial whether the quality of legal tender is imparted to such paper. Interest-bearing certificates, in denominations not exceeding ten dollars, that were issued by loan offices established by the state of Missouri and made receivable in payment of taxes or other moneys due to the state, and in payment of the fees and salaries of state officers, were held to be bills of credit whose issuance was banned by this section.[6] The states are not forbidden, however, to issue coupons receivable for taxes,[7] nor to execute instruments binding themselves to pay money at a future day for services rendered or money borrowed.[8] Bills issued by state banks are not bills of credit;[9] it is immaterial that the state is the sole stockholder of the bank,[10] that the officers of the bank were elected by the state legislature,[11] or that the capital of the bank was raised by the sale of state bonds.[12]

Legal Tender Issued by States[edit | edit source]

Relying on this clause, which applies only to the states and not to the Federal Government[13], the Supreme Court has held that, where the marshal of a state court received state bank notes in payment and discharge of an execution, the creditor was entitled to demand payment in gold or silver.[14] Because, however, there is nothing in the Constitution prohibiting a bank depositor from consenting when he draws a check that payment may be made by draft, a state law providing that checks drawn on local banks should, at the option of the bank, be payable in exchange drafts, was held valid.[15]

State Bills of Attainder[edit | edit source]

A bill of attainder is legislation that imposes punishment on a specific person or group of people without a judicial trial.[16] The Constitution includes two separate clauses respectively banning enactment of bills of attainder by the federal government and the states.[17] The Supreme Court has interpreted the federal and state bill of attainder prohibitions as having the same scope.[18]

The Supreme Court applied the constitutional prohibition on state bills of attainder in a Reconstruction-era case, Cummings v. Missouri.[19] That case involved a post-Civil War amendment to the Missouri constitution that required persons engaged in certain professions to swear an oath that they had never been disloyal to the United States.[20] The Court held that the purpose and effect of the challenged provision was to punish a group of individuals who had been disloyal to the United States by effectively permanently excluding them from the covered professions.[21] Based on that holding, the Supreme Court invalidated the provision as an unconstitutional bill of attainder.[22]

In Drehman v. Stifle, the Supreme Court rejected a bill of attainder challenge to another provision of the Missouri constitution that barred civil suits against individuals for actions taken under federal or state military authority during the Civil War.[23] The Court concluded that the law did not impose punishment on those who might want to file such suits: "If not the opposite of penal, there is certainly nothing punitive in its character. It simply exempts from suits . . . those who might otherwise be harassed by litigation and made liable in damages."[24]

The Supreme Court has also rejected bill of attainder challenges to state and local rules imposing employment qualifications, as long as those employment qualifications were not punitive. For instance, in Garner v. Board of Public Works, the Supreme Court considered bill of attainder challenges to a provision of the Charter of the City of Los Angeles barring from public employment any person who within the last five years had been affiliated with a group that advocated the forceful overthrow of the government, and a city ordinance requiring public employees to state whether they had ever been members of the Communist Party.[25] The Court upheld both provisions, holding that a bill of attainder must inflict punishment, and the Court was "unable to conclude that punishment is imposed by a general regulation which merely provides standards of qualification and eligibility for employment."[26] Similarly, in De Veau v. Braisted, the Supreme Court rejected a bill of attainder challenge to a state law that prevented any person who had been convicted of a felony and had not been pardoned from serving as an officer or agent for certain labor organizations.[27] A plurality of the Court held that the law "embodies no further implications of appellant's guilt than are contained in his . . . judicial conviction; and so it manifestly is not a bill of attainder."[28]

The state Bill of Attainder Clause is part of a single sentence of the Constitution that provides, "No State shall . . . pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts."[29] In Fletcher v. Peck, Chief Justice John Marshall stated that those restrictions on state legislative power "may be deemed a bill of rights for the people of each state."[30] The Supreme Court has held that the state Ex Post Facto Clause[31] and the Contract Clause,[32] also located in Article I, Section 10, Clause 1, apply only to legislative action and do not apply to judicial decisions.[33] The Court has not expressly considered whether the state Bill of Attainder Clause similarly excludes judicial action, but because it is located in the same provision barring states from "pass[ing]" prohibited laws, it is likely the Court would interpret this clause in the same way.

State Ex Post Facto Laws[edit | edit source]

An ex post facto law is a law that imposes criminal liability or increases criminal punishment retroactively.[34] Two separate clauses of the Constitution, Article I, Sections 9 and 10, ban enactment of ex post facto laws by the Federal Government and the states, respectively.[35] The Supreme Court has cited cases interpreting the federal Ex Post Facto Clause in challenges under the state clause, and vice versa, treating the two clauses as having the same scope.[36] The Court's decisions interpreting both clauses are therefore discussed collectively in greater detail in the Article I, Section 9 essays on the federal Ex Post Facto Clause.[37] In particular, those essays on federal and state ex post facto laws discuss Supreme Court jurisprudence addressing imposing or increasing punishments, procedural changes, employment qualifications, retroactive taxes, inapplicability to judicial decisions, and deportation and related issues.

The Supreme Court has interpreted the Ex Post Facto Clauses to limit only legislation that is criminal or penal in nature,[38] though the Court has also made clear that "the ex post facto effect of a law cannot be evaded by giving a civil form to that which is essentially criminal."[39] In addition, the Court has uniformly applied the prohibition on ex post facto legislation only to laws that operate retroactively.[40] In the 1798 case Calder v. Bull, the Court enumerated four ways in which a legislature may violate the Ex Post Facto Clauses' prohibition on imposing retroactive criminal liability: (1) making criminal an action taken before enactment of the law that was lawful when it was done; (2) increasing the severity of an offense after it was committed; (3) increasing the punishment for a crime after it was committed; and (4) altering the rules of evidence after an offense was committed so that it is easier to convict an offender.[41] The Ex Post Facto Clauses are related to other constitutional provisions that limit retroactive government action, including the federal and state Bill of Attainder Clauses, the Contract Clause, and the Due Process Clauses.[42]

Multiple Supreme Court decisions have held that the Ex Post Facto Clauses apply only to federal and state legislation, not to judicial decisions.[43] The state Ex Post Facto Clause also applies to state constitutional amendments. In Cummings v. Missouri, the Court considered a challenge to a post-Civil War amendment to the Missouri Constitution that required persons engaged in certain professions to swear an oath that they had never been disloyal to the United States.[44] In holding that the amendment violated the state Ex Post Facto Clause, the Court looked to the Clause's language providing that "'no State'--not no legislature of a State, but that 'no State'--should pass any ex post facto law," and concluded that "[i]t can make no difference, therefore, whether such legislation is found in a constitution or in a law of a State; if it be within the prohibition it is void."[45]

Contracts[edit | edit source]

Overview of Contract Clause[edit | edit source]

In addition to prohibiting states from enacting bills of attainder and ex post facto laws, the Constitution seeks to protect private rights from state interference by limiting the states' power to enact legislation that alters existing contract rights.[46] The Constitution's Contract Clause provides: "No State shall . . . pass any . . . Law impairing the Obligation of Contracts."[47] Although this language could be read as completely prohibiting a state's legislative impairment of contracts, the Supreme Court has interpreted the clause to limit a state's power to enact legislation that: (1) breaches or modifies its own contracts; or (2) regulates contracts between private parties.[48]

The Supreme Court has held that the Contract Clause does not generally prevent states from enacting laws to protect the welfare of their citizens.[49] Thus, states retain some authority to enact laws with retroactive effect that alter contractual or other legal relations among individuals and entities.[50] However, a state's regulation of contracts, whether involving public or private parties, must generally be reasonably designed and appropriately tailored to achieve a legitimate public purpose.[51]

