Constitution of the United States/Eleventh Amend.

Eleventh Amendment Suits Against States

Overview[edit | edit source]

The Eleventh Amendment is a vital element of federal jurisdiction that "go[es] to the very heart of [the] federal system and affect[s] the allocation of power between the United States and the several states."[1] It prevents federal courts from construing their judicial power to allow states to be sued by citizens of another state or by foreign states or their citizens or subjects. The Eleventh Amendment was adopted in response to the Supreme Court's 1793 decision in Chisholm v. Georgia[2] in which the court allowed a suit by a citizen of South Carolina to proceed against the State of Georgia. The Eleventh Amendment resolved uncertainty over the reach of federal judicial power, which had arisen during the Constitution's ratification.

| Clause Text |

|---|

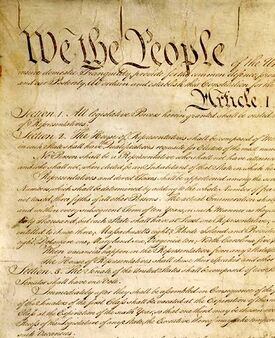

| The Judicial power of the United States shall not be construed to extend to any suit in law or equity, commenced or prosecuted against one of the United States by Citizens of another State, or by Citizens or Subjects of any Foreign State. |

Historical Background on Eleventh Amendment[edit | edit source]

During the ratification debates, opponents of the proposed Constitution expressed concern that Article III, Section 2, Clause 1--"The judicial Power shall extend . . . to Controversies between two or more States;--between a State and Citizens of another State;--between Citizens of different States;--between Citizens of the same State claiming Lands under Grants of different States, and between a State, or the citizens thereof, and foreign States, Citizens, or Subjects"[3]--could subject a state to suits in federal courts without the state's consent. These concerns were met with conflicting responses--some agreeing and others stating that the provision only applied when a state was the plaintiff.[4]

In 1789, Congress, enacted the Judiciary Act, providing the Supreme Court original jurisdiction over suits between states and citizens of other states.[5] Alexander Chisholm, a citizen of South Carolina, sued the state of Georgia under the Act to recover under a contract for supplies executed with Georgia during the Revolution. In the Supreme Court's 1793 decision, Chisholm v. Georgia,[6] four of the five Justices agreed that a state could be sued under the Article III jurisdictional provision and that the Supreme Court properly had original jurisdiction of the case pursuant to section 13 of the Judiciary Act.[7] The fifth, Justice James Iredell, reasoned that, as the common law barred suits against a sovereign, this principle applied to the states in their capacity as sovereigns and, consequently, states could not be subject to suit without their consent.[8]

By construing the Constitution to provide for a state to be sued by a citizen of another state in Chisholm,[9] the Supreme Court led Georgia and the other states to amend the Constitution. As a result, at the first meeting of Congress following the decision, the Eleventh Amendment was proposed by an overwhelming vote of both Houses and ratified with "vehement speed."[10] As proposed by Congress and ratified by the states, the Eleventh Amendment was directed at overturning the result in Chisholm and preventing suits against states by citizens of other states or by citizens or subjects of foreign jurisdictions.[11] It did not, as other possible versions of the Amendment might have done, altogether bar suits against states in the federal courts.[12] That is, the Eleventh Amendment barred suits against states with reference to their status as a plaintiff but did not address suits potentially based on subject matter.[13]

Early Jurisprudence on Eleventh Amendment[edit | edit source]

Early Supreme Court decisions examined the Eleventh Amendment, although oftentimes in dictum.[14] In Cohens v. Virginia,[15] Chief Justice John Marshall, writing for the Court, ruled that prosecution of a writ of error to review a state court judgment alleged to violate the Constitution or laws of the United States did not commence or prosecute a suit against the state. Instead, it merely continued a suit that the state had commenced, and thus could be brought in federal court under section 25 of the Judiciary Act.[16] In his Cohens opinion, the Chief Justice attributed the Eleventh Amendment's adoption to concerns about creditors being able to sue states in federal courts for payment rather than general objections about states being subject to suit without their consent.[17] He further stated his view that the Eleventh Amendment did not bar suits against states under federal question jurisdiction[18] or reach suits against a state by its own citizens.[19]

Marshall further developed his Eleventh Amendment jurisprudence in Osborn v. Bank of the United States.[20] Osborn concerned whether a state had authority to tax the Bank of the United States and whether federal courts could hear a suit against state officers seeking to collect a state tax from the bank notwithstanding the Eleventh Amendment.[21] In resolving the dispute in favor of the bank, Marshall distinguished between suits against states and suits against state officers, ruling that the Eleventh Amendment barred suits where the state was the party of record rather than suits where the state merely had an interest in the result.[22] Marshall further reasoned that a state officer cannot violate the Constitution under the cover of carrying out a state function.[23] Consequently, Marshall's Osborn ruling embodied two principles, one of which the Court soon abandoned and one of which has survived. The former holding was that a suit is not against a state unless the state is a named party of record.[24] The latter holding provides that a state official possesses no official capacity when acting illegally and consequently can derive no protection from suit when acting under an unconstitutional state statute.[25]

Postbellum Jurisprudence on Eleventh Amendment[edit | edit source]

Following the Civil War, the Supreme Court refined Chief Justice John Marshall's understanding of the scope of the Eleventh Amendment articulated in Osborn. In 1875, Congress effectively gave federal courts general federal question jurisdiction,[26] at a time when a large number of states in the South were defaulting on their revenue bonds in violation of the Contract Clause of the Constitution.[27] As bondholders sought relief in federal courts, the Supreme Court further developed its Eleventh Amendment jurisprudence in a series of cases, finding that the Eleventh Amendment precluded states from being sued by citizens of other states or by citizens or subjects of foreign states even if the case had arisen under the Constitution or laws of the United States.[28] The Court further found that the Eleventh Amendment barred suits that were filed against state officers, rather than the state itself, if the state was indispensable to the suit.

While Chief Justice John Marshall's 1821 Osborn decision had permitted the Bank of the United States to sue the officers of the state rather than the state itself and thereby avoided the Eleventh Amendment proscription, the postbellum Court adopted a more nuanced approach to the problem. In Louisiana v Jumel,[29] and Hagood v. Southern,[30] the Court held that plaintiffs could not seek relief from a state's bond default by suing the state's officers in federal court. In these cases, the Court reasoned that the party was, to all extents and purposes, the state and not the officers who acted on its behalf. In Hans v. Louisiana, the Court summarized its findings in these cases, stating "This court held that the suits were virtually against the States themselves and were consequently violative of the Eleventh Amendment of the Constitution and could not be maintained. It was not denied that they presented cases arising under the Constitution, but, notwithstanding that, they were held to be prohibited by the amendment referred to."[31] The Jumel Court noted, however, that the outcome would have been different had the state agreed to the federal court's jurisdiction.[32] Similarly, in Cunningham v. Macon & Brunswick Railroad, the Court found that if a state was an indispensable party to a suit, the Court could not take the case even if the state itself was not sued.[33]

In In re Ayres, a federal court cited the Attorney General of Virginia for contempt when he disobeyed a federal court's restraining order barring him from complying with a state law to pursue judgment against the Baltimore and Ohio Railroad, which had sought to pay its state taxes with possibly spurious state-issued coupons. The Court granted a writ of habeas corpus filed by the Attorney General and concluded that the proceeding, which had resulted in his imprisonment, was effectively a suit against the State and thus a federal court did not have jurisdiction to entertain it.[34] In dicta, however, the Court clarified that suits could be pursued against officers of a state when their action violated the Constitution or federal law. The Court stated:

Nor need it be apprehended that the construction of the eleventh Amendment, applied in this case, will in anywise embarrass or obstruct the execution of the laws of the United States in cases where officers of a State are guilty of acting in violation of them under color of its authority . . . .Nothing can be interposed between the individual and the obligation he owes to the Constitution and the laws of the United States, which can shield or defend him from their just authority . . . . If therefore, an individual acting under the assumed authority of a State, as one of its officers, and under color of its laws, comes into conflict with the superior authority of a valid law of the United States, he is stripped of his representative character, and subjected in his person to the consequences of his individual conduct.Ex parte Ayers, 123 U.S. 443, 507 (1887).

