Constitution of the United States/Art. I/Sec. 10/Clause 2 Import-Export

Article I Legislative Branch

Section 10 Powers Denied States

Clause 2 Import-Export

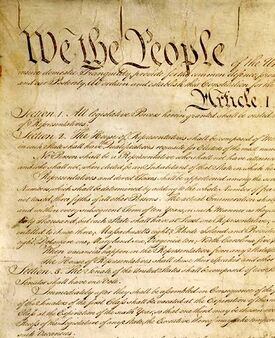

| Clause Text |

|---|

| No State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing its inspection Laws: and the net Produce of all Duties and Imposts, laid by any State on Imports or Exports, shall be for the Use of the Treasury of the United States; and all such Laws shall be subject to the Revision and Controul of the Congress. |

Overview of Import-Export Clause[edit | edit source]

In conjunction with several other provisions, particularly the Commerce Clause,[1] the Import-Export Clause was designed to limit the states' ability to interfere with commerce. To achieve this objective, the Clause generally prohibits States from imposing "imposts" or "duties" on imports and exports, absent congressional consent, except for purposes of covering charges associated with their inspection laws. The Clause further discourages States from imposing such duties by barring the States from using the funds collected from any such duties, instead requiring all funds to be deposited with the U.S. Treasury, and authorizing Congress to revise any State laws that impose duties.

Historical Background on Import-Export Clause[edit | edit source]

Prior to the Constitution's adoption, the colonies, and later states, imposed tariffs on goods from foreign countries and from other colonies, often in response to adverse economic conditions that the governments believed were due to trade imbalances, and to protect or promote domestic industries. For example, in 1788, New Hampshire adopted the first law expressly imposing import duties to improve its economic conditions in response to what it considered an unreasonable trade imbalance that favored foreign countries, primarily Great Britain. This rationale subsequently informed the adoption or amendment of other colonial tariff legislation.[2] Similarly, Massachusetts imposed two types of import duties ("double duties") on vessels from foreign powers and other colonies, as well as additional duties on all commodities from the colonies directly surrounding it.[3] These measures were described as offering "the best protection" for the colonial shipping industry in the early to mid-1700s, resulting in Massachusetts having "the most shipping," and by 1789, "nearly all the shipping in the trade of Massachusetts was American."[4]

In response to the states' fragmented approach to controlling interstate and foreign commerce, the Continental Congress asked the states in 1786 to grant the Congress authority to control or prohibit trade with foreign powers for fifteen years. Although some states agreed to the request, others did not or did so with conditions on such power, which ultimately led to no federal action and a continuance of separate state actions and regulations.[5]

The question of state power to impose import and export duties inspired significant debate during the Constitutional Convention. The delegates considered and proposed multiple drafts that reflected different views about whether states should ever be permitted to impose import and export duties, as well as what conditions should apply to any such duties that states could legally impose. This debate ultimately led to a relatively detailed constitutional provision that reflected these concerns.

An early draft of the Import-Export Clause applied only to duties on imports and was included within a larger list of actions that states generally could not undertake unless Congress authorized them to do so.[6] On August 28, 1787, however, the delegates voted 6-5 to add export duties to the general prohibition.[7] James Madison proposed moving the provision from the list of actions that states could not take without congressional consent to a different part of the Constitution that listed absolute prohibitions, thereby prohibiting states from imposing import and export duties in all circumstances. Colonel George Mason argued against such a blanket prohibition, asserting that states may wish to impose duties to assist the industries in which they had competitive advantages. Madison countered that allowing states to protect their industries through duties on foreign countries and other states would only continue the problems associated with lacking a unified, national power to regulate commerce.[8] The Convention rejected Madison's proposal by a vote of 4-7.[9]

In September 1787, the delegates continued debating amendments to the provision. On September 12, the Convention agreed to reconsider the version of the Import-Export Clause debated in August to add a qualifying phrase. This phrase stated that the Clause should not be interpreted to prevent the states from adopting export duties to cover the costs of inspection, packaging, and storage fees, as well as indemnifying the losses incurred while the goods were held by public officers.[10] Colonel Mason formally proposed the amendment on September 13 as follows:

Provided that no State shall be restrained from imposing the usual duties on produce exported from such State, for the sole purpose of defraying the charges of inspecting, packing, storing, and indemnifying the losses on such produce, while in the custody of public officers: but all such regulations shall in case of abuse, be subject to the revision and controul of Congress.Id. at 605.

