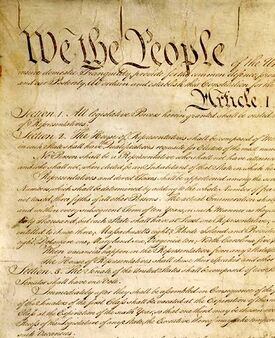

Constitution of the United States/Art. I/Sec. 9/Clause 7 Appropriations

Article I Legislative Branch

Section 9 Powers Denied Congress

Clause 7 Appropriations

| Clause Text |

|---|

| No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time. |

Overview of Appropriations Clause[edit | edit source]

The Appropriations Clause establishes a rule of law to govern money contained in "the Treasury," which is a term that describes a place where public revenue is deposited and kept and from which payments are made to cover public expenses.[1] As the Supreme Court has explained, that rule of law directs "that no money can be paid out of the Treasury unless it has been appropriated by an act of Congress."[2] The Clause has roots in the practice of English parliaments, dating from at least the 1690s, of legislating both the means of raising public revenue and also dedicating, or appropriating, newly raised sums to particular purposes. State constitutions adopted after Independence continued this practice, in most instances expressly identifying an appropriation as a necessity for drawing funds from a state treasury. The proposition that a legislature should control the disbursement of public funds appears to have become so firmly rooted by the late 1780s that the Appropriations Clause itself attracted relatively little debate either in the Constitutional Convention where it was drafted or in the state conventions where it was ratified.[3]

Strictly speaking, the Appropriations Clause does not confer a distinct legislative power upon Congress, on the order of those powers enumerated in Article I, Section 8. Instead, the Clause is phrased as a limitation on government action.[4] Thus, the Supreme Court's cases explain that any exercise of a power granted by the Constitution to the Judiciary or to the Executive is "limited by a valid reservation of congressional control over funds in the Treasury."[5] For instance, the Court has held federal courts may not enter, and Executive Branch officials may not pay, money judgments against the United States for which there is no appropriation. However, the Court's cases also explain that Congress may not dictate that funds are available subject to a limitation that is itself unconstitutional. The Court has thus disregarded a funding limitation enacted by Congress because the limitation constituted, for example, a Bill of Attainder.[6]

Historical Background on Appropriations Clause[edit | edit source]

The Appropriations Clause makes part of American constitutional law a regular practice of British Parliaments dating from at least the Glorious Revolution of the late seventeenth century. Parliament's function of granting its consent to raise revenue as a supplement to the Monarch's ordinary revenue sources had by then been an established and powerful tool.[7] However, prior to the Glorious Revolution, Parliament does not seem to have regularly directed its attention to decisions of how voted sums would be used.[8] The view of King Charles II's chief ministers in the decades prior to the Glorious Revolution, for example, was that the Monarch was the "master of his own money" and that his ministers had discretion to apply voted sums "to defray any casual expenses, of any nature" whatsoever.[9] The ministers viewed a 1665 supply bill passed by the House of Commons, for example, as "not fit for [a] monarchy" because it included a clause of appropriation, that is, legislative language stating that sums the bill raised could be used only for the costs of war against the Dutch Republic.[10] However, when King William III and Queen Mary II jointly assumed the throne in 1689, they recognized Parliament's power to legislate supply and expenditure.[11] Thereafter, clauses of appropriations became common features of parliamentary legislation.[12]

When the American states framed new systems of government after Independence, most state constitutions made legislative authorization a prerequisite for drawing any funds from a state treasury.[13] No state constitution in effect in 1787 expressly allowed a person to draw money from the state treasury without legislative authorization.[14] The states framed the Articles of Confederation to include a similar appropriating function for the Confederation Congress,[15] albeit one that drew from a common treasury supplied by taxes laid and levied by states rather than by the Confederation Congress itself.[16]

Perhaps owing to the pedigree then enjoyed by the view that a legislature should be solely endowed with the authority to identify the purposes for which public money may be spent, the Appropriations Clause itself attracted little debate at the Constitutional Convention of 1787. The Framers debated only whether the Senate--then conceived as a body whose members the states would elect--would have the power to originate or amend, among others, appropriations bills.[17] The first proposal in the Convention that mentioned Congress's appropriations function stated that "all Bills for raising or appropriating money" shall "originate in the first Branch of the Legislature, and shall not be altered or amended by the second Branch...."[18] This first proposal continued: "and that no money shall be drawn from the public Treasury but in pursuance of appropriations to be originated in the first Branch."[19] The delegates ultimately removed limitations on Senate origination and amendment of appropriations bills in the Constitution before submitting the Constitution to the states for ratification.[20]