Modern Doctrine[edit | edit source]

General Scope of State Sovereign Immunity[edit | edit source]

In its 1890 decision, Hans v. Louisiana, the Supreme Court adopted Justice James Iredell's position in Chisholm v. Georgia, that the states, as sovereigns, were immune from suit by their citizens under long-standing principles grounded in the common law.[35] In Hans v. Louisiana,[36] a resident of Louisiana brought a suit against that state in federal court under federal question jurisdiction, alleging a violation of the Contract Clause in the state's repudiation of its obligation to pay interest on certain bonds. Admitting that the Amendment on its face prohibited only entertaining a suit against a state by citizens of another state, or citizens or subjects of a foreign state, the Court reasoned that the scope of the Eleventh Amendment was informed by the scope of Article III, Section 2, Clause 1, which provided federal courts jurisdiction over suits between a state and citizens of another state and foreign States, citizens or subjects. The court noted that the Eleventh Amendment was a result of the "shock of surprise throughout the country" at the Chisholm decision, which contravened long-established common law precedent that a sovereign cannot be sued absent its consent, and reflected the general consensus that the decision was wrong, and that federal jurisdiction did not extend to making defendants of unwilling states in lawsuits brought by individuals.[37]

In the Hans Court's view, the Eleventh Amendment reversed an erroneous decision and restored the proper interpretation of the Constitution. Delivering the Court's opinion, Justice Joseph Bradley stated: "The truth is, that the cognizance of suits and actions unknown to the law, and forbidden by the law, was not contemplated by the Constitution when establishing the judicial power of the United States. The suability of a State without its consent was a thing unknown to the law."[38] The Court reasoned that the Eleventh Amendment's silence on whether a citizen of a state could sue that state should not be construed as permitting such suits. Instead "the manner in which [Chisholm] was received by the country, the adoption of the Eleventh Amendment, the light of history and the reason of the thing,"[39] led the Court unanimously to hold that states could not be sued by their own citizens on grounds arising under the Constitution and laws of the United States.

In line with Hans, the Court held, in Ex parte New York (No. 1),[40] that, absent its consent, a state was immune to suit in admiralty, the Eleventh Amendment's reference to "any suit in law or equity" notwithstanding. Writing for the Court, Justice Mahlon Pitney stated: "That a State may not be sued without its consent is a fundamental rule of jurisprudence . . . of which the Amendment is but an exemplification . . . . It is true the Amendment speaks only of suits in law or equity; but this is because the Amendment was the outcome of a purpose to set aside the effect of the decision of this court in Chisholm v. Georgia from which it naturally came to pass that the language of the Amendment was particularly phrased so as to reverse the construction adopted in that case."[41] Just as Hans v. Louisiana had demonstrated the "impropriety of construing the Amendment" so as to permit federal question suits against a state, Justice Mahlon Pitney reasoned, "it seems to us equally clear that it cannot with propriety be construed to leave open a suit against a State in the admiralty jurisdiction by individuals, whether its own citizens or not."[42]

The Court has continued to rely on Hans[43] although support for it has not been universal.[44] In 1996, the Court further solidified Hans in Seminole Tribe of Florida v. Florida,[45] holding that Congress lacks power under Article I to abrogate state immunity under the Eleventh Amendment. And, in 1999, the Court ruled in Alden v. Maine[46] that the broad principle of sovereign immunity reflected in the Eleventh Amendment bars suits against states in state courts as well as federal.

Having previously reserved the question of whether federal statutory rights could be enforced in state courts,[47] the Court in Alden v. Maine[48] held that states could also assert Eleventh Amendment "sovereign immunity" in their own courts. Recognizing that the application of the Eleventh Amendment, which limits only the federal courts, was a "misnomer"[49] as applied to state courts, the Court nonetheless concluded that the principles of common law sovereign immunity applied absent "compelling evidence" that the states had surrendered such by ratifying the Constitution. Although this immunity is subject to the same limitations as apply in federal courts, the Court's decision effectively limited applying significant portions of federal law to state governments.[50] Both Seminole Tribe and Alden were 5-4 decisions with four dissenting Justices maintaining that Hans was wrongly decided.

This split continued with Federal Maritime Commission v. South Carolina State Ports Authority,[51] which held that state sovereign immunity also applies to quasi-judicial proceedings in federal agencies. In this case, the operator of a cruise ship devoted to gambling had been denied entry to the Port of Charleston, and subsequently filed a complaint with the Federal Maritime Commission, alleging a violation of the Shipping Act of 1984.[52] Justice Stephen Breyer, writing for the four dissenting Justices, emphasized the executive (as opposed to judicial) nature of such agency adjudications, noting that the ultimate enforcement of such proceedings in federal court was exercised by a federal agency (as is allowed under the doctrine of sovereign immunity). The majority, however, while admitting to a "relatively barren historical record," presumed that when a proceeding was "unheard of" at the time of the founding of the Constitution, it could not subsequently be applied in derogation of a "State's dignity" within our system of federalism.[53]

Nature of States' Immunity[edit | edit source]

Hans v. Louisiana and Ex parte New York note that Chisholm was erroneously decided and that the Amendment's intent was to restore the "original understanding" that a state could not be sued without its consent, and that nothing in the Constitution, including Article III's grants of federal court jurisdiction, was intended to provide otherwise. In Edelman v. Jordan,[54] the Court held that a state could properly raise its Eleventh Amendment defense on appeal after having defended and lost on the merits in the trial court. The Court stated: "[I]t has been well settled . . . that the Eleventh Amendment defense sufficiently partakes of the nature of a jurisdictional bar so that it need not be raised in the trial court."[55] But that the bar is not wholly jurisdictional seems established as well.[56]

Moreover, if under Article III there is no jurisdiction of suits against states, the settled principle that states may consent to suit[57] becomes conceptually difficult, as jurisdiction may not be conferred if the state refuses its consent.[58] And Article III jurisdiction exists for some suits against states, such as those brought by the United States or by other states.[59] Furthermore, Congress is able, in some instances, to legislate away state immunity,[60] although it may not enlarge Article III jurisdiction.[61] The Court has declared that "the principle of sovereign immunity [reflected in the Eleventh Amendment] is a constitutional limitation on the federal judicial power established in Art. III," while acknowledging that "[a] sovereign's immunity may be waived."[62]

Another explanation of the Eleventh Amendment is that it merely recognized the continued vitality of the doctrine of sovereign immunity as established prior to the Constitution: a state was not subject to suit without its consent.[63] Modern case law supports this view. In the 1999 Alden v. Maine decision, the Court stated: "the States' immunity from suit is a fundamental aspect of the sovereignty which the States enjoyed before the ratification of the Constitution, and which they retain today"[64] The Court, in dealing with questions of governmental immunity from suit, has traditionally treated precedents dealing with state immunity and those dealing with Federal Governmental immunity interchangeably.[65] Viewing the Amendment and Article III this way explains consent to suit as a waiver.[66] The limited effect of the doctrine in federal courts arises from the fact that traditional sovereign immunity arose in a unitary state, barring unconsented suit against a sovereign in its own courts or the courts of another sovereign. But upon entering the Union the states surrendered their sovereignty to some undetermined and changing degree to the national government, a sovereign that does not have plenary power over them but that is more than their coequal.[67]

Within the area of federal court jurisdiction, the issue becomes the extent to which the states, upon entering the Union, ceded their immunity to suit in federal court. Chisholm held--and the Eleventh Amendment reversed --that the states had given up their immunity to suit in diversity cases based on common law or state law causes of action; Hans v. Louisiana and subsequent cases held that the Amendment, in effect, recognized state immunity to suits based on federal causes of action.[68] Other cases have held that states ceded their immunity to suits by the United States or by other states.[69]

Still another view of the Eleventh Amendment is that it embodies a state sovereignty principle limiting the Federal Government's power.[70] In this respect, the federal courts may not act without congressional guidance in subjecting states to suit, and Congress, which can act to the extent of its granted powers, is constrained by judicially created doctrines requiring it to be explicit when it legislates against state immunity.[71]

Questions regarding the constitutional dimensions of sovereign immunity have arisen in the context of interstate sovereign immunity when a private party institutes an action against a state in another state's court. In the now-overturned 1979 decision of Nevada v. Hall, the Court held that while states are free as a matter of comity "to accord each other immunity or to respect any established limits on liability," the Constitution does not compel a state to grant another state immunity in its courts.[72] In Hall, California residents who were severely injured in a car crash with a Nevada state university employee on official business sued the university and the State of Nevada in California court.[73] After considering the scope of sovereign immunity as it existed prior to and "in the early days of independence," the doctrine's effect on "the framing of the Constitution," and specific "aspects of the Constitution that qualify the sovereignty of the several States," such as the Full Faith and Credit Clause,[74] the Court concluded that "[n]othing in the Federal Constitution authorizes or obligates this Court to frustrate" California's policy of "full compensation in its courts for injuries on its highways resulting from the negligence" of state or non-state actors "out of enforced respect for the sovereignty of Nevada."[75]