The delegates adopted this amendment by a vote of 7-3, agreeing to compare and reconcile that version with the proposed provision from the Committee on Style.[11] The Committee's version of the provision separated the issue of import and export duties from all other limits on state power, stating as follows: "No state shall, without the consent of Congress, lay imposts or duties on imports or exports, nor with such consent, but to the use of the treasury of the United States."[12]

On September 15, 1787, the delegates sought to reconcile these drafts. They chose to adopt the Committee of Style's decision to make the prohibition on import and export duties a standalone provision, rather than include the prohibition within a longer list of limits on state power. This allowed the delegates to incorporate the amendments adopted on September 13 into the version reflected in the Constitution.[13] Indicative of how divisive the provision remained, however, a final motion was made to strike the Clause subjecting all state laws imposing import and export duties "to the Revision and Controul of the Congress." This motion failed, and the final text was adopted with ten delegates in favor, and Virginia the only vote in opposition.[14]

Import-Export Clause Generally[edit | edit source]

Supreme Court jurisprudence on the Import-Export Clause can be divided into two periods: the first lasting from 1827 to 1976, and the second beginning thereafter. During the first phase, the Court construed the Clause broadly to give effect to the constitutional prohibition on state interference with foreign commerce, even holding that the Twenty-First Amendment, which allowed states to prohibit the sale of alcohol, did not alter the Import-Export Clause's general prohibition on such interference.[15] The Court's jurisprudence focused on determining whether the items subject to state charges qualified as imports or exports, and did not seek to define precisely what types of charges fell within the Clause's scope.

By contrast, during the second phase of jurisprudence, the Court clarified that the Clause's prohibition on state interference applied only to the extent the charges imposed qualified as "imposts" or "duties." In other words, not all state taxation on imports or exports fall within the constitutional prohibition; therefore, a court must assess whether the relevant charge is an "impost" or "duty." The Supreme Court has not overruled its jurisprudence from the first period insofar as it addresses whether items qualify as exports or imports. However, this jurisprudence's continued relevance to Import-Export cases remains unclear.

Whether a Good Qualifies as an Import or Export[edit | edit source]

The first phase of Supreme Court doctrine on the Import-Export Clause focused on determining whether the challenged measures applied to goods that qualified as imports or exports. In a series of cases, the Court sought to clarify the Clause's scope by focusing on when products qualify as "imports" or "exports."

In the 1827 case of Brown v. Maryland, the Court established the primary contours of the doctrine applicable to the Import-Export Clause until the late 1970s. In Brown, the Court considered whether a state law requiring sellers of foreign goods to obtain and pay for a license before being permitted to sell any such goods violated the Import-Export Clause.[16] Interpreting the Clause, the Court held that it applied not only to duties on the item imported, but also to "dut[ies] levied after it has entered the country," explaining that taking a more restrictive view would potentially allow states to prevent the importation of goods.[17] The Court further held that, at some point after entering the United States, goods no longer qualify as imports and may thereafter be subject to state charges. As identifying a single point in time or fact would not address sufficiently all circumstances, the Court indicated instead that a reviewing court must consider whether the "importer has so acted upon the thing imported, that it has become incorporated and mixed up with the mass of property in the country."[18] However, while the item remained the importer's property, "in his warehouse, in the original form or package in which it was imported, a tax" on the item clearly fell within the constitutional prohibition.[19] The Court then held that the state law in question was effectively a tax on importation because it taxed only the occupation of importers and therefore violated the Import-Export Clause.[20]

In dicta, the Brown Court also addressed the Clause's territorial scope, suggesting that "import" and "export" covered goods transported in foreign as well as interstate commerce.[21] However, in Woodruff v. Parham, the Court held that the Import-Export Clause applied only to goods from or to foreign countries, and did not apply to measures affecting goods traveling only in interstate commerce.[22] Subsequent cases have consistently followed this holding.[23] The Court also extended the Clause's application to the Philippines, during the time it was a U.S. possession, on the ground that it remained outside of and therefore foreign to the United States for purposes of the Clause.[24]

Following Brown, the Court sought to clarify when a good no longer qualifies as an import or export. First, the Court maintained and applied the "original package" rule in a number of cases, holding that charges on imported goods kept in their original form within warehouses violated the Import-Export Clause. Such charges included ad valorem property taxes;[25] taxes on foreign goods sold at auction;[26] and franchise taxes on the landing, storage, or sale of imported goods.[27] By contrast, the Court held that once boxes with imported items were opened for sale or delivery, or once the goods were manipulated for use or sale, they no longer qualifed as imports.[28]