Prior to the ratification of the Fourteenth Amendment and the subsequent development of the Supreme Court's Due Process jurisprudence in the late nineteenth and early twentieth centuries, the Contract Clause was one of the few constitutional clauses that expressly limited the power of the states.[52] As Chief Justice John Marshall explained in an early opinion interpreting the Contract Clause, the Framers' intent in including such language in the Constitution was to prohibit states from enacting legislation intended to assist debtors by abrogating or modifying the terms of existing contracts, as many colonies and states had done during the Colonial Era and under the Articles of Confederation.[53] Many of the Framers believed that such laws discouraged commerce and the extension of credit, undermining the stability of contractual relations and damaging the national economy.[54] Although limited evidence exists to clarify the Contract Clause's original meaning, James Madison argued during debates over ratification of the Constitution that the Clause would prevent shifting state legislative majorities from retroactively impairing private rights.[55] And Alexander Hamilton suggested that the Contract Clause would avoid a breakdown in commercial relations among the states, noting that state laws abrogating private contract rights could serve as a source of hostility among them.[56]

The Supreme Court's views on the level of protection that the Contract Clause provides for contract rights have shifted over time. During the 1800s, and in particular prior to the ratification of the Fourteenth Amendment in 1868, the Supreme Court often relied on the Contract Clause to strike down state legislation as unconstitutional when it interfered with existing contract rights.[57] The Court interpreted the Clause to protect a variety of property interests, such as an executed grant of land[58] and the state-granted charter of a private corporation.[59] But even during the early years of the Republic, the Court recognized that the states retained some power to regulate contracts in order to further the public interest.[60]

During the late nineteenth and early twentieth centuries, the Supreme Court decided cases that gradually weakened the Contract Clause's protections.[61] The Court's view of the Contract Clause underwent a major change during the New Deal Era when the Court decided Home Building & Loan Ass'n v. Blaisdell.[62] In that case, the Court declined to enforce strictly the Contract Clause's prohibition on state legislation that alters private contracts.[63] During the depths of the Great Depression, the Court upheld the Minnesota Mortgage Moratorium Law, which allowed courts to extend temporarily the period of time during which a mortgagor (e.g., a homeowner) could redeem a home after the bank foreclosed on the property.[64] The Supreme Court's decision in Blaisdell marked a turning point in its Contract Clause jurisprudence, signaling that the Court would thereafter be more solicitous of states' use of their police powers to regulate contracts to "protect the lives, health, morals, comfort and general welfare of the people," even when the exercise of such powers would substantially impact contract rights.[65]

Since Blaisdell, the Court has permitted state legislatures to modify contract rights to serve the public interest in several cases.[66] Nonetheless, since the 1970s, the Court has decided a few cases indicating that the Contract Clause still provides some protection for contracts, at least when the state lacks a legitimate public purpose for substantially interfering with contract rights and has not regulated such rights in a reasonable or necessary way.[67] For example, the Contract Clause continues to prohibit states from unreasonably and unnecessarily breaching certain legislative covenants with private bondholders,[68] and from enacting legislation that regulates private pension contracts by imposing a substantial new and retroactive payment obligation on a narrow class of companies.[69]

Historical Background on Contract Clause[edit | edit source]

After the American Revolution, many citizens of the newly created United States had difficulty repaying their debts, motivating state legislatures to enact a number of laws to relieve them of their financial obligations.[70] During the peak of this financial crisis, and under the Articles of Confederation, states enacted laws that assisted debtors by, for example, (1) permitting a debtor to tender worthless property or nearly valueless commodities in payment of debts; (2) extending the time for repaying a debt beyond the time period provided for in a contract; and (3) permitting the payment of overdue obligations in installments rather than a lump sum.[71]

Historical sources from the time of the Founding do not shed much light on the Contract Clause's original meaning.[72] Certainly, the Framers knew the states had enacted various laws that disrupted private contracts, and they wanted to protect private property rights.[73] At least some of the delegates who attended the Constitutional Convention of 1787 in Philadelphia were aware that the Confederation Congress, the country's governing body under the Articles of Confederation, had recently passed an ordinance governing the Northwest Territory that specifically protected private contract rights from legislative interference.[74] Article 2 of the Northwest Ordinance provided that "in the just preservation of rights and property it is understood and declared, that no law ought ever to be made, or have force in the said territory, that shall in any manner whatever interfere with, or affect private contracts or engagements, bona fide and without fraud previously formed."[75]

During deliberations over the Constitution, delegate Rufus King of Massachusetts proposed to insert the Northwest Ordinance's broad language into the Constitution.[76] Delegates Gouverneur Morris and George Mason opposed the addition of this language, arguing that state legislatures would occasionally need to modify contract rights in order to protect their citizens.[77] On the other hand, James Madison "admitted that inconvenience might arise from such a prohibition but thought on the whole it would be overbalanced by the utility of it."[78] However, Madison suggested that the Constitution's prohibition on ex post facto laws would prevent states from impairing the obligation of contracts retroactively, and the delegates approved language in Article I, Section 10 of the draft Constitution without the proposed Contract Clause.[79]

The next day, however, delegate John Dickinson of Delaware stated that, after further research, he had determined the term ex post facto "related to criminal cases only; that [the language prohibiting such laws] would not, consequently, restrain the states from retrospective laws in civil cases; and that some further provision for this purpose would be requisite."[80] Nonetheless, the delegates did not approve the Contract Clause's addition to the Constitution during these deliberations; rather, the Committee of Style and Arrangement, which produced the final version of the Constitution, added a modified version of the Contract Clause to the document without significant comment.[81]

The debates over the Constitution's ratification briefly addressed the Contract Clause. Federalists, who generally supported a strong central government, argued the clause would (1) protect private contract rights from state debtor relief legislation; and (2) improve commercial relations among the states. Writing in the Federalist No. 44, James Madison briefly discussed the importance of the Contract Clause along with the Ex Post Facto Clause and the Constitution's prohibition on bills of attainder.[82] Madison argued these clauses would prevent shifting state legislative majorities from retroactively impairing private rights.[83] The Framers may also have added the Contract Clause to prevent a breakdown in commercial relations among the states. In the Federalist No. 7, Alexander Hamilton noted that state laws abrogating private contract rights could serve as a source of hostility among the states.[84] And several other speakers at state ratifying conventions argued that the Contract Clause would protect interstate contracts from impairment.[85] Perhaps surprisingly, the Anti-Federalists, who generally opposed a strong central government, supported the Contract Clause.[86] However, they believed that state courts rather than federal courts should enforce it.[87]

Although most commentators involved in debates over the proposed Constitution agreed that the document should include the Contract Clause, one delegate to the Federal Convention, Maryland Attorney General Luther Martin, opposed the Clause.[88] In a letter to the Maryland House of Delegates that foreshadowed the development of the Supreme Court's jurisprudence, Martin argued that the Contract Clause would tie states' hands and prevent them from modifying contracts to address national crises.[89]

As Justice John Marshall explained in an early opinion interpreting the Contract Clause, the Framers' intent in including such language in the Constitution was to prohibit states from enacting legislation intended to assist debtors by abrogating or modifying the terms of existing contracts,[90] as many colonies and states had done during the Colonial Era and under the Articles of Confederation.[91] The Founders believed these laws injured creditors and undermined contractual relationships.[92] The Constitution's Framers therefore sought to preserve faith in contractual relationships--and facilitate interstate and foreign commerce--by adding a constitutional restraint on state power to impair contractual obligations.[93] This restraint reflected the Framers' preference for private ordering; that is, the notion that private parties could enter into and rely upon binding contracts to "order their personal and business affairs."[94]

Evolution of Contract Clause's Use[edit | edit source]