Forty years later, the Court overruled Hall in Franchise Tax Board of California v. Hyatt (Franchise Tax Board III), holding that "States retain their sovereign immunity from private suits brought in the courts of other States."[76] Franchise Tax Board III involved a tort action by a private party against a California state agency in Nevada's courts.[77] The "sole question" before the Court was whether to overrule Nevada v. Hall, a question over which the Court divided in 2016.[78] As the majority in Franchise Tax Board III read the historical record, although interstate sovereign immunity may have existed as a voluntary practice of comity at the time of the Founding, the Constitution "fundamentally adjust[ed] the States' relationship with each other and curtail[ed] their ability, as sovereigns, to decline to recognize each other's immunity."[79] The Court reiterated the view embraced in several of its decisions since Hall that in proposing the Eleventh Amendment in response to Chisholm v. Georgia, "Congress acted not to change but to restore the original constitutional design."[80] Accordingly, the Court explained, the "sovereign immunity of the States . . . neither derives from, nor is limited by, the terms of the Eleventh Amendment."[81] Moreover, the Court reasoned, "[n]umerous provisions" in the Constitution support the view that interstate sovereign immunity is "embe[dded] . . . within the constitutional design."[82] Among other provisions, the Court cited Article I insofar as it "divests the States of the traditional diplomatic and military tools that foreign sovereigns possess" and Article IV's Full Faith and Credit Clause, which requires that "state-court judgments be accorded full effect in other States and preclude[s] States from 'adopt[ing] any policy of hostility to the public Acts' of other States."[83] Accordingly, because sovereign immunity was inherent in the constitutional design, the Court concluded that the State of California could not be sued in Nevada absent the former state's consent.[84]

Suits Against States[edit | edit source]

Despite the apparent limitations of the Eleventh Amendment, individuals may, under certain circumstances, bring constitutional and statutory cases against states. In some of these cases, the state's sovereign immunity has either been waived by the state (either explicitly or implicitly as a product of their consent to the plan of the Constitutional Convention) or abrogated by Congress. In other cases, the Eleventh Amendment does not apply because the procedural posture is such that the Court does not view them as being against a state. As discussed below, this latter doctrine is most often seen in suits to enjoin state officials. However, it has also been invoked in bankruptcy and admiralty cases, where the res, or property in dispute, is in fact the legal target of a dispute.[85]

The application of this last exception to the bankruptcy area has become less relevant, because even when a bankruptcy case is not focused on a particular res, the Court has held that a state's sovereign immunity is not infringed by being subject to an order of a bankruptcy court. In Central Virginia Community College v. Katz, the Court noted that "[t]he history of the Bankruptcy Clause, the reasons it was inserted in the Constitution, and the legislation both proposed and enacted under its auspices immediately following ratification of the Constitution demonstrate that it was intended not just as a grant of legislative authority to Congress, but also to authorize limited subordination of state sovereign immunity in the bankruptcy arena."[86] Thus, where a federal law authorized a bankruptcy trustee to recover "preferential transfers" made to state educational institutions,[87] the court held that the state's sovereign immunity was not infringed despite the fact that the issue was "ancillary" to a bankruptcy court's in rem jurisdiction.[88]

Because Eleventh Amendment sovereign immunity inheres in states and not their subdivision or establishments, a state agency that wishes to claim state sovereign immunity must establish that it is acting as an arm of the state. In Lake County Estates v. Tahoe Regional Planning Agency, the Court stated: "[A]gencies exercising state power have been permitted to invoke the [Eleventh] Amendment in order to protect the state treasury from liability that would have had essentially the same practical consequences as a judgment against the State itself."[89] In evaluating such a claim, courts will examine state law to determine the nature of the entity and whether to treat it as an arm of the state.[90] The Supreme Court has consistently refused to extend Eleventh Amendment sovereign immunity to counties, cities, or towns,[91] even though such political subdivisions exercise a "slice of state power."[92] Even when such entities enjoy immunity from suit under state law, they do not have Eleventh Amendment immunity in federal court and states may not confer it.[93] Similarly, entities created pursuant to interstate compacts (and subject to congressional approval) are not immune from suit, absent a showing that the entity was structured so as to take advantage of the state's constitutional protections.[94]

Exceptions[edit | edit source]

Waiver of State Sovereign Immunity[edit | edit source]

The immunity of a state from suit is a privilege which it may waive at its pleasure. Historically, the conclusion that a state has consented or waived its immunity has not been lightly inferred; the Court strictly construes statutes alleged to consent to suit. Thus, a state may waive its immunity in its own courts without consenting to suit in federal court,[95] and a general authorization "to sue and be sued" is ordinarily insufficient to constitute consent.[96] A statutory waiver of state Eleventh Amendment immunity is effective "only where stated in the most express language or by such overwhelming implication from the text as [will] leave no room for any other reasonable construction."[97]

Thus, in Port Authority Trans-Hudson Corp. v. Feeney,[98] an expansive consent "to suits, actions, or proceedings of any form or nature at law, in equity or otherwise" was deemed too "ambiguous and general" to waive immunity in federal court, because it might be interpreted to reflect only a state's consent to suit in its own courts. But, when combined with language specifying that consent was conditioned on venue being laid "within a county or judicial district, established by one of said States or by the United States, and situated wholly or partially within the Port of New York District," waiver was effective.[99]

There are, however, a few cases in which the Court has found a waiver by implication. For example, in Parden v. Terminal Railway,[100] the Court ruled that employees of a state-owned railroad could sue the state for damages under the Federal Employers' Liability Act (FELA). One of the two primary grounds for finding lack of immunity was that by taking control of a railroad which was subject to the FELA, enacted some twenty years previously, the state had effectively accepted the imposition of the Act and consented to suit.[101] Distinguishing Parden as involving a proprietary activity,[102] the Court later refused to find any implied consent to suit by states participating in federal spending programs; participation was insufficient, and only when waiver has been "stated by the most express language or by such overwhelming implications from the text as [will] leave no room for any other reasonable construction," will it be found.[103] Further, even if a state becomes amenable to suit under a statutory condition on accepting federal funds, remedies, especially monetary damages, may be limited, absent express language to the contrary.[104]

Another form of waiver by implication is the waiver by consent to the plan of the Constitutional Convention; that is, that states waived sovereign immunity to litigation on certain matters when they ratified the Constitution. A recent decision seems to have expanded the scope of these sort of implicit waivers. In PennEast Pipeline Co. v. New Jersey,[105] the Court heard an appeal related to an interstate pipeline approved by the federal government. Under the Natural Gas Act (NGA), parties who receive certificates to construct and operate interstate natural gas pipelines are authorized to exercise eminent domain in order to obtain the necessary rights-of-way to construct and operate the pipeline along the approved route.[106] In this instance, the approved route included lands owned by the State of New Jersey. The certificate holders brought an action in federal district court seeking to condemn those state-owned parcels, and the state responded by asserting its sovereign immunity under the eleventh Amendment. The lower courts sided with the state, rejecting the argument that the federal government had delegated its authority to sue states in the NGA and the certificate proceeding, but the Supreme Court disagreed. Writing for the 5-4 majority, Chief Justice John Roberts noted that "[t]he 'plan of the Convention' includes certain waivers of sovereign immunity to which all States implicitly consented at the founding."[107] The Court concluded that it would be "untenable" to find that this waiver did not extend to private parties authorized by the federal government to exercise eminent domain authority.[108] In addition, because the waiver of sovereign immunity was based on the states' implicit consent via the "plan of the Convention" rather than abrogation or explicit waiver, there was no need to find that the NGA clearly authorized such suits.[109] The Court's decision in PennEast is one of the only Supreme Court decisions relying on the "plan of convention" as a basis for consent or waiver, so its impact outside of federal legislation delegating eminent domain power remains to be seen.