The Appropriations Clause occasionally figured in arguments advanced on either side of ratification. Those favoring ratification cited the Clause as a way to ensure that expenditure decisions would be made by legislators, the officials who under the new Constitution would be most accountable to the people.[21] Proponents also argued that the Clause would check Executive power[22] and guard against waste of public funds.[23] Those opposing ratification of the Constitution as proposed drew unfavorable comparisons between the original text of the Appropriations Clause, which would have barred the Senate from amending or originating bills making appropriations, and the version submitted to the states for ratification, which made the Senate an equal partner to the House of Representatives in authorizing expenditures.[24]

Appropriations Clause Generally[edit | edit source]

The Supreme Court has construed the Appropriations Clause in relatively few cases, concluding that the requirement for an "appropriation made by law" to prohibit conduct that would result in disbursements of public funds for which an appropriation was lacking. The Court has explained in cases involving the claims of private parties, for example, that a judgment requiring payment to a person asserting a claim against the United States could not be entered in that person's favor without an appropriation to pay the judgment.[25] In Knote v. United States, the Court decided that an appropriation would likewise be needed for a court to order the return of the proceeds of seized property that had been paid into the Treasury.[26] Prior to entry of judgment, the Appropriations Clause also shapes the legal doctrines that courts may apply to adjudicate money claims against the United States.[27] Congress may even direct that no funds are available to pay what might otherwise be a valid debt.[28] If there is no appropriation to pay an alleged debt, either because no such appropriation had been made or Congress has validly prohibited the use of otherwise available funds, the only way that the purported creditor may seek relief is by petitioning Congress.[29]

The Appropriations Clause's limitation on drawing funds from the Treasury is not confined to the types of relief available in judicial proceedings against the United States.[30] As the Court explained in 1850 in Reeside v. Walker, if there is no appropriation available, the President and Executive Branch officers and employees lack the authority to pay the "debts of the United States generally, when presented to them"[31] or to incur obligations on behalf of the United States in anticipation of Congress later making an appropriation to support the obligation.[32] Even the President's constitutionally vested powers may not, on their own, authorize or require disbursements from the Treasury.[33] For example, though a presidential pardon removes all disabilities resulting from a pardoned offense, a pardon cannot require return of property seized, sold, and paid into the Treasury as a consequence of the offense.[34]

However, the Court has also identified circumstances in which the Appropriations Clause is not a relevant limitation on government action. The Clause governs the conduct of federal officers or employees, but it does not constrain Congress in its ability to incur obligations--binding commitments to pay federal funds--by statute[35] or to otherwise dispose of public funds.[36] Similarly, the Clause is not implicated where there is an appropriation available to make a payment, because in that event payments made pursuant to the appropriation would comply with the Clause.[37]

While the Appropriations Clause does not itself constrain Congress's ability to dictate the terms upon which it makes funds available, other provisions of the Constitution may. The Court held in United States v. Lovett that a limitation in an appropriations act that barred payment of compensation to three named federal employees was an unconstitutional bill of attainder because it inflicted punishment without judicial trial.[38] The Court also disregarded a limitation placed on an appropriation for the payment of Court of Claims judgments in United States v. Klein, explaining that the limitation impermissibly sought to change the legal effect of a presidential pardon.[39]

In short, the Court's case law has considered the Appropriations Clause and its effects in roughly three contexts. The Court has articulated how, from Congress's perspective, the Clause it not a relevant limitation on congressional action. The Clause requires an appropriation "made by law" before funds may leave the Treasury, and Congress is the branch empowered to authorize such disbursements. From the perspective of the other branches, the Clause conditions any exercise of a constitutional or statutory power, so that such powers cannot result in disbursements of Treasury funds absent an appropriation. Finally, the Court has considered appropriations made by Congress for their consistency with provisions or features of the Constitution other than the Appropriations Clause. If Congress imposes a limitation on funds that is itself unconstitutional, the limitation cannot be enforced.

- ↑ See Treasury, Black's Law Dictionary (11th ed. 2019); see also Samuel Johnson, Treasury, A Dictionary of the English Language (10th ed. 1792) ("A place in which riches are accumulated."); see also United States v. Bank of Metropolis, 40 U.S. 377, 403 (1841) (describing the "Treasury of the United States" as the place "where its money is directed by law to be kept").

- ↑ Cincinnati Soap Co. v. United States, 301 U.S. 308, 321 (1937).

- ↑ See Art. I, Sec. 9, Cl. 7: Historical Background on Appropriations Clause.