During the 1800s, the Supreme Court often relied on the Contract Clause to strike down as unconstitutional state legislation that interfered with existing contract rights. In fact, the Court relied on the Contract Clause in one of the earliest cases in which it determined that a state law violated the Constitution: its 1810 decision in Fletcher v. Peck.[95] In that case, the Court interpreted the Contract Clause to protect public contracts (i.e., those involving a state as a party to an agreement with one or more private entities) in addition to private agreements.[96] The Court determined that a state could not breach its own contracts with private parties by revoking a grant of real estate.[97] Almost a decade later, the Court held in Trustees of Dartmouth College v. Woodward that the Contract Clause barred a state from enacting legislation that substantially interfered with a private corporate charter established under state law.[98] And with respect to contracts between private parties, in the 1819 decision, Sturges v. Crowninshield, the Court held that a bankruptcy law allowing insolvent debtors to obtain the discharge of their debts by surrendering their property violated the Contract Clause.[99] But even during the early years of the Republic, the Court recognized that states retained some power to regulate contracts in order to further the public interest.[100]

The Supreme Court's view of the Contract Clause changed significantly during the New Deal Era when the Court decided Home Building & Loan Ass'n v. Blaisdell, a case in which the Court declined to enforce strictly the Contract Clause's prohibition on state legislation that altered private contracts.[101] During the depths of the Great Depression, the Court upheld the constitutionality of the Minnesota Mortgage Moratorium Law, which allowed courts to extend temporarily the period of time during which a mortgagor (e.g., a homeowner) could redeem a home after the bank foreclosed on the property.[102] Although the Minnesota law prevented the mortgagee from obtaining actual possession, the Court upheld the law as necessary and reasonable to address the economic crisis because it was appropriately tailored to address the emergency and was limited in duration.[103] The Court determined that a state had the power to regulate existing contracts to "safeguard the vital interests of its people"[104] as an exercise of its sovereignty.[105]

The Supreme Court's decision in Blaisdell marked a turning point in its Contract Clause jurisprudence, signaling that the Court would thereafter be more solicitous of states' use of their police powers to regulate contracts to "protect the lives, health, morals, comfort and general welfare of the people,"[106] even when the exercise of such powers would substantially impact contract rights. Since Blaisdell, the Court has permitted states to alter contract rights legislatively to serve a legitimate public interest.[107] But the Court has indicated that the Contract Clause still provides some protection for contracts.[108] For example, in a 1978 case, the Court closely scrutinized state legislation affecting public contracts and held that the Contract Clause prohibited a state from breaching a legislative covenant it made with private bondholders.[109] In the context of private contracts, although the Court continues to defer to the judgment of a state's legislature when weighing the impairment of private contracts against the public purposes that allegedly motivated the challenged legislation's enactment, the Court has held that the Clause prohibits a state from enacting legislation that regulates private contracts by imposing a substantial new and retroactive payment obligation on a narrow class of companies.[110]

State Contracts[edit | edit source]

Early Cases on State Modifications to State Contracts[edit | edit source]

Early in the nation's history, the Supreme Court established that, in addition to barring a state from substantially interfering with contracts of private individuals, the Constitution's Contract Clause may prohibit a state from breaching or modifying its own contracts. In fact, one of the first cases in which the Supreme Court struck down a state law as unconstitutional arose under the Contract Clause, and involved contracts between the State of Georgia and private parties.[111] In Fletcher v. Peck, Robert Fletcher sued John Peck, arguing, among other things, that Peck lacked clear title to a tract of land he had conveyed to Fletcher.[112] The State of Georgia sold the tract to private parties in 1795 by an act of its legislature.[113] However, a subsequent legislature, determining that corruption tainted the sale, passed a law purporting to rescind the earlier grant.[114] This raised the question of whether Peck had title to the land he purported to convey to Fletcher.

Chief Justice John Marshall, writing for the Court, characterized Georgia's original sale of land as a contract between Georgia and private parties that fell within the scope of the Contract Clause.[115] Although the contract had already been executed, the grant of real estate continued to impose obligations on Georgia not to reassert title to the land.[116] The Court interpreted the Contract Clause to prohibit a state from breaching its own contracts as well as impairing those between private individuals.[117] Drawing a comparison between the act rescinding the land grant and an unconstitutional ex post facto state law that punished an individual for an act that was not a crime at the time it was committed, the Court determined that the Contract Clause prohibited the Georgia legislature from nullifying its earlier grant of land.[118] The Court stated that subsequent purchasers of the land bought it without notice of the corrupt intent of the legislature that initially conveyed it, and, therefore, "the state of Georgia was restrained, either by general principles which are common to our free institutions, or by the particular provisions of the constitution of the United States, from passing a law whereby the estate of the plaintiff in the premises so purchased could be constitutionally and legally impaired and rendered null and void."[119] The Court's decision in Fletcher was an early indication that the Justices would closely scrutinize a state's breach of its own contracts with private parties, and that grants of real estate could constitute contract rights protected by the Contract Clause.

Nine years later, in a seminal corporate law decision, the Supreme Court further extended its interpretation of the types of contracts and property interests protected by the Contract Clause, determining the Clause may prohibit states from revoking or substantially interfering with private corporate charters established under state law. In Trustees of Dartmouth College v. Woodward, the New Hampshire state legislature enacted a law amending the corporate charter of Dartmouth College, which King George III of Great Britain established in a 1769 grant.[120] New Hampshire altered the charter to vest control of the College in the state's governor and other state officials.[121] The majority of the college's trustees objected to this transfer of control of the College to the state and sued the secretary of the new board of trustees to recover corporate property transferred to the new secretary.[122]

The Court determined that Dartmouth's corporate charter was a contract subject to the Contract Clause even though the Constitution's Framers may not have contemplated the Clause would protect rights granted under a corporate charter.[123] In support of this view, the Court focused on the law's effects on the corporation's property, noting the charter had been made for the "security and disposition of property" and that "real and personal estate ha[d] been conveyed to the corporation" to accomplish its mission of education.[124] Donors gifted the College with money and property upon the expectation that its mission would be fulfilled by the trustees without interference by the state legislature.[125]

Having determined the trustees' rights under the corporate charter were protected by the Contract Clause, the Court further decided that the New Hampshire law impaired these rights because, contrary to the will of the College's donors, the legislation transferred the power of governing the College from the trustees appointed in the founder's will to the New Hampshire governor and placed donor funds under the state government's control.[126] The College's founders donated funds with the expectation that the charter would protect the objectives and governance structure of Dartmouth College for posterity.[127] Furthermore, Dartmouth College was a private institution that held property for nongovernmental purposes; its professors and trustees were not public officers; and it was funded by private donors.[128]

Thus, even though the College was formed under state law, the Court determined it was not a civil institution, and thus the government had no right to change its governance structure and mission substantially without its consent.[129] Moreover, the legislature had not reserved a right to amend the charter.[130] Dartmouth College was a key decision with ramifications beyond the higher education context. The decision established constitutional limits on a state's power to alter a corporation's charter without its consent, at least when the state had not reserved a right to amend the charter.