A state may also waive its immunity by initiating or participating in litigation. In Clark v. Barnard,[110] the state had filed a claim for disputed money deposited in a federal court, and the Court held that the state could not thereafter complain when the court awarded the money to another claimant. However, the Court is loath to find a waiver simply because an official or an attorney representing the state decided to litigate the merits of a suit, so that a state may at any point in litigation raise a claim of immunity based on whether that official has the authority under state law to make a valid waiver.[111] However, this argument is only available when the state is brought into federal court involuntarily. If a state voluntarily agrees to removal of a state action to federal court, the Court has held it may not then invoke a defense of sovereign immunity and thereby gain an unfair tactical advantage.[112]

Abrogation of State Sovereign Immunity[edit | edit source]

On May 11, 2023, the Supreme Court issued a decision in Financial Oversight and Management Board for Puerto Rico v. Centro de Periodismo Investigativo, Inc., a case concerning whether the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) abrogates the sovereign immunity of "an entity within the territorial government" of Puerto Rico created by the act.[113] The Court held that Congress did not make "unmistakably clear" in PROMESA's language an intent to abrogate Puerto Rico's sovereign immunity, as required by the Court's precedents.[114] Accordingly, any sovereign immunity to which the entity might be entitled was not abrogated by PROMESA.

The Constitution grants Congress power to regulate state action by legislation. In some instances when Congress does so, it may subject states to suit by individuals to implement the legislation. The clearest example arises from the Civil War Amendments, which directly restrict state powers and expressly authorize Congress to enforce these restrictions through appropriate legislation.[115] Thus, in Fitzpatrick v. Bitzer, the Court stated: "the Eleventh Amendment and the principle of state sovereignty which it embodies . . . are necessarily limited, by the enforcement provisions of § 5 of the Fourteenth Amendment."[116] The power to enforce the Civil War Amendments is substantive, however, not being limited to remedying judicially cognizable violations of the amendments, but extending as well to measures that in Congress's judgment will promote compliance.[117] The principal judicial brake on this power to abrogate state immunity in legislation enforcing the Civil War Amendments is the rule requiring that congressional intent to subject states to suit be clearly stated.[118]

In the 1989 case of Pennsylvania v. Union Gas Co.,[119] the Court--temporarily at least--ended years of uncertainty by holding expressly that Congress acting pursuant to its Article I powers (as opposed to its Fourteenth Amendment powers) may abrogate the Eleventh Amendment immunity of the states, so long as it does so with sufficient clarity. Twenty-five years earlier the Court had stated that same principle,[120] but only as an alternative holding, and a later case had set forth a more restrictive rule.[121] The premises of Union Gas were that by consenting to ratification of the Constitution, with its Commerce Clause and other clauses empowering Congress and limiting the states, the states had implicitly authorized Congress to divest them of immunity, that the Eleventh Amendment was a restraint upon the courts and not similarly upon Congress, and that the exercises of Congress's powers under the Commerce Clause and other clauses would be incomplete without the ability to authorize damage actions against the states to enforce congressional enactments. The dissenters disputed each of these strands of the argument, and, while recognizing the Fourteenth Amendment abrogation power, took the position that no such power existed under Article I.

Pennsylvania v. Union Gas lasted less than seven years before the Court overruled it in Seminole Tribe of Florida v. Florida.[122] Chief Justice William Rehnquist, writing for a 5-4 majority, concluded that Union Gas had deviated from a line of cases, tracing back to Hans v. Louisiana,[123] which viewed the Eleventh Amendment as implementing the "fundamental principle of sovereign immunity [that] limits the grant of judicial authority in Article III."[124] Because "the Eleventh Amendment restricts the judicial power under Article III, . . . Article I cannot be used to circumvent the constitutional limitations placed upon federal jurisdiction."[125] Subsequent cases have upheld this interpretation.[126]

Section 5 of the Fourteenth Amendment, of course, is another matter. Fitzpatrick v. Bitzer,[127] which held, in part, that the Fourteenth Amendment "operated to alter the pre-existing balance between state and federal power achieved by Article III and the Eleventh Amendment," remains good law.[128] This ruling led to a number of cases that examined whether a statute that might be applied against non-state actors under an Article I power could also, under section 5 of the Fourteenth Amendment, be applied against the states.[129]

In another line of cases, a different majority of the Court focused on language Congress used to overcome immunity rather than the authority underlying the action. Henceforth, the Court held in a 1985 decision, and even with respect to statutes that were enacted prior to promulgation of this judicial rule of construction, "Congress may abrogate the States' constitutionally secured immunity from suit in federal court only by making its intention unmistakably clear in the language of the statute" itself.[130]

At one time, a plurality of the Court appeared to take the position that Congress had to refer specifically to state sovereign immunity and the Eleventh Amendment for its language to be unmistakably clear.[131] Thus in 1985 the Court held in Atascadero State Hospital v. Scanlon that general language subjecting to suit in federal court by "any recipient of Federal assistance" under the Rehabilitation Act was insufficient to satisfy this test, not because of any question about whether states are "recipients" within the meaning of the provision but because "given their constitutional role, the states are not like any other class of recipients of federal aid."[132] As a result of these rulings, Congress began to use words the Court had identified.[133] Since then, however, the Court has accepted less precise language,[134] and in at least one context, has eliminated the requirement of specific abrogation language altogether.[135]

Even before the Alden v. Maine decision,[136] when the Court believed that Eleventh Amendment sovereign immunity did not apply to suits in state courts, the Court applied its rule of strict construction to require "unmistakable clarity" by Congress in order to subject states to suit.[137] Although the Court was willing to recognize exceptions to the clear statement rule when the issue involved subjection of states to suit in state courts, the Court also suggested the need for "symmetry" so that states' liability or immunity would be the same in both state and federal courts.[138]

Officer Suits and State Sovereign Immunity[edit | edit source]

Courts may provide relief from government wrongs under the doctrine that sovereign immunity does not prevent suits to restrain individual government officials.[139] The doctrine is built upon a double fiction: that for purposes of the sovereign's immunity, a suit against an official is not a suit against the government, but for the purpose of finding state action to which the Constitution applies, the official's conduct is that of the state.[140] The doctrine is often associated with the decision in Ex parte Young.[141]

Young arose when a state legislature passed a law reducing railroad rates and providing severe penalties for any railroad that failed to comply with the law. Plaintiffs brought a federal action to enjoin Young, the state attorney general, from enforcing the law, alleging that it was unconstitutional and that they would suffer irreparable harm if he were not prevented from acting. An injunction was granted forbidding Young from acting on the law, an injunction he violated by bringing an action in state court against noncomplying railroads; for this action he was adjudged in contempt.

In deciding Young, the Court faced inconsistent lines of cases, including numerous precedents for permitting suits against state officers. Chief Justice John Marshall had begun the process in Osborn by holding that suit was barred only when the state was formally named a party.[142] He modified his position to preclude suit when an official, the governor of a state, was sued in his official capacity,[143] but relying on Osborn and reading Madrazo narrowly, the Court later held in a series of cases that an official of a state could be sued to prevent him from executing a state law in conflict with the Constitution or a law of the United States, and the fact that the officer may be acting on behalf of the state or in response to a state statutory obligation did not make the suit one against the state.[144] Subsequently the Court developed another more functional, less formalistic concept of the Eleventh Amendment and sovereign immunity, which evidenced an increasing wariness toward affirmatively ordering states to relinquish state-controlled property[145] and culminated in the broad reading of Eleventh Amendment immunity in Hans v. Louisiana.[146]

Two of the leading cases concerned suits to prevent Southern states from defaulting on bonds.[147] In Louisiana v. Jumel,[148] a Louisiana citizen sought to compel the state treasurer to apply a sinking fund that had been created under the earlier constitution for the payment of the bonds after a subsequent constitution had abolished this provision for retiring the bonds. The proceeding was held to be a suit against the state.[149] Then, In re Ayers[150] purported to supply a rationale for cases on the issuance of mandamus or injunctive relief against state officers that would have severely curtailed federal judicial power. Suit against a state officer was not barred when his action, aside from any official authority claimed as its justification, was a wrong simply as an individual act, such as a trespass, but if the act of the officer did not constitute an individual wrong and was something that only a state, through its officers, could do, the suit was in actuality a suit against the state and was barred.[151] That is, the unconstitutional nature of the state statute under which the officer acted did not itself constitute a private cause of action. For that, one must be able to point to an independent violation of a common law right.[152]