Second, the Court held that imports lose their character as imports once the goods fall within the purchaser's ownership or possession rather than the importer's,[29] or importation is otherwise complete (e.g., the goods reach their final resting place).[30] The Court also held that charges imposed on actions more remote from loading or unloading goods, such as transit through U.S. states, do not affect the import process and therefore do not fall within the Import-Export Clause's scope.[31]

The Court also extended Brown to exports expressly, holding that state taxes on the sale of goods abroad and on the ability to export qualify as unconstitutional charges on exports.[32] Further, consistent with other cases involving imports, the Court held that states may tax goods intended for export "until they have been shipped, or entered with a common carrier for transportation, to another state, or have been started upon such transportation in a continuous route or journey."[33]

A separate line of cases also clarifies that the terms "import" and "export" do not include natural persons. In several early cases, it was suggested that the Constitutional Convention's discussion of slaves in conjunction with the term "import" indicated that the Import-Export Clause extended to persons. However, in dicta in the Passenger Cases and in later cases' holdings, the Court decided that the Clause did not apply to natural persons.[34]

Whether a Charge Qualifies as an Impost or Duty[edit | edit source]

The Import-Export Clause does not define what qualifies as an "impost" or "duty" that falls within its scope. Beginning with Brown v. Maryland, the Supreme Court interpreted these terms broadly, stressing that the form or name of the charge did not determine whether it falls within the Clause's scope. Rather, the focus of the inquiry was the substance or operation of the challenged measure.[35] Thus, for example, a duty on an importer, despite not being on the product itself, was effectively equivalent to a duty on imports and thereby prohibited.[36]

Following Brown, the Supreme Court applied the Import-Export Clause to a variety of state taxes and other charges.[37] As the Court later noted, the Court generally treated the Clause as potentially applicable to all forms of state taxation on imports or exports,[38] although the Court also ruled that pilotage fees fell outside the Clause's scope, and that the measures must have some connection to importation or exportation to fall within the Clause.[39]

In 1976, the Court adopted a new approach to assessing whether a state measure violates the Import-Export Clause, cabining the Clause's scope by holding that the terms "impost" and "duty" do not encompass all taxes or charges. In Michelin Tire Corp. v. Wages, the Court considered the history and meaning of these terms to conclude that the Import-Export Clause did not reach non-discriminatory ad valorem property taxes. The Court also overruled Low v. Austin to the extent that case was inconsistent with the Court's new emphasis on defining "impost" and "duty."[40]

Under this new approach, to determine whether a charge may qualify as an impermissble impost or duty, a court must consider three factors: (1) whether it interferes with the Federal Government's ability to speak with one voice in commercial relations with foreign governments; (2) whether it diverts import revenues from the federal to state government; and (3) whether it may jeopardize harmony between the states.[41]

The Court reiterated its "different approach" to the Import-Export Clause in 1978, concluding in Department of Revenue of the State of Washington v. Ass'n of Washington Stevedors, that an occupution tax on stevedores did not fall within the Clause's scope.[42] Not until the 1984 case of Limbach v. Hooven & Allison Co., however, did the Court expressly acknowledge that, in Michelin, it "adopted a fundamentally different approach to cases claiming the protection of the Import-Export Clause" and that therefore some of its prior cases, in addition to Low, were overruled.[43] Applying this new approach, the Court has held other state taxes, including ad valorem property taxes and sales taxes, to fall outside the Clause's scope.[44]

State Inspection Charges[edit | edit source]

The Supreme Court has interpreted the Import-Export Clause's final phrase--"except what may be absolutely necessary for executing it's inspection Laws"--relatively rarely. However, the Court has upheld the constitutionality of charges for inspecting tobacco when the charges incurred were for services rendered, and when the challenged law's objective was to ensure the product's quality.[45] The Court has also suggested in dicta that whether an inspection charge is excessive "might be for congress to determine, and not the courts."[46]

- ↑ Art. I, Sec. 8, Clause 2 Borrowing.

- ↑ William W. Bates, American Navigation 35-36 (1902).

- ↑ Id. at 33.

- ↑ Id. at 33, 38.

- ↑ Id. at 41-42.

- ↑ 2 The Records of the Federal Convention of 1787, at 187 (Max Farrand ed., 1911).

- ↑ Id. at 435.

- ↑ Id. at 441.

- ↑ Id. at 435, 441.

- ↑ Id. at 583.

- ↑ Id.

- ↑ Id. at 597.

- ↑ Id. at 624.

- ↑ Id.

- ↑ Dep't of Revenue v. James B. Beam Distilling Co., 377 U.S. 341, 346 (1964).

- ↑ 25 U.S. 419 (1827).