State Sovereign Powers and Contracts[edit | edit source]

During the 1800s, the Supreme Court often interpreted the Contract Clause as providing robust protection for public and private contracts. However, the Court decided some cases that were more solicitous of the states' power to regulate contracts in the public interest. Under Chief Justice Roger B. Taney, the Court held that states could not contract away their sovereign powers, including their powers of eminent domain and police powers.[131]

An early example of a case in which the Supreme Court recognized the Contract Clause allows states some leeway to adopt legislation that would interfere with existing contracts in order to protect the public interest involved the Vermont legislature's exercise of the power of eminent domain to "take" contractual rights of private parties.[132] In West River Bridge Co. v. Dix, the Vermont legislature enacted a law granting an exclusive 100-year franchise to operate a toll bridge over the West River to the West River Bridge Company.[133] However, several decades later, the legislature passed a statute that permitted certain public officials to "take" such franchises using the power of eminent domain to construct public highways--a power the state sought to use against the West River Bridge Company's toll bridge franchise.[134] In an attempt to avoid the taking of its franchise, the company sued, arguing the state's eminent domain law impaired the obligation of the franchise contract between Vermont and itself by depriving the company of its franchise without its consent.[135]

The Supreme Court disagreed that the subsequently enacted Vermont law violated the Contract Clause.[136] Acknowledging the legislature's grant of a corporate charter to the company was a contract, the Court nevertheless determined that taking the corporation's franchise for public use upon payment of compensation was a proper exercise of the state's inherent and long-standing sovereign power of eminent domain over subordinate private property rights.[137] The Court noted the state's power of eminent domain constituted part of the background law and conditions under which parties entered into private contracts, and thus the state's exercise of that power could not impair the franchise contract.[138] However, the state would have to compensate the bridge company adequately for the taking.[139] West River Bridge Co. represents the Court's early recognition that the Contract Clause was not absolute, and that states retained some leeway to exercise their sovereign powers to protect the public interest, which they could not contract away, regardless of interference with contractual relationships.

During this era, the Supreme Court decided other important cases that recognized that a state could functionally abrogate the terms of a corporate charter to serve the public interest through the exercise of its police powers. In Proprietors of Charles River Bridge v. Proprietors of Warren Bridge,[140] Chief Justice Taney, writing for the Court, held that a state could functionally abrogate the terms of a corporate charter to benefit its economy when the charter had not specifically preserved an exclusive toll franchise for a bridge company.[141] As one scholar has noted, the Taney Court "established the principle that corporate charters should be strictly construed and that privileges such as monopoly status . . . could never be implied."[142] Later in the nineteenth century, the Court carved out additional exceptions for state police powers. For example, the Court held that a state could use its police powers to revoke, on public moral grounds, a previously granted charter to a company to operate a lottery.[143]

From the late nineteenth to early twentieth centuries, the Contract Clause gradually took on a lesser role in the Court's jurisprudence. Although the Court's Contract Clause jurisprudence protected state tax exemptions in corporate charters and the rights of state bondholders from subsequent legislative impairment,[144] the Clause diminished in importance with the ratification of the Fourteenth Amendment.[145] Specifically, the Fourteenth Amendment's Due Process Clause offered a new avenue for the protection of private property interests, including contract rights, against unreasonable state interference.[146]

Modern Doctrine on State Changes to State Contracts[edit | edit source]

The Court revived the Contract Clause in the context of public contracts in the late twentieth century. A major case from this time period, in which the Supreme Court confirmed it would thoroughly scrutinize state legislation that modified the state's own contracts, is United States Trust Co. v. New Jersey.[147] In that case, holders of bonds issued by the Port Authority of New York and New Jersey challenged a New Jersey statute as violative of the Contract Clause.[148] The law, along with a parallel New York enactment, repealed a prior statutory covenant that limited the Port Authority's discretion to use revenue and reserve funds pledged as security for the bonds in order to subsidize passenger rail transportation.[149] The bondholders argued that in repealing the covenant, which sought to promote investors' confidence in the bonds, the state impaired a contractual obligation in violation of the Contract Clause.[150]

The Supreme Court agreed with the New Jersey trial court that the state legislature's statutory covenant was a contract among New Jersey, New York, and the bondholders that fell within the Contract Clause's protection.[151] The Court further determined that repeal of the covenant impaired the obligation of the states' contract with the bondholders because the covenant had limited the Port Authority's deficits, which in turn protected bondholders from depletion of the Authority's general reserve fund, and the state had not replaced it with a comparable provision.[152] Moreover, the impairment violated the Contract Clause because it modified the express terms of the parties' agreement by repealing the covenant retroactively without being justified by a legitimate public purpose.[153] The state legislature's interests in protecting its citizens' welfare by financing new mass transit projects, conserving energy, and protecting the environment could not justify the repeal,[154] and the Court refused to defer to the state legislature's judgment when balancing the alleged benefits that would result from impairment of the covenant against the private financial loss that the private bondholders would incur from impairment of the covenant.[155] Instead, the Court considered whether the impairment was reasonable and necessary to serve the public purposes for which the State had accomplished it.[156]

In this vein, the Supreme Court determined that "a less drastic modification" of the covenant would have achieved the state's purposes, such as amending the covenant to exclude new revenues from the limitation in order to subsidize mass transit.[157] The repeal was also unreasonable because the original covenant had been made with full knowledge that the public might demand increased options for mass transit in the future.[158] In other words, the Court was not reviewing a case in which a contract had been made a long time ago and circumstances had changed significantly.

Notably, in United States Trust Co., the Court declined to defer to the state's characterization of the public interests affected by the challenged state legislation and refused to weigh these public interests against private contract rights.[159] Consequently, the Court established a heightened standard of review for state laws that modify a state's own obligations as opposed to laws that simply interfere with contracts between private parties.[160] The Court justified this "dual standard of review" on the grounds that the state was a self-interested party.[161]

Private Contracts[edit | edit source]

Early Cases on State Changes to Private Contracts[edit | edit source]

The Supreme Court has long held that the Contract Clause limits a state's power to regulate contracts between private parties. In the 1819 case Sturges v. Crowninshield, the Court examined a New York bankruptcy law that allowed insolvent debtors to obtain the discharge of their debts by surrendering their property.[162] Notably, the law applied retroactively to debt contracts parties had entered into prior to its enactment, raising the question of whether it interfered with existing contracts in violation of the Contract Clause.[163]

The Supreme Court began its analysis by defining a "contract" for purposes of the Clause as "an agreement in which a party undertakes to do, or not to do, a particular thing."[164] In the Court's view, the "obligation" of the contract in Sturges was the underlying state law binding the defendant-debtor to pay the plaintiff-creditor money on or before a certain date in accordance with a promissory note's terms.[165] When New York enacted a law allowing debtors to obtain the discharge of their entire debts upon surrender of their property, the state impaired the obligation of the debt contracts by potentially limiting a debtor's liability to an amount less than provided for in the original contract.[166]

Having determined the New York law impaired the obligation of contracts, the Court turned next to an analysis of whether that impairment violated the Contract Clause.[167] The Court adopted a broad reading of the Clause that arguably extended beyond the Framers' original understanding of its scope to encompass state bankruptcy laws.[168] To the extent the New York law operated retroactively, the Court found, it impaired the obligation of contracts in violation of the Constitution.[169]

Nearly a decade after its decision in Sturges, the Court addressed a question left unanswered in that case--that is, whether a state bankruptcy law that permits a debtor to obtain a discharge from liability under a contract entered into after the passage of the law impairs the obligations of that contract in violation of the Contract Clause.[170] In Ogden v. Saunders, a citizen of New York contracted a debt in that state and claimed to have been discharged from that debt under a bankruptcy law in force at the time he entered into the contract.[171]

As in Sturges, the Supreme Court began its analysis by defining the obligation of contracts as the state law that binds parties to contracts to perform their duties thereunder or, alternatively, to pay compensation.[172] Unless the parties agreed otherwise, such law became part of the contract and governed enforcement of parties' obligations before any tribunal, as well as the contract's validity, construction, and discharge.[173] As a result, a bankruptcy law that discharged a party from a contract made under the law of that state was part of the contract's terms and conditions and discharged the obligation in all other tribunals.[174] Such a law could not be said to impair that contract, the Court held, so long as it applied to future contracts rather than existing contracts.[175] The Ogden decision thus drew a distinction between state laws that impaired obligations of contracts already in existence at the time of enactment and laws that affected future contracts, deeming the former to be more problematic from a constitutional standpoint.