Although Ayers was in all relevant points on all fours with Young,[153] the Young Court held that the court had properly issued the injunction against the state attorney general, even though the state was in effect restrained as well. The Court stated that "[t]he act to be enforced is alleged to be unconstitutional, and, if it be so, the use of the name of the State to enforce an unconstitutional act to the injury of the complainants is a proceeding without the authority of and one which does not affect the State in its sovereign or governmental capacity."[154] Rather, the Court noted, "[i]t is simply an illegal act upon the part of a state official in attempting by the use of the name of the State to enforce a legislative enactment which is void because unconstitutional. If the act which the state Attorney General seeks to enforce be a violation of the Federal Constitution, the officer in proceeding under such enactment comes into conflict with the superior authority of that Constitution, and he is in that case stripped of his official or representative character and is subject in his person to the consequences of his individual conduct."[155] Justice John Harlan was the only dissenter, arguing that in law and fact the suit was one only against the state and that the suit against the individual was a mere "fiction."[156]

Justice John Harlan's "fiction" remains a mainstay of Eleventh Amendment jurisprudence.[157] It accounts for much of the litigation brought by individuals to challenge the execution of state policies. Suits against state officers alleging that they are acting pursuant to an unconstitutional statute are the standard device by which the validity of state legislation in federal courts is tested prior to enforcement and thus interpretation by state courts.[158] Similarly, suits to restrain state officials from contravening federal statutes[159] or to compel undertaking affirmative obligations imposed by the Constitution or federal laws[160] are common.

For years, the accepted rule was that the Eleventh Amendment did not preclude suits prosecuted against state officers in federal courts upon grounds that they are acting in excess of state statutory authority[161] or that they are not doing something required by state law.[162] However, in Pennhurst State School & Hospital v. Halderman,[163] the Court held that Young did not permit suits in federal courts against state officers alleging violations of state law. In the Court's view, Young was necessary to promote the supremacy of federal law, a basis that disappears if the violation alleged is of state law. The Court also still adheres to the doctrine, first pronounced in Governor of Georgia v. Madrazo,[164] that some suits against officers are actually suits against the state[165] and are barred by the state's immunity, such as when the suit involves state property or asks for relief which clearly calls for the exercise of official authority.[166]

For example, a suit to prevent tax officials from collecting death taxes arising from the competing claims of two states as being the last domicile of the decedent foundered upon the conclusion that there could be no credible claim of a constitutional or federal law violation; state law imposed the obligation upon the officials and "in reality" the action was against the state.[167] Suits against state officials to recover taxes have also been made increasingly difficult to maintain. Although the Court long ago held that the state sovereign immunity prevented a suit to recover money in the state treasury,[168] the Court also held that a suit would lie against a revenue officer to recover tax moneys illegally collected and still in his possession.[169] Beginning, however, with Great Northern Life Insurance Co. v. Read,[170] the Court has held that this kind of suit cannot be maintained unless the state expressly consents to suits in federal courts. In this case, the state statute provided for payment of taxes under protest and for suits afterward against state tax collection officials for recovery of taxes illegally collected, which revenues were required to be kept segregated.[171]

In Edelman v. Jordan,[172] the Court appeared to begin to adopt new restrictive interpretations of what the Eleventh Amendment proscribed. The Court announced in dictum that a suit "seeking to impose a liability which must be paid from public funds in the state treasury is barred by the Eleventh Amendment."[173] The Court held, however, that it was permissible for federal courts to require state officials to comply in the future with claims payment provisions of the welfare assistance sections of the Social Security Act, but that they were not permitted to hear claims seeking, or issue orders directing, payment of funds found to be wrongfully withheld.[174] Conceding that some of the characteristics of prospective and retroactive relief would be the same in their effects upon the state treasury, the Court nonetheless believed that retroactive payments were equivalent to imposing liabilities which must be paid from public funds in the treasury, and that this was barred by the Eleventh Amendment. The spending of money from the state treasury by state officials shaping their conduct in accordance with a prospective-only injunction is "an ancillary effect" which "is a permissible and often an inevitable consequence" of Ex parte Young, whereas "payment of state funds . . . as a form of compensation" to those wrongfully denied the funds in the past "is in practical effect indistinguishable in many aspects from an award of damages against the State."[175]

That Edelman, in many instances, may be a formal rather than an actual restriction is illustrated by Milliken v. Bradley,[176] in which state officers were ordered to spend money from the state treasury to finance remedial educational programs to counteract effects of past school segregation; the decree, the Court said, "fits squarely within the prospective-compliance exception reaffirmed by Edelman."[177] Although the payments were a result of past wrongs, the Court did not view them as "compensation," inasmuch as they were not to be paid to victims of past discrimination but rather used to better conditions either for them or their successors.[178] The Court also applied Edelman in Papasan v. Allain,[179] holding that a claim against a state for payments representing a continuing obligation to meet trust responsibilities stemming from a nineteenth century grant of public lands for the benefit of educating the Chickasaw Indian Nation is barred by the Eleventh Amendment as indistinguishable from an action for past loss of trust corpus, but that an Equal Protection claim for present unequal distribution of school land funds is the type of ongoing violation for which the Eleventh Amendment does not bar redress.

In Idaho v. Coeur d'Alene Tribe of Idaho,[180] the Court further narrowed Ex parte Young. The implications of the case are difficult to predict, because of the narrowness of the Court's holding, the closeness of the vote (5-4), and the inability of the majority to agree on a rationale. The Court held that the Tribe's suit against state officials for a declaratory judgment and injunction to establish the Tribe's ownership and control of the submerged lands of Lake Coeur d'Alene is barred by the Eleventh Amendment. The Tribe's claim was based on federal law--Executive Orders issued in the 1870s, prior to Idaho statehood. The portion of Justice Anthony Kennedy's opinion that represented the Court's opinion concluded that the Tribe's "unusual" suit was "the functional equivalent of a quiet title action which implicates special sovereignty interests."[181] The case was "unusual" because state ownership of submerged lands traces to the Constitution through the "equal footing doctrine," and because navigable waters "uniquely implicate sovereign interests."[182] This was therefore no ordinary property dispute in which the state would retain regulatory control over land regardless of title. Rather, grant of the "far-reaching and invasive relief" sought by the Tribe "would diminish, even extinguish, the State's control over a vast reach of lands and waters long . . . deemed to be an integral part of its territory."[183]

The Supreme Court faced a novel question related to state sovereign immunity in the 2021 case Whole Woman's Health v. Jackson.[184] That case involved a challenge to a Texas state law known as the Texas Heartbeat Act or S.B. 8, which allowed private citizens to sue healthcare providers and others who perform or abet abortions after a fetal heartbeat is detected. Because S.B. 8 banned some pre-viability abortions, it appeared to conflict with the Supreme Court's abortion jurisprudence at the time it was enacted. However, because the statute was enforced through private civil suits, rather than by state actors, it was not clear whether people challenging the law could bring suit under Ex parte Young to prevent its enforcement. Some opponents of S.B. 8 brought suit under Young against the Texas attorney general, clerks and judges of Texas state courts that could hear S.B. 8 claims, and certain state medical licensing officials. The Supreme Court held that the suit could not proceed against state court judges or clerks because judicial officers are not subject to suit under Young,[185] and that the plaintiffs could not sue the Texas attorney general because he lacked the power to enforce S.B. 8.[186] The Court allowed the suit to proceed against the state medical licensing officials, however, concluding that those officials had some authority to enforce S.B. 8.[187] Whole Woman's Health did not fully resolve questions about the extent to which states can enact legislation that limits the exercise of constitutional rights but evades federal judicial review under Young.[188]

Thus, as with the cases dealing with suits facially against the states themselves, the Court's greater attention to state immunity in the context of suits against state officials has resulted in a mixed picture, of some new restrictions, of the lessening of others. But a number of Justices have increasingly turned to the Eleventh Amendment as a means to reduce federal-state judicial conflict.[189]

Tort Actions Against State Officials[edit | edit source]

In Tindal v. Wesley,[190] the Court adopted the rule of United States v. Lee,[191] a tort suit against federal officials, to permit a tort action against state officials to recover real property held by them and claimed by the state and to obtain damages for the period of withholding. State immunity afforded by the Eleventh Amendment has long been held not to extend to actions against state officials for damages arising out of willful and negligent disregard of state laws.[192] The reach of the rule is evident in Scheuer v. Rhodes,[193] in which the Court held that plaintiffs were not barred by the Eleventh Amendment or other immunity doctrines from suing the governor and other officials of a state alleging that they deprived plaintiffs of federal rights under color of state law and seeking damages, when it was clear that plaintiffs were seeking to impose individual and personal liability on the officials. There was no "executive immunity" from suit, the Court held; rather, the immunity of state officials is qualified and varies according to the scope of discretion and responsibilities of the particular office and the circumstances existing at the time the challenged action was taken.[194]

- ↑ C. Wright, The Law of Federal Courts § 48 at 286 (4th ed. 1983).

