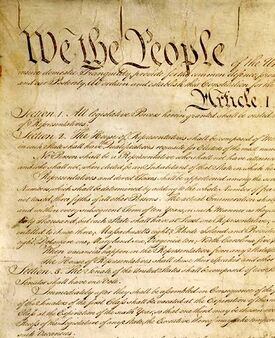

Constitution of the United States/Art. I/Sec. 7/Clause 1 Revenue

Article I Legislative Branch

Section 7 Legislation

Clause 1 Revenue

| Clause Text |

|---|

| All Bills for raising Revenue shall originate in the House of Representatives; but the Senate may propose or concur with Amendments as on other Bills. |

Origination Clause and Revenue Bills[edit | edit source]

Until ratification of the Seventeenth Amendment in 1913,[1] only members of the House of Representatives were elected by the people directly.[2] To ensure that persons elected directly by the people would have initial responsibility over tax decisions,[3] the Constitution's Origination Clause directs that all "Bills for raising Revenue shall originate in the House of Representatives."[4] The Clause permits Senate amendments to such bills.[5] By implication, though, the Senate may not originate bills for raising revenue.[6]

The Origination Clause is part of the procedures that Congress and the President must follow to enact a law.[7] The Clause is a prerogative of the House--it alone is allowed to originate such bills. However, in all Origination Clause challenges, the House has passed a bill containing matter alleged to have improperly originated in the Senate. House passage has not prevented the Court from addressing an Origination Clause challenge.[8]

The typical Origination Clause challenge involves a federal law that requires a person to pay a particular sum. These sums have gone by various names in statute,[9] including a "tax."[10] The person challenging the payment requirement focuses on Congress's consideration of the bill that became law with the payment requirement. The challenger alleges that this bill was one for raising revenue within the meaning of the Origination Clause and that action of the Senate is what first gave the bill its revenue-raising character.[11]

Origination Clause cases potentially pose a factual question and a legal question. The potential factual question is whether the bill that became law containing the challenged payment requirement first took on a revenue-raising character as a result of action by the Senate. The Court has never resolved competing factual claims about origination by, for example, considering evidence of a bill's content at different stages in its congressional consideration. In a related context, the Court has limited its factual inquiry into the process by which a bill became law, citing the "respect due to" Congress.[12] Similar concerns have impacted the Court's approach to Origination Clause cases, which has been to resolve only the primary legal question posed by such cases and not competing factual claims about where bill matter actually originated.[13]

This legal question is whether the bill that became law was a "Bill[ ] for raising Revenue." The House-origination requirement applies only to bills that levy taxes "in the strict sense."[14] A statute that raises revenue to support the general functions of the Government fits this category.[15] If a bill with a revenue-raising provision originates in the House, the Origination Clause does not prevent the Senate from removing that revenue-raising provision and substituting another in its place.[16] A statute does not levy taxes in the strict sense--and thus is not subject to House origination--if it establishes a program and raises money for the support of that program in particular.[17] The fact that such a statute might refer to a monetary exaction as a "tax" does not make the bill subject to the Origination Clause.[18]

- ↑ See William Jennings Bryan, Certification of Adoption of Seventeenth Amendment as Part of Constitution, reprinted in 38 Stat. 2049-50 (1915).

- ↑ See Seventeenth Amend.: Historical Background on Popular Election of Senators.

- ↑ Skinner v. Mid-Am. Pipeline Co., 490 U.S. 212, 221 (1989).

- ↑ Art. I, Sec. 7, Clause 1 Revenue.

- ↑ Id.

- ↑ See id.

- ↑ United States v. Munoz-Flores, 495 U.S. 385, 396-97 (1990) (rejecting the contention of a dissenting justice that improperly originated bills for raising revenue may nonetheless become law if passed according to the other legislative process requirements of Article I, Section 7).

- ↑ Id. at 395 (rejecting the argument that an Origination Clause claim poses a nonjusticiable political question to be decided solely by the House when it decides whether to pass legislation).

- ↑ Id. at 388 (special assessment).

- ↑ Millard v. Roberts, 202 U.S. 429, 435 (1906); Twin City Nat'l Bank of New Brighton v. Nebecker, 167 U.S. 196, 197 (1897).

- ↑ Most commonly, one of two types of Senate action has been alleged: either the bill that became law with revenue-raising features was originally introduced in the Senate, see Millard, 202 U.S. at 435 (apparently describing relevant bills as having been introduced in the Senate), or the bill first passed the House without any revenue-raising features, which the Senate then added through amendment, see Nebecker, 167 U.S. at 197 (challenge to a "tax on the circulating notes of national banks" that was alleged to have "originated in the Senate, by way of amendment to the House bill," which bill originally passed the House with no provisions for raising revenue). But see infra note here.

- ↑ See Marshall Field & Co. v. Clark, 143 U.S. 649, 672-73, 679 (1892) (declining to examine the journals of the houses, committee reports, or "other documents printed by authority of Congress" to determine whether, as required by Article I, Section 7, Clause 2, a bill passed both chambers in identical form and was presented to the President in the same form); see also Art. I, Sec. 5, Cl. 3: Requirement that Congress Keep a Journal.

- ↑ See Nebecker, 167 U.S. at 203 (stating that because the Court held that the bill in question was not a "Bill[ ] for raising Revenue," the Court did not need to "consider whether, for the decision of the question before us, the journals of the two houses of congress can be referred to for the purpose of determining" whether an act "originated in the one body or the other"); see also Rainey v. United States, 232 U.S. 310, 317 (1914) (similar); Flint v. Stone Tracy Co., 220 U.S. 107, 143 (1911) (similar).

- ↑ United States v. Norton, 91 U.S. 566, 569 (1875) (internal quotation marks omitted) (interpreting provisions of criminal law by reference to the Origination Clause's use of the term "revenue").

- ↑ United States v. Munoz-Flores, 495 U.S. 385, 397-98 (1990).

- ↑ In Flint v. Stone Tracy Co., a bill allegedly originated in the House containing an inheritance tax, but after House passage of the measure the Senate amended the bill to substitute a corporate tax for the inheritance tax. The Court found no constitutional impediment to this process, because the bill had "properly originated in the House" and the Senate amendment was germane to the bill's subject matter and not beyond the Senate's power to propose. 220 U.S. at 143.

- ↑ Munoz-Flores, 495 U.S. at 397-98 (concluding that a "special assessment provision was passed as part of a particular program" to compensate and assist crime victims "to provide money for that program"). Earlier cases employed an equivalent framing, asking whether the money-raising aspects of a bill were a means of achieving the central, non-revenue-raising object of the bill. See Millard v. Roberts, 202 U.S. 429, 435-36 (1906) (ruling that taxes imposed on property in the District of Columbia merely financed a bill's central object of infrastructure improvements); Nebecker, 167 U.S. at 202-03 (holding that a tax on certain notes was a means of accomplishing a bill's main purpose of providing a national currency and further explaining that the act did not "raise revenue to be applied in meeting the expenses or obligations of the government" more generally).

- ↑ See Munoz-Flores, 495 U.S. at 398.