Following its decision in Ogden, the Supreme Court decided cases in the 1800s that often adopted a broad view of the Contract Clause's protections for both public and private contracts.[176] But, as noted, by the end of the nineteenth century, the Contract Clause diminished in importance with the ratification of the Fourteenth Amendment and the imposition of limits on state power in the Amendment's Due Process Clause.[177] And during the early twentieth century, the Court further reduced the Contract Clause's protections, specifically holding that "private agreements as well as public contracts were subject to the police power."[178]

Blaisdell Case and State Modifications to Private Contracts[edit | edit source]

Although the Supreme Court had long recognized that states retained at least some sovereign power to regulate contracts to protect the public welfare[179]--and increasingly permitted states to modify private contract rights to respond to changes in the economy during the early twentieth century[180]--a major shift in Contract Clause doctrine resulted from the Court's decision in Home Building & Loan Ass'n v. Blaisdell in 1934.[181] Prior to the 1930s, the Court often adopted a robust interpretation of the Contract Clause when evaluating state legislation, applying it stringently to strike down state laws deemed to interfere with contract and property interests.[182] However, during the depths of the Great Depression, the Court significantly weakened the constraints that the Contract Clause imposes on state government regulation of private contracts.[183]

In Blaisdell, the State of Minnesota enacted the Minnesota Mortgage Moratorium Law, which allowed courts to extend temporarily the period of time during which a mortgagor (e.g., a homeowner) could redeem a home after the bank foreclosed on the property, preventing the mortgagee from obtaining possession during that time.[184] This right ran contrary to existing contracts, which granted the lender the right to foreclose.[185] In order to take advantage of this option, the mortgagor had to pay a "reasonable value of the income on" or "reasonable rental value of" the property to the mortgagee.[186]

Although the Minnesota law prevented the mortgagee from obtaining actual possession, the Supreme Court upheld the law as necessary and reasonable to address the economic crisis because it was appropriately tailored to address the emergency and was limited in duration.[187] The Court noted that a state had the power to regulate existing contracts in order to "safeguard the vital interests of its people"[188] as an exercise of its sovereignty.[189] The Court cited several examples of cases in which it upheld state regulation aimed at protecting citizen welfare despite interference with existing contracts. For example, a state could amend its constitution to forbid lotteries that it previously authorized[190] or regulate intoxicating liquors[191] without violating existing contracts. It could regulate to protect the public from nuisances[192] or regulate to further public safety more generally, even when such regulations disrupted existing contractual relationships.[193] The Court also cited cases in which a state exercised its sovereign powers to protect its own economic interests, despite interference with existing contracts, including cases in which the Court upheld a state's regulation of rates charged by public services corporations or laws that imposed various legal requirements on businesses.[194]

In addition to signaling that the Court would more often defer to state regulation of private contracts in the public interest, Blaisdell is also notable because the Court set forth a test for when such state regulation impairs private contractual obligations in violation of the Contract Clause. The Court adopted a balancing test, justifying a pragmatic approach on the grounds that contract rights were meaningful only if the state exercised its powers to "safeguard the economic structure upon which the good of all depends."[195] It held that a state may regulate existing private contractual relationships, consistent with the Contract Clause, if the law serves a legitimate public purpose and the "measures taken are reasonable and appropriate to that end."[196] This standard, which is more deferential to the state than the standard applicable to public contracts,[197] leaves judges with room to balance the states' reserved powers to regulate to protect the public welfare against the Contract Clause's limitation on state power, which aims to safeguard the sanctity of contractual relationships.[198]

State Laws Creating New Contractual Obligations[edit | edit source]

Although the Supreme Court has not had occasion to consider many Contract Clause challenges in the modern era, it has refined the test for private contracts it developed in the 1934 case Home Building & Loan Ass'n v. Blaisdell, focusing on whether the challenged state legislation is broadly applicable, was foreseeable, and has a legitimate purpose. For example, in the 1978 case Allied Structural Steel Co. v. Spannaus, the Court determined a state law that regulated private pension contracts violated the Contract Clause because it sought to address a limited societal problem through the imposition of a substantial new and retroactive payment obligation on a narrow class of companies.[199]

In Allied Structural Steel Co., the Minnesota legislature enacted the Private Pension Benefits Protection Act, requiring certain companies having offices in the state and offering pension plans to employees to pay a fee to cover full pensions for employees who worked at least ten years if the employer terminated its pension plan or closed a Minnesota office.[200] The Court considered whether it would violate the Contract Clause to apply the law to the appellant, an Illinois steel corporation that closed a Minnesota office.[201] Minnesota charged the company $185,000 under the Act to cover the cost of pensions for eligible discharged employees.[202] In response, the company maintained the fee "unconstitutionally impaired its contractual obligations to its employees under its pension agreement."[203]

The Supreme Court held the Act impaired the company's employment contracts because it substantially increased the company's obligation to fund pensions beyond the terms of the existing contracts it had entered into with its employees.[204] However, the Court noted it had to further examine whether such an impairment violated the Contract Clause.[205] Although noting the Contract Clause does not "obliterate" the states' police powers,[206] the Court determined the Minnesota law amounted to a significant impairment that could not be justified for public policy reasons.[207]

First, the employer relied on the payment terms of the existing pension plan when determining how to allocate its resources, and the Act retroactively required the company to pay more to its employees than the company had foreseen because the company closed its office.[208] There was no indication in the record that the state targeted an issue of pressing social need by enacting sweeping legislation covering a variety of employers and circumstances.[209] Rather, the Act targeted for the first time a narrow societal problem by imposing on a specific class of companies a substantial retroactive and permanent payment obligation unforeseen at the time of the pension plans' creation and contrary to the company's employment agreements.[210] These factors, the Court held, amounted to a violation of the Contract Clause.[211] Allied Structural Steel Co. stands for the notion that a state law may impair the obligation of contracts not only when it abrogates contractual obligations, but also when it imposes substantial new and retroactive legal obligations on a specific subset of entities.

Public Interest and State Modifications to Private Contracts[edit | edit source]

In the 1980s, the Supreme Court upheld generally applicable state laws regulating private contracts, which it determined were intended to serve a broad public interest, against Contract Clause challenges. For example, in Exxon Corp. v. Eagerton, the Court considered the constitutionality of an Alabama law that increased the severance tax on oil and gas extracted from wells located in the state, which the state imposed on producers at the time of severance.[212] The law, which amended a statute that imposed a tax on oil and gas extracted from Alabama wells, exempted the owners of royalty interests from the tax increase and forbid producers from passing the tax increase on to purchasers or consumers.[213] Oil and gas producers argued the law impaired the obligations of their contracts with royalty owners and consumers in violation of the Contract Clause.[214]

The Supreme Court determined the royalty owner exemption did not violate the Contract Clause because it did not impair contractual obligations benefiting the producers.[215] The Alabama law merely provided that the royalty owners were not legally responsible for paying the tax to the state, and did not prevent the producers from shifting the burden of the tax to the royalty owners through contractual stipulations.[216]

With regard to the state law's prohibition on passing through the severance tax to consumers, the Supreme Court confronted a more difficult question.[217] The Court determined the prohibition interfered with producers' existing contracts that required consumers to absorb increases in severance taxes.[218] However, the Court noted the Contract Clause leaves some room for state regulation to protect the public welfare, even when such regulation would interfere with existing contracts.[219] The Court deemed the pass-through prohibition to be similar to state laws setting rates in heavily regulated industries, like the electricity industry or oil transportation sector, which were consistent with the Contract Clause despite their incidental effect on existing contracts.[220] Comparing the pass-through prohibition to a rate-setting scheme that displaced contractual rates, the Court determined the prohibition applied broadly, had a legitimate public interest justification (i.e., safeguarding consumers from high prices), and was not targeted specifically at contracts of oil and gas producers.[221] Thus, there was no violation of the Contract Clause.[222]