- ↑ Chisholm v. Georgia, 2 U.S. (2 Dall.) 419 (1793).

- ↑ Art. III, Sec. 2, Clause 1 Cases or Controversies.

- ↑ The Convention adopted this provision largely as it came from the Committee on Detail, without recorded debate. 2 The Records of the Federal Convention of 1787, at 423-25 (Max Farrand ed., 1937). In the Virginia ratifying convention, George Mason, who had refused to sign the proposed Constitution, objected to making states subject to suit, 3 Jonathan Elliot, Debates in the Several State Conventions on the Adoption of the Federal Constitution 526-27 (1836), but both James Madison and John Marshall (the latter had not been a delegate at Philadelphia) denied states could be made party defendants, id. at 533, 555-56, while Edmund Randolph (who had been a delegate, as well as a member of the Committee of Detail) granted that states could be and ought to be subject to suit. Id. at 573. James Wilson, a delegate and member of the Committee on Detail, seemed to say in the Pennsylvania ratifying convention that states would be subject to suit. 2 id. at 491. Hamilton, in The Federalist No. 81 (Alexander Hamilton), also denied state suability.

- ↑ Ch. 20, § 13, 1 Stat. 80 (1789). For a thorough consideration of passage of the Act itself, see Julius Goebel, History of the Supreme Court of the United States, Antecedents and Beginnings to 1801, at 457-508 (1971).

- ↑ Chishom v.Georgia, 2 U.S. (2 Dall.) 419 (1793).

- ↑ Goebel, supra note here, at 726-34.

- ↑ Chisholm v. Georgia, 2 U.S. (2 Dall.) 419, 435 (1793) (Iredell, J.) ("No other part of the common law of England, it appears to me, can have any reference to this subject, but that part of it which prescribes remedies against the crown. Every State in the Union in every instance where its sovereignty has not been delegated to the United States, I consider to be completely sovereign, as the United States are in respect to the power surrendered."). Justice James Iredell noted that the only circumstance under which the common law allowed such suits to proceed was when the sovereign consented to the suit. He said: "Thus, it appears, that in England even in case of a private debt contracted by the King, in his own person, there is no remedy but by petition, which must receive his express sanction, otherwise, there can be no proceeding upon it." Id. at 445.

- ↑ Chisholm v. Georgia, 2 U.S. (2 Dall.) 419 (1793).

- ↑ The phrase is Justice Felix Frankfurter's, from Larson v. Domestic & Foreign Commerce Corp., 337 U.S. 682, 708 (1949) (dissenting), a federal sovereign immunity case. The amendment was proposed on March 4, 1794, when it passed the House and it was ratified on February 7, 1795, when the twelfth state acted, there then being fifteen states in the Union.

- ↑ Hollingsworth, et al. v. Virginia, 3 U.S. (3 Dall.) 378 (1798) ("[T]he [Eleventh] amendment being constitutionally adopted, there could not be exercised in any jurisdiction, in any case, past or future, in which a State was sued by the citizens of another State or by citizens or subjects of any foreign state.").

- ↑ Goebel, supra note here, at 736.

- ↑ Party status is one part of the Article III grant of jurisdiction, as in diversity of citizenship of the parties; subject matter jurisdiction is the other part, as in federal question or admiralty jurisdiction.

- ↑ Justice Bushrod Washington, on Circuit, held in United States v. Bright, 24 F. Cas. 1232 (No. 14647) (C.C.D. Pa. 1809), that the Eleventh Amendment's reference to "any suit in law or equity" excluded admiralty cases, so that states were subject to suits in admiralty. During this period, the Court did not rule on this understanding, see Governor of Georgia v. Madrazo, 26 U.S. (1 Pet.) 110, 124 (1828); 3 Joseph Story, Commentaries on the Constitution of the United States 560-61 (1833); United States v. Peters, 9 U.S. 115 (1809); Ex parte Madrazo, 32 U.S. (7 Pet.) 627 (1833). In 1921, the Court held it to be in error in Ex parte New York (No. 1), 256 U.S. 490 (1921).

- ↑ 19 U.S. (6 Wheat.) 264 (1821).

- ↑ 1 Stat. 73, 85.

- ↑ Cohens, 19 U.S. at 406. Justice Marshall stated: "It is a part of our history that, at the adoption of the constitution, all the states were greatly indebted; and the apprehension that these debts might be prosecuted in the federal courts, formed a very serious objection to that instrument. Suits were instituted; and the court maintained its jurisdiction. . . . That its motive was not to maintain the sovereignty of a state from the degradation supposed to attend a compulsory appearance before the tribunal of the nation, may be inferred from the terms of the amendment. It does not comprehend controversies between two or more states, or between a state and a foreign state. The jurisdiction of the court still extends to these cases: and in these, a state may still be sued. . . . Those who were inhibited from commencing a suit against a state, or from prosecuting one which might be commenced before the adoption of the amendment, were persons who might probably be its creditors. There was not much reason to fear that foreign or sister states would be creditors to any considerable amount, and there was reason to retain the jurisdiction of the court in those cases, because it might be essential to the preservation of peace. The amendment, therefore, extended to suits commenced or prosecuted by individuals, but not to those brought by states." 19 U.S. at 406-07.

- ↑ Id. Justice John Marshall stated: "The powers of the Union, on the great subjects of war, peace and commerce, and on many others, are in themselves limitations of the sovereignty of the states; but in addition to these, the sovereignty of the states is surrendered, in many instances, where the surrender can only operate to the benefit of the people, and where, perhaps, no other power is conferred on Congress than a conservative power to maintain the principles established in the constitution . . . .[A]re we at liberty to insert in this general grant, an exception of those cases in which a state may be a party? Will the spirit of the constitution justify this attempt to control its words? We think it will not. We think a case arising under the constitution or laws of the United States, is cognizable in the courts of the Union, whoever may be the parties to that case." 19 U.S. at 382-83.

- ↑ Justice John Marshall stated: "If this writ of error be a suit, in the sense of the eleventh amendment, it is not a suit commenced or prosecuted 'by a citizen of another state, or by a citizen or subject of any foreign state.' It is not, then, within the amendment, but is governed entirely by the constitution as originally framed, and we have already seen, that in its origin, the judicial power was extended to all cases arising under the constitution or laws of the United States, without respect to parties." 19 U.S. at 412 (citations omitted).

- ↑ 22 U.S. (9 Wheat.) 738 (1824)

- ↑ The Bank of the United States was initially treated as if it were a private citizen, rather than as the United States itself, and hence a suit by it was a diversity suit by a corporation, as if it were a suit by the individual shareholders. Bank of the United States v. Deveaux, 9 U.S. (5 Cr.) 61 (1809).

- ↑ Osborn v. Bank of the United States, 22 U.S. 738, 857 (1824) ("[T]he eleventh amendment, which restrains the jurisdiction granted by the constitution over suits against States, is, of necessity, limited to those suits in which a State is a party of record.").

- ↑ Id. at 868. For cases following Osborn, see Davis v. Gray, 16 Wall 203, 220 (1872) ("In deciding who are parties to the suit the court will not look beyond the record. Making a state officer a party does not make the State a party, although her law may have prompted his action and the State may stand behind him as the real party in interest."); McComb v. Board of Liquidation, 92 U.S. 531 540, (1875) ("A State, without its consent, cannot be sued by an individual; and a court cannot substitute its own discretion for that of executive officers in matters belonging to the proper jurisdiction of the latter. But it has been well settled, that, when a plain official duty, requiring no exercise of discretion, is to be performed, and performance is refused, any person who will sustain personal injury by such refusal may have a mandamus to compel its performance; and when such duty is threatened to be violated by some positive official act, any person who will sustain personal injury thereby, for which adequate compensation cannot be had at law, may have an injunction to prevent it. . . . In either case, if the officer plead the authority of an unconstitutional law for the non-performance or violation of his duty, it will not prevent the issuing of the writ. An unconstitutional law will be treated by the courts as null and void.").