- ↑ Id. at 437-38.

- ↑ Id. at 441-42.

- ↑ Id. at 442.

- ↑ Id. at 444.

- ↑ Id. at 419.

- ↑ 75 U.S. 123, 133 (1868).

- ↑ Pervear v. Commonwealth of Mass., 72 U.S. (5 Wall.) 475 (1866); In re State Tax on Ry. Gross Receipts, 82 U.S. (15 Wall.) 284, 296-97 (1872); Pittsburgh & S. Coal Co. v. Louisiana, 156 U.S. 590, 600 (1895); Am. Steel & Wire Co. v. Speed, 192 U.S. 500, 519-20 (1904); New Mexico ex rel. E.J. McLean Co. v. Denver & Rio Grande R.R., 203 U.S. 38, 50 (1906); Toomer v. Witsell, 334 U.S. 385, 394 (1948).

- ↑ Hooven & Allison Co. v. Evatt, 324 U.S. 652, 679 (1945), rev'd on other grounds, 466 U.S. 353 (1984).

- ↑ Low v. Austin, 80 U.S. 29, 32 (1871).

- ↑ Cook v. Pennsylvania, 97 U.S. 566, 573 (1878).

- ↑ Anglo-Chilean Nitrate Sales Corp. v. Alabama, 288 U.S. 218, 225 (1933).

- ↑ May v. New Orleans, 178 U.S. 496, 508-09 (1900); Gulf Fisheries Co. v. MacInerney, 276 U.S. 124, 126 (1928); Youngstown Sheet & Tube Co. v. Bowers, 358 U.S. 534, 542 (1959).

- ↑ Waring v. Mayor, 75 U.S. 110, 116 (1868); Hooven & Allison Co., 324 U.S. at 658.

- ↑ Pittsburgh & S. Coal Co. v. Bates, 156 U.S. 577, 598-99 (1895); New York v. Wells, 208 U.S. 14 (1908).

- ↑ Canton R.R. v. Rogan, 340 U.S. 511, 515 (1951); W. Md. Ry. v. Rogan, 340 U.S. 520, 521 (1951).

- ↑ Crew Levick Co. v. Pennsylvania, 245 U.S. 292, 295-96 (1917); Richfield Oil Corp. v. State Bd. of Equalization, 329 U.S. 69, 85-86 (1946).

- ↑ Empresa Siderurgica v. Cnty. of Merced, 337 U.S. 154, 156-57 (1949); Joy Oil Co. v. State Tax Comm'n of Mich., 337 U.S. 286, 288-89 (1949); Kosydar v. Nat'l Cash Reg. Co., 417 U.S. 62, 69 (1974).

- ↑ Passenger Cases, 48 U.S. 283 (1849); Crandall v. Nevada, 73 U.S. 35, 41 (1868); New York v. Compagnie Generale Transatlantique, 107 U.S. 59, 61-62 (1883).

- ↑ Brown v. Maryland, 25 U.S. 419, 444-45 (1827); Selliger v. Kentucky, 213 U.S. 200, 209 (1909).

- ↑ Brown, 25 U.S. at 444-45.

- ↑ See, e.g., Almy v. California, 65 U.S. 169 (1860) (stamp tax on bills of lading for gold and silver exports); Crew Levick & Co. v. Pennsylvania, 245 U.S. 292 (1917) (state tax on the business of selling goods in foreign commerce, as measured by gross receipts from merchandise shipped abroad); Anglo-Chilean Nitrate Sales Corp. v. Alabama, 288 U.S. 218 (1933) (franchise tax).

- ↑ Limbach v. Hooven & Allison Co., 466 U.S. 353, 360 (1984).

- ↑ Mager v. Grima, 49 U.S. 490, 494 (1850); Cooley v. Bd. of Wardens, 53 U.S. 299 (1851).

- ↑ 423 U.S. 276, 279-83 (1976).

- ↑ Id. at 285-86.

- ↑ 435 U.S. 734, 752-54 (1976).

- ↑ 466 U.S. at 359-61 (overruling Hooven & Allison Co. v. Evatt, 324 U.S. 652, 658 (1945)).

- ↑ R.J. Reynolds Tobacco Co. v. Durham Cnty., 479 U.S. 130, 153 (1986); Itel Containers Int'l Corp. v. Huddleston, 507 U.S. 60, 77 (1993).

- ↑ Turner v. Maryland, 107 U.S. 38, 54 (1883).

- ↑ Patapsco Guano Co. v. Bd. of Agric., 171 U.S. 345, 350-51 (1898).