Another case in which the Supreme Court determined that a state's sovereign power to protect public interests justified the impairment of private contracts is Keystone Bituminous Coal Ass'n v. DeBenedictis.[223] In that case, the Pennsylvania legislature, concerned about public safety, land conservation, and other issues, enacted a law prohibiting mining that would damage existing structures, such as public buildings and homes, by eliminating underground support.[224] Petitioners, including a coal industry association and companies that controlled subsurface coal reserves, sued to enjoin a state environmental agency from enforcing the act and regulations promulgated thereunder.[225] One of the petitioners' challenges was that the Act on its face violated the Contract Clause by nullifying the surface owner's contractual waiver of liability for damage to the surface estate from coal mining.[226] The Court agreed with the lower courts that "the Commonwealth's strong public interests in the legislation [were] more than adequate to justify the impact of the statute on petitioners' contractual agreements."[227]

The Court determined that a contract right had been impaired because the coal companies secured waivers of liability from property owners for damages from mining to surface structures and much of the land affected by the Subsidence Act.[228] The Act impaired this right by nullifying the surface owners' contractual waiver obligations.[229] However, the Court found that Pennsylvania's interest in preventing environmental damage and hazards to people and property outweighed this contract right.[230] Because the state was not a party to the contracts at issue, the court deferred to the state's judgment that the legislation was appropriately tailored to the public purpose justifying it.[231]

In a subsequent case, Sveen v. Melin, the Supreme Court examined state regulation of private contracts in the context of a life insurance policy.[232] In that case, the Court upheld against a Contract Clause challenge a Minnesota law that revoked any revocable beneficiary designation an individual made to his or her spouse (e.g., in a life insurance policy) if their marriage was dissolved or annulled.[233] The law operated on the theory that the policyholder would have supported the revocation, and it allowed the policyholder to redesignate the ex-spouse as the beneficiary at any time.[234]

In Sveen, the life insurance policyholder designated his wife as the primary beneficiary prior to the state's passage of the law, which operated retroactively.[235] The policyholder and his wife subsequently divorced, and the divorce decree did not mention the insurance policy.[236] After the policyholder passed away, his wife, who would have been the primary beneficiary under the policy if the legislature had not enacted the law, and his children, who were the contingent beneficiaries, claimed a right to the insurance proceeds.[237] The Court examined whether retroactive application of the revocation-on-divorce law to the policyholder's designation violated the Contract Clause.[238]

The Supreme Court, in an opinion authored by Justice Elena Kagan, rejected the Contract Clause challenge to the Minnesota statute.[239] Although the Court determined that a life insurance policy was a contract subject to the Contract Clause,[240] its holding recognized that not all laws that retroactively alter contracts in existence at the time of their passage violate the Contract Clause.[241] Rather, a violation occurs only when (1) the law substantially impairs a contractual relationship (e.g., by undermining the agreement, interfering with a party's reasonable expectations, or preventing a party from safeguarding or reinstating its rights); and (2) the law was not a reasonable and appropriate means of furthering a "significant and legitimate public purpose."[242]

In Sveen, the Court determined the Minnesota law did not substantially impair the life insurance contract for three reasons.[243] First, the law supported the general objectives of life insurance contracts by attempting "to reflect a policyholder's intent."[244] Second, the law would not undermine the policyholder's expectations regarding his or her beneficiary designation because the policyholder could not significantly rely upon that designation; a divorce court could revoke the beneficiary designation.[245] Finally, the law provided a default rule the policyholder could modify simply by submitting paperwork.[246]

- ↑ Williams v. Bruffy, 96 U.S. 176, 183 (1878).

- ↑ 39 U.S. (14 Pet.) 540 (1840).

- ↑ United States v. California, 332 U.S. 19 (1947).

- ↑ 313 U.S. 69 (1941).

- ↑ 313 U.S. at 78-79.

- ↑ Craig v. Missouri, 29 U.S. (4 Pet.) 410, 425 (1830); Byrne v. Missouri, 33 U.S. (8 Pet.) 40 (1834).

- ↑ Virginia Coupon Cases (Poindexter v. Greenhow), 114 U.S. 270 (1885); Chaffin v. Taylor, 116 U.S. 567 (1886).

- ↑ Houston & Texas Central R.R. v. Texas, 177 U.S. 66 (1900).

- ↑ Briscoe v. Bank of Kentucky, 36 U.S. (11 Pet.) 257 (1837).

- ↑ Darrington v. Bank of Alabama, 54 U.S. (13 How.) 12, 15 (1851); Curran v. Arkansas, 56 U.S. (15 How.) 304, 317 (1853).

- ↑ Briscoe v. Bank of Kentucky, 36 U.S. (11 Pet.) 257 (1837).

- ↑ Woodruff v. Trapnall, 51 U.S. (10 How.) 190, 205 (1851).

- ↑ Juilliard v. Greenman, 110 U.S. 421, 446 (1884).

- ↑ Gwin v. Breedlove, 43 U.S. (2 How.) 29, 38 (1844). See also Griffin v. Thompson, 43 U.S. (2 How.) 244 (1844).

- ↑ Farmers & Merchants Bank v. Federal Reserve Bank, 262 U.S. 649, 659 (1923).

- ↑ See, e.g., Nixon v. Adm'r of Gen. Servs., 433 U.S. 425, 468 (1977).

- ↑ For the prohibition on federal bills of attainder, see Art. I, Sec. 9, Clause 3 Nullification. For discussion of the prohibition on federal bills of attainder and further information on the historical roots of the federal and state Bill of Attainder Clauses, see Art. I, Sec. 9, Cl. 3: Historical Background on Bills of Attainder.

- ↑ See, e.g., Nixon, 433 U.S. at 468-76. In Nixon, the Court cited Cummings v. Missouri, 71 U.S. 277 (1866), a case involving the state Bill of Attainder Clause, to support its application of the federal Bill of Attainder Clause.

- ↑ 71 U.S. 277 (1866). In an earlier case, the Supreme Court considered a challenge to a Georgia statute enacted before the federal Constitution was ratified that punished treason through banishment and confiscation of property without a judicial trial. Cooper v. Telfair, 4 U.S. 14, 14-15 (1800). A former resident of Georgia living abroad who had allegedly supported the British during the Revolutionary War argued that the statute violated the Georgia state constitution, which did not expressly bar enactment of bills of attainder. Id. at 16-17. The Court declined to strike down the law. Id. at 19. Justice William Paterson opined, "the power of confiscation and banishment does not belong to the judicial authority, whose process could not reach the offenders: and yet, it is a power, that grows out of the very nature of the social compact, which must reside somewhere, and which is so inherent in the legislature, that it cannot be divested, or transferred, without an express provision of the constitution." Id. (opinion of Paterson, J.).

- ↑ Id. at 280.

- ↑ See id. at 320 (The oath requirement "was exacted, not from any notion that the several acts designated indicated unfitness for the callings, but because it was thought that the several acts deserved punishment, and that for many of them there was no way to inflict punishment except by depriving the parties, who had committed them, of some of the rights and privileges of the citizen.").

- ↑ Id. at 325-29. In a related case, Ex parte Garland, the Court applied its reasoning in Cummings to strike down a similar federal law. 71 U.S. 333, 377-78 (1866). For additional discussion of Cummings and Garland, see Art. I, Sec. 9, Cl. 3: Historical Background on Bills of Attainder. See also Pierce v. Carskadon, 83 U.S. 234, 239 (1873); cf. Klinger v. Missouri, 80 U.S. 257, 262 (1872) (holding, in a challenge to a loyalty oath for jurors, that it would have raised constitutional concerns if a juror was excluded solely for past conduct, "simply because he had sympathized with or aided the rebellion during the war," but that it was permissible to exclude a juror who "also refused to take [the oath] because he was still a more bitter rebel than ever, [because] the avowal of such a feeling was inconsistent with the upright and loyal discharge of his duties").

- ↑ 75 U.S. 595, 598 (1869).