- ↑ 22 U.S. at 850-58. For a reassertion of the Chief Justice's view of the limited effect of the Amendment, see id. at 857-58. But compare id. at 849. The holding was repudiated in Governor of Georgia v. Madrazo, wherein Marshall conceded that the suit had been brought against the governor solely in his official capacity and with the design of forcing him to exercise his official powers. Georgia v. Madrazo, 26 U.S. 110, 124 (1828) ("[W]here the chief magistrate of a State is sued, not by his name, but by his style of office, and the claim made upon him is entirely in his official character, we think the State itself may be considered as a party on the record."). In determining whether a suit is prosecuted against a state "the Court will look behind and through the nominal parties on the record to ascertain who are the real parties to the suit." In re Ayers, 123 U.S. 443, 487 (1887). See also Poindexter v. Greenhow, 114 U.S. 270, 287 (1885) ("[T]he question whether a suit is within the prohibition of the eleventh Amendment is not always determined by reference to the nominal parties on the record.").

- ↑ 22 U.S. (9 Wheat.) 738 (1824).

- ↑ Act of March 3, 1875, ch. 137, § 1, 18 Stat. 470 ("That the Circuit Courts of the United States shall have original cognizance, concurrent with the courts of the several states; of all suits of a civil nature at common law or in equity, arising under the Constitution or laws of the United States, or treaties made, or which shall be made under their authority."). Article III, Section 2, Clause 1, of the Constitution provides "the judicial power of the United States shall extend to all cases in Law and Equity arising under this Constitution, the Laws of the United States, and Treaties made, or which shall be made under their Authority," federal courts have jurisdiction over cases concerning the Constitution or federal law. See discussion under "Development of Federal Question Jurisdiction," supra.

- ↑ See, e.g., J.V. Orth, The Eleventh Amendment and the North Carolina State Debt, 59 N.C. L. Rev. 747 (1981); J.V. Orth, The Fair Fame and Name of Louisiana: The Eleventh Amendment and the End of Reconstruction, 2 Tul. Law. 2 (1980); J. V. Orth, The Virginia State Debt and the Judicial Power of the United States, in Ambivalent Legacy: a Legal History of the South 106 (D. Bodenhamer & J. Ely eds., 1983).

- ↑ U.S. Const. Art. III Sec. 2, Clause 1 "(The judicial Power shall extend to all Cases, in Law and Equity, arising under this Constitution, the Laws of the United States, and Treaties made, or which shall be made, under their Authority . . . .").

- ↑ 107 U.S. 711, 721 (1882) ("The question, then, is whether the contract can be enforced, notwithstanding the Constitution, by coercing the agents and officers of the State, whose authority has been withdraw in violation of the contract, without the State itself in its political capacity being a party to the proceedings.") .

- ↑ 117 U.S. 52, 67 (1886) ("Though not nominally a party to the record, it is the real and only party in interest, the nominal defendants being the officers and agents of the State, having no personal interest in the subject-matter of the suit, and defending only as representing the State . . . . The State is not only the real party to the controversy, but the real party against which relief is sought by the suit, and the suit is, therefore, substantially within the prohibition of the eleventh amendment . . . .")

- ↑ Hans v. Louisiana, 134 U.S. 1, 10 (1890).

- ↑ Louisiana v. Jumel, 107 U.S. 711, 728 (1882) ("When a State submits itself, without reservation, to the jurisdiction of a court in a particular case, that jurisdiction may be used to give full effect to what the State has by its act of submission allowed to be done; . . . But this is very far from authorizing the courts, when a State cannot be sued, to set up its jurisdiction over the officers in charge of the public moneys, so as to control them as against the political power in their administration of the finances of the State.").

- ↑ Cunningham v. Macon and Brunswick R.R., 109 U.S. 446, 451 (1883) ("[W]henever it can be clearly seen that the State is an indispensable party to enable the court, according to the rules which govern its procedure, to grant the relief sought, it will refuse to take jurisdiction.")

- ↑ 123 U.S. 443, 505 (1887) ("[B]y virtue of the eleventh Amendment to the Constitution, there being no remedy by a suit against the State, the contract is substantially without sanction, except that which arises out of the honor and good faith of the State itself, and these are not subject to coercion.").

- ↑ 134 U.S. 1 (1890).

- ↑ Id. at 11.

- ↑ Id. at 13-14.

- ↑ Id. at 15, 16.

- ↑ 134 U.S. at 18. The Court acknowledged that Chief Justice John Marshall's opinion in Cohens v. Virginia, 19 U.S. (6 Wheat.) 264, 382-83, 406-07, 410-12 (1821), was to the contrary, but observed that the language was unnecessary to the decision and thus dictum, "and though made by one who seldom used words without due reflection, ought not to outweigh the important considerations referred to which lead to a different conclusion." 134 U.S. at 20.

- ↑ 256 U.S. 490 (1921).

- ↑ Id. at 497-98.

- ↑ Id. at 498. See also Florida Dep't of State v. Treasure Salvors, 458 U.S. 670 (1982); Welch v. Texas Dep't of Highways and Transp., 483 U.S. 468 (1987).

- ↑ E.g., Pennhurst State School & Hosp. v. Halderman, 465 U.S. 89, 97-103 (1984) (opinion of the Court by Justice Lewis Powell); Atascadero State Hosp. v. Scanlon, 473 U.S. 234, 237-40, 243-44 n.3 (1985) (opinion of the Court by Justice Lewis Powell); Welch v. Texas Dep't of Highways & Pub. Transp., 483 U.S. 468, 472-74, 478-95 (1987) (plurality opinion of Justice Lewis Powell); Pennsylvania v. Union Gas Co., 491 U.S. 1, 29 (1989) (Justice Antonin Scalia concurring in part and dissenting in part); Dellmuth v. Muth, 491 U.S. 223, 227-32 (1989) (opinion of the Court by Justice Anthony Kennedy); Hoffman v. Connecticut Dep't of Income Maintenance, 492 U.S. 96, 101 (1989) (plurality opinion of Justice Byron White); id. at 105 (concurring opinions of Justices Sandra Day O'Connor and Antonin Scalia); Port Authority Trans-Hudson Corp. v. Feeney, 495 U.S. 299, 305 (1990) (opinion of the Court by Justice Sandra Day O'Connor).

- ↑ E.g., Atascadero State Hosp. v. Scanlon, 473 U.S. 234, 246 (1985) (dissenting); Welch v. Texas Dep't of Highways & Pub. Transp., 483 U.S. 468, 496 (1987) (dissenting); Dellmuth v. Muth, 491 U.S. 223, 233 (1989) (dissenting); Port Authority Trans-Hudson Corp. v. Feeney, 495 U.S. 299, 309 (1990) (concurring). Joining Justice William Brennan were Justices Thurgood Marshall, Harry Blackmun, and John Stevens. See also Pennsylvania v. Union Gas Co., 491 U.S. 1, 23 (1989) (Justice Stevens concurring).

- ↑ 517 U.S. 44 (1996).

- ↑ 527 U.S. 706 (1999).

- ↑ Employees of the Dep't of Public Health and Welfare v. Department of Public Health and Welfare, 411 U.S. 279, 287 (1973). 16. 527 U.S. 706 (1999).

- ↑ 527 U.S. 706 (1999).

- ↑ 527 U.S. at 713.

- ↑ Note, however, that at least one subsequent decision has seemingly enhanced the applicability of federal law to the states themselves. In PennEast Pipeline Co. v New Jersey, (595 U.S. --), the Court held that a private company that was granted authority to exercise eminent domain by the federal government could exercise that authority to take possession of property interests owned by a state.

- ↑ 535 U.S. 743 (2002). Justice Breyer's dissenting opinion describes a need for "continued dissent" from the majority's sovereign immunity holdings. 535 U.S. at 788.

- ↑ 46 U.S.C. §§ 40101 et seq.

- ↑ 535 U.S. at 755, 760.

- ↑ 415 U.S. 651 (1974).

- ↑ 415 U.S. at 678. The Court relied on Ford Motor Co. v. Department of Treasury of Indiana, 323 U.S. 459 (1945), where the issue was whether state officials who had voluntarily appeared in federal court had authority under state law to waive the state's immunity. Edelman has been followed in Sosna v. Iowa, 419 U.S. 393, 396 n.2 (1975); Mt. Healthy City Bd. of Educ. v. Doyle, 429 U.S. 274, 278 (1977), with respect to the Court's responsibility to raise the Eleventh Amendment jurisdictional issue on its own motion.