- ↑ Compare, e.g., Art. I, Section 8 Enumerated Powers ("The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States."), with id art. I, § 9, cl. 7 ("No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law.").

- ↑ Off. of Pers. Mgmt. v. Richmond, 496 U.S. 414, 425 (1990).

- ↑ See Art. I, Sec. 9, Cl. 7: Appropriations Clause Generally.

- ↑ See 1 William Blackstone, Commentaries *271, *296-97 (distinguishing between the Monarch's ordinary revenue, meaning revenue sources that belonged to the Monarch by long-standing custom, and extraordinary revenues, defined as the "aids, subsidies, and supplies" periodically granted by Parliament to supplement ordinary revenues).

- ↑ See, e.g., 3 John Hatsell, Precedents of Proceedings in the House of Commons 203 (1818) (dating regular use of clauses of appropriation to 1688). However, members of Parliament maintained that they had the authority to legislate expenditure decisions even before the practice became more common. See 3 Anchitell Grey, Debates of the House of Commons 446-47 (1763) (statement of William Sacheverell, M.P.) (asserting, during 1675 debate in the Grand Committee of Supply, precedent for clauses of appropriation in supply bills dating from the 13th century).

- ↑ 3 Edward Hyde,The Life of Edward Earl of Clarendon 17 (1827).

- ↑ Id. at 10-11, 13. The clause passed the House of Commons, on Lord High Chancellor Clarendon's telling, because to that point King Charles II had lent it his support, relying on the faulty advice of its proponents. Id. at 11. After the House of Lords received the bill, near when Parliament was to be prorogued, the King heard debate over its merits. Id. at 14-22. The King left the debate "unsatisfied" but gave the bill his assent because there was not enough time left in the session to correct the allegedly troublesome clause. See id. at 22; see also 17 Car. II, c. 1 (1665), reprinted in 5 Statutes of the Realm 573 (John Raithby ed., 1819) (reciting that "noe moneyes leavyable by this Act be issued out of the Exchequer dureing this Warr but by such Order or Warrant mentioning that the moneyes payable by such Order or Warrant are for the service of Your Majestie in the said Warr respectively").

- ↑ See Bill of Rights of 1689, 1 W. & M., 2d sess., c.2 (1688) (dated under the Old Style calendar), reprinted in 6 Statutes of the Realm 143 (John Raithby ed., 1819) (listing among Parliament's ancient rights and liberties the rule that "levying Money for or to the Use of the Crowne" by pretense "of Prerogative without Grant of Parlyament for longer time or in other manner then the same is or shall be granted is Illegall").

- ↑ See 3 Hatsell, supra note note here at 202-05 (stating that between 1689 and the early 1800s Parliament's general practice was to specify "the particular sums which they thought necessary to be applied to the different services they had voted in the course of the session").

- ↑ See Del. Const. of 1776, art. VII (providing for the appointment of a "chief magistrate" empowered to "draw for such sums of money as shall be appropriated by the general assembly, and be held accountable to them for the same"); Md. Const. or Form of Gov't of 1776, at X - XI (specifying that the House of Delegates would originate all "money bills," a term defined to include all bills "appropriating money in the treasury" or otherwise providing supplies "for the support of the government"); Mass. Const. of 1780, ch. 2, § 1, art. XI ("No moneys shall be issued out of the treasury of this Commonwealth, and disposed of . . . but by warrant, under the hand of the Governour for the time being, with the advice and consent of the council, for the necessary defence and support of the Commonwealth; and for the protection and preservation the inhabitants thereof, agreeably to the act and resolves of the general court."); N.H. Const. of 1783, pt. 2, reprinted in The Perpetual Laws of the State of New-Hampshire 16 (John Melcher ed., 1789) (substantially similar language to that of Massachusetts Constitution of 1780); N.C. Const. of 1776, § 19 ("That the governor for the time being, shall have the power to draw for and apply such sums of money as shall be voted by the general assembly for the contingencies of government, and be accountable to them for the same"); Pa. Const. of 1776, § 20 (providing that the president and the president's council "may draw upon the treasury for such sums as shall be appropriated by the house"); S.C. Const. of 1778, art. XVI (directing that no "money be drawn out of the public treasury but by the legislative authority of the state").

- ↑ The constitutions of Georgia, New Jersey, New York, and Virginia, in effect in 1787, did not expressly refer to the making of appropriations. See Ga. Const. of 1777; NJ. Const. of 1776; N.Y. Const. of 1777; Va. Const. of 1776. Rhode Island and Connecticut "retained their colonial charters with only minor modifications as their fundamental law into the nineteenth century." G. Alan Tarr, Understanding States Constitutions 60 (1998).