- ↑ Id. at 601.

- ↑ 341 U.S. 716, 718-19 (1951).

- ↑ Id. at 722. See also Hawker v. People of New York, 170 U.S. 189, 198-200 (1898); Konigsberg v. State Bar of California, 366 U.S. 36, 47 n.9 (1961). Loyalty oaths in public employment, particularly those premised on political affiliation, have sometimes also been challenged under the First Amendment. See Garner, 341 U.S. at 719-21 (noting that "Congress may reasonably restrict the political activity of federal civil service employees" to protect the integrity and competency of the service, and holding that "a State is not without power to do as much"); see also, e.g., Keyishian v. Bd. of Regents, 385 U.S. 589, 606 (1967) (holding that university professors could not be dismissed based on their refusal to swear that they had never been members of the Communist party, as mere "membership without a specific intent to further the unlawful aims of an organization is not a constitutionally adequate basis for exclusion from such positions").

- ↑ 363 U.S. 144, 160 (1960) (plurality opinion). Justice William Brennan concurred, stating in part that the challenged provision "does not deny due process or otherwise violate the Federal Constitution." Id. at 161 (Brennan, J., concurring).

- ↑ Id. at 160 (plurality opinion).

- ↑ Art. I, Sec. 10, Clause 1 Proscribed Powers.

- ↑ 10 U.S. 87, 138 (1810).

- ↑ See Art. I, Sec. 10, Cl. 1: State Ex Post Facto Laws.

- ↑ See Art. I, Sec. 10, Cl. 1: State Ex Post Facto Laws.

- ↑ E.g., Frank v. Mangum, 237 U.S. 309, 344 (1914) ("the constitutional prohibition: "No state shall . . . pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts" . . . is directed against legislative action only, and does not reach erroneous or inconsistent decisions by the courts"); see also Ross v. Oregon, 227 U.S. 150, 161 (1913); Moore-Mansfield Constr. Co. v. Elec. Installation Co., 234 U.S. 619, 624 (1914).

- ↑ See, e.g., Calder v. Bull, 3 U.S. 386, 391 (1798); Locke v. New Orleans, 71 U.S. 172, 173 (1867).

- ↑ For the prohibition on federal ex post facto laws, see Art. I, Sec. 10, Clause 1 Proscribed Powers; see also Art. I, Sec. 9, Cl. 3: Overview of Ex Post Facto Laws.

- ↑ See, e.g., Peugh v. United States, 569 U.S. 530, 532-33 (2013) (case construing federal clause citing case construing state clause); Reetz v. Michigan, 188 U.S. 505, 510 (1903) (case construing state clause citing case construing federal clause).

- ↑ See Art. I, Sec. 9, Cl. 3: Overview of Ex Post Facto Laws.

- ↑ E.g., Calder, 3 U.S. at 389; Watson v. Mercer, 33 U.S. 88, 110 (1834); see also Art. I, Sec. 9, Cl. 3: Ex Post Facto Law Prohibition Limited to Penal Laws.

- ↑ Burgess v. Salmon, 97 U.S. 381, 385 (1878).

- ↑ E.g., Calder, 3 U.S. at 389; see also Art. I, Sec. 9, Cl. 3: Retroactivity of Ex Post Facto Laws.

- ↑ Calder, 3 U.S. at 390.

- ↑ See, e.g., Fletcher v. Peck, 10 U.S. 87, 138-39 (1810); cf. Landgraf v. USI Film Prods., 511 U.S. 244, 267 (1994) (the restrictions that the Constitution places on retroactive legislation "are of limited scope" and "[a]bsent a violation of one of those specific provisions," when a new law makes clear that it is retroactive, the arguable "unfairness of retroactive civil legislation is not a sufficient reason for a court to fail to give [that law] its intended scope").

- ↑ E.g., Frank v. Magnum, 237 U.S. 309, 344-45 (1914); cf. Rogers v. Tennessee, 532 U.S. 451, 456-60 (2000) (holding that "limitations on ex post facto judicial decisionmaking are inherent in the notion of due process," but the due process limitation on courts is not identical to the ex post facto prohibition that applies to legislation); see also Art. I, Sec. 9, Cl. 3: Ex Post Facto Prohibition and Judicial Decisions.

- ↑ 71 U.S. 277, 280-81 (1866).

- ↑ Id. at 307-08. For additional discussion of Cummings, see Art. I, Sec. 9, Cl. 3: Employment Qualifications and Ex Post Facto Laws.

- ↑ See Ogden v. Saunders, 25 U.S. (12 Wheat.) 213, 266-67 (1827) ("If it were proper to prohibit a State legislature to pass a retrospective law, which should take from the pocket of one of its own citizens a single dollar, as a punishment for an act which was innocent at the time it was committed; how much more proper was it to prohibit laws of the same character precisely, which might deprive the citizens of other States, and foreigners, as well as citizens of the same State, of thousands, to which, by their contracts, they were justly entitled, and which they might possibly have realized but for such State interference?"); see also Home Bldg. & Loan Ass'n v. Blaisdell, 290 U.S. 398, 431 (1934) ("The obligations of a contract are impaired by a law which renders them invalid, or releases or extinguishes them[,] and impairment, as above noted, has been predicated on laws which without destroying contracts derogate from substantial contractual rights.") (citations omitted).

- ↑ Art. I, Sec. 10, Clause 1 Proscribed Powers. The Supreme Court has long considered contractual "obligations" to encompass both the express terms of an agreement and the underlying state law regarding interpreting and enforcing contracts upon which the parties relied when they made the contract. See U.S. Trust Co. v. New Jersey, 431 U.S. 1, 19-20 & n.17 (1977) ("The obligations of a contract long have been regarded as including not only the express terms but also the contemporaneous state law pertaining to interpretation and enforcement."). Such underlying state law may include the law of the place in which the contract was made and the place where it will be performed. Id. Thus, the "obligation" of a contract refers to laws that affect its "validity, construction, discharge and enforcement." Blaisdell, 290 U.S. at 429-30 (quoting Von Hoffman v. City of Quincy, 71 U.S. (4 Wall.) 535, 550 (1866)). States have long regulated the formation, interpretation, enforcement, and performance of contracts. Ogden, 25 U.S. (12 Wheat.) at 286 ("But to assign to contracts, universally, a literal purport, and to exact for them a rigid literal fulfilment, could not have been the intent of the constitution. It is repelled by a hundred examples. Societies exercise a positive control as well over the inception, construction, and fulfilment of contracts, as over the form and measure of the remedy to enforce them.").

- ↑ U.S. Trust Co., 431 U.S. at 17. Notably, the Clause does not apply to acts of the Federal Government. Sinking-Funds Cases, 99 U.S. 700, 718-19 (1878) (acknowledging that the Federal Government is "prohibited from depriving persons or corporations of property without due process of law" but is "not included within the constitutional prohibition which prevents States from passing laws impairing the obligation of contracts"); see also Samuel R. Olken, Charles Evans Hughes and the Blaisdell Decision: A Historical Study of the Contract Clause, 72 Or. L. Rev. 513, 519 (1993) (discussing how the Contract Clause "differed from the Northwest Ordinance in that it barred only state impairment of contract obligations").

- ↑ Blaisdell, 290 U.S. at 434-35 (observing that a state "continues to possess authority to safeguard the vital interests of its people[;] . . . [t]his principle of harmonizing the constitutional prohibition with the necessary residuum of state power has had progressive recognition in the decisions of this Court"); see also W.B. Worthen Co. v. Thomas, 292 U.S. 426, 433 (1934) ("[L]iteralism in the construction of the contract clause . . . would make it destructive of the public interest by depriving the State of its prerogative of self-protection.").