- ↑ See Patsy v. Florida Board of Regents, 457 U.S. 496, 515-16 n.19 (1982), in which the Court bypassed the Eleventh Amendment issue, which had been brought to its attention, because of the interest of the parties in having the question resolved on the merits. See id. at 520 (Justice Lewis Powell dissenting).

- ↑ Clark v. Barnard, 108 U.S. 436 (1883).

- ↑ E.g., People's Band v. Calhoun, 102 U.S. 256, 260-61 (1880). See Justice Lewis Powell's explanation in Patsy v. Florida Board of Regents, 457 U.S. 496, 528 n.13 (1982) (dissenting) (no jurisdiction under Article III of suits against unconsenting states).

- ↑ See, e.g., the Court's express rejection of the Eleventh Amendment defense in these cases. United States v. Texas, 143 U.S. 621 (1892); South Dakota v. North Carolina, 192 U.S. 286 (1904).

- ↑ E.g., Fitzpatrick v. Bitzer, 427 U.S. 445 (1976); Pennsylvania v. Union Gas Co., 491 U.S. 1 (1989).

- ↑ The principal citation is Marbury v. Madison, 5 U.S. (1 Cr.) 137 (1803).

- ↑ Pennhurst State School & Hosp. v. Halderman, 465 U.S. 89, 98, 99 (1984).

- ↑ As Justice Oliver Holmes explained, the doctrine is based "on the logical and practical ground that there can be no legal right as against the authority that makes the law on which the right depends." Kawananakoa v. Polyblank, 205 U.S. 349, 353 (1907). Of course, when a state is sued in federal court pursuant to federal law, the Federal Government, not the defendant state, is "the authority that makes the law" creating the right of action. See Seminole Tribe of Florida v. Florida, 517 U.S. 44, 154 (1996) (Souter, J., dissenting). For the history and jurisprudence, see Lewis J. Jaffe, Suits Against Governments and Officers: Sovereign Immunity, 77 Harv. L. Rev. 1 (1963).

- ↑ Alden v. Maine, 527 U.S. 706, 713 (1999).

- ↑ See, e.g., United States v. Lee, 106 U.S. 196, 210-14 (1882); Belknap v. Schild, 161 U.S. 10, 18 (1896); Hopkins v. Clemson Agricultural College, 221 U.S. 636, 642-43, 645 (1911).

- ↑ A sovereign may consent to suit. E.g., United States v. Sherwood, 312 U.S. 584, 586 (1941); United States v. United States Fidelity & Guaranty Co., 309 U.S. 506, 514 (1940).

- ↑ See Fletcher, supra.

- ↑ For a while only Justice William Brennan advocated this view, Parden v. Terminal Ry., 377 U.S. 184 (1964); Emps. of the Dep't of Pub. Health and Welfare v. Dep't of Pub. Health and Welfare, 411 U.S. 279, 298 (1973) (dissenting), but in time he was joined by three others. See, e.g., Atascadero State Hosp. v. Scanlon, 473 U.S. 234, 247 (1985) (Justice William Brennan, joined by Justices Thurgood Marshall, Harry Blackmun, and John Stevens, dissenting).

- ↑ E.g., United States v. Texas, 143 U.S. 621 (1892); South Dakota v. North Carolina, 192 U.S. 286 (1904). See Kansas v. Colorado, 533 U.S. 1 (2001) (state may seek damages from another state, including damages to its citizens, provided it shows that the state has an independent interest in the proceeding).

- ↑ E.g., Fitzpatrick v. Bitzer, 427 U.S. 445, 456 (1976); Quern v. Jordan, 440 U.S. 332, 337 (1979).

- ↑ See Hutto v. Finney, 437 U.S. 678 (1978), in which the various opinions differ among themselves as to the degree of explicitness required. See also Quern v. Jordan, 440 U.S. 332, 343-45 (1979). As noted in the previous section, later cases stiffened the rule of construction. The parallelism of congressional power to regulate and to legislate away immunity is not exact. Thus, in Employees of the Dep't of Pub. Health and Welfare v. Department of Pub. Health and Welfare, 411 U.S. 279 (1973), the Court strictly construed congressional provision of suits as not reaching states, while in Maryland v. Wirtz, 392 U.S. 183 (1968), it had sustained the constitutionality of the substantive law.

- ↑ 440 U.S. 410, 426 (1979), overruled by Franchise Tax Bd. v. Hyatt, 139 S. Ct. 1485, 1492 (2019) [hereinafter Franchise Tax Bd. III. Id. at 411-12.

- ↑ Id. at 411-12.

- ↑ Id. at 414-18.

- ↑ Id. at 426. In the Court's view, for a federal court to infer "from the structure of our Constitution and nothing else, that California is not free in this case to enforce its policy of full compensation, that holding would constitute the real intrusion on the sovereignty of the States--and the power of the people--in our Union." Id. at 426-27.

- ↑ Franchise Tax Bd. III, 139 S. Ct. 1485, 1492 (2019).

- ↑ Id. at 1490-91.

- ↑ Id. at 1491; see also Franchise Tax Bd. of Cal. v. Hyatt, 136 S. Ct. 1277, 1279 (2016) ("The Court is equally divided on this question, and we consequently affirm the Nevada courts' exercise of jurisdiction over California."); Franchise Tax Bd. III, 139 S. Ct. at 1490-91 (explaining that the two prior Franchise Tax Board decisions centered on interpretations of the Full Faith and Credit Clause of Article IV of the Constitution).

- ↑ Franchise Tax Bd. III, 139 S. Ct. at 1493, 1497.

- ↑ Id. at 1496 (quoting Alden v. Maine, 527 U.S. 706, 722 (1999)).

- ↑ Id. (quoting Alden, 527 U.S. at 713). 49. Id. at 1497.

- ↑ Id. at 1497.

- ↑ Id. (citation omitted).

- ↑ Id. at 1499. The Court reasoned that stare decisis did not compel it to follow Hall even though "some plaintiffs, such as Hyatt" relied on that decision in litigation against states. Id. at1499. In the Court's view, Hall "failed to account for the historical understanding of state sovereign immunity" and stood "as an outlier in [the Court's] sovereign immunity jurisprudence." Id.

- ↑ See Tennessee Student Assistance Corp. v. Hood, 541 U.S. 440, 446-48 (2004) (exercise of bankruptcy court's in rem jurisdiction over a debtor's estate to discharge a debt owed to a state does not infringe the state's sovereignty); California v. Deep Sea Research, Inc., 523 U.S. 491, 507-08 (1998) (despite state claims over shipwrecked vessel, the Eleventh Amendment does not bar federal court in rem admiralty jurisdiction where the res is not in the possession of the sovereign).

- ↑ Central Virginia Community College v. Katz, 546 U.S. 356, 362-63 (2006). The Court has cautioned, however, that Katz's analysis is limited to the context of the Bankruptcy Clause. Specifically, the Court has described the Clause as "sui generis" or "unique" among Article I's grants of authority, and, unlike other such grants, the Bankruptcy Clause itself abrogated state sovereign immunity in bankruptcy proceedings. See Allen v. Cooper, 140 S.Ct. 994, 1002-03 (2020) (observing that Katz "points to a good-for-one-clause-only holding" and does not cast further doubt on Seminole Tribe's "general rule that Article I cannot justify haling a State into federal court").

- ↑ A "preferential transfer" was defined as the transfer of a property interest from an insolvent debtor to a creditor, which occurred on or within ninety days before the filing of a bankruptcy petition, and which exceeds what the creditor would have been entitled to receive under such bankruptcy filing. 11 U.S.C. § 547(b). 55. 546 U.S. at 373.

- ↑ 546 U.S. at 373.

- ↑ Lake County Estates v. Tahoe Regional Planning Agency, 440 U.S. 391, 400-01 (1979), citing Edelman v. Jordan, 415 U.S. 651 (1974), and Ford Motor Co. v. Department of Treasury, 323 U.S. 459 (1945). The fact that a state agency can be indemnified for the costs of litigation does not divest the agency of its Eleventh Amendment immunity. Regents of the University of California v. Doe, 519 U.S. 425 (1997).

- ↑ See, e.g., Mt. Healthy City Bd. of Educ. v. Doyle, 429 U.S. 274, 280 (1977) (local school district not an arm of the state based on (1) its designation in state law as a political subdivision, (2) the degree of supervision by the state board of education, (3) the level of funding received from the state, and (4) the districts' empowerment to generate their own revenue through the issuance of bonds or levying taxes.