- ↑ Articles of Confederation of 1781, art. IX, para. 5 (granting the Confederation Congress the power to "ascertain the necessary sums of Money to be raised for the service of the united states, and to appropriate and apply the same for defraying the public expenses").

- ↑ Id. art. VIII.

- ↑ 1 The Records of the Federal Convention of 1787, at 544-45 (Max Farrand ed. 1911).

- ↑ Id. at 524.

- ↑ Id.

- ↑ 2 The Records of the Federal Convention of 1787, at 545, 552 (Max Farrand ed. 1911).

- ↑ See, e.g., 2 The Documentary History of the Ratification of the Constitution: Pennsylvania 417 (Merrill Jensen ed., 1976) (Nov. 28, 1787 convention statement of Thomas McKean) (contending that because the Appropriations Clause would settle responsibility for disbursements on Congress and the Statements and Accounts Clause would require disclosure of disbursements, the people could "judge of the conduct of their rulers and, if they see cause to object to the use or the excess of the sums raised, they may express their wishes or disapprobation to the legislature in petitions or remonstrances"); 6 The Documentary History of the Ratification of the Constitution: Massachusetts 1322 (John P. Kaminski et al. eds., 2000) (similar argument in January 23, 1788 convention statement of James Bowdoin); see also Brutus, Virginia J. (Dec. 6, 1787), reprinted in 8 The Documentary History of the Ratification of the Constitution: Virginia 215 (John P. Kaminski et al. eds., 1988) (excerpted response to George Mason's objections to the Constitution) (pointing to the Appropriations Clause as requiring that "any evils which may arise from an improper application of the public money must either originate with, or have the assent of the immediate Representatives of the people").

- ↑ See An Impartial Citizen, in Petersburg Virginia Gazette (Jan. 10, 1788), reprinted in 8 The Documentary History of the Ratification of the Constitution: Virginia 295 (John P. Kaminski et al. eds., 1988) (arguing that because, among other things, the President could not "appropriate the public money to any use, but what is expressly provided by law," the President's constitutional powers would leave "dignity enough for the execution" of the office "without the possibility of making a bad use of it").

- ↑ See A Native of Virginia, Observations upon the Proposed Plan of Federal Government (Apr. 2, 1788), reprinted in 9 The Documentary History of the Ratification of the Constitution: Virginia 676 (John P. Kaminski et al. eds., 1990) ("As all appropriations of money are to be made by law, and regular statements thereof published, no money can be applied but to the use of the United States.").

- ↑ See, e.g., George Mason, Objections to the Proposed Federal Constitution (1787), reprinted in Pamphlets on the Constitution of the United States Published During Its Discussion by the People, 1787-1788, at 329 (Paul Leicester Ford ed., 1888) [hereinafter Pamphlets on the Constitution] (pointing to the Senate's composition powers, including its ability to alter money bills and originate appropriations, to argue that the Senate would "destroy any balance in the government"); but see James Iredell, Answers to Mr. Mason's Objections to the New Constitution, Recommended by the Late Convention (1788), reprinted in Pamphlets on the Constitution, at 340-41 (arguing that the Senate should have a role in offering and amending appropriations because the House of Representatives might overlook a needed appropriation and the House would be able to check the Senate's power by withholding its assent to appropriations proposed in the upper chamber).

- ↑ Reeside v. Walker, 52 U.S. (11 How.) 272, 291 (1851) ("[N]o mandamus or other remedy lies against any officer of the Treasury Department, in a case situated like this, where no appropriation to pay it has been made.").

- ↑ See 95 U.S. 149, 154 (1877) (explaining that "if the proceeds" of condemned and sold property "have been paid into the treasury, the right to them has so far become vested in the United States that they can only be secured to the former owner of the property through an act of Congress"); see also Republic Nat. Bank v. United States (Rehnquist, C.J., opinion of the Court) (reading Knote as standing for "the principle that once funds are deposited into the Treasury, they become public money," and "thus may only be paid out pursuant to a statutory appropriation," even if the Government's ownership of the funds is disputed, but concluding that there was an appropriation that authorized payment of the funds sought by the petitioner).

- ↑ See Off. of Pers. Mgmt. v. Richmond, 496 U.S. 414, 426 (1990) ("[J]udicial use of the equitable doctrine of estoppel cannot grant respondent a money remedy that Congress has not authorized.").