- ↑ See Blaisdell, 290 U.S. at 428 ("[T]he prohibition is not an absolute one and is not to be read with literal exactness like a mathematical formula."); U.S. Trust Co., 431 U.S. at 17 ("[T]he Contract Clause does not prohibit the States from repealing or amending statutes generally, or from enacting legislation with retroactive effects."); El Paso v. Simmons, 379 U.S. 497, 506-09 (1965) ("[I]t is not every modification of a contractual promise that impairs the obligation of contract under federal law . . . . The State has the 'sovereign right . . . to protect the . . . general welfare of its people . . . . Once we are in this domain of the reserve power of a State we must respect the wide discretion on the part of the legislature in determining what is and what is not necessary.'") (quoting E. N.Y. Sav. Bank v. Hahn, 326 U.S. 230, 232-33 (1945)); Trs. of Dartmouth Coll. v. Woodward, 17 U.S. (4 Wheat.) 518, 628-30 (1819) ("Taken in its broad unlimited sense, the [Contract Clause] would be an unprofitable and vexatious interference with the internal concerns of a State . . . . [T]he framers of the constitution could never have intended to insert in that instrument a provision so unnecessary, so mischievous, and so repugnant to its general spirit."). Notably, other constitutional provisions may limit a state's power to enact retroactive legislation that, for example, imposes a punishment (e.g., a bill of attainder or ex post facto law). See U.S. Trust Co., 431 U.S. at 17 n.13. For example, the Contract Clause generally does not prevent a state from altering laws governing state offices or civil institutions, or from enacting laws on the subject of divorce. Trs. of Dartmouth Coll., 17 U.S. (4 Wheat.) at 627-30 ("That the framers of the constitution did not intend to retrain the States in the regulation of their civil institutions, adopted for internal government, and that the instrument they have given us, is not to be so construed, may be admitted. The provision of the constitution never has been understood to embrace other contracts, than those which respect property, or some object of value, and confer rights which may be asserted in a court of justice. It never has been understood to restrict the general right of the legislature to legislate on the subject of divorces."). The Court has cautioned, however, that the clause should not be interpreted to imply that parties may contract to obtain immunity from state regulation. U.S. Trust Co., 431 U.S. at 22 ("The States must possess broad power to adopt general regulatory measures without being concerned that private contracts will be impaired, or even destroyed, as a result. Otherwise, one would be able to obtain immunity from state regulation by making private contractual arrangements."); see also Hudson Cnty. Water Co. v. McCarter, 209 U.S. 349, 357 (1908) ("One whose rights, such as they are, are subject to state restriction, cannot remove them from the power of the State by making a contract about them.").

- ↑ U.S. Trust Co., 431 U.S. at 22 ("Legislation adjusting the rights and responsibilities of contracting parties must be upon reasonable conditions and of a character appropriate to the public purpose justifying its adoption."). A court's evaluation of the reasonableness of state legislation that affects private contract rights may include consideration of the background circumstances that motivated the state law's adoption and the measure's duration, among other factors. See Blaisdell, 290 U.S. at 444-47. Courts accord legislatures some deference in determining necessity and reasonableness of such legislation. U.S. Trust Co., 431 U.S. at 22-23.

- ↑ See Allied Structural Steel Co. v. Spannaus, 438 U.S. 234, 241 (1978) (characterizing the Contract Clause as "perhaps the strongest single constitutional check on state legislation during our early years as a Nation"); U.S. Trust Co., 431 U.S. at 15 ("Over the last century, however, the Fourteenth Amendment has assumed a far larger place in constitutional adjudication concerning the States [than the Contract Clause]."). As noted in McDonald v. Chicago, 561 U.S. 742 (2010), during the 1960s, the Court "shed any reluctance to hold that rights guaranteed by the Bill of Rights met the requirements for protection under the Due Process Clause. The Court eventually incorporated almost all of the provisions of the Bill of Rights. Only a handful of the Bill of Rights protections remain unincorporated." Id. at 764-65; see e.g., Duncan v. Louisiana, 391 U.S. 145, 161-62 (1968) (holding that the Fourteenth Amendment's Due Process Clause incorporates the Sixth Amendment right to trial by jury and makes it applicable to the states). For a discussion of the limitations that the Due Process Clause imposes on states with respect to retroactive deprivations of a life, liberty, or property interest, see Fourteenth Amend., Sec. 1: Overview of Procedural Due Process. In addition, the Dormant Commerce Clause doctrine, although not specifically directed at protecting contract rights, limits state power by restraining state authority to regulate interstate commerce. For more, see Art. I, Sec. 8, Cl. 3: Overview of Dormant Commerce Clause.

- ↑ Cf. Trs. of Dartmouth Coll., 17 U.S. (4 Wheat.) at 628-30 ("That anterior to the formation of the constitution, a course of legislation had prevailed in many, if not in all, of the States, which weakened the confidence of man in man, and embarrassed all transactions between individuals, by dispensing with a faithful performance of engagements."); Sturges v. Crowninshield, 17 U.S. (4 Wheat.) 122, 199, 203 (1819) ("[T]he prevailing evil of the times, which produced this clause in the constitution, was the practice of emitting paper money, of making property which was useless to the creditor a discharge of his debt, and of changing the time of payment by authorizing distant instalments.").

- ↑ Blaisdell, 290 U.S. at 427-28.

- ↑ The Federalist No. 44 (James Madison).

- ↑ The Federalist No. 7 (Alexander Hamilton) ("Laws in violation of private contracts, as they amount to aggressions on the rights of those States whose citizens are injured by them, may be considered as another probable source of hostility [among the states].").

- ↑ See, e.g., Trs. of Dartmouth Coll., 17 U.S. (4 Wheat.) at 627, 654 (striking down as unconstitutional a state law that interfered with a private corporate charter established under state law); Sturges, 17 U.S. (4 Wheat.) at 208 (holding a bankruptcy law that allowed insolvent debtors to obtain the discharge of their debts by surrendering their property violated the Contract Clause); Fletcher v. Peck, 10 U.S. (6 Cranch) 87, 127, 135-39 (1810) (interpreting the Contract Clause to prohibit a state from breaching its own contracts by rescinding a land grant); see also James W. Ely, Jr., The Contract Clause: A Constitutional History 1 (2016) ("Under the leadership of John Marshall, the Supreme Court construed the provision expansively, and it rapidly became the primary vehicle for federal judicial review of state legislation before the adoption of the Fourteenth Amendment. Indeed, the contract clause was one of the most litigated provisions of the Constitution throughout the nineteenth century . . . .").

- ↑ Fletcher, 10 U.S. (6 Cranch) at 137.

- ↑ See Trs. of Dartmouth Coll., 17 U.S. (4 Wheat.) at 644, 652-54. As the Court noted in Blaisdell, the Clause has been held not to encompass a marriage contract as it pertains to divorce laws, a judgment rendered upon a contract, or a state's waiver of sovereign immunity in general legislation. Blaisdell, 290 U.S. at 429 n.8.

- ↑ See, e.g., W. River Bridge Co. v. Dix, 47 U.S. (6 How.) 507, 535-36 (1848) (upholding a state's authority to use the power of eminent domain to take a company's toll bridge franchise in order to construct a public highway as not violative of the Contract Clause).

- ↑ Ely, supra note here, at 1 ("Over time . . . courts carved out several malleable exceptions to the constitutional protection of contracts . . . thereby weakening the protection of the contract clause and enhancing state regulatory authority.").

- ↑ 290 U.S. 398 (1934).

- ↑ Id. at 444-48.

- ↑ Id. at 415-16, 424. The law prevented the mortgagee from obtaining possession during that time. Id. This right ran contrary to existing contracts, which granted the lender the right to foreclose. Id. at 424-25.

- ↑ Allied Structural Steel Co v. Spannaus, 438 U.S. 234, 241 (1978) (quoting Manigault v. Springs, 199 U.S. 473, 480 (1905)).