- ↑ See Hart v. United States, 118 U.S. 62, 65, 67 (1886) ("It was entirely within the competency of congress to declare" that no debt that accrued prior to the outbreak of the Civil War could be paid in favor of a claimant who had "promoted, encouraged, or in any manner sustained" rebellion "till the further order of congress.").

- ↑ See Bradley v. United States, 98 U.S. 104, 117 (1878) (stating that where the Federal Government contracted to lease real property owned by a third party, subject to Congress making appropriations in the future to pay the agreed annual rental amounts, the lessor had to "rely upon the justice of Congress" to recover the difference between the agreed rental value for the third year of the lease, $4,200, and the lesser amount actually appropriated for that year's rental payments, $1,800); Reeside, 52 U.S. (11 How.) at 291 ("Hence, the petitioner should have presented her claim on the United States to Congress, and prayed for an appropriation to pay it."); cf. R.R. v. Alabama, 101 U.S. 832, 835 (1879) (drawing an analogy between the Appropriations Clause and a similar provision in the Alabama Constitution to explain that in the absence of an appropriation "the party who gets a judgment must wait until Congress makes an appropriation before his money can be had").

- ↑ Richmond, 496 U.S. at 425.

- ↑ Reeside, 52 U.S. at 291 ("No officer, however high, not even the President, much less a Secretary of the Treasury or Treasurer, is empowered to pay debts of the United States generally, when presented to them . . . . However much money may be in the Treasury at any one time, not a dollar of it can be used in the payment of any thing not thus previously sanctioned.").

- ↑ See Bradley, 98 U.S. at 114 ("Argument to show that money cannot be drawn from the treasury before it is appropriated is unnecessary, as the Constitution provides that 'no money shall be drawn from the treasury but in consequence of an appropriation made by law. . . .'" (quoting Art. I, Sec. 9, Clause 7 Appropriations)).

- ↑ See Richmond, 496 U.S. at 425 ("Any exercise of a power granted by the Constitution to one of the other branches of Government is limited by a valid reservation of congressional control over funds in the Treasury.").

- ↑ Knote v. United States, 95 U.S. 149, 154 (1877) (holding that however large the President's pardon power may be, that power, like "all" of the President's powers, "cannot touch moneys in the treasury of the United States, except expressly authorized by act of Congress").

- ↑ See Me. Cmty. Health Options v. United States, No. 18-1023, slip op. at 10, 13 (U.S. Apr. 27, 2020) (explaining that the Appropriations Clause constrains "how federal employees and officers may make or authorize payments without appropriations" but does not address "whether Congress itself can create or incur an obligation directly by statute").

- ↑ See Cincinnati Soap Co. v. United States, 301 U.S. 308, 321 - 22 (1937) (concluding that the Appropriations Clause was "intended as a restriction upon the disbursing authority of the Executive department" and thus was "without significance" in a case challenging Congress's decision to pay the proceeds of a tax on coconut oil to the treasury of the Philippine Islands and further rejecting the argument that the terms of the appropriation were so general that it constituted an impermissible delegation of legislative power to the Executive Branch); cf. United States v. Realty Co., 163 U.S. 427, 444 (1896) (stating that Congress's decision to recognize a claim "founded upon equitable and moral considerations, and grounded upon principles of right and justice" and "appropriating money for its payment, can rarely, if ever, be the subject of review by the Judicial Branch of the government").

- ↑ See Salazar v. Ramah Navajo Chapter, 567 U.S. 182, 198 n.9 (2012) (reading Richmond as having "indicated that the Appropriations Clause is no bar to recovery in a case like this one, in which 'the express terms of a specific statute' establish 'a substantive right to compensation' from" an appropriation (quoting Richmond)). Congress may appropriate funds in terms that leave disbursing officials no discretion to deny a claimant the funds owed. See United States v. Price, 116 U.S. 43, 44 (1885) ("fully" concurring with the conclusion of the Court of Claims that "congress undertook, as it had the right to do, to determine, not only what particular citizens of Tennessee, by name, should have relief, but also the exact amount which should be paid to each of them" (internal quotation marks omitted)); United States v. Jordan, 113 U.S. 418, 422 (1885) (same).

- ↑ See 328 U.S. 303, 313, 316-18 (1946) (holding that though Congress phrased the limitation as compensation prohibition it served as a permanent bar on federal employment, a consequence that case law held to be punishment within the meaning of the Bill of Attainder Clause).

- ↑ See United States v. Klein, 80 U.S. 128, 147 - 48 (1871) (explaining that the "legislature cannot change the effect of" a "pardon any more than the executive can change a law").